Credit Suisse To Pay Whistleblowers Up To $150 Million

Table of Contents

The Details of Credit Suisse's Whistleblower Program

Credit Suisse's commitment to uncovering and addressing financial crime is evident in its ambitious whistleblower program. This initiative aims to encourage the reporting of misconduct by offering substantial rewards, thereby strengthening its compliance efforts and protecting the integrity of the financial system.

The $150 Million Reward

The program offers a maximum reward of $150 million for information leading to successful enforcement actions. However, the final payout isn't a guaranteed sum. Several factors influence the final amount awarded to the whistleblower.

- Severity of the misconduct: The more serious the violation, the higher the potential reward. Cases involving significant financial losses or widespread harm will likely command larger payouts.

- Quality of information: The accuracy, completeness, and timeliness of the information provided are crucial. Evidence that leads directly to successful enforcement is more valuable.

- Uniqueness of information: Information that is already known to authorities or the company will not warrant a substantial reward. The whistleblower needs to provide new and significant information.

The program also includes limitations and conditions. For example, payouts may be reduced if the whistleblower withheld critical information or if the information is deemed unreliable. Furthermore, the reward might be shared among multiple whistleblowers who provide overlapping information.

Types of Misconduct Covered

Credit Suisse's whistleblower program incentivizes reporting on a broad range of illegal activities. This comprehensive approach aims to capture all forms of financial misconduct.

- Money laundering: Reporting schemes designed to conceal the origins of illegally obtained funds.

- Fraud: Reporting instances of intentional misrepresentation or deception for financial gain.

- Insider trading: Reporting the illegal trading of securities based on non-public information.

- Market manipulation: Reporting attempts to artificially influence market prices for personal gain.

- Regulatory violations: Reporting any breaches of financial regulations and compliance rules.

The program's broad scope underscores Credit Suisse's commitment to tackling all forms of financial crime within its operations.

SEC Involvement and Compliance

The Securities and Exchange Commission (SEC) plays a vital role in overseeing whistleblower programs within financial institutions. Credit Suisse's initiative aligns closely with the SEC's whistleblower program, which offers significant financial incentives for reporting securities law violations.

- Collaboration with the SEC: Credit Suisse likely works closely with the SEC to ensure compliance with all relevant regulations. The information received through the program may be shared with the SEC for investigation and enforcement.

- SEC Whistleblower Program: Credit Suisse's program complements the existing SEC whistleblower program, strengthening the overall mechanism for reporting misconduct. Both programs offer robust protection for whistleblowers.

- Industry-wide implications: The program sets a precedent and might prompt other financial institutions to enhance their own whistleblower programs to remain competitive and demonstrate a commitment to ethical conduct.

This collaboration ensures that the program operates within the legal framework and contributes to a more transparent and accountable financial system.

Implications for the Financial Industry

Credit Suisse's $150 million whistleblower reward program has far-reaching implications for the entire financial industry.

Increased Reporting

The substantial reward offered is expected to significantly increase the reporting of internal misconduct. This heightened reporting is a double-edged sword.

- Positive Impact: Increased reporting should lead to the uncovering of more instances of financial crime, improving the integrity of the financial system. Early detection of misconduct can help mitigate losses and prevent larger-scale scandals.

- Potential Negative Impact: The program may also lead to an increase in frivolous or malicious reports. Robust mechanisms must be in place to assess the validity of claims and avoid wasting resources on baseless accusations.

A well-managed program must effectively balance the benefits of increased reporting with the potential downsides.

Setting a Precedent

Credit Suisse's bold move is likely to influence other financial institutions to reconsider and enhance their whistleblower programs.

- Competitive Pressure: The program creates competitive pressure on other banks and financial institutions to adopt similar, or even more attractive, whistleblower initiatives.

- Industry-wide changes: This could lead to industry-wide improvements in corporate governance and ethical standards, ultimately benefitting investors and the public.

- Improved risk management: Financial institutions with robust whistleblower programs can better manage risks associated with internal fraud and misconduct.

This could usher in a new era of greater transparency and accountability within the financial industry.

Strengthening Corporate Governance

Credit Suisse's initiative demonstrates a serious commitment to improving corporate governance and fostering a culture of ethical conduct.

- Long-term benefits: The program can enhance Credit Suisse's reputation, attract and retain talent, and improve investor confidence.

- Improved risk management: A strong whistleblower program helps identify and address risks before they escalate into major crises.

- Stronger corporate culture: By encouraging reporting, Credit Suisse is actively cultivating a culture that prioritizes ethical behavior and accountability.

The long-term impacts on Credit Suisse and the wider financial industry are likely to be substantial.

Protecting Whistleblowers

Credit Suisse's program prioritizes the safety and security of those who come forward to report wrongdoing.

Confidentiality and Anonymity

The program incorporates stringent measures to protect whistleblowers' identities and confidentiality.

- Secure reporting channels: Multiple channels are likely available for reporting misconduct, including secure online platforms and confidential hotlines.

- Data encryption: Information provided by whistleblowers is likely encrypted to prevent unauthorized access.

- Legal protection: Whistleblowers are protected by relevant laws, and Credit Suisse will likely have policies ensuring their identities are not disclosed.

Retaliation Protection

Credit Suisse has implemented policies and procedures to protect whistleblowers from retaliation.

- Anti-retaliation policy: A clear policy prohibiting any form of retaliation against whistleblowers is essential.

- Independent investigation: Reports of misconduct will be investigated by an independent body to prevent bias or interference.

- Legal recourse: Whistleblowers are legally protected from retaliation and can pursue legal action if they experience negative consequences as a result of their reporting.

Conclusion

Credit Suisse's $150 million whistleblower reward program represents a significant development in the fight against financial crime. The program's substantial rewards, broad scope of covered misconduct, and strong emphasis on whistleblower protection are likely to increase reporting and significantly improve corporate governance within the financial industry. This initiative sets a compelling precedent and will likely influence other institutions to enhance their own whistleblower programs. The program underscores the importance of tackling financial misconduct and fosters a more ethical and transparent financial landscape.

Call to Action: If you have information about misconduct at Credit Suisse or any other financial institution, consider reporting it. Utilize the available resources and explore the potential benefits of becoming a whistleblower. The substantial rewards offered by Credit Suisse and other programs underscore the importance of reporting financial crimes and protecting the integrity of the financial system. Learn more about whistleblower protections and reporting mechanisms available to you. Don't hesitate – report misconduct and help make a difference.

Featured Posts

-

Montoya Claims Doohans F1 Future Already Decided

May 09, 2025

Montoya Claims Doohans F1 Future Already Decided

May 09, 2025 -

Wynne Evans Addresses Strictly Come Dancing Return Calls

May 09, 2025

Wynne Evans Addresses Strictly Come Dancing Return Calls

May 09, 2025 -

Edmonton Oilers Favoured Betting Odds And Kings Series Prediction

May 09, 2025

Edmonton Oilers Favoured Betting Odds And Kings Series Prediction

May 09, 2025 -

Almdkhnwn Fy Ealm Krt Alqdm Tathyr Altdkhyn Ela Aladae Alryady

May 09, 2025

Almdkhnwn Fy Ealm Krt Alqdm Tathyr Altdkhyn Ela Aladae Alryady

May 09, 2025 -

30 Drop For Palantir Investment Opportunity Or Warning Sign

May 09, 2025

30 Drop For Palantir Investment Opportunity Or Warning Sign

May 09, 2025

Latest Posts

-

Analyzing The Trump Presidency A Focus On Day 109 May 8th 2025

May 10, 2025

Analyzing The Trump Presidency A Focus On Day 109 May 8th 2025

May 10, 2025 -

The Jeffrey Epstein Case Public Opinion On Ag Pam Bondis Decision To Release Files

May 10, 2025

The Jeffrey Epstein Case Public Opinion On Ag Pam Bondis Decision To Release Files

May 10, 2025 -

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025 -

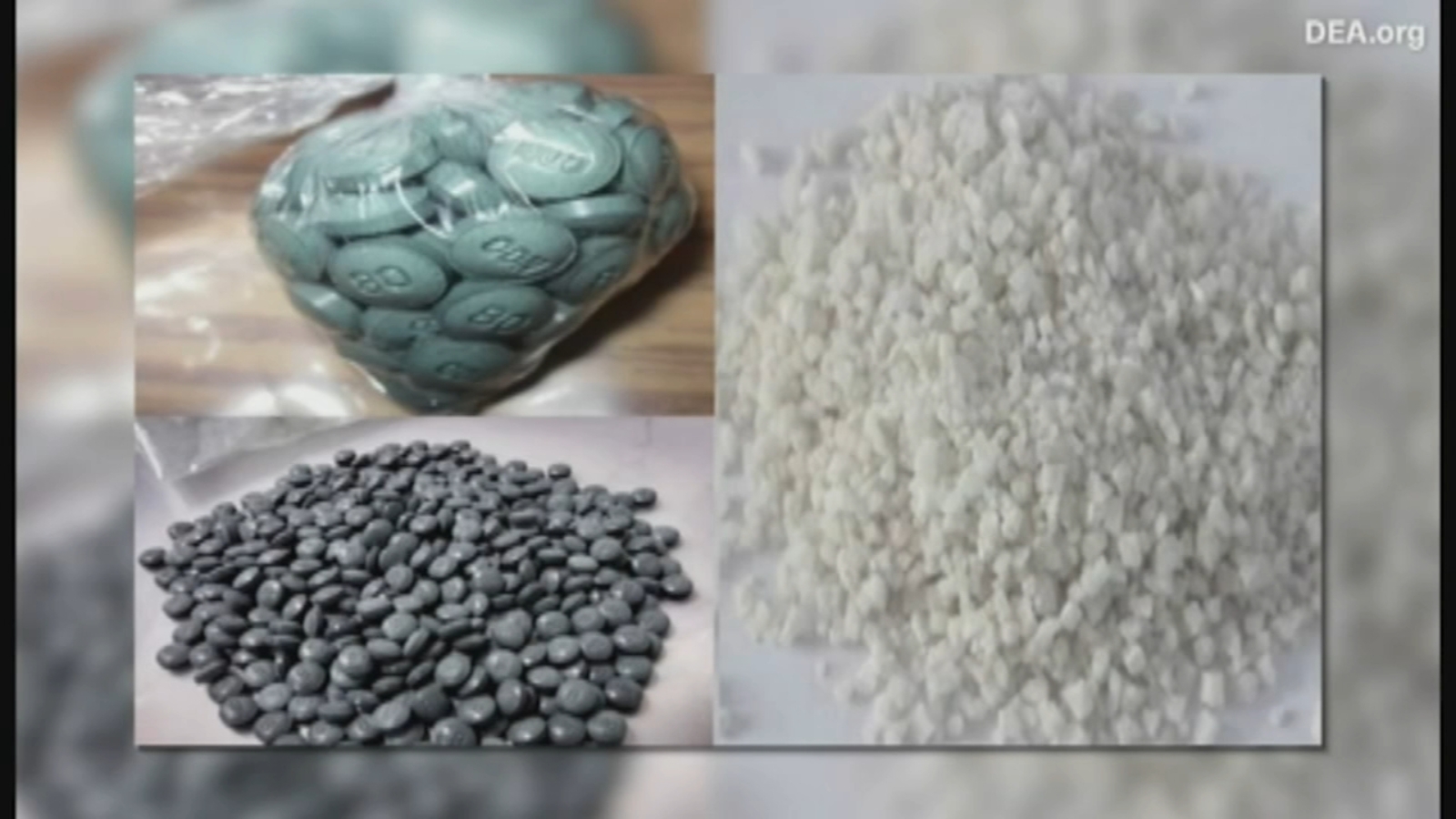

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025 -

Transparency And Justice Evaluating The Release Of Jeffrey Epstein Files And Ag Pam Bondis Role

May 10, 2025

Transparency And Justice Evaluating The Release Of Jeffrey Epstein Files And Ag Pam Bondis Role

May 10, 2025