China's Economic Vulnerability: Unveiling Beijing's Trade War Losses

Table of Contents

Declining Exports and the Impact on Manufacturing

The imposition of tariffs by the US significantly impacted Chinese exports, leading to a considerable decline in several key manufacturing sectors. This downturn reverberated throughout the Chinese economy, affecting employment and related industries.

-

Specific examples of affected industries: The electronics industry, particularly concerning smartphones and computer components, suffered greatly. Similarly, the textile and apparel sectors experienced a notable decrease in orders and revenue. The furniture industry also felt the impact of reduced exports.

-

Quantifiable data on export decline: Reports indicate a double-digit percentage decrease in exports in specific sectors following the implementation of tariffs. The loss of revenue amounted to billions of dollars, impacting both large multinational corporations and smaller export-oriented businesses.

-

Analysis of the ripple effect on related industries and employment: The decline in exports triggered a ripple effect, impacting related industries such as logistics, transportation, and packaging. Job losses in these sectors added to the economic strain, increasing unemployment and social anxieties.

-

Discussion of China's efforts to diversify export markets: In response, China actively sought to diversify its export markets, focusing on expanding trade with countries in Africa, Southeast Asia, and Latin America. However, this diversification strategy takes time and significant investment to yield substantial results. Related Keywords: Chinese exports, trade war impact, manufacturing decline, export diversification, global trade

The Agricultural Sector's Struggle

The trade disputes also severely challenged China's agricultural sector, particularly impacting key products like soybeans and pork. The tariffs imposed by the US significantly reduced Chinese demand for American soybeans, impacting both American farmers and Chinese agricultural businesses.

-

Focus on specific agricultural products affected: The soybean market experienced the most significant disruption. China, being the world's largest soybean importer, relied heavily on US supplies before the trade war. The disruption led to price volatility and supply chain issues. Pork production also faced challenges due to the African Swine Fever outbreak, further exacerbated by trade tensions.

-

Explain the impact on farmers' incomes and the domestic food supply: Farmers' incomes decreased due to reduced demand and lower prices for their products. The disruption of soybean imports led to increased domestic prices, impacting food costs for consumers. Food security concerns arose due to supply chain disruptions.

-

Discuss government support measures and their effectiveness: The Chinese government implemented various support measures, including subsidies and price stabilization policies, to help farmers and ensure food security. However, the effectiveness of these measures has been debated, with some arguing they haven't adequately compensated for the losses.

-

Analyze the long-term implications for food security in China: The trade war highlighted the importance of ensuring food security and reducing reliance on foreign agricultural imports for China. It spurred efforts to improve domestic agricultural production and increase self-sufficiency. Related Keywords: Chinese agriculture, soybean trade, pork production, food security, agricultural subsidies

Foreign Investment Slowdown and Capital Flight

The trade tensions and uncertainty surrounding the US-China relationship led to a significant slowdown in foreign direct investment (FDI) into China. This decline reflects a loss of investor confidence and a shift in investment priorities.

-

Explain the reasons behind the FDI slowdown: Uncertainty surrounding trade policies and the escalating trade war created a climate of risk aversion for foreign investors. Concerns about intellectual property rights and market access also contributed to the slowdown.

-

Quantifiable data on FDI decline: The FDI decline was substantial, with numerous reports showcasing a notable percentage decrease in investment inflows. This drop signifies a considerable loss of capital for China's economy.

-

Discuss the impact on job creation and economic growth: Reduced FDI directly impacted job creation, especially in export-oriented and foreign-invested industries. The decline in investment hampered economic growth, contributing to slower expansion.

-

Analyze potential capital flight and its consequences: The uncertainty also led to concerns about potential capital flight, where Chinese investors sought to move their assets outside the country. This capital flight could destabilize the financial markets and negatively impact the Chinese currency. Related Keywords: Foreign Direct Investment (FDI), capital flight, Chinese economy, investment slowdown, global investment

Technological Dependence and its Implications

China's reliance on foreign technology, particularly in semiconductors and advanced manufacturing equipment, has become a significant vulnerability exposed by the trade war.

-

Discuss the impact of trade restrictions on access to crucial technologies: The US imposed restrictions on the export of certain technologies to China, hindering its technological advancements. This had a direct impact on the development of key industries.

-

Analyze the implications for China's technological advancement and innovation: Limited access to advanced technology slows down technological innovation and slows China's competitiveness in high-tech sectors.

-

Examine China's efforts to achieve technological self-reliance: China has invested heavily in research and development to achieve technological self-reliance. The government's "Made in China 2025" initiative aims to boost domestic technological capabilities. However, achieving technological independence in the short term is a significant challenge. Related Keywords: Technological dependence, technological self-reliance, China tech sector, innovation, trade restrictions

The Rise of Domestic Consumption and its Limitations

To offset the decline in exports and foreign investment, the Chinese government has prioritized boosting domestic consumption. While showing some progress, this strategy has limitations.

-

Explain the government's strategies to boost domestic demand: The government employed various strategies, such as tax cuts, infrastructure investments, and social welfare programs to stimulate consumer spending and support domestic businesses.

-

Discuss the limitations and challenges of relying on domestic consumption: The effectiveness of boosting domestic demand depends on several factors, including income levels, consumer confidence, and the overall economic climate. China's high savings rate poses a challenge to significantly increasing consumption.

-

Analyze the potential for long-term growth driven by domestic consumption: While domestic consumption offers a pathway for sustainable economic growth, it requires significant structural reforms to improve income distribution and boost consumer confidence in the long run. Related Keywords: Domestic consumption, consumer spending, Chinese economy, economic stimulus, domestic demand

Conclusion

The ongoing trade war has undeniably inflicted significant losses on the Chinese economy, impacting various sectors from manufacturing and agriculture to foreign investment and technological advancement. While Beijing has implemented measures to mitigate these effects, including a focus on domestic consumption and technological self-reliance, the long-term consequences remain uncertain. Understanding the depth of China's economic vulnerability is crucial for navigating the complexities of the global economic landscape. Further research into the effectiveness of government responses and the evolving nature of the trade conflict is essential. Continue to stay informed on the ongoing developments impacting China's Economic Vulnerability, and explore further analysis of China's economic vulnerabilities to better understand the potential risks and opportunities in the Chinese market.

Featured Posts

-

Bebe De L Annee Gate Par Une Boulangerie Normande Un Cadeau Enorme

May 02, 2025

Bebe De L Annee Gate Par Une Boulangerie Normande Un Cadeau Enorme

May 02, 2025 -

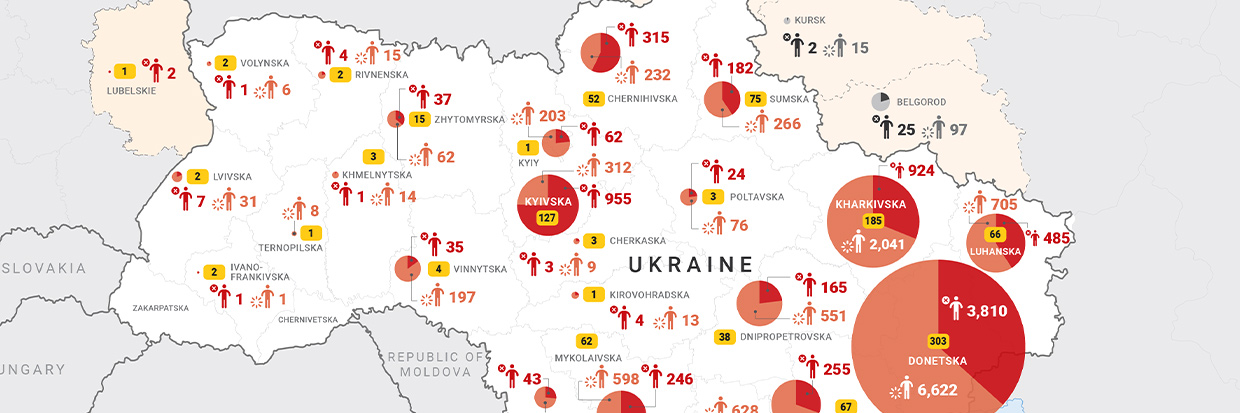

Is Xrp Ripple A Buy Under 3 A Comprehensive Investment Guide

May 02, 2025

Is Xrp Ripple A Buy Under 3 A Comprehensive Investment Guide

May 02, 2025 -

Duurzame School Kampen Juridische Strijd Om Aansluiting Op Elektriciteitsnet

May 02, 2025

Duurzame School Kampen Juridische Strijd Om Aansluiting Op Elektriciteitsnet

May 02, 2025 -

Analyzing Ziaire Williams Performance Is This His Breakout Season

May 02, 2025

Analyzing Ziaire Williams Performance Is This His Breakout Season

May 02, 2025 -

Successfully Completing A Nuclear Reactor Power Uprate With The Nrc

May 02, 2025

Successfully Completing A Nuclear Reactor Power Uprate With The Nrc

May 02, 2025

Latest Posts

-

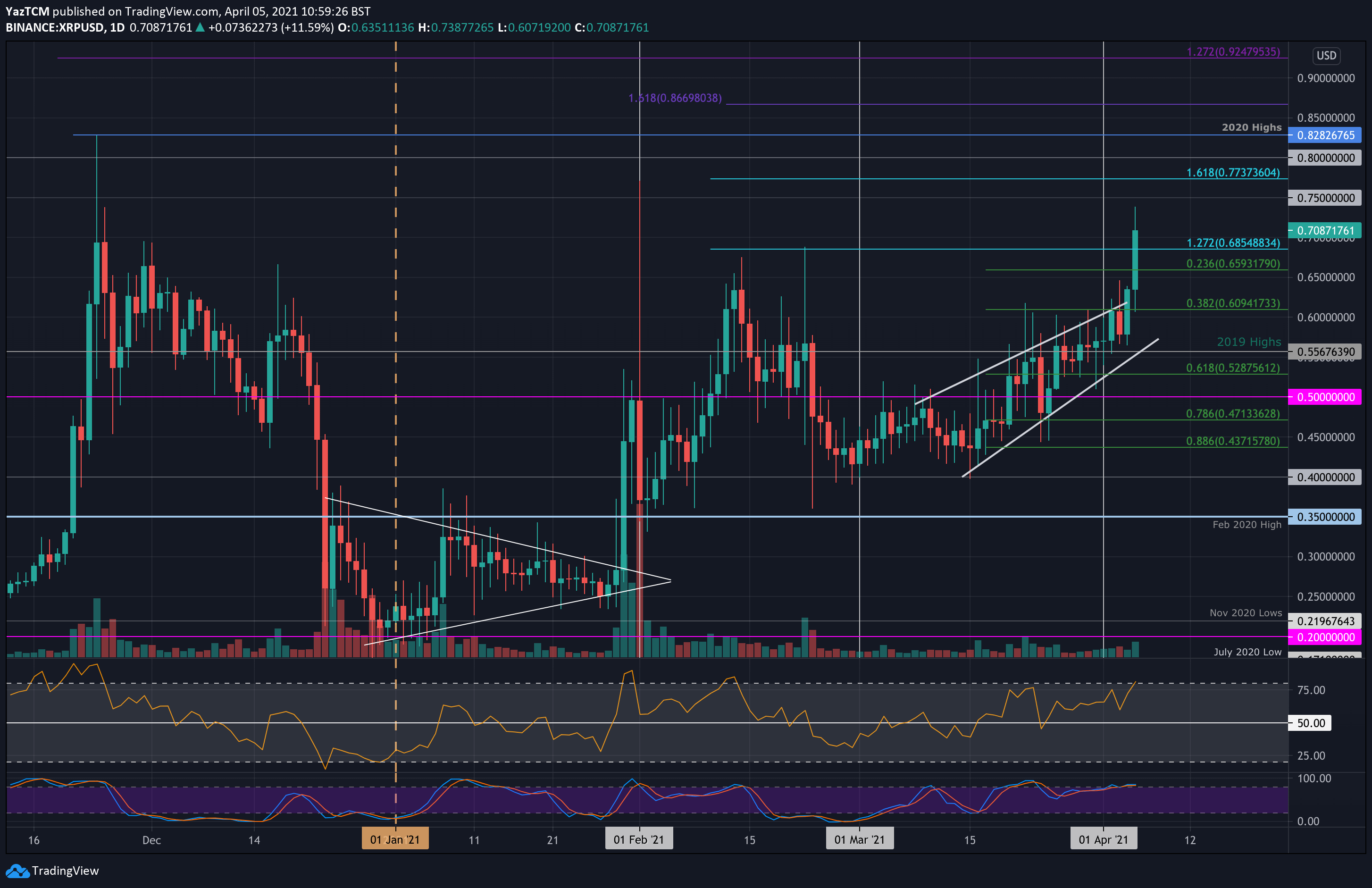

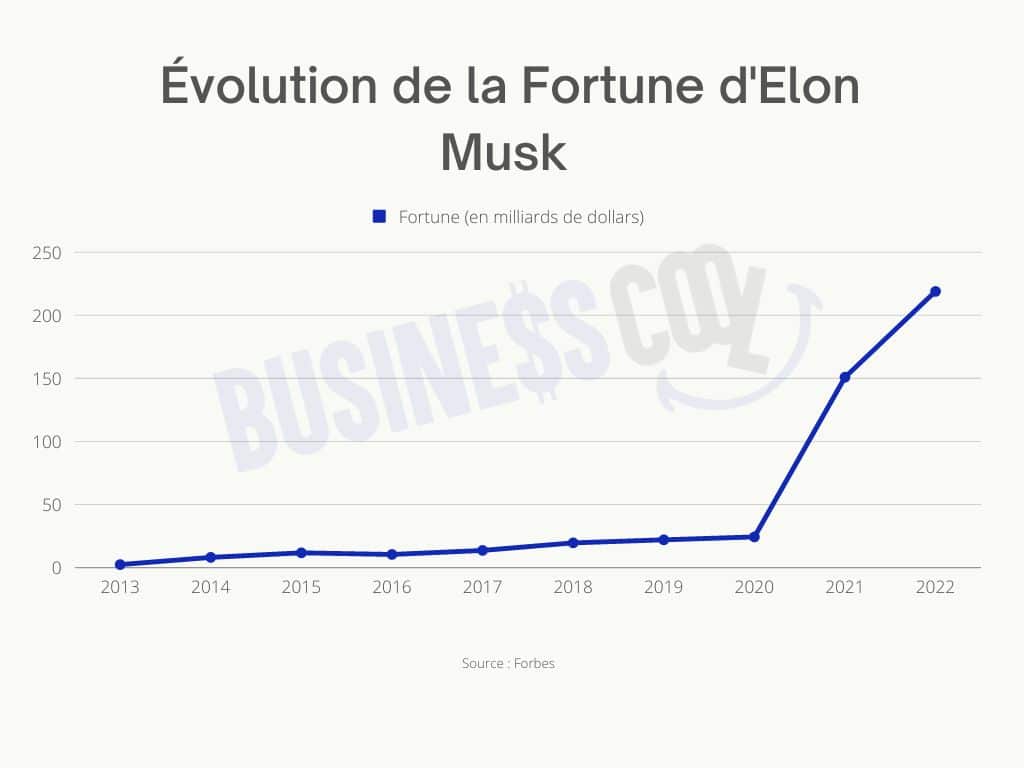

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 10, 2025

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 10, 2025 -

Examining The Relationship Between Us Economic Power And Elon Musks Wealth

May 10, 2025

Examining The Relationship Between Us Economic Power And Elon Musks Wealth

May 10, 2025 -

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Trends

May 10, 2025

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Trends

May 10, 2025 -

Teslas Success And Elon Musks Fortune An Examination Of Us Economic Factors

May 10, 2025

Teslas Success And Elon Musks Fortune An Examination Of Us Economic Factors

May 10, 2025 -

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025