Cryptocurrency's Resilience: Navigating The Trade War's Impact

Table of Contents

Decentralization as a Safe Haven

Reduced Dependence on Geopolitical Events

The core strength of cryptocurrencies lies in their decentralized architecture. Unlike traditional financial systems heavily reliant on centralized institutions and governmental regulations, cryptocurrencies operate outside the direct control of any single entity. This inherent characteristic significantly reduces their vulnerability to the disruptions caused by trade wars.

- Cryptocurrencies operate outside the control of any single government or institution. This means they are not susceptible to nationalization, sanctions, or trade restrictions imposed during trade conflicts.

- Transactions are not subject to trade restrictions or sanctions imposed during trade conflicts. Crypto transactions can bypass traditional banking systems and their associated geopolitical limitations.

- This decentralization offers a level of protection from geopolitical instability. Even amidst escalating trade tensions, cryptocurrency transactions can continue relatively unimpeded.

For example, during periods of heightened US-China trade friction, certain cryptocurrencies demonstrated relatively stable performance compared to the significant fluctuations observed in traditional stock markets. This relative stability underscores the potential of decentralization as a buffer against geopolitical risks.

Increased Demand During Uncertainty

Safe Haven Asset Properties

Increasingly, cryptocurrencies are viewed as safe haven assets, similar to gold, during times of economic uncertainty. This perception stems from their perceived scarcity and the potential for long-term growth, making them an attractive investment during periods of geopolitical instability.

- Investors seek alternative stores of value during trade wars and geopolitical instability. Traditional markets can be significantly impacted, leading investors to explore alternative options.

- Cryptocurrency's perceived scarcity and potential for growth can attract investment. The limited supply of many cryptocurrencies, coupled with the potential for significant price appreciation, drives investor interest.

- Diversification into cryptocurrencies can mitigate risks associated with traditional markets. By diversifying investment portfolios to include cryptocurrencies, investors can potentially reduce their exposure to the volatility of traditional assets impacted by trade wars.

Data on cryptocurrency market capitalization during periods of trade war escalation often reveals increased demand. While volatility remains a characteristic, the overall trend sometimes suggests a flight to alternative assets, including cryptocurrencies, in search of stability. (Insert relevant chart or graph here illustrating market cap fluctuations during trade war periods).

Technological Innovation and Adaptation

Evolving Solutions for Global Transactions

Blockchain technology, the foundation of many cryptocurrencies, offers innovative solutions for global transactions, bypassing traditional financial systems often hindered by trade barriers.

- Blockchain's transparency and immutability can build trust in cross-border transactions. This increased transparency reduces the need for intermediaries, streamlining international payments.

- Stablecoins provide a more stable alternative to volatile cryptocurrencies, reducing risk for international trade. Stablecoins pegged to fiat currencies minimize the volatility risk associated with other cryptocurrencies.

- New decentralized finance (DeFi) protocols are streamlining global transactions. DeFi platforms offer solutions for cross-border payments, lending, and borrowing, reducing reliance on traditional financial institutions.

Examples of blockchain-based solutions used for international payments or supply chain management highlight their resistance to trade war disruptions. These technologies offer the potential to create more resilient and efficient global trade networks, less susceptible to geopolitical interference.

Challenges and Limitations

Regulatory Uncertainty and Volatility

While cryptocurrencies exhibit resilience against some aspects of trade wars, they are not entirely immune to their effects. Significant challenges remain.

- Regulatory changes in different jurisdictions can impact cryptocurrency adoption and trading. Varying regulatory frameworks across countries can create hurdles for cross-border transactions and limit the overall growth of the market.

- Market volatility remains a significant challenge. Cryptocurrency prices can experience substantial fluctuations, impacting investor confidence and making it challenging to use as a reliable store of value.

- The lack of widespread adoption still limits the extent of its resilience. The limited adoption by businesses and consumers hinders its ability to fully displace traditional financial systems.

Examples of regulatory hurdles faced by cryptocurrency exchanges or projects in countries impacted by trade wars underscore the challenges of navigating this evolving regulatory landscape.

Conclusion

Cryptocurrency's resilience in the face of trade war uncertainty is largely attributed to its decentralized nature, its potential as a safe haven asset, and continuous technological advancements. While regulatory uncertainty and market volatility present ongoing challenges, the inherent characteristics of blockchain technology and cryptocurrencies suggest a level of resilience not always observed in traditional financial systems. Understanding Cryptocurrency's resilience is crucial for investors and businesses navigating the complexities of the global economy. Further research into specific cryptocurrencies and blockchain technologies, coupled with an understanding of evolving regulatory landscapes, will be key to leveraging the potential of this evolving asset class and developing effective cryptocurrency resilience strategies.

Featured Posts

-

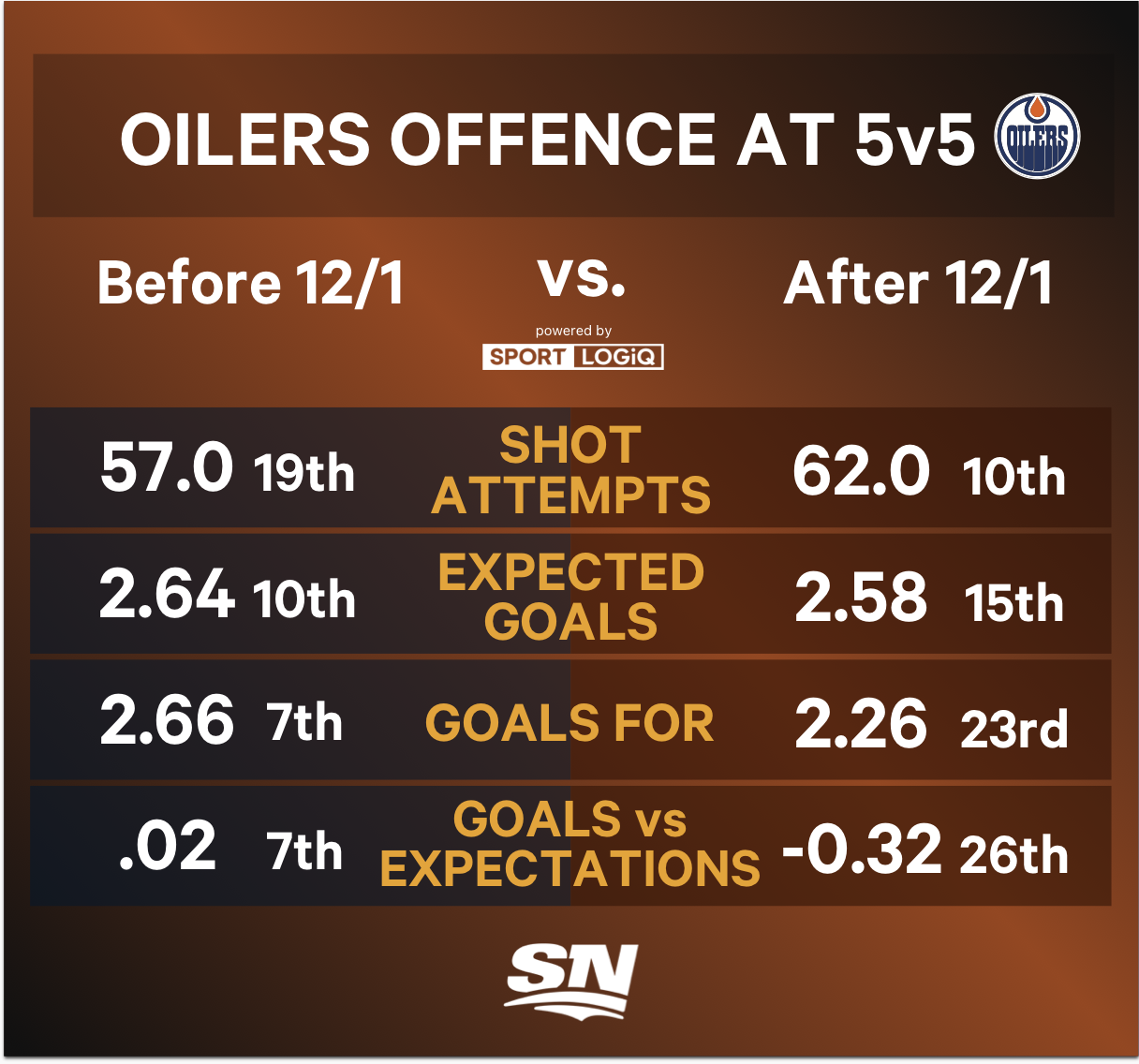

Edmonton Oilers Playoff Chances Hinge On Draisaitls Recovery

May 09, 2025

Edmonton Oilers Playoff Chances Hinge On Draisaitls Recovery

May 09, 2025 -

Rocket Launch Abort Blue Origin Cites Subsystem Malfunction

May 09, 2025

Rocket Launch Abort Blue Origin Cites Subsystem Malfunction

May 09, 2025 -

X Platform Silences Turkish Mayor After Opposition Rallies

May 09, 2025

X Platform Silences Turkish Mayor After Opposition Rallies

May 09, 2025 -

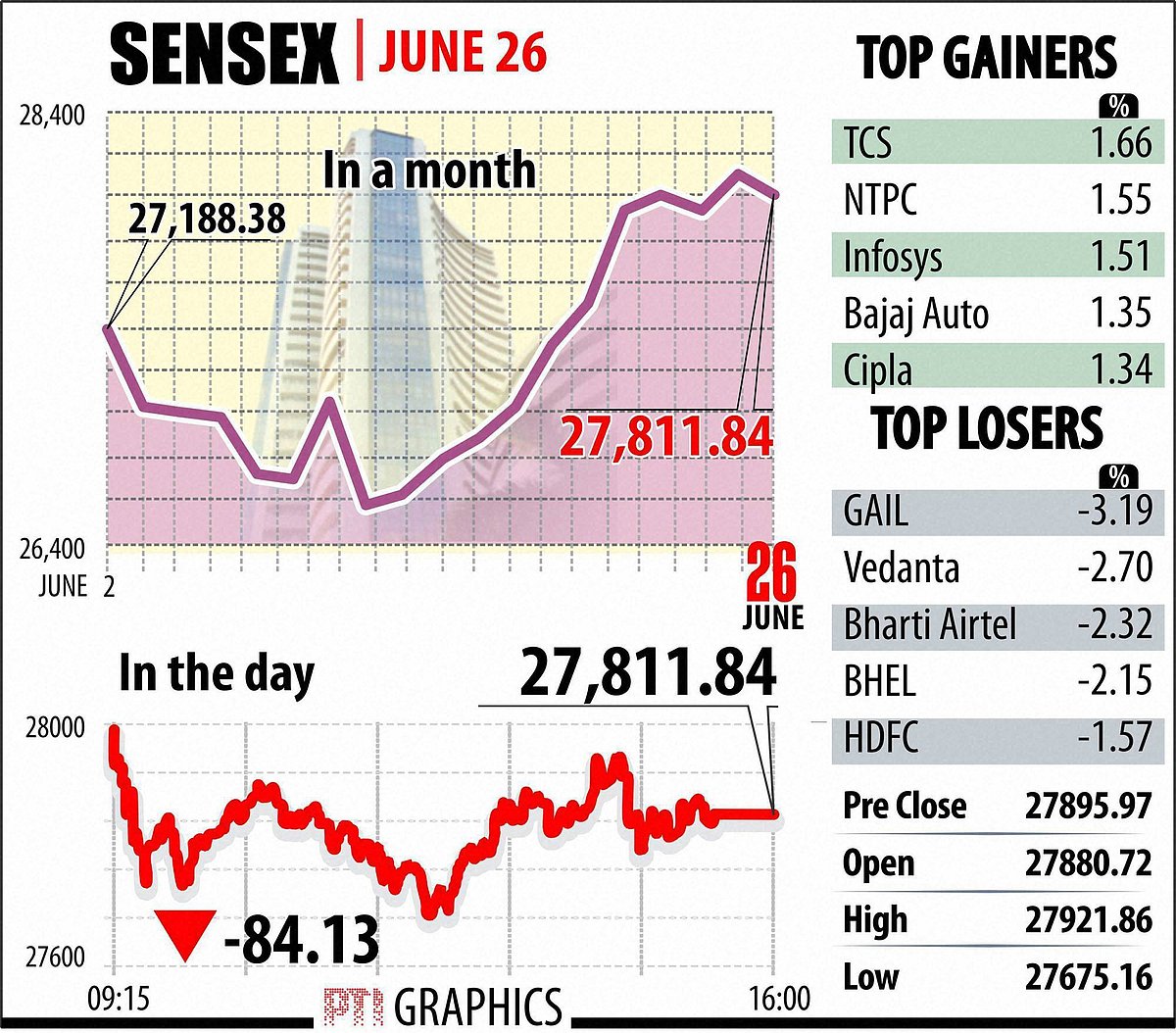

Sensex And Nifty 50 Surge Understanding The 1 400 And 23 800 Point Gains

May 09, 2025

Sensex And Nifty 50 Surge Understanding The 1 400 And 23 800 Point Gains

May 09, 2025 -

Jeanine Pirros Fox News Career An In Depth Examination

May 09, 2025

Jeanine Pirros Fox News Career An In Depth Examination

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025