Is The GOP Tax Plan Fiscally Responsible? Examining The Deficit Claims

Table of Contents

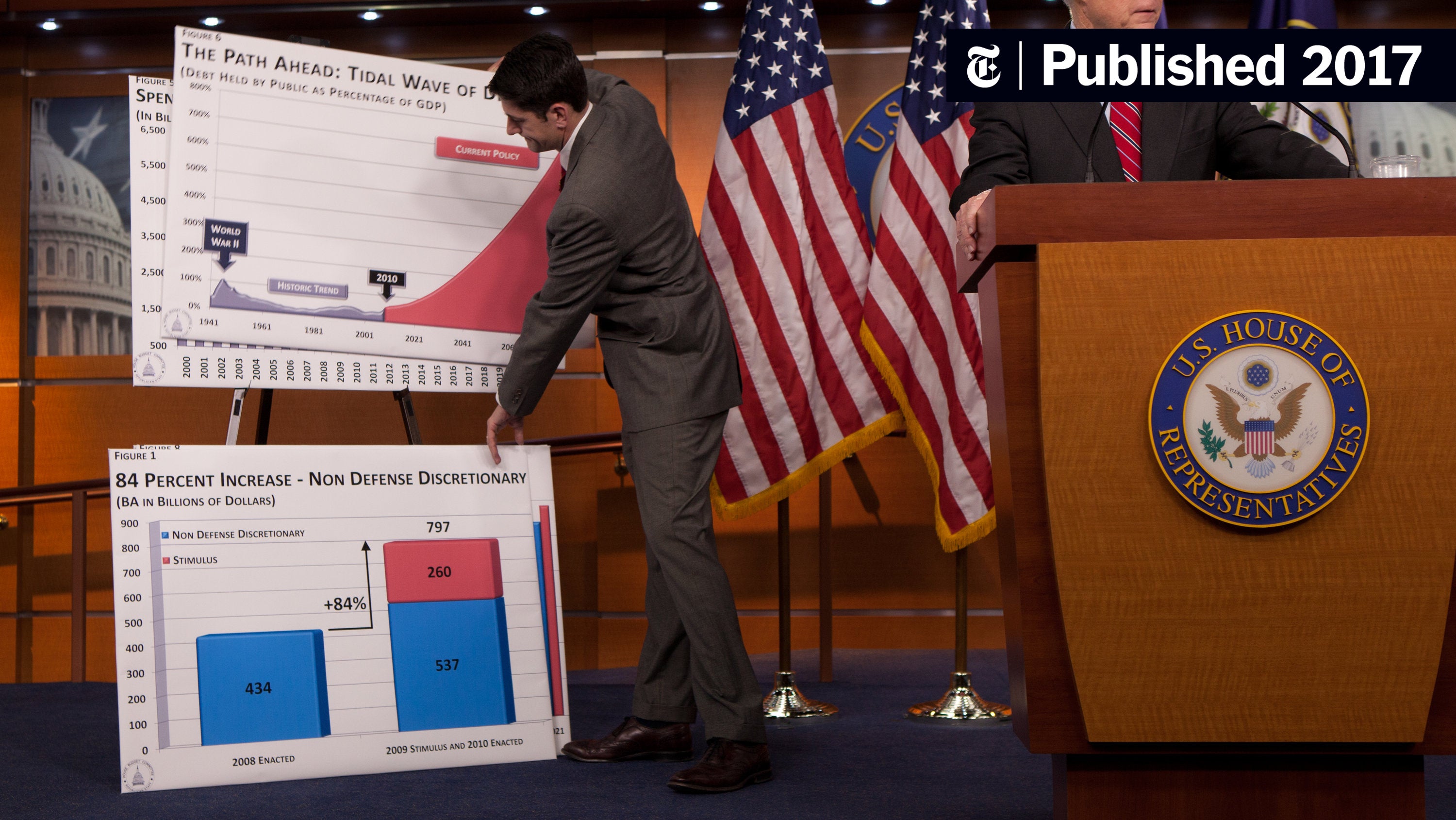

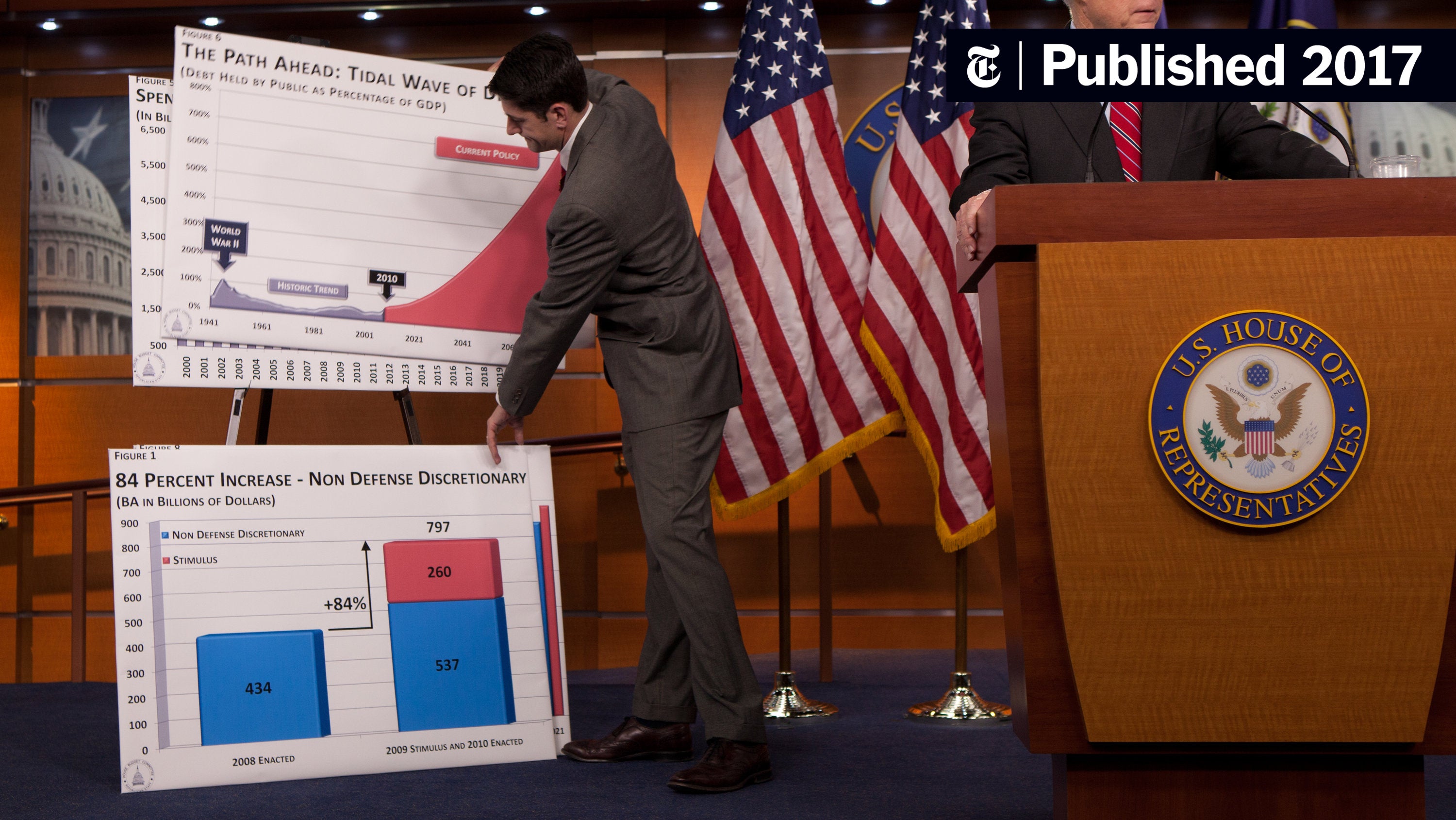

Projected Increases in the National Deficit

The Congressional Budget Office (CBO) plays a crucial role in assessing the fiscal impact of proposed legislation. Understanding their projections and methodology is key to evaluating the GOP tax plan's potential effect on the deficit.

Analyzing the CBO Score and its Methodology

The CBO uses a complex model to project the impact of the tax plan on the federal budget. This involves estimating changes in tax revenues, government spending, and economic growth. However, the CBO's methodology has faced criticism:

- Limitations of Static Scoring: Critics argue that the CBO's traditional "static scoring" underestimates the potential positive effects of tax cuts on economic growth. Static scoring assumes that tax cuts don't affect economic behavior.

- Uncertainty in Economic Forecasting: Predicting future economic growth is inherently uncertain, making accurate deficit projections challenging. Unexpected economic downturns can significantly alter the projected impact.

- Unforeseen Consequences: The CBO's models may not fully capture all the potential consequences of a tax plan, such as changes in investment behavior or tax avoidance strategies.

Independent analyses often yield different results, highlighting the inherent uncertainties involved in such projections. For example, the Tax Policy Center offers alternative projections that often differ from the CBO's estimates.

Revenue Projections vs. Actual Revenue

The GOP's tax plan relies on projected revenue increases stemming from economic growth stimulated by the tax cuts themselves. However, comparing these projections to historical data reveals a mixed record:

- Past Tax Cuts: Previous tax cuts haven't always resulted in the projected revenue increases. The Economic Recovery Tax Act of 1981, for instance, initially failed to meet revenue projections.

- Economic Growth and Tax Avoidance: The actual impact of tax cuts depends on numerous factors, including the overall state of the economy, the responsiveness of businesses to tax incentives, and the extent of tax avoidance strategies employed by individuals and corporations.

- Data Discrepancies: Different economic models and assumptions lead to varying conclusions about the plan's revenue impact, making a definitive assessment challenging.

The Role of Dynamic Scoring

Dynamic scoring incorporates the idea that tax cuts can stimulate economic activity, leading to higher tax revenues in the long run. While proponents argue that this effect should be considered, critics point out limitations:

- Uncertain Multiplier Effects: Determining the precise magnitude of the stimulative effect (the "tax multiplier") is highly uncertain and subject to significant debate among economists.

- Potential for Manipulation: Dynamic scoring can be susceptible to manipulation, with varying assumptions leading to widely different results.

- Time Horizon: The timing of the positive effects is also uncertain; revenue increases may not materialize immediately.

Long-Term Economic Effects and Their Impact on the Deficit

Analyzing the long-term consequences of the GOP tax plan is crucial for assessing its fiscal responsibility. This requires a careful consideration of potential impacts on various sectors of the economy.

Stimulative Effects vs. Increased Inequality

Proponents argue that the tax cuts will stimulate economic growth, leading to higher tax revenues that offset the initial revenue loss. Critics, however, contend that the benefits will be disproportionately concentrated among the wealthy, exacerbating income inequality:

- Trickle-Down Economics: The "trickle-down" theory suggests that tax cuts for businesses and the wealthy will eventually benefit the lower and middle classes through job creation and increased investment. However, evidence for this effect is mixed.

- Distributional Effects: The tax plan's impact on different income groups is significant. While some may see tax reductions, others may face tax increases or reduced government services.

- Multiplier Effect Uncertainty: The actual size of the economic multiplier, which determines the extent of the stimulative effects, is highly uncertain.

Impact on Investment and Productivity

The GOP tax plan aims to boost investment and productivity through corporate tax cuts and tax incentives. The success of this strategy is contingent upon several factors:

- Business Confidence: Increased business confidence due to the tax cuts could encourage investment and innovation.

- Tax Incentives Effectiveness: The effectiveness of specific tax incentives in driving investment depends on their design and the overall economic climate. Past experience shows mixed results.

- Global Competition: The impact of the tax cuts on US competitiveness relative to other countries is another crucial factor.

Debt Sustainability and Future Generations

The long-term increase in the national debt resulting from the GOP tax plan raises concerns about debt sustainability and its impact on future generations:

- Increased Interest Payments: A higher national debt leads to increased interest payments, potentially crowding out other government spending.

- Reduced Government Spending Capacity: The increased debt burden could constrain the government's ability to finance crucial social programs and infrastructure projects in the future.

- Economic Instability: High levels of national debt can increase the vulnerability of the economy to economic shocks.

Alternative Perspectives and Counterarguments

A comprehensive assessment requires considering alternative viewpoints and counterarguments. This section explores diverse perspectives and supporting evidence.

Arguments for Fiscal Responsibility

Proponents of the GOP tax plan argue that:

- Economic Growth Outpaces Revenue Losses: Stimulated economic growth will lead to higher tax revenues, eventually offsetting the initial revenue loss from the tax cuts.

- Improved Business Climate: The tax cuts will create a more favorable business climate, attracting investment and creating jobs.

- Increased Tax Base: Lower tax rates could encourage more people and businesses to enter the formal economy, expanding the overall tax base.

Criticisms and Rebuttals

Critics argue that:

- Revenue Projections are Unrealistic: The projected revenue increases are overly optimistic and unlikely to materialize.

- Increased Inequality: The tax cuts will disproportionately benefit the wealthy, exacerbating income inequality.

- Long-Term Debt Unsustainable: The increased national debt will have serious long-term consequences for the economy and future generations.

Independent Analyses and Expert Opinions

Many independent economic analyses offer various perspectives. The Tax Foundation, the Brookings Institution, and the Committee for a Responsible Federal Budget, among others, offer detailed analyses, which should be consulted for a comprehensive understanding. It's crucial to consider the methodologies and assumptions of each analysis.

Conclusion: Assessing the Fiscal Responsibility of the GOP Tax Plan

The question of whether the GOP tax plan is fiscally responsible remains complex and multifaceted. While proponents highlight potential stimulative effects and long-term economic growth, critics point to projected increases in the national deficit and concerns about debt sustainability. The uncertainty surrounding economic forecasts, the varying methodologies used in deficit projections, and the differing interpretations of economic models make a definitive answer elusive. Ultimately, the true fiscal impact will only be known with time.

To form your own informed opinion, engage in further research using terms like "GOP tax plan fiscal impact," "GOP tax plan deficit analysis," and "is the GOP tax plan fiscally responsible?" Explore the various analyses and expert opinions available to gain a deeper understanding of this crucial issue. The debate continues, and your informed participation is vital.

Featured Posts

-

Miami Hedge Fund Manager Banned From Us For Alleged Immigration Fraud

May 20, 2025

Miami Hedge Fund Manager Banned From Us For Alleged Immigration Fraud

May 20, 2025 -

Voice Assistant Development Revolutionized Open Ais 2024 Breakthrough

May 20, 2025

Voice Assistant Development Revolutionized Open Ais 2024 Breakthrough

May 20, 2025 -

10 Minute Pilotless Lufthansa Flight Investigation Into Co Pilots Medical Emergency

May 20, 2025

10 Minute Pilotless Lufthansa Flight Investigation Into Co Pilots Medical Emergency

May 20, 2025 -

Railroad Bridge Accident Two Dead Childrens Fate Uncertain

May 20, 2025

Railroad Bridge Accident Two Dead Childrens Fate Uncertain

May 20, 2025 -

Transfert De Melvyn Jaminet Kylian Jaminet Denonce Un Montant Excessif

May 20, 2025

Transfert De Melvyn Jaminet Kylian Jaminet Denonce Un Montant Excessif

May 20, 2025