Chinese Buyout Firm's Potential Sale Of Chip Tester UTAC

Table of Contents

UTAC's Significance in the Semiconductor Landscape

UTAC holds a considerable position within the competitive landscape of semiconductor testing equipment. Its influence stems from its advanced testing solutions and its established market share, making it a key player in ensuring the quality and reliability of modern chips. Understanding UTAC's significance requires examining its capabilities and market standing.

-

Market share within the chip testing sector: While precise figures are often confidential, industry analysts suggest UTAC commands a significant portion of the market for specific types of chip testing, particularly in high-end applications. This market share reflects its technological prowess and established client base.

-

Key technologies employed by UTAC: UTAC's success is built upon its innovative approach to chip testing. They utilize advanced algorithms and proprietary testing methodologies to ensure high accuracy and efficiency in identifying defects. Their expertise extends to various testing techniques, including functional testing, parametric testing, and burn-in testing.

-

Client base (types of companies using UTAC's equipment): UTAC's client roster is likely diverse, encompassing major semiconductor manufacturers, fabless chip designers, and contract manufacturers across the globe. This wide range of clients highlights UTAC's versatility and adaptability across different semiconductor applications.

-

UTAC's competitive advantages: Beyond its technological capabilities, UTAC likely possesses strong competitive advantages, including established relationships with key clients, a robust service network, and a well-regarded brand reputation within the industry.

Reasons Behind the Potential Sale of UTAC

The Chinese buyout firm's decision to consider selling UTAC is likely driven by a complex interplay of factors, involving strategic considerations, financial incentives, and broader market dynamics.

-

Potential financial incentives for the buyout firm: The firm may seek to realize significant returns on its initial investment in UTAC. A sale could provide a substantial capital gain, allowing the firm to reinvest in other promising ventures within its portfolio.

-

Strategic reasons for divestment (e.g., portfolio restructuring): The firm's overall strategic goals may necessitate divesting assets to streamline operations, focus on core businesses, or align with a new investment strategy. Selling UTAC might be part of a broader portfolio restructuring.

-

Impact of global economic conditions on the decision: The current economic climate, including global uncertainties and potential downturns in the semiconductor sector, could influence the firm's decision to sell. A sale might be seen as a way to mitigate risk in a challenging market.

-

Potential regulatory pressures: Given the geopolitical landscape and increasing scrutiny of Chinese investments in sensitive technologies, regulatory pressures could be a factor influencing the decision to sell UTAC.

Potential Buyers and Acquisition Implications

The potential sale of UTAC is likely to attract interest from a variety of buyers, both domestic and international. The implications of different buyers will significantly impact the future of UTAC and the broader semiconductor industry.

-

Likely profiles of potential acquirers (e.g., competitors, industry consolidators): Potential acquirers could include rival chip testing equipment manufacturers seeking to expand their market share, larger semiconductor companies aiming to vertically integrate their supply chains, or private equity firms looking for profitable investments in the technology sector.

-

Potential impact on market competition: The acquisition by a direct competitor could lead to reduced competition in the chip testing market, potentially impacting pricing and innovation. Conversely, acquisition by a non-competitor could lead to increased competition and innovation.

-

Geopolitical implications of different buyers: The nationality of the acquirer holds significant geopolitical implications. An acquisition by a US-based company, for example, could impact technology transfer and intellectual property concerns.

-

Effects on technological innovation and development: The acquirer's investment strategy and commitment to R&D will determine UTAC's future technological trajectory. A buyer focused on innovation could further enhance UTAC's capabilities, while a buyer prioritizing cost-cutting could stifle innovation.

The Future of UTAC and the Chip Testing Market

The sale of UTAC will undoubtedly reshape the company's future and its role in the chip testing market. The long-term implications extend far beyond UTAC itself.

-

Possible strategic shifts under new ownership: Under new ownership, UTAC could experience significant shifts in its strategic direction, including changes in product focus, market expansion plans, and investment priorities.

-

Impact on UTAC's R&D and innovation efforts: The acquirer's commitment to research and development will greatly impact UTAC's ability to maintain its technological edge in the highly competitive chip testing market.

-

Predictions for the future of the chip testing market: The transaction could significantly influence the dynamics of the chip testing market, impacting competition, innovation, and pricing strategies.

-

Long-term implications for semiconductor manufacturing: The sale of UTAC could have broader implications for semiconductor manufacturing, potentially influencing the quality, reliability, and cost of chip production.

Conclusion

The potential sale of UTAC by a leading Chinese buyout firm presents a significant development in the semiconductor industry. The reasons behind the sale are multifaceted, encompassing financial incentives, strategic realignment, and market conditions. The identity of the eventual buyer will have profound implications for competition, technological innovation, and geopolitical dynamics within the chip testing market and the wider semiconductor landscape. The future of UTAC, and indeed the future of the chip testing market itself, hangs in the balance. Stay informed about the developments surrounding the potential sale of UTAC and its impact on the Chinese buyout firm and the broader chip testing market. Follow us for further updates on this crucial transaction in the semiconductor industry.

Featured Posts

-

Bitcoin Btc Market Analysis Trump The Fed And Price Movement

Apr 24, 2025

Bitcoin Btc Market Analysis Trump The Fed And Price Movement

Apr 24, 2025 -

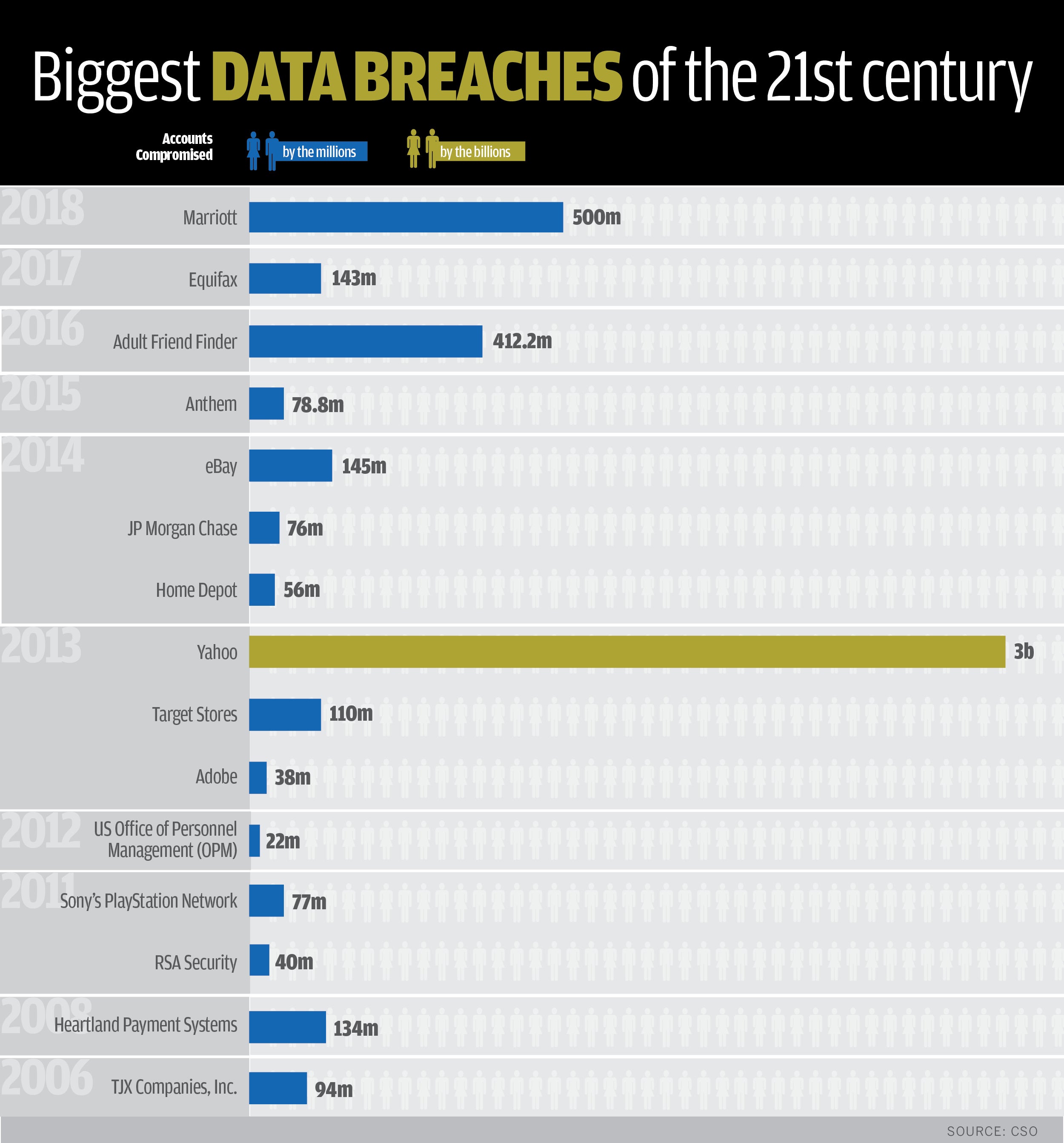

Millions Lost Executive Office365 Accounts Targeted In Major Data Breach

Apr 24, 2025

Millions Lost Executive Office365 Accounts Targeted In Major Data Breach

Apr 24, 2025 -

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025 -

Oil Price Update Market News And Analysis For April 23

Apr 24, 2025

Oil Price Update Market News And Analysis For April 23

Apr 24, 2025 -

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 24, 2025

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 24, 2025