High Stock Market Valuations: BofA's Reassuring Analysis For Investors

Table of Contents

BofA's Key Arguments Against Immediate Market Correction

BofA's analysis presents a compelling case against an immediate market downturn, citing several key factors that support a more optimistic outlook.

Strong Corporate Earnings Growth

BofA's positive outlook on earnings growth is rooted in several key observations. The bank points to robust economic activity driving strong corporate performance across various sectors. Using data from their report (specific data points would need to be inserted here from the actual BofA report), they project continued earnings growth exceeding initial expectations.

- Robust growth in the technology sector: Fueled by ongoing digital transformation and innovation.

- Increased consumer spending driving retail earnings: Resilient consumer demand continues to support strong performance in the retail sector.

- Resilience in the financial sector despite interest rate hikes: The financial sector shows surprising strength despite the Federal Reserve's monetary tightening policy.

This sustained earnings growth provides a strong foundation for current stock valuations and counters concerns about an imminent market correction triggered by overvalued assets.

Low Inflation Expectations

BofA's perspective on inflation is crucial to their overall analysis. They highlight that lower-than-expected inflation significantly reduces the pressure on central banks to aggressively raise interest rates. This more moderate approach to monetary policy supports stable market conditions and reduces the likelihood of a sharp economic downturn that could negatively impact stock valuations. The bank points to several factors contributing to lower inflation projections.

- Easing supply chain pressures: Improved global supply chain efficiency reduces inflationary pressures on goods and services.

- Central bank's effective monetary policy: Central bank actions, while impacting interest rates, have shown effectiveness in curbing inflation without causing a significant economic slowdown.

- Decreasing commodity prices: A decline in commodity prices further contributes to the moderation of inflation.

Attractive Long-Term Growth Prospects

BofA's analysis extends beyond the immediate future, emphasizing the compelling long-term growth potential of various market sectors. The bank highlights several key areas poised for significant expansion.

- Growth in renewable energy: The transition to sustainable energy sources presents significant opportunities for growth and investment.

- Expansion of the healthcare sector: An aging population and advancements in medical technology drive ongoing growth in the healthcare industry.

- Advancements in artificial intelligence: The rapid development and adoption of AI technology creates substantial investment potential across multiple sectors.

These long-term growth prospects suggest that despite current high valuations, the market possesses considerable potential for future returns, mitigating some of the risks associated with current price levels.

Addressing Concerns about High Price-to-Earnings Ratios (P/E)

While high price-to-earnings (P/E) ratios are a valid concern, BofA's analysis provides context that mitigates some of the alarm.

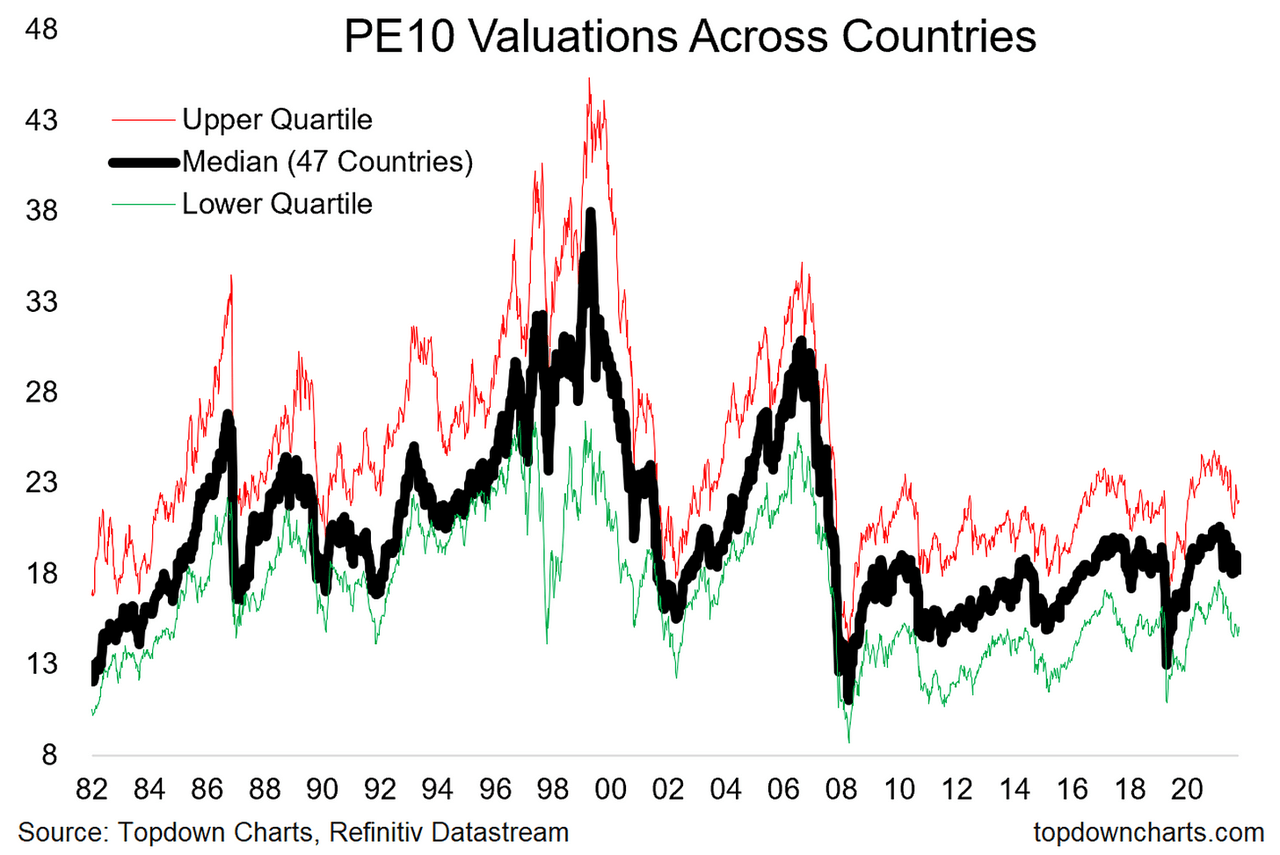

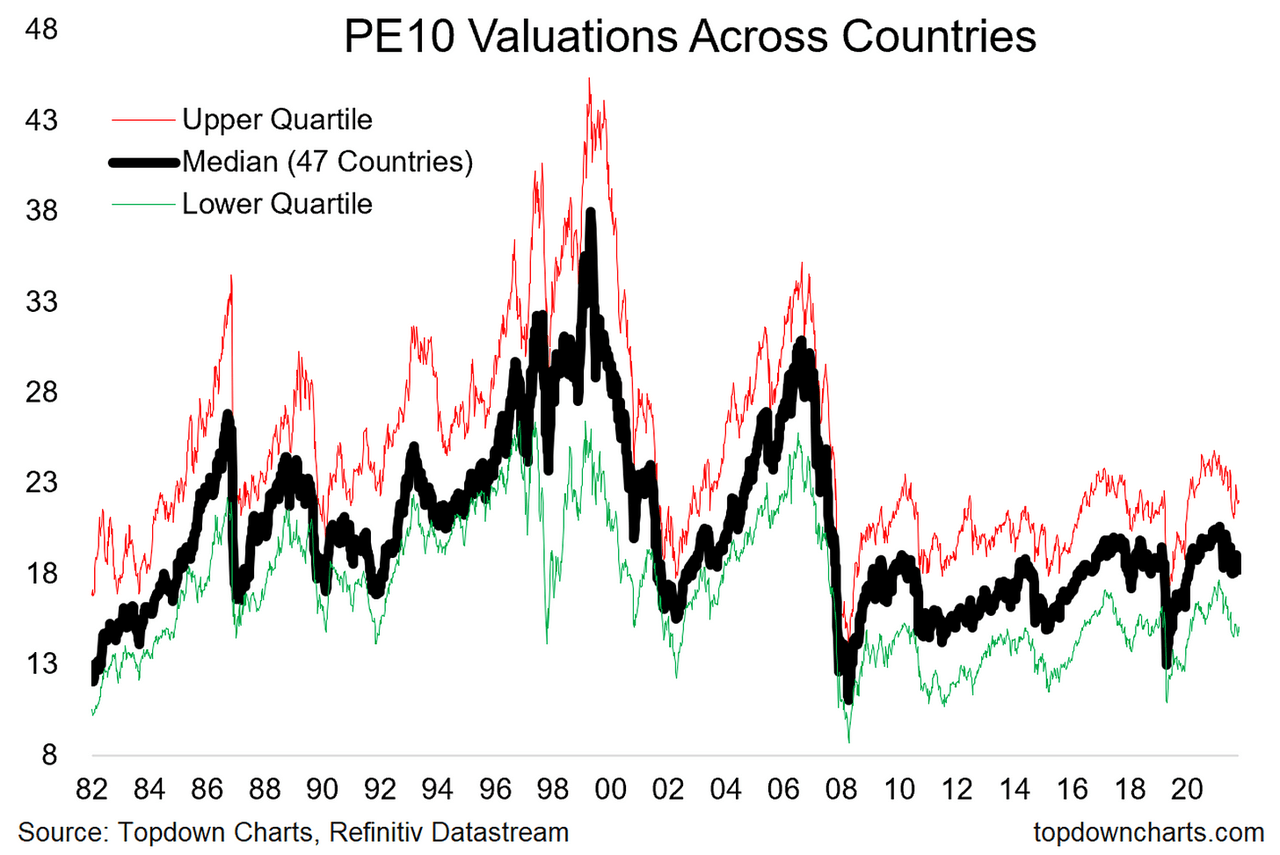

Contextualizing High P/E Ratios

High P/E ratios aren't always indicative of an overvalued market. Several factors influence P/E ratios beyond earnings, including interest rates and overall market sentiment. Historically, low interest rates have often correlated with higher P/E ratios. By comparing current P/E ratios to historical data during periods of similar economic conditions, BofA aims to offer a more nuanced perspective.

- Low interest rates historically correlate with higher P/E ratios: Lower borrowing costs support higher valuations.

- Comparison to P/E ratios during periods of similar economic conditions: Historical comparisons put current valuations in perspective.

- Analysis of specific sectors with high P/E ratios and reasons why: BofA's analysis accounts for sector-specific factors that influence P/E ratios.

BofA's Suggested Strategies for Navigating High Valuations

BofA doesn't simply dismiss concerns; they offer practical strategies for investors to navigate the market effectively.

- Diversify across different asset classes: Reduce risk by spreading investments across various asset classes.

- Focus on companies with strong fundamentals: Prioritize companies with robust earnings, strong balance sheets, and sustainable growth prospects.

- Maintain a long-term investment strategy: High valuations are less concerning for investors with a long-term perspective.

Conclusion: Navigating High Stock Market Valuations – A Call to Action

BofA's analysis offers a reassuring perspective on high stock market valuations. Strong earnings growth, low inflation expectations, and attractive long-term growth prospects significantly mitigate the risks of an immediate market correction. However, informed decision-making is crucial. Thorough research and understanding of market dynamics are essential for investors to make well-informed decisions. Don't let high stock market valuations deter you. Understanding BofA's analysis can empower you to make informed investment decisions. Review the full report today and take control of your financial future. Develop a comprehensive investment strategy that accounts for current market conditions and long-term growth potential.

Featured Posts

-

Landlord Price Gouging Following La Fires A Reality Tv Stars Testimony

Apr 24, 2025

Landlord Price Gouging Following La Fires A Reality Tv Stars Testimony

Apr 24, 2025 -

Trump Lawsuit Prompts 60 Minutes Executive Producer To Resign

Apr 24, 2025

Trump Lawsuit Prompts 60 Minutes Executive Producer To Resign

Apr 24, 2025 -

India Stock Market Positive Indicators Boost Niftys Growth

Apr 24, 2025

India Stock Market Positive Indicators Boost Niftys Growth

Apr 24, 2025 -

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025 -

Teslas Q1 Profit Drop Impact Of Musks Political Involvement

Apr 24, 2025

Teslas Q1 Profit Drop Impact Of Musks Political Involvement

Apr 24, 2025