Chinese Stock Market Shows Positive Movement After Recent Setback

Table of Contents

Factors Contributing to the Positive Market Movement

Several intertwined economic and political factors are fueling the recent uptick in the Chinese stock market. Understanding these contributing elements is crucial for assessing the sustainability of this positive market movement and the implications for future investment in China.

-

Government Stimulus Packages: The Chinese government has implemented several stimulus packages aimed at boosting economic growth and supporting various sectors. These initiatives, including infrastructure spending and tax cuts, have injected much-needed liquidity into the market, improving investor sentiment and stimulating economic activity. The impact on market confidence is significant, as evidenced by increased trading volumes and a rise in share prices across multiple sectors.

-

Regulatory Reforms: The ongoing regulatory reforms aimed at fostering a fairer and more transparent market environment are also playing a vital role. These reforms, addressing concerns about monopolies and encouraging healthy competition, are gradually improving investor confidence in the long-term stability and potential of the Chinese stock market. This increased trust is attracting both domestic and foreign investment.

-

Increased Foreign Investment: Growing foreign investment is another key contributor. As international investors regain confidence in the Chinese economy and market reforms, capital inflow is increasing, further supporting the upward trajectory. This influx of foreign capital adds liquidity and provides a much-needed boost to market capitalization.

-

Technological Advancements: China's rapid advancements in technology, particularly in sectors such as artificial intelligence, renewable energy, and e-commerce, are driving significant growth and attracting substantial investment. These technological breakthroughs are creating new opportunities and stimulating innovation, contributing positively to overall market performance.

-

Improving Consumer Spending: Signs of improving consumer spending indicate a strengthening domestic economy, which is a critical factor supporting the stock market's positive movement. Increased consumer confidence translates to higher demand for goods and services, benefiting companies listed on the Chinese stock exchanges and boosting overall market performance.

Key Indices and Their Performance

The recent positive movement is clearly reflected in the performance of major Chinese stock market indices.

-

Shanghai Composite Index: The Shanghai Composite Index has shown a significant percentage increase (insert actual percentage and timeframe here) since the recent market setback, demonstrating a clear upward trend.

-

Shenzhen Component Index: Similarly, the Shenzhen Component Index (insert actual percentage and timeframe here) reflects a positive market trajectory, mirroring the gains seen in Shanghai.

-

CSI 300: The CSI 300 index, a benchmark index tracking the performance of the 300 largest companies listed on the Shanghai and Shenzhen exchanges, (insert actual percentage and timeframe here) also showcases the positive market movement, highlighting broad-based growth across major sectors. (Include relevant charts and graphs here to visually represent the data)

The performance variations between these indices reflect the diverse performance across different sectors within the Chinese economy. Analyzing these sector-specific trends provides valuable insights into the underlying drivers of the overall market movement. Furthermore, a comparison of these indices with global market trends helps to understand the extent to which the positive movement is domestically driven or influenced by global factors.

Challenges and Potential Risks Remaining

Despite the positive momentum, significant challenges and potential risks remain that could impact the continued upward trend.

-

Geopolitical Risks and Trade Tensions: Ongoing geopolitical uncertainties and potential trade tensions with other countries pose a threat to market stability. These external factors could introduce volatility and negatively influence investor sentiment.

-

Inflationary Pressures: Rising inflation could erode investor confidence and curb economic growth, potentially reversing the positive market trend. Careful monitoring of inflation rates is crucial for assessing the long-term sustainability of the current market performance.

-

Economic Uncertainty: The ongoing economic uncertainty, both domestically and globally, continues to present a challenge. Unforeseen economic shocks could easily trigger market corrections, underscoring the need for cautious optimism.

-

Market Volatility: The Chinese stock market remains susceptible to periods of volatility. Investors should adopt prudent risk management strategies to navigate potential market fluctuations and protect their investments.

Conclusion

The Chinese stock market's recent positive movement, fueled by government stimulus, regulatory reforms, increased foreign investment, technological advancements, and improving consumer spending, presents a cautiously optimistic outlook. While challenges like geopolitical risks, inflation, and economic uncertainty remain, the potential for continued growth is undeniable. The performance of key indices like the Shanghai Composite, Shenzhen Component, and CSI 300 clearly indicate this upward trend. However, investors should remain vigilant and adopt a well-informed approach, acknowledging the inherent risks involved. Stay updated on the latest developments in the Chinese stock market to capitalize on potential future growth. Understanding the nuances of this dynamic market is crucial for informed investment in China.

Featured Posts

-

The Rise Of Chinese Stocks A Post Negotiation And Data Analysis

May 07, 2025

The Rise Of Chinese Stocks A Post Negotiation And Data Analysis

May 07, 2025 -

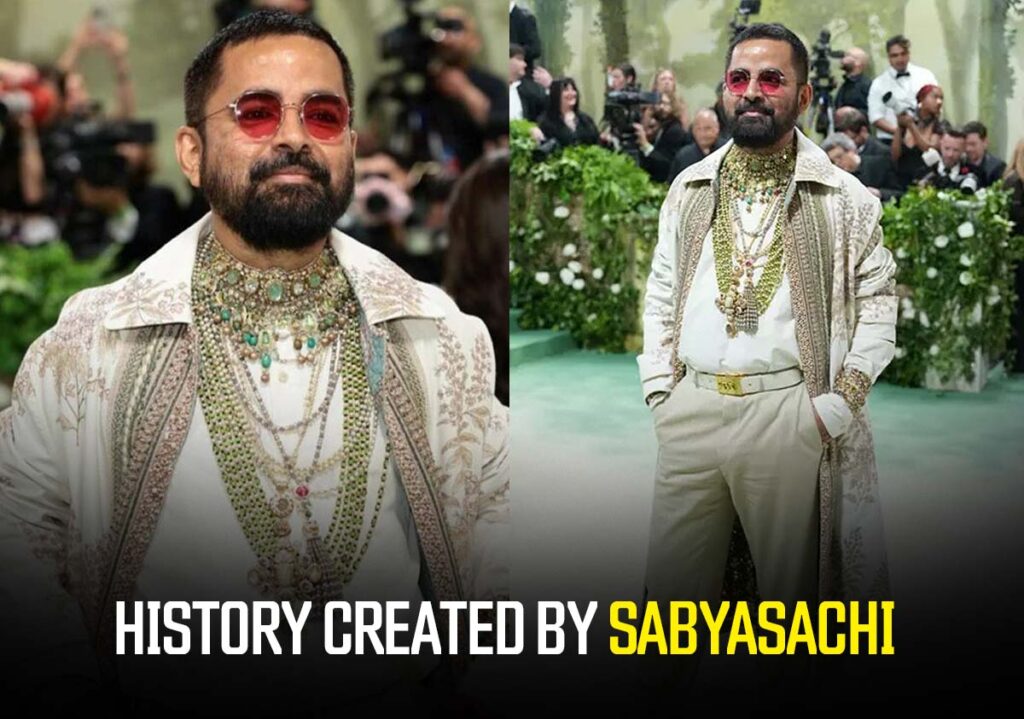

Shah Rukh Khan Makes Met Gala History In Sabyasachi

May 07, 2025

Shah Rukh Khan Makes Met Gala History In Sabyasachi

May 07, 2025 -

John Wicks Las Vegas Adventure Play The Role Of Baba Yaga

May 07, 2025

John Wicks Las Vegas Adventure Play The Role Of Baba Yaga

May 07, 2025 -

The Ftcs Chat Gpt Investigation A Turning Point For Ai Accountability

May 07, 2025

The Ftcs Chat Gpt Investigation A Turning Point For Ai Accountability

May 07, 2025 -

Zendaya Dazzles In See Through Gown In Southern France

May 07, 2025

Zendaya Dazzles In See Through Gown In Southern France

May 07, 2025