Effortless Dividend Investing For Higher Returns

Table of Contents

Understanding Dividend Investing Basics

Before diving into effortless strategies, let's solidify our understanding of the fundamentals. Dividend investing involves purchasing stocks in companies that regularly pay out a portion of their profits to shareholders as dividends. These payouts represent a share of the company's success and can provide a consistent stream of passive income.

-

Dividends and How They Work: Companies distribute dividends based on their profitability and board decisions. These payments are typically made quarterly.

-

Dividend Yield vs. Payout Ratio: Dividend yield represents the annual dividend payment relative to the stock price (annual dividend/stock price). The payout ratio shows the percentage of earnings paid out as dividends (dividends/earnings). A high yield doesn't always mean a good investment; analyzing the payout ratio is crucial to assess sustainability.

-

Importance of Dividend Growth: Companies committed to increasing their dividends over time offer superior long-term returns. Look for companies with a history of consistent dividend growth.

-

Types of Dividend Stocks: There's a range of dividend stocks, including:

- Blue-chip stocks: Established, large-cap companies known for stability and consistent dividends.

- Growth stocks: Companies reinvesting profits to fuel expansion but still paying dividends.

- Income stocks: Companies prioritizing dividend payouts, often with high yields.

-

Key Metrics to Analyze: Dividend yield, payout ratio, dividend growth rate, earnings per share (EPS).

-

Risks of Dividend Investing: Dividend cuts are possible if company performance declines. Stock prices can fluctuate, impacting total returns.

-

Tax Implications of Dividends: Dividends are generally taxed as ordinary income, so factor this into your investment strategy.

Strategies for Effortless Dividend Investing

The beauty of effortless dividend investing lies in its simplicity. By employing smart strategies, you can minimize the time and effort required while maximizing your returns.

Diversification for Reduced Risk

Diversification is crucial for mitigating risk. Don't put all your eggs in one basket! Spread your investments across various sectors and companies to reduce the impact of any single company's underperformance.

-

ETFs and Mutual Funds: These offer instant diversification with a single investment. They hold a portfolio of dividend-paying stocks, reducing research and management time.

-

Examples of Dividend ETFs/Mutual Funds: Vanguard High Dividend Yield ETF (VYM), Schwab US Dividend Equity ETF (SCHD), iShares Core Dividend Growth ETF (DGRO). (Note: Always conduct thorough research before investing in any specific ETF or mutual fund.)

-

Benefits of ETF Investing: Low expense ratios, diversification, ease of trading.

-

Risks of Concentrated Holdings: Higher risk of significant losses if a small number of holdings underperform.

Dollar-Cost Averaging (DCA): A Simple Approach

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy helps mitigate risk by buying more shares when prices are low and fewer when prices are high.

-

Implementing DCA: Decide on a fixed amount and investment frequency (e.g., $100 per week).

-

Ease and Simplicity: DCA requires minimal market timing skills, making it perfect for beginners.

-

Calculating DCA Investments: Determine your investment budget and divide it by the number of investment periods.

-

Setting a Regular Investment Schedule: Automate your investments through your brokerage account to ensure consistency.

Dividend Reinvestment Plans (DRIPs): Automating Growth

Dividend reinvestment plans (DRIPs) allow you to automatically reinvest your dividend payments to purchase more shares. This powerful tool accelerates compounding and maximizes long-term growth.

-

How DRIPs Work: Your dividends are automatically used to purchase additional shares of the same company.

-

Convenience and Automation: DRIPs handle the reinvestment process for you, requiring minimal effort.

-

Finding Companies with DRIPs: Check company websites or your brokerage account for availability.

-

DRIP Fees and Limitations: Some DRIPs may charge small fees, and there might be minimum investment requirements.

Identifying High-Yield Dividend Stocks with Minimal Effort

Finding suitable dividend stocks doesn't require hours of painstaking research. Leverage readily available resources to streamline the process.

-

Screening Tools and Resources: Many online brokers offer stock screening tools that allow you to filter stocks based on various criteria, such as dividend yield, payout ratio, and growth history.

-

Consistent Dividend Payments: Prioritize companies with a long and consistent track record of paying dividends.

-

Financial Health and Stability: Assess a company's financial strength before investing. Look at key financial ratios like debt-to-equity ratio and return on equity.

-

Reliable Online Resources for Screening: Use reputable financial websites and brokerage platforms.

-

Key Financial Ratios to Check: Debt-to-equity ratio, return on equity (ROE), price-to-earnings ratio (P/E).

-

Importance of Due Diligence: Even with screening tools, conduct thorough research before investing.

Conclusion: Achieve Effortless Dividend Investing for Higher Returns

By implementing the strategies discussed – diversification, dollar-cost averaging, dividend reinvestment plans, and utilizing efficient screening tools – you can significantly simplify your dividend investing journey. Effortless dividend investing allows you to build wealth passively, generating a consistent stream of income over time. Remember that patience and long-term commitment are crucial for achieving your financial goals.

Begin your effortless dividend investing journey today! Start building passive income through dividend investing by researching suitable dividend stocks or ETFs. Don't hesitate to take advantage of the resources available and begin your path towards a more secure and prosperous future.

Featured Posts

-

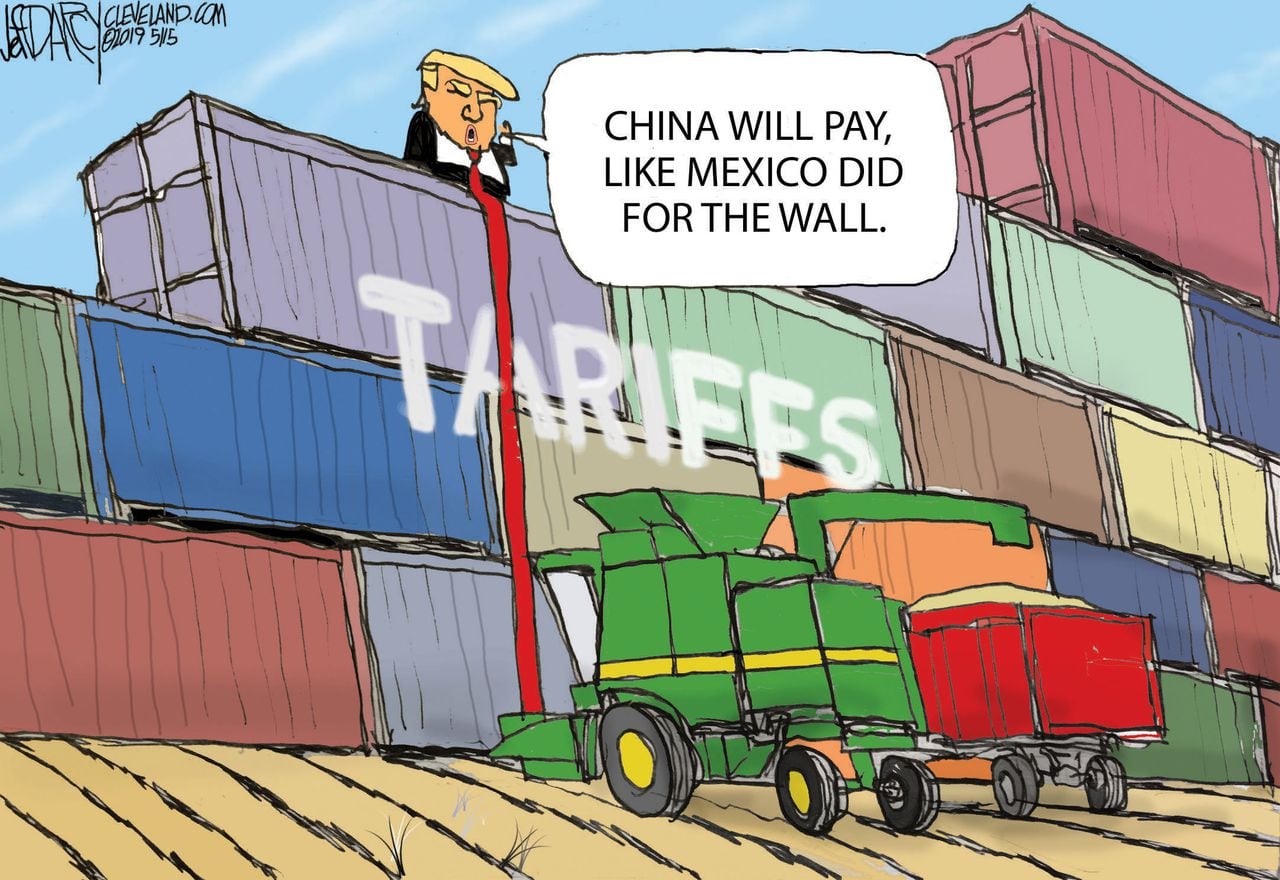

Trumps 10 Tariff Threat Baseline Unless Exceptional Offer Received

May 10, 2025

Trumps 10 Tariff Threat Baseline Unless Exceptional Offer Received

May 10, 2025 -

Trois Hommes Agresses Sauvagement Pres Du Lac Kir A Dijon

May 10, 2025

Trois Hommes Agresses Sauvagement Pres Du Lac Kir A Dijon

May 10, 2025 -

High Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 10, 2025

High Stock Market Valuations Bof A Explains Why Investors Shouldnt Panic

May 10, 2025 -

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025 -

Chinas Steel Production Cuts And The Future Of Iron Ore Prices

May 10, 2025

Chinas Steel Production Cuts And The Future Of Iron Ore Prices

May 10, 2025