Desjardins Forecasts Three Further Bank Of Canada Interest Rate Cuts

Table of Contents

Desjardins' Rationale Behind the Forecast

Desjardins' forecast of three further interest rate cuts rests on several key economic indicators. Their assessment points towards a more cautious outlook for the Canadian economy than previously anticipated. The key factors underpinning their prediction likely include:

-

Slower-than-Expected GDP Growth: Recent data may suggest that the Canadian economy is expanding at a slower pace than initially projected, signaling a potential weakening of economic momentum. This sluggish growth could trigger the Bank of Canada to ease monetary policy.

-

Easing Inflation Pressures (But Still Above Target): While inflation is showing signs of cooling, it remains stubbornly above the Bank of Canada's target of 2%. However, the easing trend might give the central bank room to consider further interest rate cuts to stimulate the economy without significantly fueling inflation.

-

Rising Unemployment or Concerns About Potential Job Losses: An increase in unemployment figures or concerns about future job losses could further incentivize the Bank of Canada to lower interest rates to boost economic activity and prevent a deeper economic downturn. This is a crucial factor in monetary policy decisions.

-

Global Economic Uncertainty: Global economic headwinds, such as geopolitical instability or slowing growth in major economies, are also likely factored into Desjardins' analysis. These external factors can significantly influence the Bank of Canada's decisions.

Desjardins' overall assessment likely paints a picture of a Canadian economy needing further stimulus to avoid a more significant slowdown. Their forecast reflects a cautious approach, anticipating the need for more aggressive monetary easing.

Potential Impact of Three Further Interest Rate Cuts

If Desjardins' prediction proves accurate, three further interest rate cuts could have a ripple effect across the Canadian economy:

-

Lower Mortgage Rates: Homebuyers could benefit from significantly lower mortgage rates, making homeownership more accessible and potentially boosting the housing market. This could lead to increased demand and potentially higher house prices.

-

Reduced Borrowing Costs for Businesses: Lower interest rates would reduce borrowing costs for businesses, potentially encouraging investment and expansion. This could lead to job creation and economic growth.

-

Increased Consumer Spending: Reduced interest rates on credit cards and loans could lead to increased consumer spending, stimulating economic activity. However, this increased spending also carries the risk of potential inflation.

-

Potential Risks Associated with Lower Interest Rates: While stimulating the economy, lower interest rates also carry risks. These include the potential for increased inflation, the formation of asset bubbles in certain sectors, and a weakening of the Canadian dollar. A careful balance is needed.

Alternative Views and Market Reaction

It's important to note that not all economists share Desjardins' optimistic view. Some may argue that the current inflation rate still justifies a more cautious approach, potentially advocating for interest rate holds or even further increases. The market's reaction to Desjardins' forecast will also be telling. Stock market movements, bond yields, and the Canadian dollar's exchange rate will likely reflect investor sentiment and their assessment of the likelihood of further interest rate cuts. The Bank of Canada's ultimate decisions will depend on a multitude of factors, including the evolving economic data and its assessment of risks and opportunities.

What This Means for You

Desjardins' forecast has significant implications for your personal finances and business strategy:

-

Reviewing Mortgage Options: If you are considering buying a home or refinancing your existing mortgage, monitoring interest rate changes closely is crucial to take advantage of potential savings.

-

Considering Refinancing Existing Debt: Lower interest rates present an opportunity to refinance existing high-interest debt, saving you money on monthly payments.

-

Adjusting Investment Strategies: Shifts in interest rates can impact investment returns. Consider reviewing your investment portfolio and adjusting your strategy accordingly.

-

Planning for Potential Changes in Spending Habits: Depending on your financial situation, you might want to adjust your spending habits in anticipation of potential changes in borrowing costs.

Conclusion

Desjardins' forecast of three further Bank of Canada interest rate cuts presents a complex economic picture. While potentially beneficial for homeowners and businesses through lower borrowing costs, it also carries risks like increased inflation and asset bubbles. Understanding the rationale behind this forecast, the potential impacts, and alternative views is crucial for making informed financial decisions. Stay updated on the latest developments regarding Bank of Canada interest rate cuts and plan accordingly. Learn more about how Desjardins' interest rate cut forecast might affect your financial planning by consulting reputable financial sources and seeking professional advice.

Featured Posts

-

Big Rig Rock Report 3 12 Rock 101 Trucking Industry Insights

May 23, 2025

Big Rig Rock Report 3 12 Rock 101 Trucking Industry Insights

May 23, 2025 -

100 Test Wickets Blessing Muzarabanis Road To A Significant Achievement

May 23, 2025

100 Test Wickets Blessing Muzarabanis Road To A Significant Achievement

May 23, 2025 -

The Legal Status Of Character Ai Chatbot Conversations

May 23, 2025

The Legal Status Of Character Ai Chatbot Conversations

May 23, 2025 -

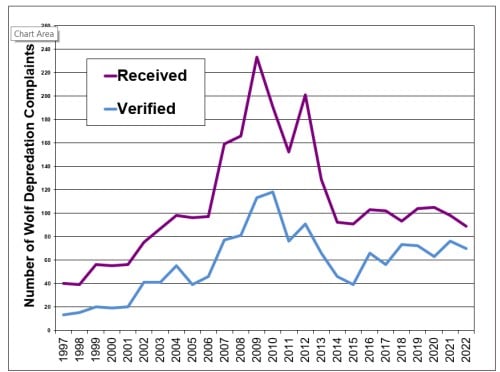

Addressing The Rising Number Of Wolf Incidents In The North State

May 23, 2025

Addressing The Rising Number Of Wolf Incidents In The North State

May 23, 2025 -

Reporte Del Coe Nivel De Alerta En 9 Y 5 Provincias

May 23, 2025

Reporte Del Coe Nivel De Alerta En 9 Y 5 Provincias

May 23, 2025

Latest Posts

-

Maryland Softball Rallies Past Delaware 5 4

May 24, 2025

Maryland Softball Rallies Past Delaware 5 4

May 24, 2025 -

Hamiltons Controversial Comments Draw Scathing Criticism From Ferrari

May 24, 2025

Hamiltons Controversial Comments Draw Scathing Criticism From Ferrari

May 24, 2025 -

Ferrarin Uusi Taehti On Vain 13 Vuotias

May 24, 2025

Ferrarin Uusi Taehti On Vain 13 Vuotias

May 24, 2025 -

13 Vuotias Moottoriurheilun Ihme Ferrarin Uusi Nuori Kyky

May 24, 2025

13 Vuotias Moottoriurheilun Ihme Ferrarin Uusi Nuori Kyky

May 24, 2025 -

Ferrari Chief Slams Lewis Hamiltons Unfair Comments

May 24, 2025

Ferrari Chief Slams Lewis Hamiltons Unfair Comments

May 24, 2025