Decoding The Proxy Statement (Form DEF 14A): A Practical Guide For Investors

Table of Contents

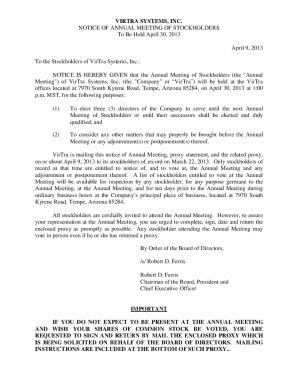

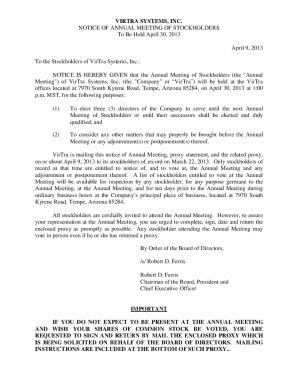

What is a Proxy Statement (Form DEF 14A)?

A proxy statement, formally known as Form DEF 14A, is a formal document that publicly traded companies send to their shareholders before annual or special shareholder meetings. It outlines the matters up for a vote, providing shareholders with the information they need to make informed decisions. The purpose of DEF 14A filings is to ensure transparency and allow shareholders to participate in the governance of the company. This is a critical element of corporate governance best practices.

Importance for Investors: The proxy statement is far more than just a formality; it's your roadmap to influencing the company's direction. By understanding the information presented, you can make informed voting decisions that can directly impact your investment return and the future trajectory of the company. It's the key to exercising your shareholder rights and participating in corporate policy.

Key Sections Overview: While a proxy statement can be lengthy, focusing on several key sections will provide the most critical insights. These include: Executive Compensation, detailing executive pay packages; Director Nominees, presenting biographies and qualifications; and Shareholder Proposals, outlining proposals submitted by shareholders. Understanding these sections will equip you to make informed decisions on the issues at hand.

Key Information Contained Within a Proxy Statement (Form DEF 14A)

The proxy statement is packed with crucial information. Let's delve into some of the most important sections:

Executive Compensation

This section meticulously details the compensation packages of the company's top executives, including the CEO. Scrutinizing this information is critical for evaluating corporate governance.

- Analysis of CEO and executive pay packages: Look for the breakdown of salary, bonuses, stock options, and other forms of compensation.

- Comparison to industry peers: Compare executive compensation to similar companies to determine if it is aligned with industry standards and performance.

- Performance-based incentives: Analyze the correlation between executive compensation and company performance. Are incentives properly structured to reward success and penalize poor performance?

- Identifying potential conflicts of interest: Carefully review any potential conflicts of interest related to executive compensation arrangements.

Board of Directors

The composition and qualifications of the board of directors significantly impact a company's governance.

- Biographies and qualifications of director nominees: Review the background and experience of each nominee to assess their suitability for the board.

- Independent director status: Determine the percentage of independent directors on the board. Independent directors are crucial for ensuring unbiased oversight.

- Director compensation and potential conflicts of interest: Examine director compensation and identify potential conflicts of interest.

- Committee assignments: Analyze the committee assignments of the directors to understand their roles and responsibilities in areas like audit, compensation, and nominating committees.

Shareholder Proposals

This section outlines proposals submitted by shareholders, offering a window into concerns and potential improvements.

- Review of proposals submitted by shareholders: Carefully read each proposal to understand the shareholder's concerns and proposed solutions.

- Understanding the rationale behind each proposal: Evaluate the logic and merit of each proposal.

- The company's response and recommendation: Review the management's response to each proposal and their recommendation on how to vote.

- Impact of voting for or against shareholder proposals: Consider the potential impact of your vote on the company's strategy and future direction.

Auditor Information

This section provides details about the company's independent auditor.

- Information about the company's independent auditor: Identify the audit firm and review their qualifications and independence.

- The audit firm's opinion on the company's financial statements: Review the auditor's opinion on the accuracy and fairness of the company's financial statements.

- Understanding the role of the independent auditor in corporate governance: The auditor plays a crucial role in ensuring the integrity of the company's financial reporting.

- Potential conflicts of interest and auditor independence: Carefully review any potential conflicts of interest that could compromise the auditor's independence.

How to Effectively Analyze a Proxy Statement (Form DEF 14A)

Analyzing a proxy statement requires a systematic approach:

Step-by-Step Guide:

- Familiarize yourself with the company's background: Understand the company's business model, industry, and recent performance.

- Focus on key sections: Prioritize the sections discussed above: Executive Compensation, Board of Directors, Shareholder Proposals, and Auditor Information.

- Compare information with previous years: Analyze trends in executive compensation, board composition, and shareholder proposals over time.

- Look for red flags: Pay close attention to any potential conflicts of interest, questionable accounting practices, or unusual compensation arrangements.

Utilizing Online Resources: The SEC's EDGAR database is the primary source for accessing proxy statements (Form DEF 14A). Other financial news websites often provide summaries and analyses of proxy statements for major companies.

Seeking Professional Advice: For sophisticated investment strategies or particularly complex proxy statements, seeking advice from a financial advisor or legal professional is advisable. They can provide valuable insights and help interpret the information effectively.

Proxy Voting: Exercising Your Rights as a Shareholder

Your proxy statement grants you the right to vote on important matters affecting the company.

- Understanding your voting rights: Every share gives you a vote.

- Methods of voting: You can typically vote online, by mail, or by phone.

- The importance of timely voting: Submit your vote by the deadline to ensure your voice is heard.

- The impact of shareholder votes: Your vote influences corporate governance, company strategy, and ultimately, your investment return.

Conclusion

Understanding the intricacies of a proxy statement (Form DEF 14A) is critical for all investors. By carefully analyzing this document, you can gain valuable insights into a company's governance, executive compensation, and strategic direction, allowing you to make informed investment decisions and effectively exercise your shareholder rights. Don't let the complexity of the proxy statement (Form DEF 14A) intimidate you. Use this guide as a starting point to become a more engaged and informed investor. Take control of your investments – master the proxy statement (Form DEF 14A) today!

Featured Posts

-

Jack Bit Contender For Best Bitcoin Casino Of 2025

May 17, 2025

Jack Bit Contender For Best Bitcoin Casino Of 2025

May 17, 2025 -

Refinancing Federal Student Loans Is It Right For You

May 17, 2025

Refinancing Federal Student Loans Is It Right For You

May 17, 2025 -

Preocupacion Por Prestamos Estudiantiles Que Implica Un Segundo Mandato De Trump

May 17, 2025

Preocupacion Por Prestamos Estudiantiles Que Implica Un Segundo Mandato De Trump

May 17, 2025 -

Brasilien Als Zukunftsmarkt Warum Die Vae In Favelas Investieren

May 17, 2025

Brasilien Als Zukunftsmarkt Warum Die Vae In Favelas Investieren

May 17, 2025 -

Lakers Win After Jalen Brunsons Ankle Injury In Overtime

May 17, 2025

Lakers Win After Jalen Brunsons Ankle Injury In Overtime

May 17, 2025