D-Wave Quantum (QBTS) Stock: Factors Contributing To The 2025 Price Decline

Table of Contents

Increased Competition in the Quantum Computing Market

The quantum computing landscape is fiercely competitive, with numerous companies vying for market share. This intense rivalry could significantly pressure D-Wave's market position and profitability by 2025.

Emergence of New Players and Technologies

The quantum computing arena is rapidly evolving, with new players and technologies constantly emerging. This dynamic environment poses a significant threat to D-Wave's dominance.

- Rise of gate-based quantum computers: Companies like IBM and Google are aggressively pursuing gate-based quantum computing, a different approach than D-Wave's quantum annealing. These gate-based systems are seen by many as more versatile and potentially more powerful in the long run. This technological competition puts pressure on D-Wave's market share.

- Development of alternative quantum annealing approaches: Other companies are also developing their own versions of quantum annealing, potentially offering improved performance or cost-effectiveness compared to D-Wave's offerings. This creates further competitive pressure in the quantum annealing niche.

- Increased investment in hybrid classical-quantum computing solutions: Hybrid approaches combining classical and quantum computing are gaining traction. These solutions may offer more immediate practical applications, potentially diverting investment away from pure quantum annealing technologies like D-Wave's. This shift in focus could impact QBTS valuation.

Technological Advancements Outpacing D-Wave's Progress

D-Wave's adiabatic quantum computation approach, while innovative, might struggle to keep pace with the rapid advancements in other quantum computing technologies.

- Faster qubit development in competing technologies: Competitors are achieving significant breakthroughs in qubit development, creating more powerful and stable qubits than those currently available in D-Wave's systems.

- Improved error correction techniques in gate-based systems: Gate-based systems are making progress in error correction, a critical challenge in quantum computing. Superior error correction capabilities translate to more reliable and accurate computations, providing a competitive advantage.

- Increased qubit coherence times in rival platforms: Longer qubit coherence times are essential for performing complex calculations. Improvements in coherence times by competitors could make their systems significantly more powerful than D-Wave's.

Challenges in Scaling and Commercialization

Scaling quantum processors and demonstrating clear real-world applications are crucial for D-Wave's long-term success and the QBTS stock price. Significant hurdles remain in both areas.

Difficulties in Scaling Quantum Processors

Scaling up the number of qubits while maintaining performance and cost-effectiveness is a major challenge for the entire quantum computing industry, including D-Wave.

- Increased manufacturing complexity and cost with larger qubit counts: Building larger quantum processors is exponentially more difficult and expensive, potentially limiting D-Wave's ability to compete with companies that can achieve higher qubit counts at a lower cost.

- Challenges in maintaining qubit coherence at larger scales: As the number of qubits increases, maintaining their delicate quantum states becomes increasingly difficult, impacting the performance and reliability of the system.

- Difficulties in error correction and fault tolerance in larger systems: Error correction is crucial for large-scale quantum computers. Implementing effective error correction in larger systems is a complex and challenging task.

Limited Real-World Applications and Revenue Generation

Demonstrating clear, practical applications with substantial revenue potential is critical for long-term stock value. Currently, the real-world applications of quantum annealing remain relatively niche.

- Limited commercial deployments of D-Wave's quantum annealers: The number of commercial deployments of D-Wave's systems is still relatively small, hindering the company's ability to generate significant revenue and demonstrate the market viability of its technology.

- Slow adoption of quantum computing solutions by industries: Industries are still hesitant to fully adopt quantum computing solutions due to cost, complexity, and a lack of clear ROI. This slow adoption limits the potential market for D-Wave's technology.

- Challenges in proving a significant return on investment for quantum computing solutions: Demonstrating a clear return on investment for quantum computing solutions remains a significant challenge, hindering broader adoption and affecting investor confidence.

Macroeconomic Factors and Investor Sentiment

Broader economic conditions and investor sentiment can significantly impact the performance of high-growth, speculative stocks like QBTS.

Overall Economic Downturn

A general economic downturn or market correction could negatively impact investor confidence in high-risk investments such as QBTS.

- Reduced investor appetite for riskier investments during economic downturns: During economic uncertainty, investors tend to move towards safer, more established investments, leading to decreased demand for high-growth, speculative stocks.

- Increased volatility in the stock market affecting technology stocks: Technology stocks are particularly vulnerable to market corrections, and QBTS, as a technology stock, would likely experience increased volatility during an economic downturn.

- Potential for decreased funding for quantum computing research and development: Economic downturns can lead to reduced funding for research and development in emerging technologies, potentially impacting D-Wave's ability to innovate and compete.

Shifting Investor Focus

Investor interest in specific technologies can shift quickly, potentially leading to a decrease in demand for D-Wave's stock.

- Emergence of other promising technologies competing for investor attention: New and exciting technologies constantly emerge, competing for investor capital and potentially diverting attention and investment away from quantum computing.

- Changes in market sentiment towards quantum computing as a whole: Market sentiment towards quantum computing can change rapidly based on technological breakthroughs, disappointments, or changes in the competitive landscape.

- Potential for overvaluation in the initial stages of market hype: In the early stages of a new technology, there's a risk of overvaluation based on hype rather than solid fundamentals. A correction could follow as the market re-evaluates the technology's true potential.

Conclusion

This analysis highlights several potential factors that could contribute to a decline in D-Wave Quantum (QBTS) stock price by 2025. Increased competition, scaling challenges, limited commercial applications, and macroeconomic factors all pose significant risks. While the quantum computing sector holds immense long-term promise, investors should carefully consider these potential downsides before investing in QBTS. Thorough due diligence and a realistic assessment of the risks associated with D-Wave Quantum (QBTS) stock are essential for navigating this dynamic and evolving market. Conduct further research and consult with financial advisors before making any investment decisions regarding D-Wave Quantum (QBTS) stock or other quantum computing stocks.

Featured Posts

-

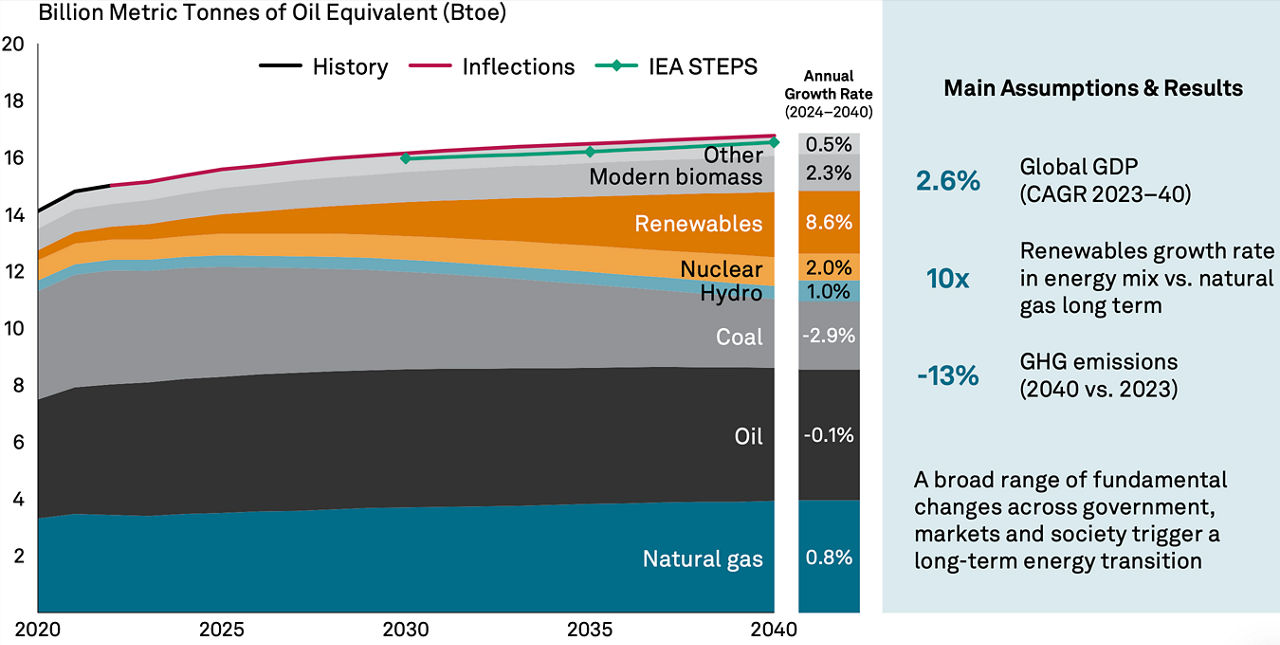

Taiwan Shifts To Lng Impact Of Nuclear Reactor Closure

May 20, 2025

Taiwan Shifts To Lng Impact Of Nuclear Reactor Closure

May 20, 2025 -

Ia Et Ecriture Une Agatha Christie Virtuelle Efficace

May 20, 2025

Ia Et Ecriture Une Agatha Christie Virtuelle Efficace

May 20, 2025 -

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025 -

Pro D2 8 Equipes A 8 Points Perspectives Pour Valence Romans Et Su Agen

May 20, 2025

Pro D2 8 Equipes A 8 Points Perspectives Pour Valence Romans Et Su Agen

May 20, 2025 -

The Future Of Buy Canadian Tariffs And The Beauty Industrys Response

May 20, 2025

The Future Of Buy Canadian Tariffs And The Beauty Industrys Response

May 20, 2025