China Seeks Middle East LPG To Offset US Supply Disruptions

Table of Contents

Shrinking US LPG Exports and Their Impact on China

Declining US LPG exports are forcing China to seek alternative supply sources. Several factors contribute to this decline. Increased domestic consumption within the US, driven by a robust petrochemical industry and growing demand for residential heating, has significantly reduced the volume of LPG available for export. Furthermore, shifts in US energy policy, including potential export restrictions or prioritization of domestic needs, have added further uncertainty to the market.

This reduced US LPG supply has tangible consequences for China. The most immediate impact is price volatility. Reduced supply inevitably leads to increased prices, impacting Chinese industries that rely heavily on LPG as a feedstock, and households that use it for heating and cooking. Supply shortages are also a concern, potentially disrupting industrial production and energy access for consumers.

- Statistics on US LPG export decline: While precise figures fluctuate yearly, reports indicate a consistent downward trend in US LPG exports to China over the past [Insert timeframe and data source].

- Impact on Chinese LPG prices: The decreased US supply has contributed to increased LPG prices in China, creating uncertainty in the market and potentially impacting consumer and industrial budgets.

- Analysis of China's LPG consumption patterns: China's LPG consumption is experiencing continuous growth fueled by industrial expansion, urbanization, and rising living standards. This upward trend increases the nation's vulnerability to supply disruptions.

The Middle East: A Promising Alternative for China's LPG Needs

The Middle East possesses vast LPG resources and substantial production capacity, making it an attractive alternative to the US. Countries in the region, particularly those with significant oil and gas reserves, have the potential to significantly increase their LPG exports to China. This would establish a more diversified and potentially more stable supply chain for the country.

Several key Middle Eastern nations are already emerging as key LPG suppliers to China, and existing trade relationships are expected to deepen. The development of new infrastructure, including pipelines and specialized shipping capabilities, is further facilitating this growing trade.

- Key LPG producing countries in the Middle East: Saudi Arabia, Qatar, Iran, and the UAE are among the leading LPG producers in the region with the capacity to significantly contribute to China's energy needs.

- Existing and potential trade agreements: Bilateral agreements between China and several Middle Eastern nations are either in place or under negotiation, streamlining the import of LPG.

- Infrastructure development for LPG transportation: Investments in new pipelines and enhanced shipping capabilities are underway to ensure the efficient and reliable transportation of LPG from the Middle East to China.

Geopolitical Implications of China's LPG Sourcing Diversification

China's move to reduce its dependence on US LPG carries significant geopolitical implications. It signals a shift in global energy dynamics, lessening US influence over China's energy security. The development of stronger energy partnerships with Middle Eastern nations enhances China's strategic leverage in the region and globally. This diversification also fosters greater regional cooperation in the energy sector.

- Impact on US influence in the global LPG market: China's diversification reduces the US's ability to leverage its LPG exports for geopolitical influence.

- Strengthening of China's energy partnerships with Middle Eastern nations: Closer energy ties strengthen existing political and economic alliances between China and Middle Eastern countries.

- Potential for increased regional cooperation in the energy sector: This shift could spark increased collaboration on energy infrastructure, technology, and market regulations within the Middle East and between China and the region.

Challenges and Opportunities in Expanding Middle East-China LPG Trade

While the potential for expanded Middle East-China LPG trade is substantial, several challenges must be addressed. Logistics, including efficient transportation across vast distances, present a hurdle. Infrastructure limitations, both in the Middle East and in China, require significant investment. Regulatory frameworks and trade agreements also need to be streamlined to facilitate smooth and transparent trade.

However, the opportunities are significant. Long-term energy security for China is paramount, and the Middle East offers a reliable and abundant alternative. This trade creates economic benefits for both regions, fostering growth and development.

- Logistics and infrastructure development needs: Investments in pipelines, specialized LNG carriers, and port facilities are crucial to overcoming logistical challenges.

- Regulatory frameworks and trade agreements: Clear and efficient regulations governing LPG trade are essential for promoting seamless transactions.

- Investment opportunities in the LPG sector: The expansion of LPG trade presents significant investment opportunities in infrastructure, logistics, and related technologies.

Securing China's LPG Future Through Middle Eastern Partnerships

In conclusion, China's strategic shift towards Middle Eastern LPG signifies a proactive approach to mitigating the risks associated with relying solely on US supplies. Diversifying LPG sources is critical for enhancing energy security and fostering economic stability. The potential for mutually beneficial cooperation between China and Middle Eastern LPG producers is substantial, promising long-term energy security and economic growth for all involved. Further research into the specific implications of this shift and the potential for future collaborations is essential. Understanding the dynamics of China's growing reliance on Middle East LPG and exploring future partnerships in this sector will be crucial for navigating the complexities of the global energy market.

Featured Posts

-

Warriors Hield And Payton Stellar Bench Performances Fuel Victory

Apr 24, 2025

Warriors Hield And Payton Stellar Bench Performances Fuel Victory

Apr 24, 2025 -

Are Trumps Budget Cuts Exacerbating Tornado Season Risks A Look At The Evidence

Apr 24, 2025

Are Trumps Budget Cuts Exacerbating Tornado Season Risks A Look At The Evidence

Apr 24, 2025 -

Houston Isd Mariachi Headed To Uil State Competition After Viral Whataburger Video

Apr 24, 2025

Houston Isd Mariachi Headed To Uil State Competition After Viral Whataburger Video

Apr 24, 2025 -

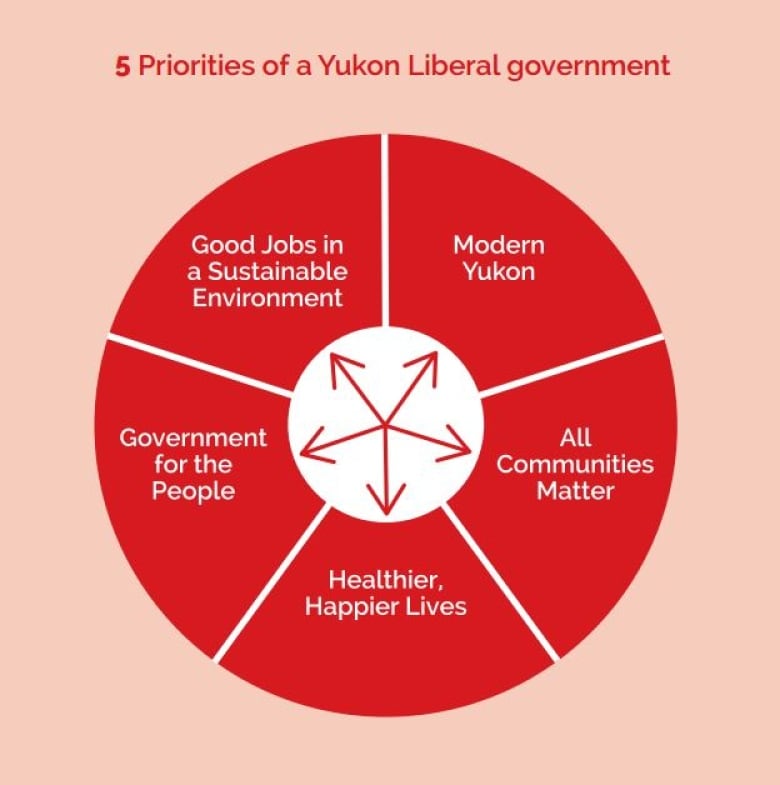

Is The Liberal Platform Right For You A Detailed Review

Apr 24, 2025

Is The Liberal Platform Right For You A Detailed Review

Apr 24, 2025 -

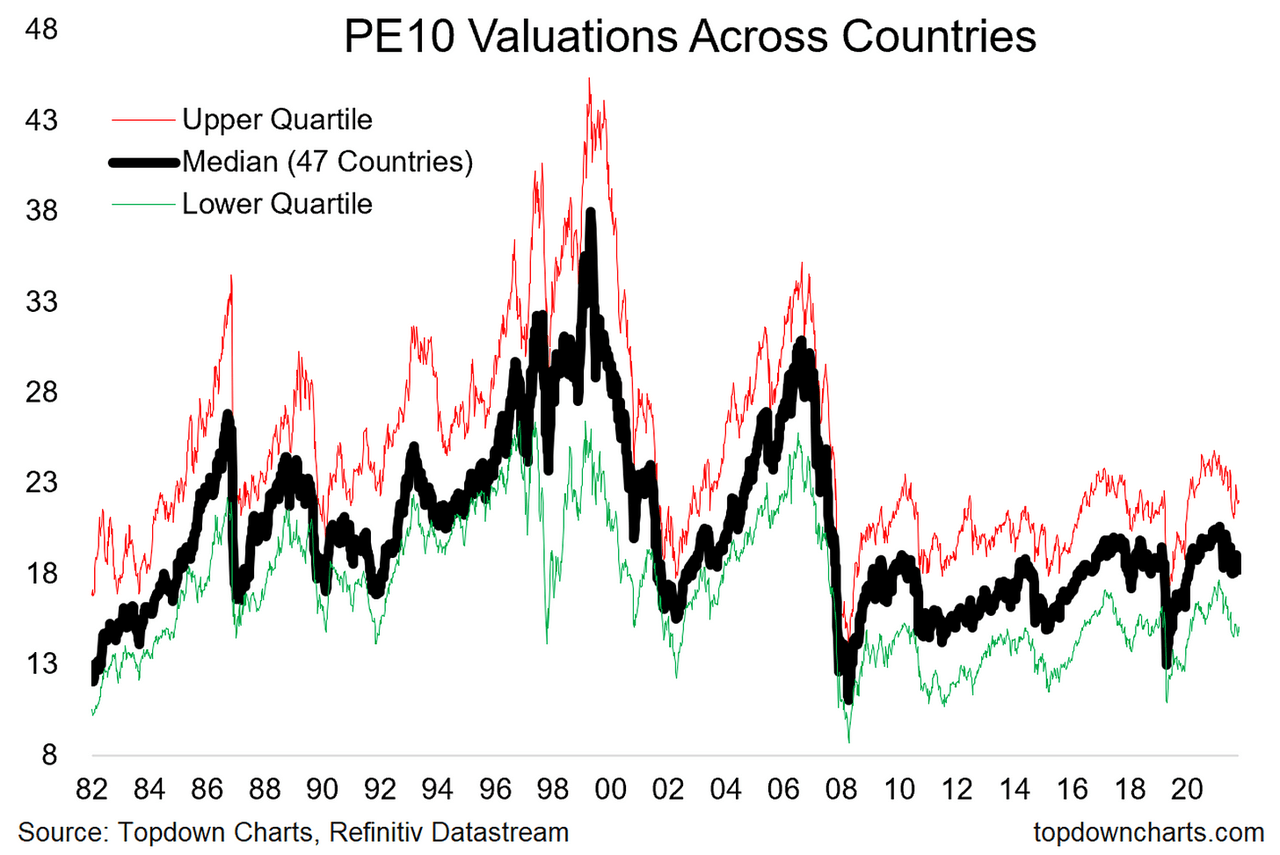

High Stock Market Valuations Bof As Reassuring Analysis For Investors

Apr 24, 2025

High Stock Market Valuations Bof As Reassuring Analysis For Investors

Apr 24, 2025