D-Wave Quantum (QBTS) Stock Performance In 2025: A Deep Dive

Table of Contents

D-Wave's Technological Advancements and Market Position in 2025

D-Wave Quantum's success in 2025 hinges on its technological progress and market positioning. The company's current focus on annealing-based quantum computers is already finding applications in optimization problems. However, the competitive landscape is fierce, with players like IBM, Google, and IonQ pursuing different quantum computing architectures.

To maintain its edge, D-Wave needs to demonstrate significant advancements by 2025. This includes:

- Increased Qubit Count and Coherence Times: Higher qubit counts and longer coherence times are crucial for tackling more complex problems and improving the accuracy of calculations. Significant improvements in these metrics would boost investor confidence.

- New Applications and Partnerships: Expanding the applications of D-Wave's technology beyond optimization problems, into areas like materials science and drug discovery, is essential for growth. Strategic partnerships with major corporations can accelerate this process.

- Market Penetration Strategies and Projected Market Share: D-Wave needs a robust strategy to expand its market share. This may involve targeting specific industry verticals and developing tailored solutions. Increased market penetration will directly impact its stock price.

- Comparison with Competitors: While D-Wave currently holds a unique position with its annealing approach, the performance and scalability of gate-based quantum computers from competitors like IBM and Google will remain a key factor influencing D-Wave's market share and investor sentiment.

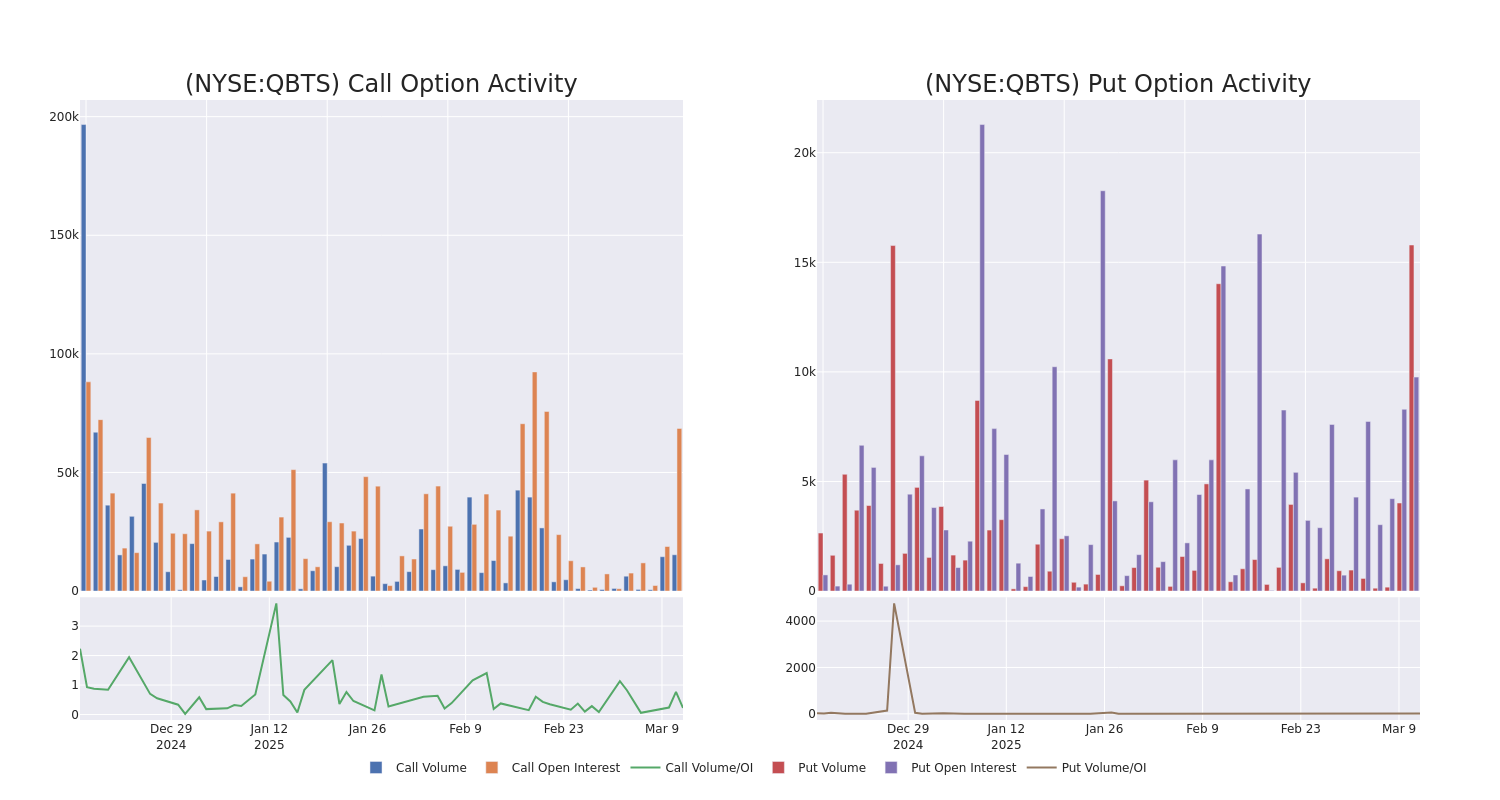

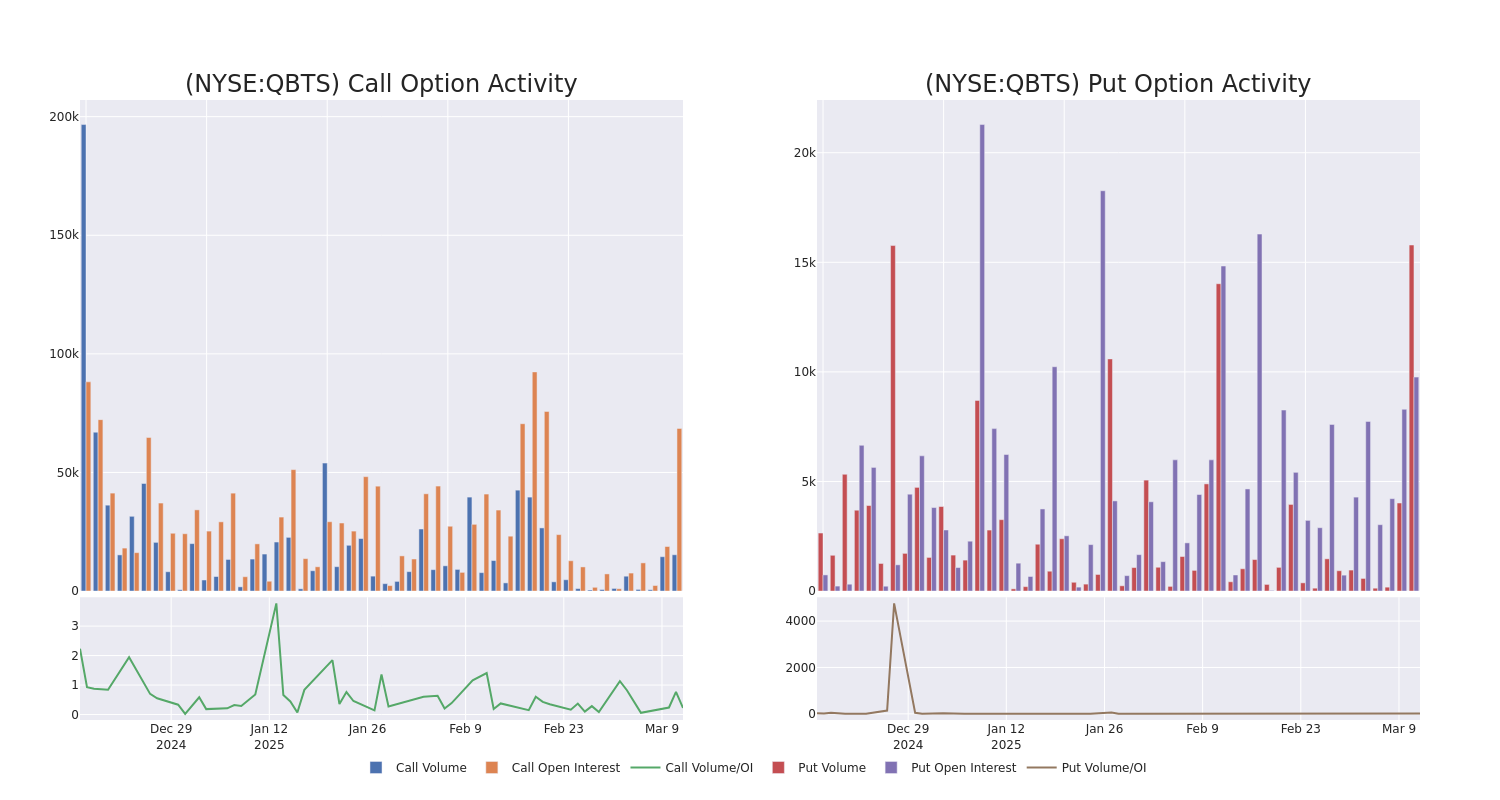

Factors Influencing QBTS Stock Price in 2025

Predicting QBTS stock price in 2025 requires considering a multitude of factors. These can be broadly categorized into macroeconomic, industry-specific, and company-specific influences.

Macroeconomic Factors: The overall health of the global economy, interest rate fluctuations, and investor sentiment towards technology stocks will significantly impact QBTS's performance. A strong economy and positive investor sentiment are generally favorable for tech stocks.

Industry-Specific Factors: The competitive landscape in quantum computing, government regulations, and the level of government funding for research and development will all play a crucial role. Increased government investment could significantly boost the entire industry, including D-Wave.

Company-Specific Factors: D-Wave's financial performance, the success of new product launches, the formation of strategic partnerships, and key management decisions will directly influence its stock valuation. Positive financial results and strong partnerships would likely increase investor confidence.

- Impact of Successful Product Launches and Commercial Applications: The successful launch of new products and their widespread adoption by businesses will be a major driver of QBTS stock price.

- Potential Risks and Challenges for D-Wave: Technological challenges, competition, and the slow pace of market adoption pose significant risks.

- Analysis of Financial Forecasts and Analysts' Ratings: Careful consideration of financial projections and analysts' ratings can provide valuable insights into the potential future performance of QBTS stock.

Risk Assessment and Investment Strategies for QBTS in 2025

Investing in QBTS involves substantial risk. The quantum computing market is still nascent, making accurate predictions challenging. The stock price is likely to experience significant volatility.

- Risk Factors: Technological hurdles in scaling quantum computers, intense competition from established tech giants, and slower-than-expected market adoption pose significant risks.

- Mitigation Strategies: Diversification of investment portfolios and a dollar-cost averaging strategy can mitigate some risks. Investing a fixed amount at regular intervals regardless of price fluctuations can help reduce the impact of volatility.

- Potential Returns and Downsides: While the potential returns in quantum computing are substantial, the downsides, including significant losses, should also be considered.

Investors with a high-risk tolerance and a long-term investment horizon might consider QBTS. However, those seeking lower-risk investments should explore other options.

Conclusion: Investing in the Future of Quantum Computing: QBTS Stock Outlook for 2025

D-Wave Quantum's future success in 2025 depends on its technological advancements, market penetration, and the broader economic and industry landscape. While the potential upside is considerable, significant risks remain. Predicting the exact stock performance is impossible, but a combination of successful technological developments, strategic partnerships, and favorable market conditions would be crucial for a positive QBTS stock outlook.

Before investing in D-Wave Quantum (QBTS) stock, conduct thorough due diligence and consider consulting with a financial advisor. Learn more about D-Wave Quantum (QBTS) and make informed investment decisions based on your risk tolerance and investment goals.

Featured Posts

-

Logitechs Next Big Thing Designing The Ultimate Long Lasting Mouse

May 21, 2025

Logitechs Next Big Thing Designing The Ultimate Long Lasting Mouse

May 21, 2025 -

Bruins Offseason Strategy Espn Highlights Key Franchise Changes

May 21, 2025

Bruins Offseason Strategy Espn Highlights Key Franchise Changes

May 21, 2025 -

Llm Powering Siri Apples Plan For A Smarter Assistant

May 21, 2025

Llm Powering Siri Apples Plan For A Smarter Assistant

May 21, 2025 -

Little Britain Cancelled In 2020 Understanding Gen Zs Unexpected Obsession

May 21, 2025

Little Britain Cancelled In 2020 Understanding Gen Zs Unexpected Obsession

May 21, 2025 -

Stronger Earnings Lead To Vodacom Vod Payout Surpassing Estimates

May 21, 2025

Stronger Earnings Lead To Vodacom Vod Payout Surpassing Estimates

May 21, 2025

Latest Posts

-

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025 -

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025 -

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025 -

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025