Dangote Refinery's Influence On NNPC Petrol Pricing

Table of Contents

Increased Domestic Refining Capacity and its Impact

Nigeria's current refining capacity is woefully inadequate, leading to heavy dependence on imported petroleum products and significant strain on foreign exchange reserves. The Dangote refinery, with its projected capacity to process 650,000 barrels of crude oil per day, represents a monumental shift. This massive increase in domestic refining capacity will significantly reduce Nigeria's reliance on imported petrol.

- Projected increase in daily refining capacity: 650,000 barrels per day – a substantial boost to Nigeria's refining capabilities.

- Expected reduction in petrol import bills: Billions of dollars currently spent on petrol imports could be redirected to other crucial sectors of the Nigerian economy.

- Potential impact on the Nigerian Naira: Reduced demand for foreign currency to import petrol could strengthen the Naira, improving its stability.

- Increased energy security for Nigeria: Less reliance on international markets translates to greater energy independence and resilience against global price fluctuations.

Competition and its Effect on Petrol Prices

The Dangote refinery's entrance into the market introduces a significant competitor to the NNPC, which currently enjoys a near-monopoly. This newfound competition could lead to several scenarios:

- NNPC's current market dominance: NNPC has historically controlled petrol pricing, often leading to criticism regarding transparency and pricing fairness.

- Potential price reductions due to competition: The introduction of a major competitor like Dangote could trigger a price war, benefiting consumers with lower petrol prices.

- The role of government regulation in petrol pricing: Government policies and regulations will play a vital role in determining the outcome of this competition.

- Impact on consumer affordability: Lower petrol prices directly translate to reduced transportation costs and potentially lower prices for goods and services, improving consumer affordability. A more competitive market could also drive innovation and efficiency improvements within the industry.

Government Policy and Regulatory Influence

The Nigerian government's role in regulating fuel prices is paramount. Its policies, including subsidies and price controls, significantly impact the market dynamics. The introduction of the Dangote refinery necessitates a review of these policies:

- Government's current fuel subsidy policy: The ongoing fuel subsidy debate will be significantly impacted by the increased domestic supply.

- Potential changes in fuel subsidy policies: The government may need to adjust its subsidy policies to reflect the new market realities.

- The impact of deregulation on petrol pricing: Further deregulation could lead to more market-driven pricing, potentially resulting in lower prices for consumers.

- Government's role in ensuring market transparency: Transparent and effective regulation is crucial to ensure fair competition and prevent manipulation of petrol prices.

Economic and Social Implications

The implications of lower petrol prices, driven by the Dangote refinery and increased competition, are far-reaching:

- Reduced transportation costs: Lower fuel costs will benefit individuals and businesses, reducing their operational expenses.

- Lower production costs for businesses: Reduced transportation costs will contribute to lower production costs across various industries, enhancing competitiveness.

- Increased disposable income for consumers: Lower fuel prices mean more disposable income for consumers, potentially stimulating economic activity.

- Potential job creation in the downstream sector: The refinery's operations and associated industries will likely create numerous jobs, boosting employment in Nigeria.

Conclusion

The Dangote refinery's impact on NNPC petrol pricing is expected to be substantial. Increased domestic refining capacity, coupled with increased competition, presents a significant opportunity for lower and more stable petrol prices in Nigeria. However, the success of this transformation hinges on effective government regulation, transparency, and a commitment to fair market practices. Staying informed about the developments at the Dangote refinery and its impact on NNPC petrol pricing is crucial to understanding the evolving dynamics of the Nigerian fuel market. Further research into the Dangote refinery's influence on Nigeria's fuel economy is encouraged to fully grasp the long-term implications.

Featured Posts

-

Wynne And Joanna All At Sea A Comprehensive Guide

May 10, 2025

Wynne And Joanna All At Sea A Comprehensive Guide

May 10, 2025 -

Stephen King Weighs In Stranger Things And The It Connection

May 10, 2025

Stephen King Weighs In Stranger Things And The It Connection

May 10, 2025 -

Oilers Vs Kings Prediction Game 1 Playoffs Best Bets And Picks

May 10, 2025

Oilers Vs Kings Prediction Game 1 Playoffs Best Bets And Picks

May 10, 2025 -

10 Film Noir Classics You Need To See

May 10, 2025

10 Film Noir Classics You Need To See

May 10, 2025 -

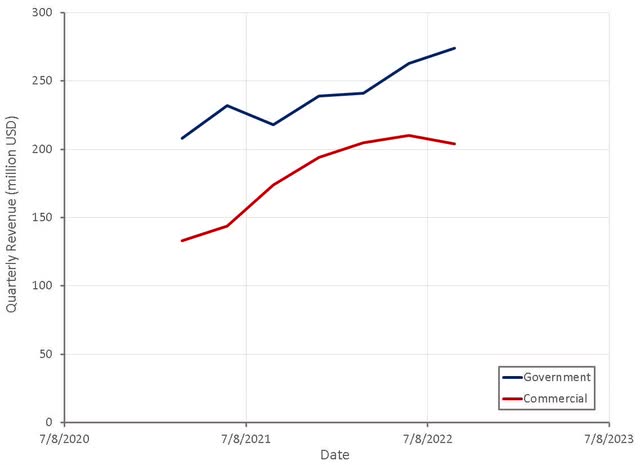

Government And Commercial Sectors Drive Palantir Stock Performance In Q1

May 10, 2025

Government And Commercial Sectors Drive Palantir Stock Performance In Q1

May 10, 2025