D-Wave Quantum (QBTS) Stock Decline Monday: A Deep Dive Into The Causes

Table of Contents

Market Sentiment and Wider Tech Sector Downturn

Monday's overall market performance played a role in the QBTS stock decline. A broader downturn in the tech sector, impacting many companies beyond just quantum computing, likely contributed to the negative sentiment. This wasn't an isolated incident affecting only D-Wave; the ripple effect impacted many technology stocks.

- Major market indices like the Nasdaq Composite and the S&P 500 experienced declines on Monday, indicating a general negative market sentiment. News sources such as the Financial Times and Bloomberg reported on these broad market fluctuations.

- Several tech companies, especially those involved in artificial intelligence (AI) and related technologies, also experienced stock price drops, suggesting a sector-wide correction. This negative correlation strengthens the hypothesis of a broader market influence.

- Negative news regarding interest rate hikes or macroeconomic uncertainty could have further exacerbated the bearish sentiment, leading to sell-offs across the tech sector, including QBTS.

Absence of Positive Catalysts and Recent News

The absence of positive news or catalysts for D-Wave Quantum could have further fueled the QBTS stock decline. Investor expectations often drive stock prices, and any disappointment can lead to a sell-off.

- There were no major announcements or positive developments from D-Wave Quantum on Monday that could have buoyed investor confidence. The lack of positive news created a vacuum, allowing negative market sentiment to dominate.

- Recent financial reports or analyst assessments may have raised concerns about the company's financial performance or future outlook, contributing to the sell-off. Any missed earnings expectations or downward revisions to future projections could impact investor sentiment.

- Negative press coverage or critical analyst reports could also have played a part in eroding investor confidence. Scrutiny of the company's technology, market position, or financial health can lead to significant stock price fluctuations.

Speculative Trading and Short-Selling Activity

Speculative trading and short-selling likely played a significant role in the QBTS stock price drop. Increased short interest can put downward pressure on a stock price, amplifying negative sentiment.

- Monday's trading volume for QBTS may have been unusually high, indicating increased trading activity potentially driven by speculative trading or short-selling. Analyzing this volume against historical data offers valuable insights.

- Algorithmic trading, which uses complex computer programs to execute trades, can amplify price swings, particularly during periods of negative sentiment. Rapid sell-offs driven by algorithms can exacerbate a downward trend.

- Data on short interest – the number of shares sold short – could reveal if a significant increase in short positions preceded or coincided with Monday's decline. A sudden spike in short interest can be a powerful indicator of negative market sentiment.

The Impact of Quantum Computing Competition

The competitive landscape within the quantum computing industry is highly dynamic. Advancements or announcements from competing companies can influence investor perception of D-Wave Quantum and its prospects.

- Companies like IBM, Google, and IonQ are key competitors in the quantum computing market. Breakthroughs or announcements from these rivals could potentially divert investor attention and capital away from D-Wave.

- Positive news regarding competitors, such as successful product launches or significant funding rounds, could trigger a reassessment of D-Wave's market position, potentially leading to a stock price decline.

- Investor perception of D-Wave's technology compared to its competitors is critical. If investors believe D-Wave is lagging behind in terms of technological advancements, this could lead to a shift in investment strategies.

Conclusion

The D-Wave Quantum (QBTS) stock decline on Monday was likely a confluence of factors, including broader market downturns in the technology sector, the absence of positive news from the company, speculative trading activity, and the competitive pressures within the quantum computing industry. While stock market fluctuations are inherent, understanding these contributing elements is vital for informed investment decisions. For a comprehensive understanding, further research into D-Wave Quantum’s financials and future prospects, through a detailed D-Wave Quantum stock analysis, is recommended. Analyzing the QBTS investment outlook and understanding the QBTS stock market trends are critical for investors navigating this dynamic space. Continue monitoring the D-Wave Quantum (QBTS) stock and the broader quantum computing sector for further updates and developments before making any investment decisions.

Featured Posts

-

Spectacles Engages Au Festival Le Bouillon De Clisson

May 21, 2025

Spectacles Engages Au Festival Le Bouillon De Clisson

May 21, 2025 -

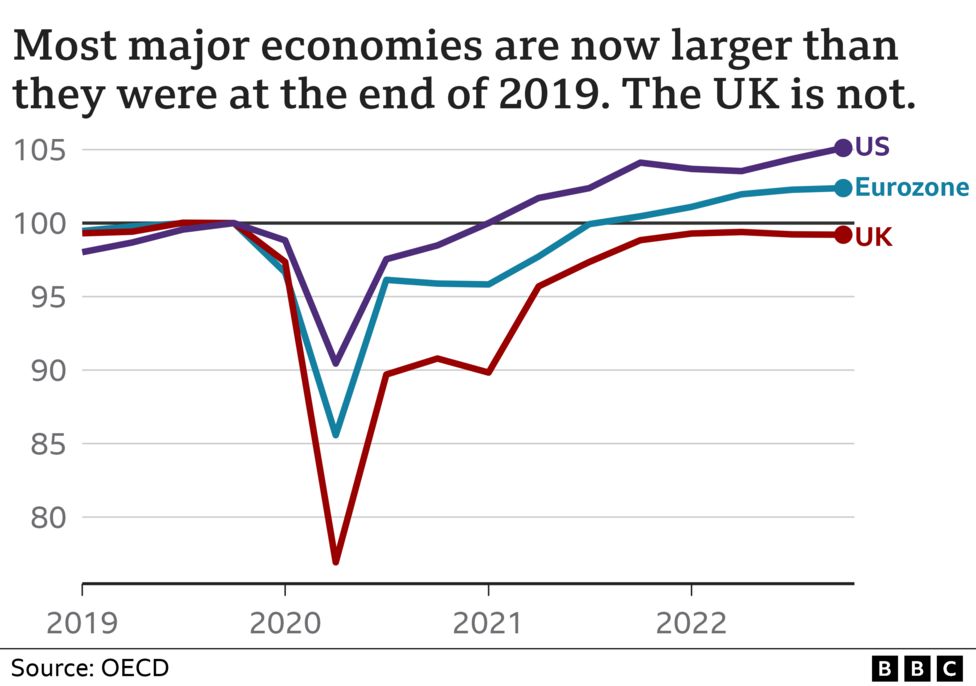

The Brexit Effect Slowing Growth In Uk Luxury Exports To The Eu

May 21, 2025

The Brexit Effect Slowing Growth In Uk Luxury Exports To The Eu

May 21, 2025 -

Upcoming Qbts Earnings A Guide For Investors On Stock Market Reaction

May 21, 2025

Upcoming Qbts Earnings A Guide For Investors On Stock Market Reaction

May 21, 2025 -

Ginger Zee Silences Critic With Powerful Response To Aging Comments

May 21, 2025

Ginger Zee Silences Critic With Powerful Response To Aging Comments

May 21, 2025 -

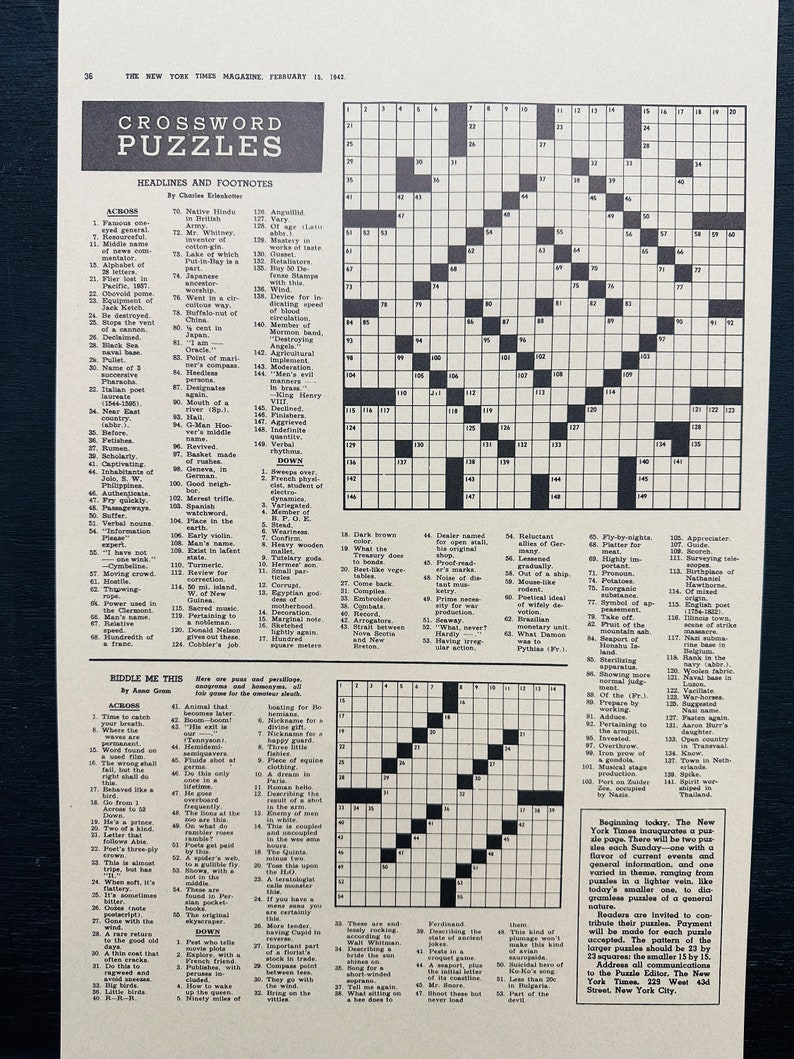

Solving The May 1st Nyt Mini Crossword The Marvel The Avengers Clue

May 21, 2025

Solving The May 1st Nyt Mini Crossword The Marvel The Avengers Clue

May 21, 2025

Latest Posts

-

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025 -

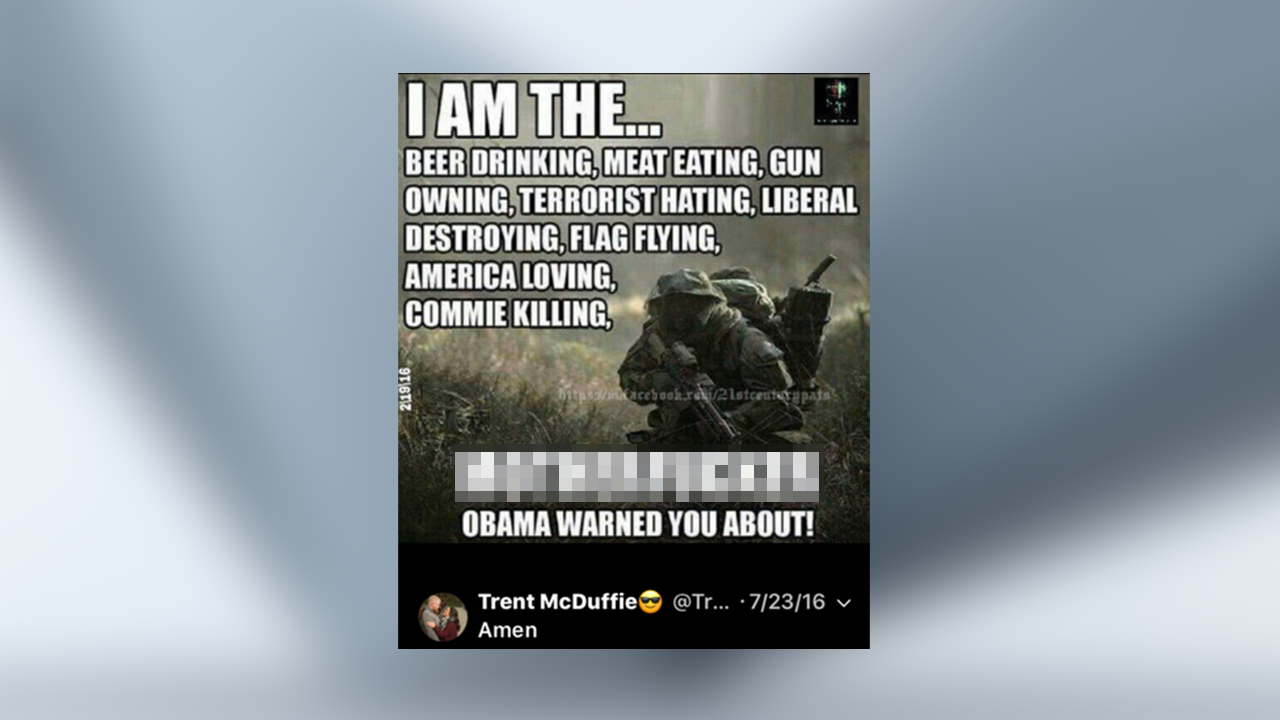

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025 -

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025 -

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025