Credit Card Industry Faces Headwinds Amidst Reduced Consumer Spending

Table of Contents

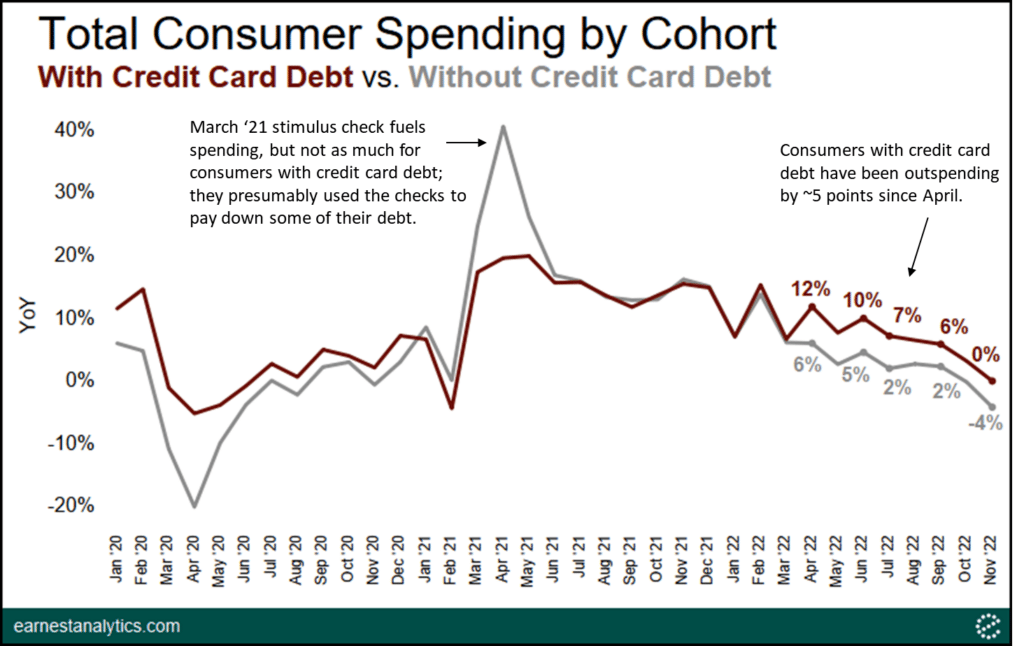

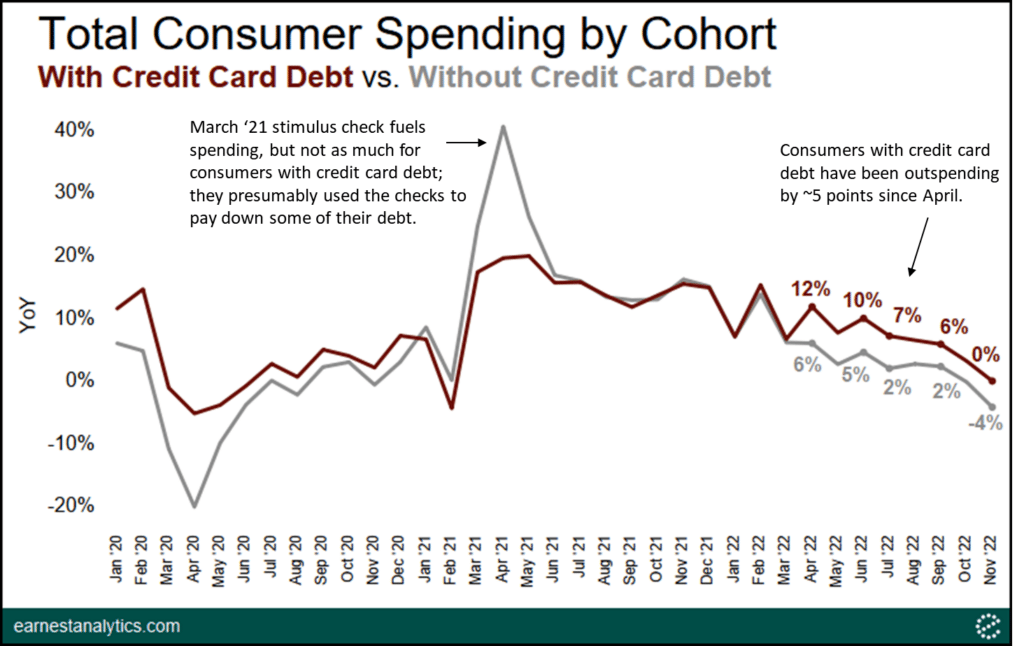

Declining Credit Card Spending and Increased Delinquency Rates

Reduced consumer spending has a direct and significant correlation with a rise in credit card delinquencies and defaults. As consumers tighten their belts, they are less likely to make timely payments on their credit card balances, leading to increased delinquency rates and ultimately, charge-off rates. This trend is further exacerbated by rising interest rates and economic uncertainty.

Data from [insert reputable source, e.g., the Federal Reserve or a major credit rating agency] shows a [insert specific percentage or statistic] decrease in credit card spending in recent months/quarters, coupled with a [insert specific percentage or statistic] increase in delinquency rates. This paints a concerning picture for the industry’s financial health.

- Rising interest rates are impacting borrowers' ability to repay debts, as minimum payments become increasingly burdensome.

- Increased unemployment is leading to job losses and reduced income, leaving many consumers struggling to meet their financial obligations.

- Inflation is eroding purchasing power, leaving less disposable income for non-essential spending and increasing the strain on household budgets.

These factors have significant implications for credit card issuers. Increased losses from defaults force them to adopt tighter lending standards, potentially impacting the availability of credit for consumers who need it most. This creates a vicious cycle, impacting both consumer access to credit and the profitability of the credit card industry.

The Impact of Inflation and Rising Interest Rates on Credit Card Usage

High inflation and subsequent interest rate hikes are significantly impacting consumer behavior and credit card usage. The mechanics are simple: higher interest rates (credit card APR) directly increase the cost of borrowing. This makes it more expensive for consumers to carry balances, reducing their willingness to use credit cards for discretionary spending. Consumers are forced to prioritize essential spending, resulting in lower credit card utilization.

- Consumers are utilizing credit cards less frequently due to the increased cost of borrowing.

- Higher interest rates make debt management exponentially more difficult, pushing many into a cycle of debt.

- Increased financial stress forces consumers to prioritize essential spending over non-essential purchases.

To mitigate these challenges, credit card companies are exploring various strategies, including offering more competitive interest rates (where feasible), introducing more flexible repayment options, and focusing on acquiring customers with lower risk profiles. However, the overall impact of inflation and rising interest rates remains a significant headwind for the industry.

Shifting Consumer Behavior and the Rise of Alternative Payment Methods

The credit card industry faces another challenge: the rise of alternative payment methods. The increasing popularity of Buy Now Pay Later (BNPL) services and digital wallets is reshaping the payments landscape and diverting spending away from traditional credit cards. These alternative options often provide attractive short-term financing options or convenient, integrated purchasing experiences that compete directly with credit cards' functionalities.

- BNPL offers attractive short-term financing options, directly competing with credit cards for consumer spending.

- Digital wallets offer convenience and seamless integration with online shopping platforms.

- Mobile payments are becoming increasingly prevalent, particularly amongst younger demographics, who are less likely to rely on traditional credit cards.

This shift in consumer preferences and technological advancements demands that the traditional credit card industry adapt. They must innovate to compete with these emerging payment technologies, either by incorporating similar features or by focusing on the unique advantages that credit cards still possess, such as rewards programs and broader acceptance.

Strategies for Credit Card Companies to Navigate the Current Climate

To thrive in this challenging climate, credit card companies must adopt proactive strategies to improve customer retention and adapt to the changing market conditions. This requires a multi-pronged approach:

- Implementing more flexible repayment options: Offering options such as extended payment plans or reduced minimum payment amounts can help ease the burden on consumers struggling to manage their debt.

- Offering personalized rewards and benefits: Tailoring rewards programs to individual customer preferences can incentivize continued use and loyalty.

- Investing in robust risk management systems: Sophisticated analytics and predictive modeling can help identify and mitigate potential risks associated with lending.

- Leveraging data analytics for improved customer segmentation: Understanding customer behavior allows for more targeted marketing and product development.

Further innovation through digital transformation is crucial. This includes improving mobile app functionality, offering seamless integration with other financial services, and enhancing the overall customer experience.

Conclusion

The credit card industry is undeniably facing significant headwinds due to reduced consumer spending, fueled by inflation, rising interest rates, and the emergence of alternative payment methods. These challenges necessitate a strategic response from credit card companies, requiring a focus on innovation, risk management, and adapting to evolving consumer preferences. Understanding the complexities of the current economic climate and the impact on the credit card industry is crucial for both consumers and businesses. Stay informed about the latest trends in consumer spending and the evolution of the credit card market to make informed financial decisions and navigate the challenges of reduced consumer spending effectively.

Featured Posts

-

From Scatological Documents To Podcast Gold An Ai Driven Approach

Apr 24, 2025

From Scatological Documents To Podcast Gold An Ai Driven Approach

Apr 24, 2025 -

Selling Sunset Star Condemns La Landlord Price Gouging After Fires

Apr 24, 2025

Selling Sunset Star Condemns La Landlord Price Gouging After Fires

Apr 24, 2025 -

Understanding Hegseths Role In Trumps Communication Strategy

Apr 24, 2025

Understanding Hegseths Role In Trumps Communication Strategy

Apr 24, 2025 -

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025 -

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 24, 2025

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 24, 2025