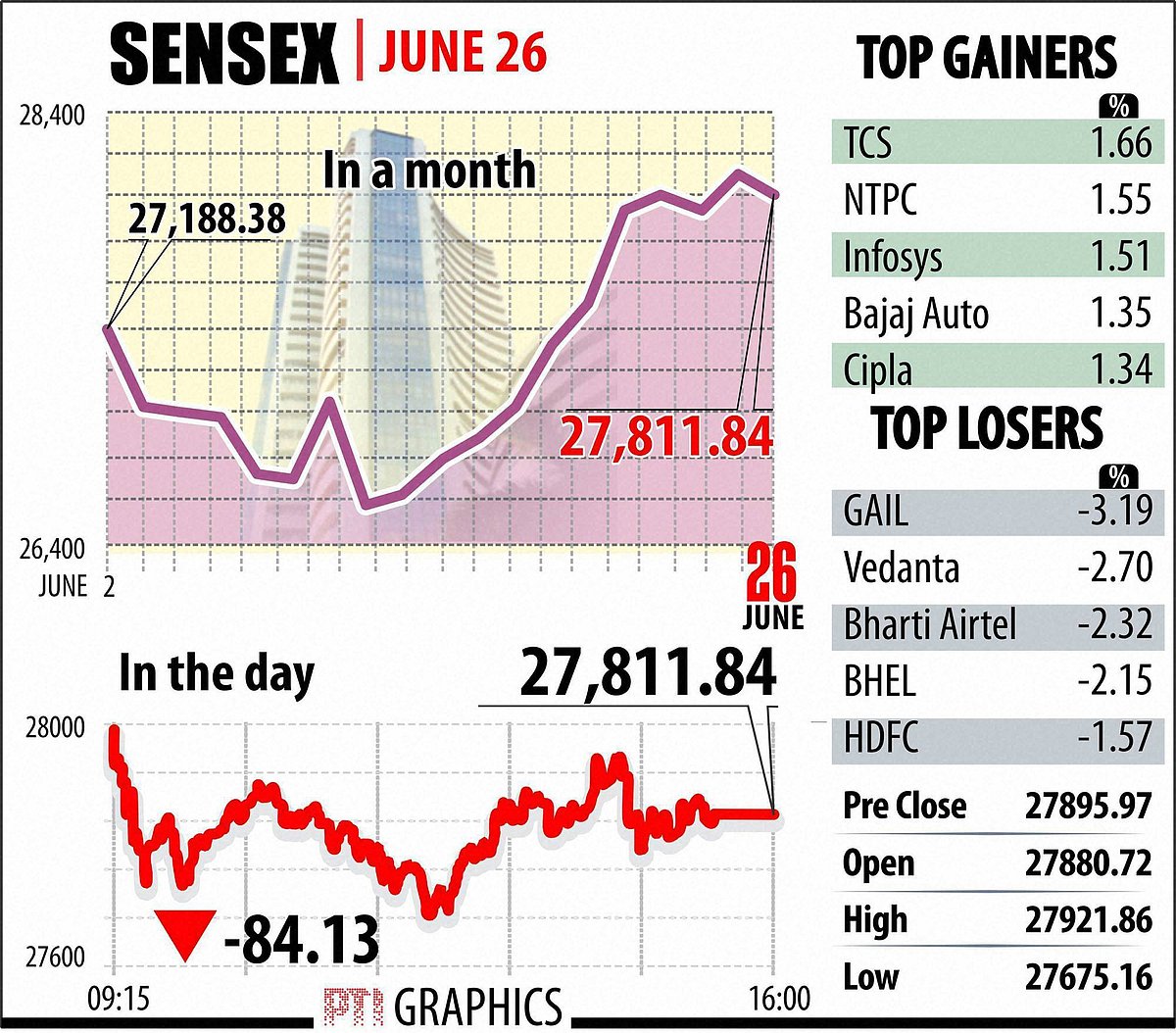

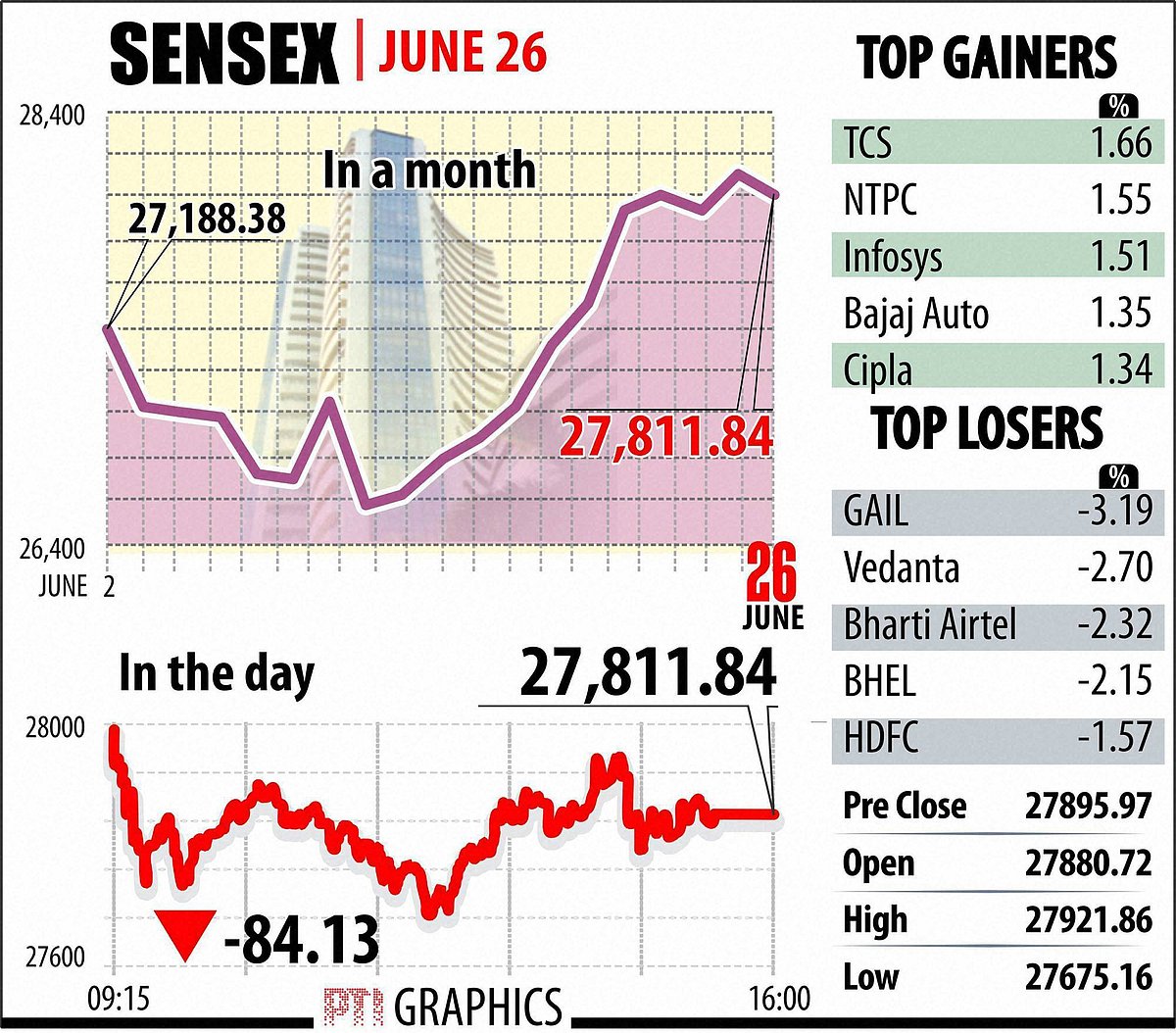

Sensex And Nifty 50 Surge: Understanding The 1,400 And 23,800 Point Gains

Table of Contents

Global Factors Driving the Sensex and Nifty 50 Rally

Several global factors have played a significant role in the recent Sensex and Nifty 50 rally. These positive global economic winds have created a favorable environment for investment in emerging markets like India.

Positive Global Economic Indicators

Positive news from major global economies has significantly boosted investor confidence. Improved GDP growth forecasts, coupled with easing inflation concerns in several key regions, have created a more optimistic outlook for the global economy. This improved global economic outlook translates into increased foreign investment in markets like India.

- Examples: Stronger-than-expected GDP growth in the US and Europe, declining inflation rates in several developed nations.

- Impact: Increased foreign institutional investor (FII) inflows into the Indian stock market, leading to higher demand for Indian stocks and pushing up the Sensex and Nifty 50.

Strengthening US Dollar and its Impact

The strength or weakness of the US dollar has a direct correlation with the performance of emerging markets, including India. While a strong dollar can initially put pressure on emerging market currencies, its impact on the Sensex and Nifty 50 is often complex and depends on various factors.

- Correlation: A weakening US dollar generally boosts emerging market currencies, making Indian assets more attractive to foreign investors. Conversely, a strengthening dollar can lead to capital outflows.

- FII Flows: Changes in the USD's value directly influence FII flows into India. A weaker dollar tends to attract more foreign investment, whereas a strong dollar can deter investors.

- Impact on Sensex and Nifty 50: The net effect on the Sensex and Nifty 50 depends on the interplay of various factors, including investor sentiment and domestic economic conditions.

Geopolitical Stability (or Instability) and its Influence

Geopolitical events significantly influence global market sentiment. Periods of relative stability, such as easing trade tensions or reduced geopolitical uncertainty, tend to boost investor confidence. Conversely, heightened geopolitical risks can lead to market volatility and capital outflows.

- Examples: Easing of trade tensions between major economies, reduction in global conflict. Conversely, ongoing conflicts or escalating geopolitical tensions can negatively impact investor sentiment.

- Investor Confidence: A stable geopolitical environment fosters investor confidence, leading to increased investment in riskier assets, including emerging market equities.

- Effect on Sensex and Nifty: Positive geopolitical developments often contribute to a rise in the Sensex and Nifty 50, while negative developments can trigger market corrections.

Domestic Factors Fueling the Indian Stock Market Growth

Strong domestic factors have also contributed significantly to the recent Sensex and Nifty 50 rally. These positive domestic developments have fueled investor optimism and attracted significant investment.

Positive Corporate Earnings

Robust corporate earnings reports from several Indian companies have significantly boosted investor confidence. Strong earnings demonstrate the health and growth potential of the Indian economy.

- Examples: Strong earnings growth from IT, Pharma, and FMCG sectors. Specific examples of companies that have reported strong earnings.

- Sectors Showing Robust Growth: Highlight specific sectors that have demonstrated strong growth and contributed to the overall market surge.

Government Policies and Initiatives

Positive government policies and initiatives, such as infrastructure spending and tax reforms, have played a crucial role in enhancing investor confidence and boosting economic growth.

- Examples: Government initiatives focused on infrastructure development, tax reforms aimed at boosting domestic investment, and ease of doing business initiatives.

- Impact on Specific Sectors: Discuss how specific government policies have positively impacted various sectors, contributing to the overall market growth.

Increased Foreign Institutional Investor (FII) Inflows

Increased FII investments have played a vital role in driving the recent market surge. Positive global sentiment coupled with the strong growth outlook for the Indian economy has attracted significant foreign investment.

- Data on FII Investments: Provide data on recent FII investments in the Indian stock market.

- Reasons for Increased Investment: Analyze the factors driving increased FII investments in India, such as strong corporate earnings, positive economic outlook, and government reforms.

Investor Sentiment and Market Psychology

Investor sentiment and market psychology play a crucial role in driving market movements. Positive sentiment, driven by various factors, fuels market growth, whereas negative sentiment can lead to corrections.

Bullish Investor Sentiment

The recent market surge has been largely driven by a strong bullish investor sentiment. Positive news, coupled with expectations of future growth, has fueled optimism and increased investment.

- Factors Contributing to Bullish Sentiment: Improved economic indicators, positive corporate earnings, government initiatives, and expectations of continued growth.

Speculation and Market Volatility

Market volatility is a natural occurrence, and speculation plays a role in influencing short-term price movements. While speculation can amplify gains, it also carries the risk of significant losses.

- Factors Contributing to Volatility: Global uncertainties, unexpected events, and short-term trading activities.

- Impact of Short-Term Trading: Highlight how short-term trading strategies can contribute to market volatility.

Retail Investor Participation

Increased participation of retail investors has also contributed to the recent market surge. Growing financial literacy and ease of access to investment platforms have encouraged more retail participation.

- Data on Retail Investor Participation: Provide data illustrating the increased participation of retail investors.

- Factors Driving Increased Retail Investment: Increased financial literacy, ease of access to investment platforms, and positive market sentiment.

Conclusion: Navigating the Sensex and Nifty 50 Surge: A Look Ahead

The remarkable surge in the Sensex and Nifty 50 indices is a result of a confluence of factors, including positive global economic indicators, strong domestic economic performance, supportive government policies, and robust investor sentiment. While the outlook remains positive, it's crucial to acknowledge potential risks and remain vigilant. Understanding these factors is vital for making informed investment decisions. Stay updated on the latest Sensex and Nifty 50 movements and develop your investment strategy with continued market analysis. Remember to diversify your portfolio and consult with a financial advisor before making any investment decisions.

Featured Posts

-

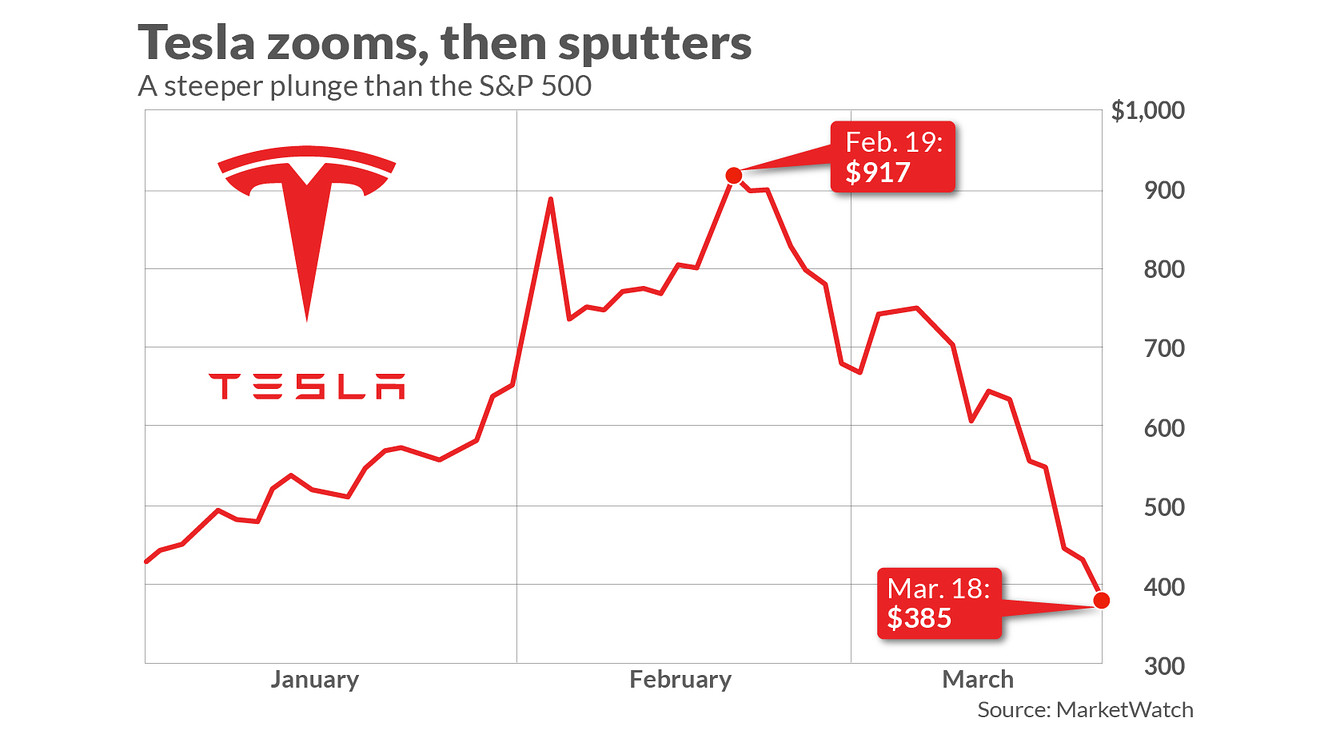

Elon Musks Influence Tesla Stock Decline And The Impact On Dogecoin

May 09, 2025

Elon Musks Influence Tesla Stock Decline And The Impact On Dogecoin

May 09, 2025 -

Alpine Bosss Stern Warning To Doohan F1 News

May 09, 2025

Alpine Bosss Stern Warning To Doohan F1 News

May 09, 2025 -

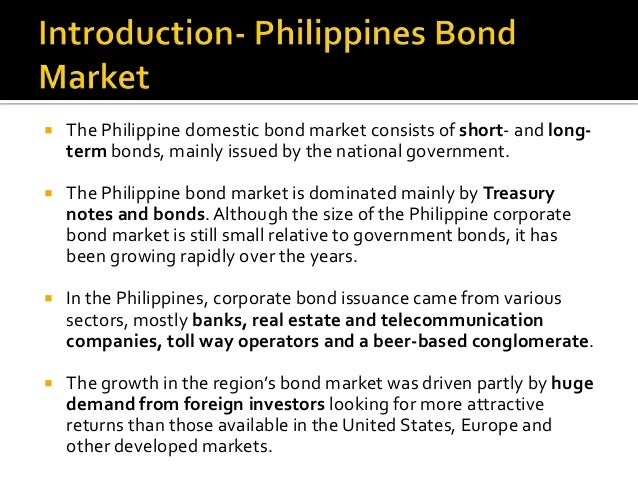

Bond Forward Market Reform The Indian Insurers Perspective

May 09, 2025

Bond Forward Market Reform The Indian Insurers Perspective

May 09, 2025 -

Anger In Nottingham After Nhs Staff Access A And E Records Of Stabbing Victims Families

May 09, 2025

Anger In Nottingham After Nhs Staff Access A And E Records Of Stabbing Victims Families

May 09, 2025 -

Elizabeth Arden Skincare Walmart Prices And Deals

May 09, 2025

Elizabeth Arden Skincare Walmart Prices And Deals

May 09, 2025

Latest Posts

-

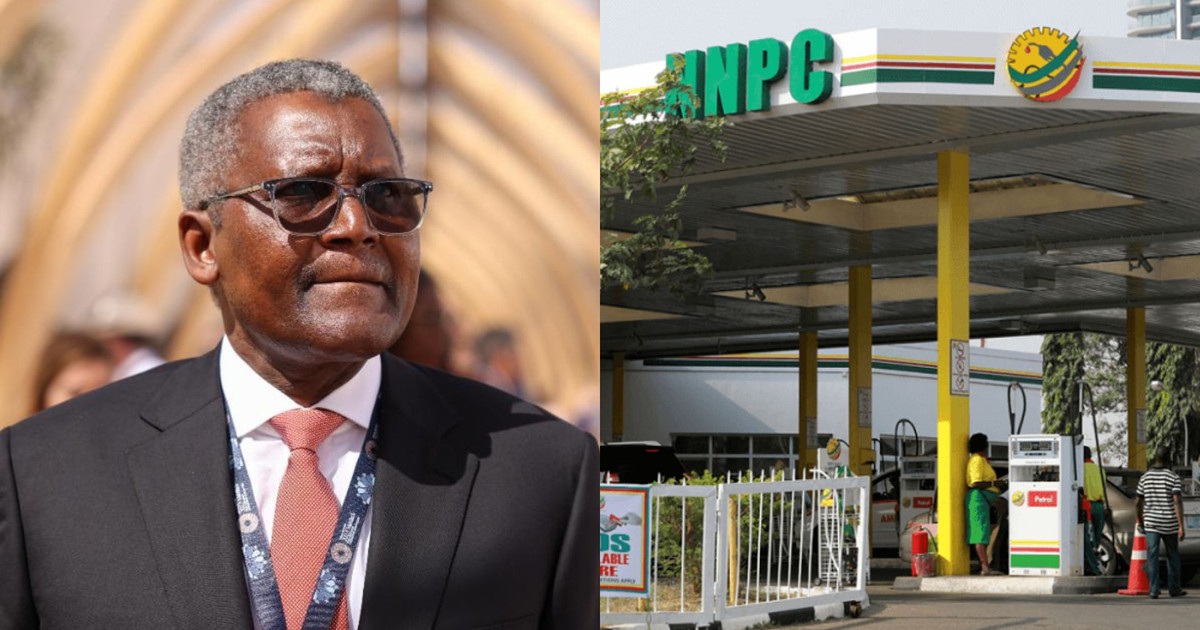

Analyzing The Correlation Between Dangote And Nnpc Petrol Prices

May 09, 2025

Analyzing The Correlation Between Dangote And Nnpc Petrol Prices

May 09, 2025 -

Unprovoked Racist Attack Woman Charged With Murder After Stabbing

May 09, 2025

Unprovoked Racist Attack Woman Charged With Murder After Stabbing

May 09, 2025 -

The Role Of Dangote Refinery In Shaping Nnpc Petrol Prices Thisdaylive Perspective

May 09, 2025

The Role Of Dangote Refinery In Shaping Nnpc Petrol Prices Thisdaylive Perspective

May 09, 2025 -

Woman Kills Man In Racist Stabbing Attack Unprovoked Violence

May 09, 2025

Woman Kills Man In Racist Stabbing Attack Unprovoked Violence

May 09, 2025 -

Dangotes Influence On Nnpc Petrol Prices A Thisdaylive Analysis

May 09, 2025

Dangotes Influence On Nnpc Petrol Prices A Thisdaylive Analysis

May 09, 2025