Climate Risk: Understanding The Potential Impact On Your Home Buying Credit Score

Table of Contents

The cost of home insurance is skyrocketing, with premiums increasing by an average of 15% annually in some high-risk areas due to the escalating frequency and intensity of extreme weather events. This alarming trend directly impacts your ability to secure a mortgage and maintain a healthy credit score. This article addresses the critical issue of Climate Risk: Understanding the Potential Impact on Your Home Buying Credit Score, a growing concern for both lenders and prospective homeowners. We'll explore how climate change affects home values, the subsequent impact on your credit, and strategies to mitigate these risks.

H2: How Climate Change Affects Home Values

Climate change significantly impacts property values, creating a ripple effect that extends to your financial well-being. Understanding these impacts is crucial before making a significant investment in a home.

H3: Increased Insurance Premiums

Properties located in high-risk areas, such as flood zones, wildfire-prone regions, and coastal communities, face exponentially higher insurance premiums. This increase can make securing a mortgage significantly more challenging or even impossible. Insurance companies meticulously assess climate risk, utilizing sophisticated models to predict future damage. The resulting premiums can be prohibitive, adding substantial costs to homeownership.

- Examples: Coastal properties in Florida may see premiums increase by 50% or more compared to inland properties. Homes in California's wildfire zones can experience significant premium hikes or even face insurance denial.

- Insurance Company Risk Assessment: Companies consider factors like proximity to water bodies, historical weather data, vegetation density (for wildfire risk), and building codes when assessing risk.

- Insurance Denial: In some high-risk areas, insurers may refuse to provide coverage altogether, making homeownership impractical or impossible.

H3: Property Damage from Extreme Weather

Extreme weather events like hurricanes, floods, wildfires, and severe storms directly damage properties, significantly impacting their value. Even minor damage can lead to a lower appraisal value, making it difficult to secure a mortgage or refinance.

- Examples: Hurricane damage can lead to structural instability, water damage, mold, and electrical issues. Wildfires can cause complete property destruction or leave behind significant smoke and ash damage. Floods can compromise foundations and cause irreparable water damage.

- Loan Difficulties Post-Damage: Securing a loan after property damage becomes incredibly challenging, even with repairs, as lenders are hesitant to lend on damaged properties.

- Decreased Value After Repairs: Even after repairs, a property's value might remain diminished due to the perception of increased risk and the potential for future damage.

H3: Reduced Demand in High-Risk Areas

The growing awareness of climate risk is depressing demand for properties in vulnerable areas, leading to lower property values. Buyers are increasingly hesitant to invest in homes that might face significant damage or become uninsurable.

- Examples: Coastal communities experiencing increased flooding are seeing slower property sales and reduced prices. Areas with a high wildfire risk are witnessing a decline in property values.

- Buyer and Seller Implications: Sellers in high-risk areas may need to accept lower offers, while buyers might find it difficult to get financing or face significantly higher insurance costs.

- Government Regulations and Building Codes: Stricter building codes and regulations in high-risk areas may influence property values and buyer decisions.

H2: The Impact on Your Credit Score

The financial implications of climate risk extend beyond property values; they directly impact your credit score.

H3: Mortgage Approval and Loan-to-Value Ratio (LTV)

Lenders meticulously assess climate risk when evaluating mortgage applications. A higher perceived risk can lead to higher interest rates, a lower loan amount (reducing your LTV), or even outright loan denial.

- Appraisal and Climate Risk: Appraisers consider climate risk when determining a property's value, potentially lowering the appraisal and impacting the LTV.

- LTV and Credit Score: A lower LTV requires a larger down payment, affecting your available credit and potentially harming your credit score if you need to utilize other credit lines to make the down payment.

H3: Foreclosure Risk and Credit Impacts

If a property suffers significant climate-related damage and the homeowner cannot afford repairs or rebuild, the risk of foreclosure increases. Foreclosure has a devastating impact on credit scores, making it extremely difficult to obtain future loans.

- Credit Reporting Process: Foreclosure is reported on credit reports for seven years, severely impacting your creditworthiness.

- Foreclosure Avoidance: Strategies like obtaining sufficient insurance, having an emergency fund, and exploring government assistance programs can help avoid foreclosure.

H3: Insurance Claims and Credit History

Filing multiple insurance claims due to repeated climate-related damage can negatively impact your credit score. Information about insurance claims is often shared between insurance companies and credit bureaus.

- Insurance-Credit Bureau Data Sharing: While not always directly impacting credit scores, a history of frequent claims can raise red flags for lenders.

- Mitigating Negative Impact: Proactive steps like implementing preventative measures and ensuring adequate insurance coverage can minimize the frequency of claims.

H2: Mitigating Climate Risk When Buying a Home

Taking proactive steps can significantly reduce your exposure to climate risk and protect your financial future.

H3: Research and Due Diligence

Thorough research is paramount. Investigate the climate risk associated with a property before making an offer.

- Resources: Utilize government websites (e.g., FEMA flood maps, wildfire risk maps), consult local authorities, and consider professional environmental assessments.

- Home Inspection: A comprehensive home inspection by a qualified professional should include an assessment of climate-related vulnerabilities.

H3: Choosing a Location Wisely

Selecting a location with lower climate risk is crucial.

- Climate-Resilient Features: Consider homes with elevated foundations, fire-resistant materials, or other features that increase their resilience to extreme weather.

H3: Financial Planning

Develop a robust financial plan that accounts for potential climate-related costs.

- Emergency Funds: Build a substantial emergency fund to cover unexpected repairs or replacement costs.

- Adequate Insurance: Secure comprehensive home insurance that covers various climate-related risks.

3. Conclusion:

Climate risk poses a significant threat to home values and can severely impact your credit score. Understanding these risks is crucial for making informed decisions. By conducting thorough research, selecting a less vulnerable location, and implementing robust financial planning, you can mitigate the potential negative impacts on your credit and financial well-being. Before you make one of the biggest financial decisions of your life, understand the impact of climate risk on your home buying credit score. Conduct thorough research, seek professional advice, and make informed choices. Don't let climate risk negatively affect your financial future!

Featured Posts

-

Huizenmarktprognose Abn Amro Hogere Prijzen Ondanks Rentestijging

May 21, 2025

Huizenmarktprognose Abn Amro Hogere Prijzen Ondanks Rentestijging

May 21, 2025 -

Premier League Champions 2024 25 A Picture Special

May 21, 2025

Premier League Champions 2024 25 A Picture Special

May 21, 2025 -

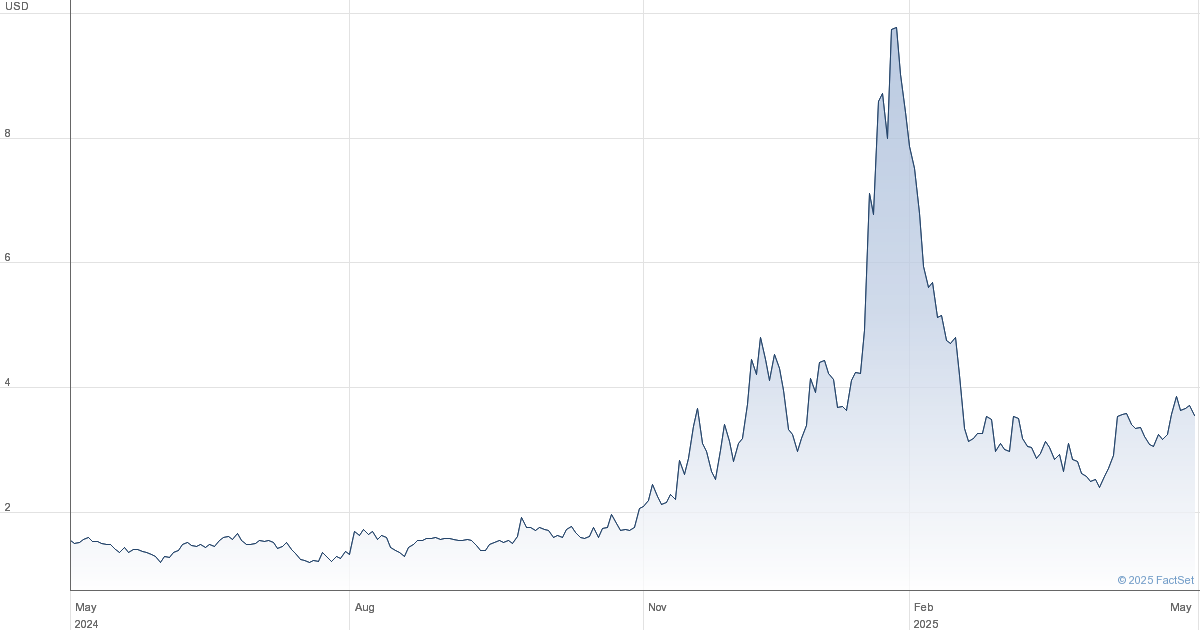

Big Bear Ai Bbai Shares Fall On Weak Q1 Results

May 21, 2025

Big Bear Ai Bbai Shares Fall On Weak Q1 Results

May 21, 2025 -

Us Credit Rating Cut Dow Futures And Dollar React

May 21, 2025

Us Credit Rating Cut Dow Futures And Dollar React

May 21, 2025 -

Space Based Supercomputing Chinas Technological Advancement

May 21, 2025

Space Based Supercomputing Chinas Technological Advancement

May 21, 2025

Latest Posts

-

Zoey Starks Injury Wwe Raw Match Update And Recovery Timeline

May 21, 2025

Zoey Starks Injury Wwe Raw Match Update And Recovery Timeline

May 21, 2025 -

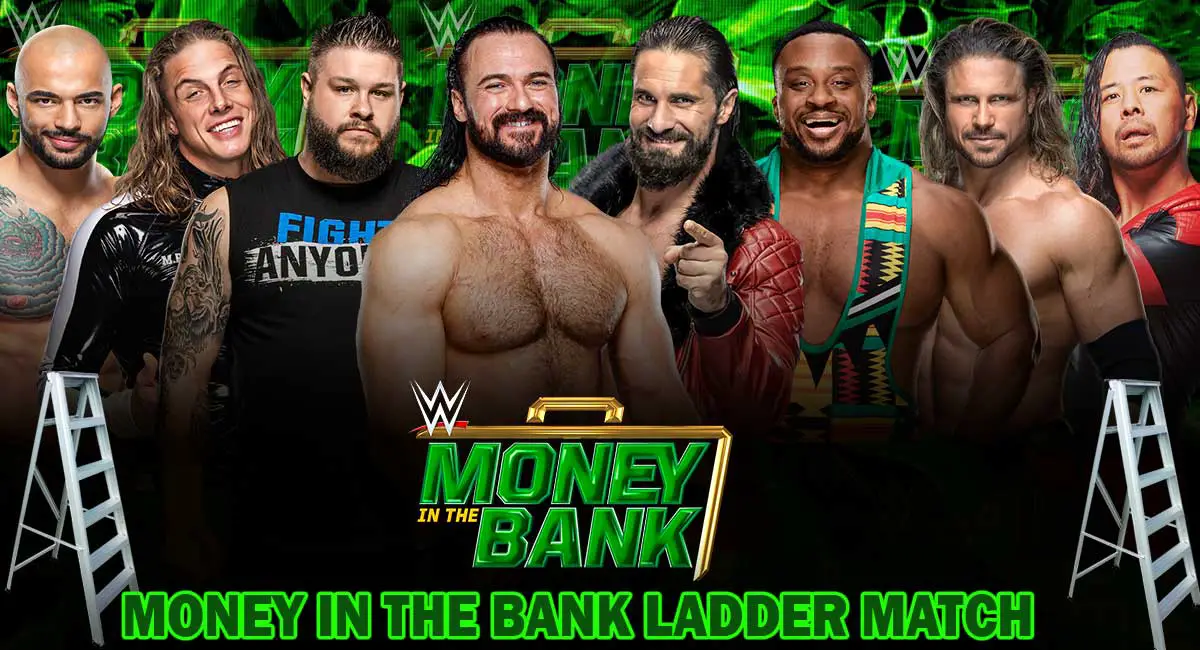

2025 Money In The Bank Perez And Ripley Qualify For Ladder Match

May 21, 2025

2025 Money In The Bank Perez And Ripley Qualify For Ladder Match

May 21, 2025 -

Wwe Raw Zoey Starks Injury And Potential Impact On Future Matches

May 21, 2025

Wwe Raw Zoey Starks Injury And Potential Impact On Future Matches

May 21, 2025 -

Roxanne Perez And Rhea Ripley 2025 Money In The Bank Ladder Match Qualification

May 21, 2025

Roxanne Perez And Rhea Ripley 2025 Money In The Bank Ladder Match Qualification

May 21, 2025 -

Zoey Stark Injured During Wwe Raw Match Details And Updates

May 21, 2025

Zoey Stark Injured During Wwe Raw Match Details And Updates

May 21, 2025