D-Wave Quantum (QBTS) Stock Plunge: Understanding Thursday's Decline

Table of Contents

Analyzing the Immediate Triggers for the QBTS Stock Drop

Several factors likely converged to trigger Thursday's QBTS stock decline. Understanding these immediate triggers is crucial for interpreting the broader market reaction and assessing future investment implications.

Lack of Positive News or Earnings Announcements

The absence of positive catalysts significantly impacted QBTS's stock price. In the volatile world of technology stocks, and particularly in emerging sectors like quantum computing, positive news cycles are vital for maintaining investor confidence and supporting stock valuations. The lack of such news created a vacuum, leaving the stock vulnerable to negative pressures.

- No major contract wins announced: The absence of significant new business deals signaled a potential slowdown in growth, discouraging investors.

- No significant technological breakthroughs revealed: Without announcements of innovative advancements, investor enthusiasm waned, impacting the perceived value of the company.

- Absence of positive analyst ratings or upgrades: Lack of positive endorsements from financial analysts further dampened investor sentiment, contributing to the selling pressure.

Broader Market Sell-Offs and Sectoral Weakness

Thursday's QBTS stock plunge wasn't happening in a vacuum. A broader market downturn or negative sentiment within the technology sector likely exacerbated the decline.

- Overall market sentiment on Thursday: If the overall market experienced a downturn, QBTS, as a growth stock in a relatively nascent sector, would be disproportionately affected.

- Performance of competing quantum computing companies: Negative performance by competitors could have signaled broader weakness in the quantum computing sector, influencing investor perception of QBTS.

- Downturn in the technology sector generally: A general sell-off in the tech sector would likely drag down even promising companies like D-Wave, given the inherent risk associated with growth stocks.

Potential Impact of Investor Sentiment and Short Selling

Investor sentiment and speculative trading play a crucial role in stock price volatility. Negative sentiment, amplified by short selling, can create a self-fulfilling prophecy, driving down the stock price further.

- Increased short interest in QBTS: A high level of short interest makes the stock more susceptible to sharp price drops, as short-sellers profit from a declining stock price.

- Negative media coverage or social media sentiment: Negative news coverage or social media chatter can significantly impact investor perception and trigger selling pressure.

- Panic selling impacting the stock price: Fear and uncertainty among investors can lead to panic selling, accelerating the downward trend.

Long-Term Implications for D-Wave Quantum (QBTS) Investors

While Thursday's decline was significant, investors need to assess the long-term implications for D-Wave Quantum and adjust their investment strategies accordingly.

Assessing the Fundamental Value of QBTS

Despite the short-term volatility, the fundamental value of QBTS needs careful consideration. This involves a thorough evaluation of the company's long-term prospects.

- Review of D-Wave's technology and its competitive advantages: Analyzing D-Wave's unique technology and its position within the competitive landscape is crucial.

- Evaluation of their market share and growth potential: Assessing the company's market share and its potential for future growth is essential for long-term investment decisions.

- Analysis of their financial health and future projections: Examining the company's financial health and its projections for future revenue and profitability is vital for assessing its long-term viability.

Strategies for Investors Following the Stock Plunge

Investors now face critical decisions. Several strategies can be considered based on risk tolerance and investment goals.

- Holding onto the stock for the long term: A long-term perspective might be appropriate for investors who believe in D-Wave's long-term potential.

- Averaging down on the stock price: Buying more shares at a lower price can reduce the average cost per share, mitigating potential losses.

- Selling the stock to mitigate losses: For investors with lower risk tolerance, selling might be the prudent choice to prevent further losses.

- Diversifying investments: Diversification across various asset classes can help reduce the overall risk of the investment portfolio.

Future Outlook and Potential for Recovery

The potential for a QBTS stock price rebound depends on various factors, including market conditions and the company's performance.

- Factors that could lead to a QBTS stock price rebound: Positive news, strong earnings reports, and improved market sentiment could trigger a recovery.

- Potential risks and uncertainties facing the company: Continued challenges in the quantum computing sector or internal company issues could hinder recovery.

- Importance of monitoring market developments and company news: Closely monitoring market trends and company announcements is essential for making informed decisions.

Conclusion

The sharp decline in D-Wave Quantum (QBTS) stock on Thursday underscores the inherent volatility in the quantum computing sector. While several factors contributed to this plunge, from a lack of positive news to broader market conditions, investors need to carefully evaluate the long-term potential of QBTS. Understanding the fundamental value of the company and employing informed investment strategies are critical for navigating the fluctuations in this exciting but unpredictable market. Continue to research the D-Wave Quantum (QBTS) stock and its position within the broader quantum computing market to make well-informed decisions regarding your investment strategy.

Featured Posts

-

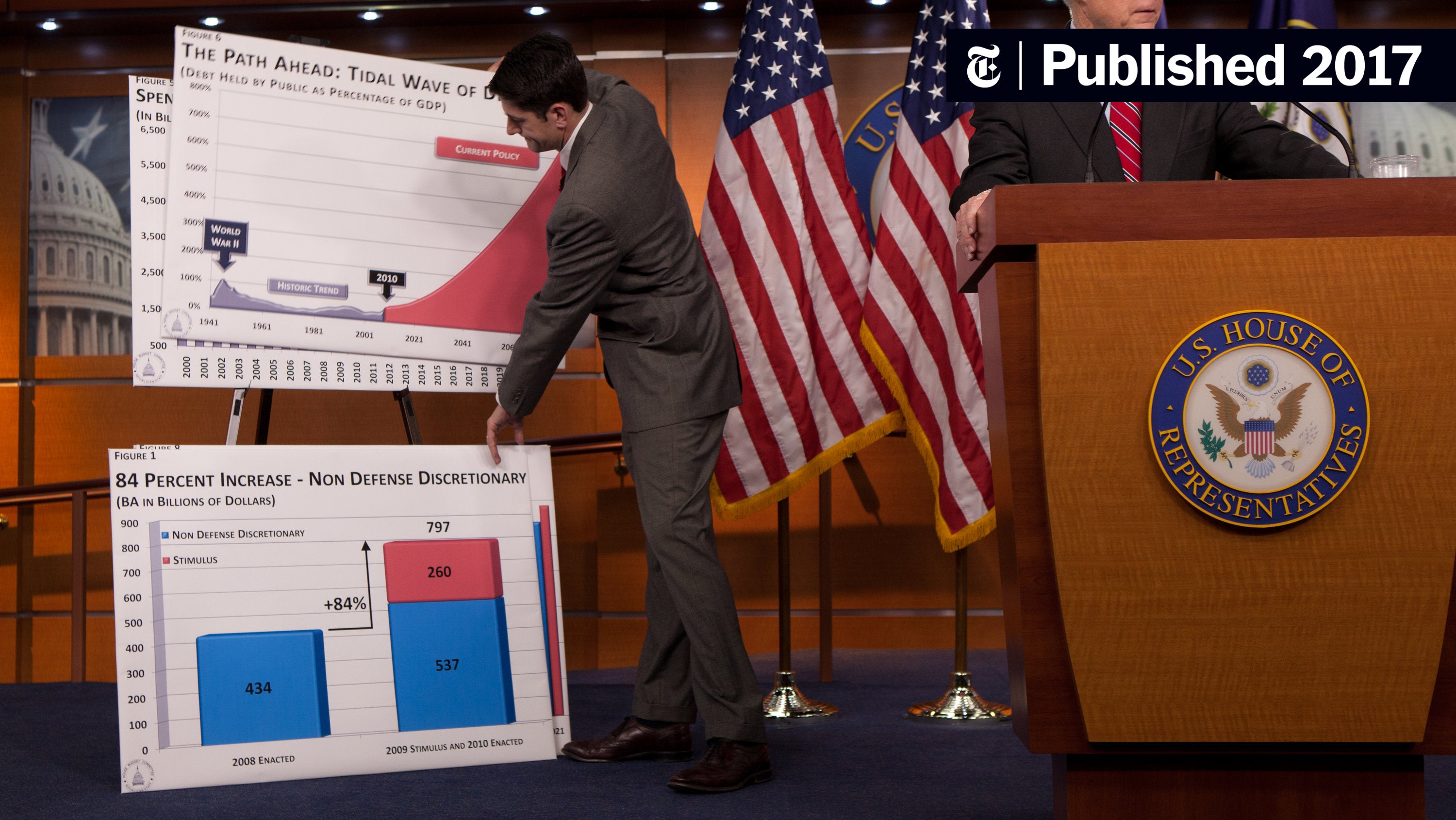

Is The Gop Tax Plan Fiscally Responsible Examining The Deficit Claims

May 20, 2025

Is The Gop Tax Plan Fiscally Responsible Examining The Deficit Claims

May 20, 2025 -

Germany Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025

Germany Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025 -

Mainzs Impressive Win At Gladbach Solidifies Top Four Position

May 20, 2025

Mainzs Impressive Win At Gladbach Solidifies Top Four Position

May 20, 2025 -

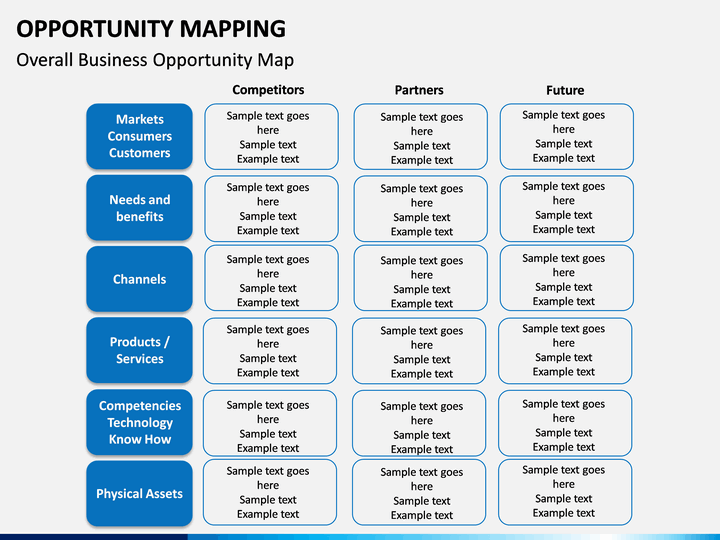

Investment Opportunities Mapping The Countrys Emerging Business Hubs

May 20, 2025

Investment Opportunities Mapping The Countrys Emerging Business Hubs

May 20, 2025 -

Tony Hinchcliffes Wwe Segment A Behind The Scenes Look At A Failed Appearance

May 20, 2025

Tony Hinchcliffes Wwe Segment A Behind The Scenes Look At A Failed Appearance

May 20, 2025