CoreWeave (CRWV): Deconstructing Wednesday's Stock Price Appreciation

Table of Contents

Market Sentiment and Investor Confidence

Several factors contributed to the positive market sentiment surrounding CoreWeave (CRWV) stock. Understanding these factors is key to interpreting the Wednesday price jump and predicting future CoreWeave (CRWV) stock price movements.

Positive News and Announcements

Several potential catalysts could have fueled investor enthusiasm:

- New Partnerships or Contracts: Did CoreWeave announce any significant new partnerships or contract wins around Wednesday? Securing a major deal with a prominent cloud computing client, for instance, could significantly boost investor confidence and drive up the CoreWeave (CRWV) stock price. A press release detailing such an agreement would be a key piece of the puzzle.

- Positive Industry News: The broader cloud computing, AI infrastructure, and data center services sectors experienced positive momentum recently. Positive regulatory developments, increased adoption of AI solutions, or strong financial results from competitor companies could have created a ripple effect, impacting CoreWeave (CRWV) stock price positively.

- Overall Market Sentiment: A general upswing in the technology sector, particularly among cloud computing stocks, would likely contribute to the increased CoreWeave (CRWV) stock price. Positive investor sentiment towards the broader market often translates into higher valuations for individual stocks.

Short Squeeze Potential

Another factor to consider is the potential for a short squeeze. A short squeeze occurs when a stock's price rapidly increases, forcing short sellers (investors who bet against the stock) to buy shares to cover their positions, further driving up the price.

- High Short Interest: High short interest in CoreWeave (CRWV) prior to Wednesday's price surge could have made the stock susceptible to a short squeeze. Examining short interest data from reliable financial sources is crucial to determine the extent of this factor's influence.

- Positive News as Catalyst: Positive news, as described above, can trigger a short squeeze by encouraging short sellers to cover their positions quickly to limit further losses.

- Short-Term Strategy Limitations: It's essential to remember that short squeezes are inherently short-term events. Relying on short squeezes for long-term investment strategies is generally risky and not advisable.

Technical Analysis of CoreWeave (CRWV) Stock Chart

Analyzing the technical aspects of the CoreWeave (CRWV) stock chart offers additional insights into Wednesday's price action.

Trading Volume and Price Action

High trading volume is usually indicative of a significant price movement.

- Volume Analysis: Analyzing the trading volume on Wednesday is crucial. A significant increase in volume alongside the price surge would support the idea that the movement was not just caused by sporadic trading.

- Candlestick Patterns: Examining candlestick patterns (e.g., bullish engulfing patterns) on the stock chart can reveal information about the strength and potential continuation of the upward trend.

- Resistance Levels: Did the price increase break through any significant resistance levels? Breaking through such levels often signals a potential continuation of the upward trend.

Chart Patterns and Indicators

Technical indicators and chart patterns can provide valuable information.

- Chart Patterns: Identifying chart patterns like breakouts, flags, or pennants can help predict the future direction of the stock price.

- Technical Indicators: Analyzing indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can confirm the strength and sustainability of the upward trend.

- Limitations of Technical Analysis: It's crucial to remember that technical analysis is not foolproof. It should be used in conjunction with fundamental analysis for a more comprehensive investment strategy.

Fundamental Analysis of CoreWeave's Business

Understanding CoreWeave's business fundamentals is crucial for evaluating the long-term prospects of the CoreWeave (CRWV) stock price.

Company Performance and Growth Prospects

Assessing CoreWeave's financial performance and growth prospects is essential.

- Financial Performance: Examining key financial metrics such as revenue growth, profitability, and cash flow provides insights into the company's overall health and performance.

- Growth Prospects: Evaluating CoreWeave's position within the rapidly growing cloud computing and AI infrastructure markets is crucial. The company’s potential for expansion and market share capture directly affects the CoreWeave (CRWV) stock price.

- Competitive Advantages and Risks: Understanding CoreWeave's competitive advantages (e.g., innovative technology, strong partnerships) and potential risks (e.g., competition, economic downturns) is essential for assessing the company's long-term sustainability.

Industry Trends and Competition

Analyzing industry trends and the competitive landscape is crucial.

- Market Growth: The overall growth rate of the cloud computing and AI infrastructure markets directly influences the growth potential of companies like CoreWeave.

- Competitive Landscape: Identifying CoreWeave's main competitors and understanding their strengths and weaknesses provides valuable context for evaluating CoreWeave's position.

- Competitive Positioning: Assessing how CoreWeave is positioned to compete effectively in a dynamic market is essential for predicting its future success and the corresponding impact on the CoreWeave (CRWV) stock price.

Conclusion

The CoreWeave (CRWV) stock price appreciation on Wednesday resulted from a combination of factors, including positive market sentiment, potential short squeezes, and potentially positive company news. A complete analysis demands scrutinizing technical indicators and fundamental business elements. Investors should carefully assess these factors, considering short-term volatility and long-term growth prospects before making investment decisions. Further research into the CoreWeave (CRWV) stock price, encompassing news analysis and financial reporting, remains crucial for making informed choices. Continue your due diligence on CoreWeave (CRWV) stock to make sound investment choices.

Featured Posts

-

Adam Ramey Dropout Kings Vocalist Passes Away

May 22, 2025

Adam Ramey Dropout Kings Vocalist Passes Away

May 22, 2025 -

Protecting Your Financial Future Avoiding Common Mistakes Women

May 22, 2025

Protecting Your Financial Future Avoiding Common Mistakes Women

May 22, 2025 -

Cinq Itineraires Velo Pour Decouvrir La Loire Le Vignoble Nantais Et L Estuaire

May 22, 2025

Cinq Itineraires Velo Pour Decouvrir La Loire Le Vignoble Nantais Et L Estuaire

May 22, 2025 -

Trans Australia Run Record A New World Best Imminent

May 22, 2025

Trans Australia Run Record A New World Best Imminent

May 22, 2025 -

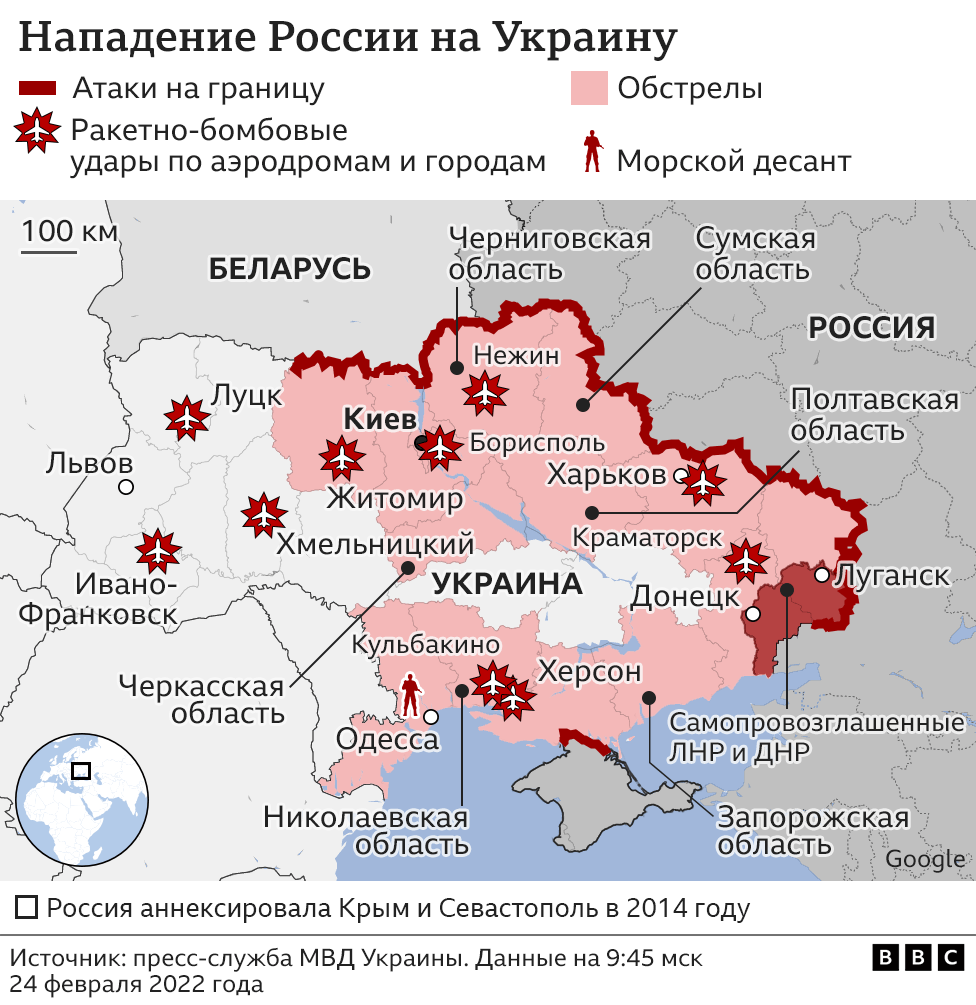

Vstuplenie Ukrainy V Nato Pozitsiya Evrokomissara I Perspektivy Peregovorov

May 22, 2025

Vstuplenie Ukrainy V Nato Pozitsiya Evrokomissara I Perspektivy Peregovorov

May 22, 2025

Latest Posts

-

Liga De Naciones Los Memes Que Dejo La Derrota De Panama Ante Mexico

May 22, 2025

Liga De Naciones Los Memes Que Dejo La Derrota De Panama Ante Mexico

May 22, 2025 -

Protecting Israeli Diplomatic Missions A Response To Recent Threats

May 22, 2025

Protecting Israeli Diplomatic Missions A Response To Recent Threats

May 22, 2025 -

Panama Vs Mexico Recopilacion De Los Mejores Memes De La Final

May 22, 2025

Panama Vs Mexico Recopilacion De Los Mejores Memes De La Final

May 22, 2025 -

La Derrota De Panama Los Memes Que Inundaron Las Redes

May 22, 2025

La Derrota De Panama Los Memes Que Inundaron Las Redes

May 22, 2025 -

Israeli Prime Minister Orders Enhanced Security Following Antisemitic Attacks

May 22, 2025

Israeli Prime Minister Orders Enhanced Security Following Antisemitic Attacks

May 22, 2025