Government And Commercial Sectors Drive Palantir Stock Performance In Q1

Table of Contents

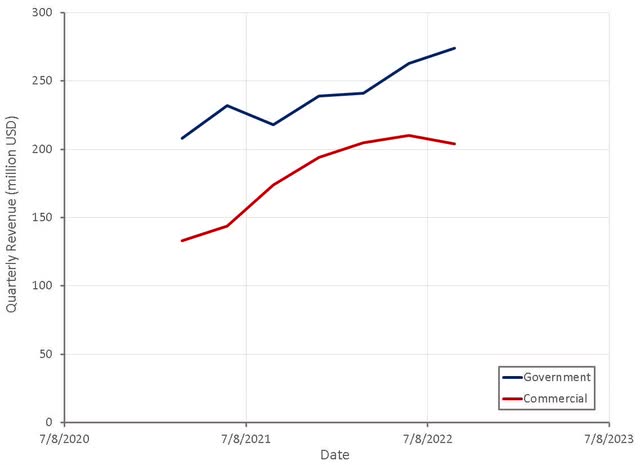

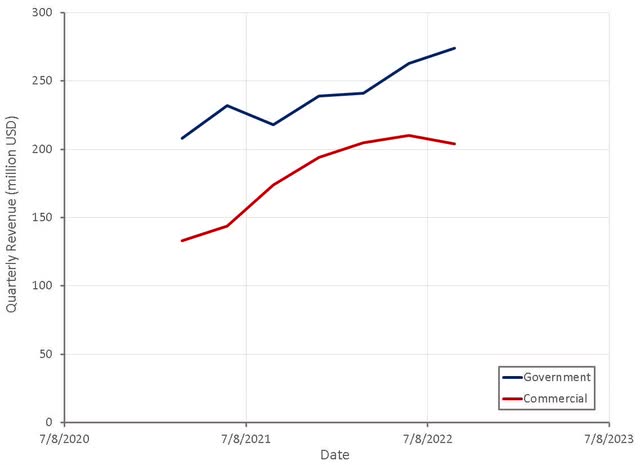

Government Sector Growth Fuels Palantir Stock Performance

Palantir's success in the government sector played a crucial role in its strong Q1 performance. This growth stems from two primary areas: increased government contracts and spending, and expanding government partnerships and solutions.

Increased Government Contracts and Spending

- Significant Contract Wins: Palantir secured several substantial contracts in Q1, notably a multi-year, multi-million dollar contract with the US Department of Defense for enhanced intelligence analysis capabilities. Another key win involved a contract with a leading European intelligence agency for cybersecurity threat detection and response. While specific contract values are often confidential, reports suggest these deals are worth hundreds of millions of dollars collectively.

- Strategic Importance: These government contracts are strategically vital to Palantir’s overall growth strategy. They not only contribute substantially to immediate revenue, but also solidify Palantir's position as a leading provider of data analytics solutions for national security and defense. These government contracts represent a significant portion of Palantir's revenue and demonstrate the company’s ability to secure large-scale, long-term agreements. Increased defense spending globally also contributes to this positive trend.

- Impact on Palantir Stock Performance: The securing of these large government contracts directly translates into increased revenue and improved profitability, boosting investor confidence and positively impacting Palantir stock performance. The long-term nature of these contracts provides predictability and stability, further reassuring investors.

Expanding Government Partnerships and Solutions

- New Partnerships: Palantir formed new partnerships with various government agencies, including collaborations focused on improving public health initiatives and optimizing resource allocation in several key departments. This expansion showcases Palantir’s commitment to providing comprehensive data solutions across the public sector.

- Solution Adoption: Existing government partnerships also saw significant expansion, with several agencies adopting new Palantir solutions for enhanced data integration and analysis. The improved data integration capabilities facilitated by Palantir's technology enable agencies to make better, more data-driven decisions. Keywords: government partnerships, data integration.

- Impact on Palantir Stock Performance: The expansion of existing partnerships and the adoption of new Palantir solutions within the government sector strengthens the company's market share and establishes long-term revenue streams. This predictable revenue growth is a critical factor driving positive Palantir stock performance.

Commercial Sector Expansion Contributes Significantly to Palantir Stock Performance

While the government sector remains a significant driver, Palantir's impressive growth in the commercial sector also contributed significantly to its Q1 success. This expansion is evident in two key areas: growth in key commercial sectors and the widespread adoption of its AI and data analytics solutions.

Growth in Key Commercial Sectors

- Key Sectors: Palantir experienced substantial growth across several key commercial sectors, including healthcare, finance, and energy. The company secured substantial new contracts and expanded existing partnerships within these sectors. Specific examples include a major contract with a leading healthcare provider to improve operational efficiency and a collaboration with a major energy company to optimize energy production and distribution.

- Client Wins: These client wins showcase the versatility and applicability of Palantir's solutions across various industries. The company's ability to tailor its platform to meet the unique needs of different commercial clients has been a key factor in its success. Keywords: commercial clients, healthcare analytics, financial services, energy sector.

- Scalability and Future Growth: The scalability of Palantir's platform allows it to effectively serve both large enterprises and smaller organizations, ensuring robust growth potential within these various commercial sectors. This scalability is a significant contributor to positive Palantir stock performance.

Adoption of Palantir's AI and Data Analytics Solutions

- Increased Adoption: Commercial clients are increasingly adopting Palantir's AI-powered data analytics platforms. This adoption reflects a growing recognition of the value of data-driven decision-making and the power of Palantir's technology to uncover hidden insights and improve operational efficiency. Keywords: artificial intelligence, data analytics platforms, machine learning, data-driven decision making.

- Success Stories: Numerous case studies highlight the significant return on investment (ROI) achieved by Palantir's commercial clients. These success stories serve as compelling evidence of the platform's effectiveness and contribute to its growing market reputation.

- Market Validation: The widespread adoption of Palantir’s AI and data analytics solutions demonstrates market validation and positively influences investor perception. This positive perception directly impacts Palantir stock performance.

Overall Market Sentiment and Investor Confidence

Positive market sentiment and strong investor confidence played a significant role in the positive Palantir stock performance witnessed in Q1.

Positive Analyst Ratings and Forecasts

- Analyst Upgrades: Several leading financial analysts upgraded their ratings for Palantir stock in Q1, citing the company's strong performance and positive outlook. Many raised their price targets, indicating a belief that the stock is undervalued. Keywords: stock price forecast, analyst ratings, investor sentiment.

- Positive Forecasts: Analysts generally offered positive forecasts for Palantir's future growth, projecting continued strong revenue growth and increasing profitability. This positive sentiment reinforced investor confidence.

- Impact on Palantir Stock Performance: Positive analyst ratings and forecasts significantly influence investor behavior, driving demand for Palantir stock and contributing to its increased price.

Impact of Macroeconomic Factors

- Macroeconomic Conditions: While macroeconomic factors like interest rates and inflation can impact the overall market, Palantir's strong performance in Q1 suggests its growth is relatively resilient to these broader economic trends. Keywords: macroeconomic factors, interest rates, inflation.

- Geopolitical Events: Geopolitical events can also influence investor sentiment. However, Palantir's strong position in the government sector, particularly in national security and defense, may act as a buffer against some of these negative influences.

- Impact on Palantir Stock Performance: While macroeconomic factors and geopolitical events can influence investor behavior, Palantir's strong fundamentals and robust growth in both the government and commercial sectors appear to have mitigated some of the potential negative impacts in Q1.

Conclusion

Palantir's strong Q1 performance showcases the success of its dual-sector strategy. Robust government contracts and the expanding adoption of its AI-powered data analytics solutions in the commercial sector have significantly impacted positive Palantir stock performance. The positive outlook from analysts further reinforces investor confidence. To stay updated on future developments and the continued influence on Palantir stock performance, follow our regular updates and analysis. Understanding the drivers behind Palantir stock performance is crucial for making informed investment decisions.

Featured Posts

-

Capital Market Cooperation Deepens Pakistan Sri Lanka And Bangladesh Collaboration

May 10, 2025

Capital Market Cooperation Deepens Pakistan Sri Lanka And Bangladesh Collaboration

May 10, 2025 -

Can Nigel Farages Reform Party Deliver On Its Promises

May 10, 2025

Can Nigel Farages Reform Party Deliver On Its Promises

May 10, 2025 -

How Trumps Executive Orders Affected The Transgender Community Sharing Your Stories

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community Sharing Your Stories

May 10, 2025 -

Gen Z And Smartphones Will Androids Redesign Make A Difference

May 10, 2025

Gen Z And Smartphones Will Androids Redesign Make A Difference

May 10, 2025 -

The Power Of Middle Management Fostering Collaboration And Achieving Business Goals

May 10, 2025

The Power Of Middle Management Fostering Collaboration And Achieving Business Goals

May 10, 2025