China's Steel Industry Slowdown: Driving Down Iron Ore Prices

Table of Contents

Reduced Steel Demand in China

The primary driver behind the falling iron ore price is the significant reduction in Chinese steel demand. Several interconnected factors contribute to this slowdown:

-

Slowing Chinese Economic Growth: China's economic growth has decelerated in recent years, impacting various sectors reliant on steel, including construction and infrastructure. The country's GDP growth rate has noticeably slowed, directly impacting the demand for steel. For example, a recent report showed a decrease of X% in GDP growth, leading to a corresponding reduction in infrastructure spending. This directly translates to reduced demand for Chinese steel.

-

Government Efforts to Curb Carbon Emissions and Reduce Overcapacity: The Chinese government has implemented stringent measures to curb carbon emissions and address the overcapacity issue within its steel sector. These policies, while crucial for environmental sustainability, have resulted in reduced steel production and consequently lower demand for iron ore. The aim is to create a more efficient and environmentally responsible steel industry.

-

Decreased Construction Activity (Real Estate Market Slowdown): The slowdown in China's real estate sector has significantly impacted steel demand. Construction projects, a major consumer of steel, have been scaled back, leading to a substantial drop in demand. Reports indicate a Y% decrease in housing starts, directly affecting the construction industry's need for steel.

-

Impact of COVID-19 Lingering Effects on Infrastructure Projects: The lingering effects of the COVID-19 pandemic have caused delays and disruptions to infrastructure projects, further reducing steel demand. Supply chain bottlenecks and labor shortages have compounded the problem, leading to a further decrease in the Chinese steel demand.

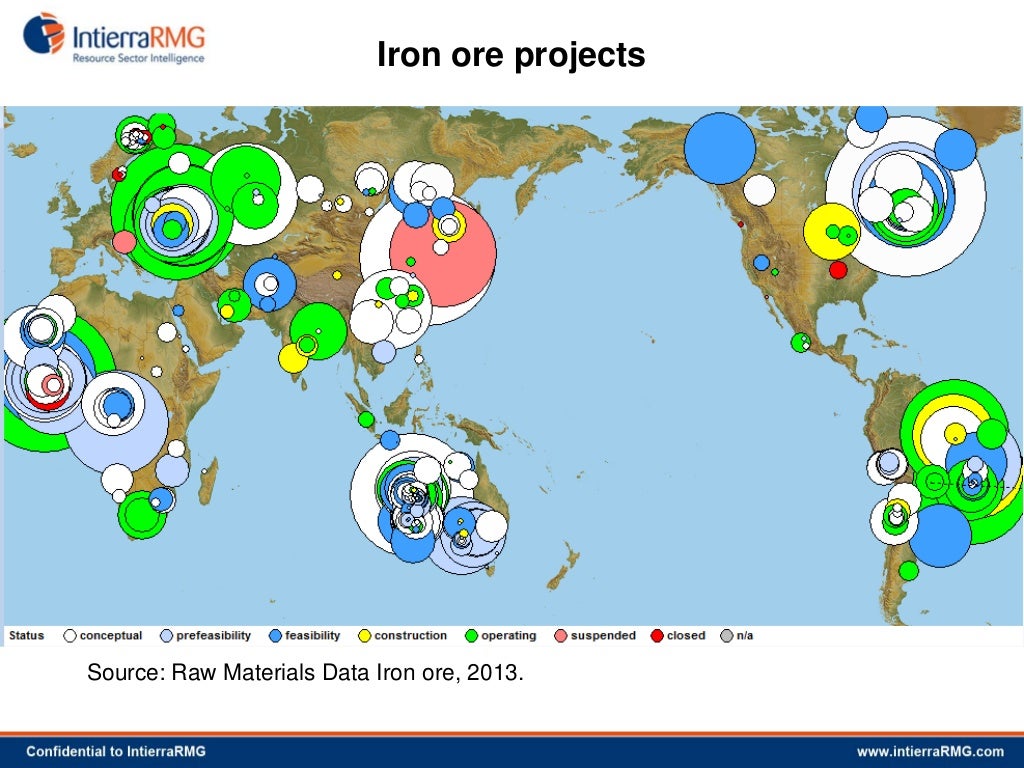

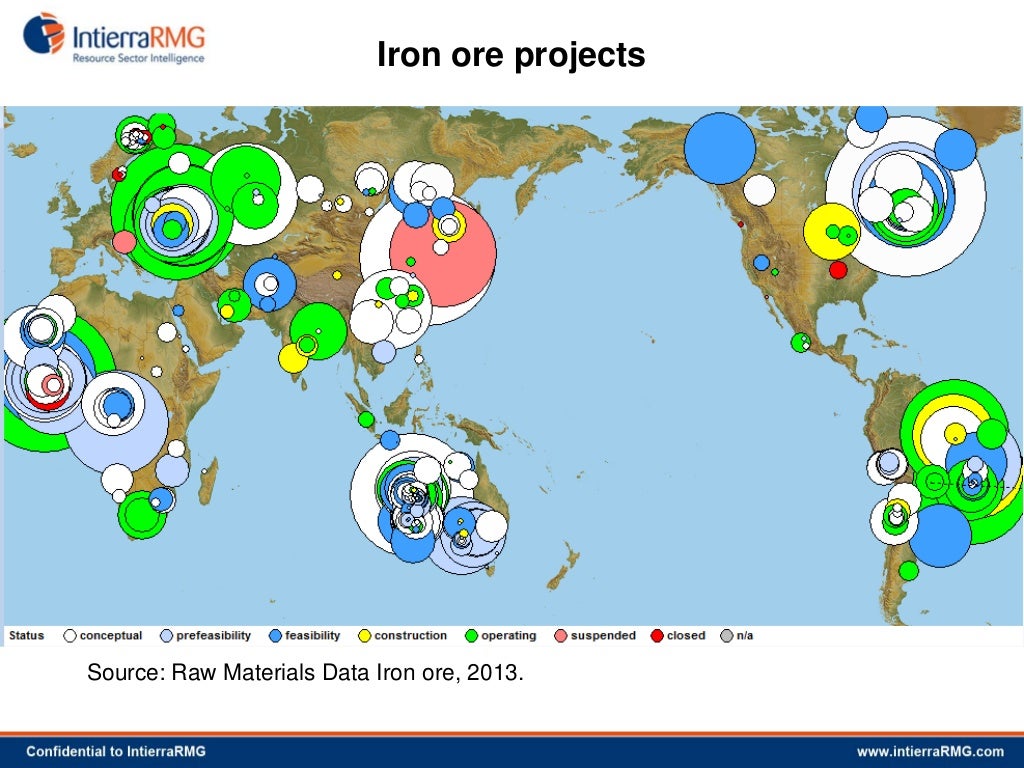

Impact on Iron Ore Supply and Demand

The reduced Chinese steel production has had a profound impact on the global iron ore market, creating a significant imbalance between supply and demand.

-

Over-supply of Iron Ore Leading to Price Reductions: The decreased demand from China has resulted in a global oversupply of iron ore, putting downward pressure on prices. This surplus has led to a significant drop in iron ore price, affecting producers and traders globally.

-

Major Iron Ore Producing Countries (Australia, Brazil) Affected by Decreased Demand: Australia and Brazil, the world's leading iron ore producers, are directly impacted by the reduced Chinese demand. Their iron ore exports have declined, leading to decreased revenue and impacting their economies. Australian iron ore exports, for example, have fallen by Z%.

-

Price Fluctuations and Volatility in the Iron Ore Market: The fluctuating nature of iron ore prices has increased market volatility. This uncertainty makes it challenging for producers, traders, and investors to plan and manage their operations effectively. The recent price swings highlight this inherent instability.

-

Analysis of the Impact on Iron Ore Mining Companies and Their Stock Prices: The iron ore price decline has severely impacted the profitability and stock prices of major iron ore mining companies. Many companies have reported significant losses, causing significant investor concern.

Alternative Factors Affecting Iron Ore Prices

While China's steel industry slowdown is the dominant factor, other elements influence iron ore prices:

-

Global Inflation and its Effect on Commodity Prices: Global inflation plays a role, influencing the prices of all commodities, including iron ore. Rising inflation often leads to higher commodity prices, although other factors can counteract this trend.

-

Geopolitical Events and Their Potential Impact on Trade and Supply Chains: Geopolitical events and trade disputes can disrupt global supply chains, impacting iron ore availability and prices. Events like the war in Ukraine have significantly influenced commodity markets.

-

Changes in Currency Exchange Rates: Fluctuations in currency exchange rates affect the cost of iron ore, influencing international trade and pricing. A stronger US dollar, for instance, can reduce the price of iron ore denominated in other currencies.

-

Speculation and Trading Activity in the Iron Ore Futures Market: Speculation and trading activity in the iron ore futures market can contribute to price volatility, independent of underlying supply and demand fundamentals.

Forecasting Future Iron Ore Prices

Predicting future iron ore prices remains challenging due to ongoing uncertainty. However, several potential scenarios are worth considering:

-

Potential Scenarios for China's Steel Industry Recovery: The pace of China's economic recovery will significantly impact future steel demand and thus iron ore prices. A robust recovery could lead to increased demand, while a prolonged slowdown could exacerbate the price decline.

-

Predictions for Global Steel Demand in the Coming Years: Global steel demand projections are essential in forecasting future iron ore prices. Factors such as infrastructure development in emerging economies will influence global steel consumption.

-

Factors That Could Potentially Drive Iron Ore Prices Upward: A reduction in iron ore supply due to production constraints or unexpected geopolitical events could lead to price increases. Increased infrastructure spending globally could also boost demand.

-

Risks and Uncertainties Associated with Price Forecasting: Forecasting commodity prices is inherently uncertain. Unforeseen economic shocks, geopolitical instability, and unexpected changes in supply and demand can significantly affect price predictions.

Conclusion: China's Steel Industry Slowdown and the Future of Iron Ore Prices

The strong correlation between China's slowing steel industry and the decline in iron ore prices is undeniable. Careful monitoring of China's economic indicators, particularly steel production levels, is crucial for predicting future iron ore price movements. The interplay of global economic conditions, geopolitical risks, and the internal dynamics of China's steel sector will continue to shape the future of the iron ore market. To make informed investment decisions related to iron ore price, China steel production, and the global iron ore market, stay informed about developments in these key areas. Understanding these factors is paramount for navigating the complexities of the global iron ore market.

Featured Posts

-

Mediatheque Champollion Dijon Intervention Des Pompiers Pour Un Debut D Incendie

May 10, 2025

Mediatheque Champollion Dijon Intervention Des Pompiers Pour Un Debut D Incendie

May 10, 2025 -

2025 A Good Year For Stephen King Despite A Potential The Monkey Flop

May 10, 2025

2025 A Good Year For Stephen King Despite A Potential The Monkey Flop

May 10, 2025 -

Omada Health Ipo Andreessen Horowitz Backed Telehealth Company Files For Public Offering

May 10, 2025

Omada Health Ipo Andreessen Horowitz Backed Telehealth Company Files For Public Offering

May 10, 2025 -

Palantir Stock Plunge Should You Buy The Dip

May 10, 2025

Palantir Stock Plunge Should You Buy The Dip

May 10, 2025 -

Effortless Dividend Investing For Higher Returns

May 10, 2025

Effortless Dividend Investing For Higher Returns

May 10, 2025