Despite Lowered Apple Price Target, Wedbush's Long-Term Outlook Remains Positive

Table of Contents

Wedbush's Rationale for Lowering the Apple Price Target

Wedbush's decision to lower its Apple price target stems from a confluence of factors impacting the near-term performance of Apple's product lines and the broader macroeconomic environment. While the long-term Apple stock picture remains bright in their view, several short-term headwinds prompted this adjustment.

-

Concerns about slowing iPhone sales growth: Wedbush cites slowing iPhone sales growth in certain key regions, particularly in China, as a significant factor. Increased competition and economic uncertainty in these markets are contributing to this slowdown. Data from Wedbush's research suggests a potential year-over-year decline in iPhone shipments for Q4 2023.

-

Impact of global inflation on consumer discretionary spending: Global inflation continues to impact consumer behavior. High inflation reduces disposable income, leading to consumers delaying or forgoing purchases of non-essential items, including premium electronics like iPhones and Apple's other products. This decreased consumer confidence directly impacts Apple's sales projections.

-

Potential challenges in the supply chain: While supply chain disruptions have eased somewhat, Wedbush acknowledges ongoing challenges, particularly concerning certain components crucial to Apple's product manufacturing. These potential bottlenecks could impact production volumes and subsequently affect Apple's revenue streams. The report highlights lingering uncertainties related to geopolitical factors influencing global supply chains.

The Positive Long-Term Outlook for Apple Remains Intact

Despite the short-term headwinds, Wedbush's analysts remain steadfast in their positive long-term outlook for Apple. Their confidence is rooted in several key factors indicating continued growth and market dominance for the tech giant.

-

Strong iPhone ecosystem and user loyalty: The iPhone's immense popularity and the strong loyalty of its users constitute a formidable competitive advantage. The tight integration within the Apple ecosystem, encompassing services like iCloud, Apple Music, and the App Store, creates a powerful retention mechanism, reducing customer churn.

-

Growth potential in services revenue: Apple's services segment, encompassing subscriptions and digital content, shows significant growth potential. This recurring revenue stream provides a more predictable and resilient income stream compared to hardware sales, mitigating the impact of fluctuating iPhone sales.

-

Innovation in areas such as AR/VR and wearables: Apple's investments in cutting-edge technologies, such as augmented reality (AR) and virtual reality (VR), along with its expanding wearable portfolio (Apple Watch, AirPods), represent significant growth opportunities. These new product categories are expected to drive future revenue and expand Apple's market reach.

-

Expansion into new markets: Apple continues to explore and penetrate new markets globally, identifying untapped opportunities for growth. Strategic investments in emerging economies and tailored product offerings for specific regions are expected to contribute to sustained long-term growth.

Implications for Investors

Wedbush's assessment presents a nuanced picture for Apple investors. While the lowered price target reflects legitimate short-term concerns, the long-term outlook remains positive.

-

Investment strategies: The current situation calls for a balanced approach. Investors should carefully consider both the short-term headwinds and the strong long-term potential before making any decisions. Some might choose to hold their existing Apple stock, while others might consider dollar-cost averaging or selectively acquiring shares at a potentially lower price.

-

Potential risks and rewards: The main risk lies in the possibility of a more prolonged slowdown in consumer spending or unforeseen supply chain disruptions. However, the potential rewards are significant, considering Apple's market dominance, brand loyalty, and ongoing innovation.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Conclusion: Navigating the Apple Stock Outlook with Wedbush's Insight

In summary, Wedbush Securities' lowered Apple price target reflects near-term concerns such as slowing iPhone sales and macroeconomic headwinds. However, their maintained positive long-term outlook for Apple stock is based on the strength of the Apple ecosystem, growth in services, innovation in new product categories, and ongoing market expansion. Investors must carefully consider both the short-term and long-term perspectives when assessing their Apple investment strategy. Understanding the complexities surrounding the Apple price target and the long-term outlook for Apple is crucial for informed decision-making. Conduct thorough research and consult a financial advisor before making any investment decisions related to Apple stock.

Featured Posts

-

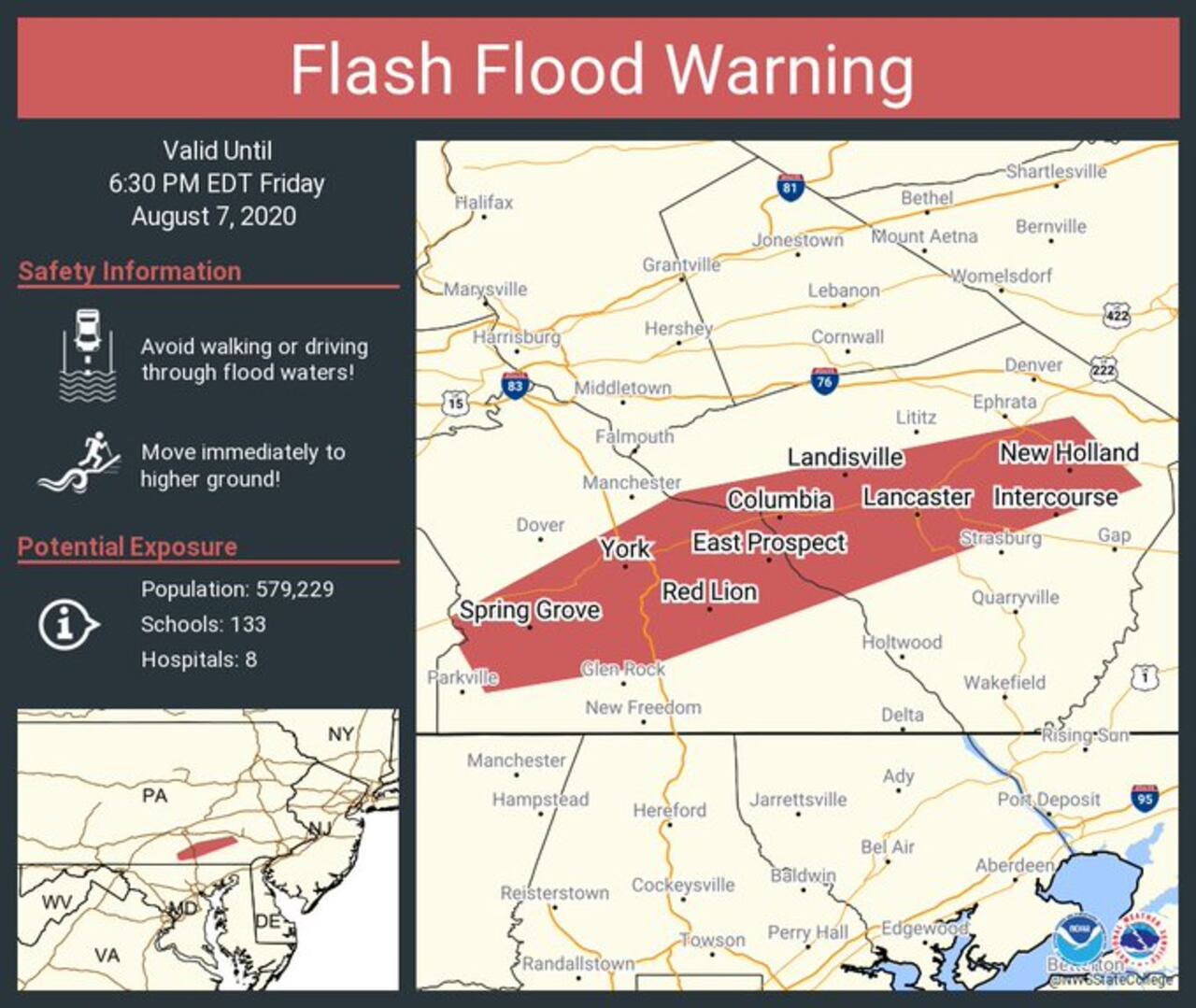

Bradford And Wyoming Counties Flash Flood Warning Until Tuesday Evening

May 25, 2025

Bradford And Wyoming Counties Flash Flood Warning Until Tuesday Evening

May 25, 2025 -

Stoxx Europe 600 Ve Dax 40 Endeksleri Duestue Avrupa Borsalari Analizi 16 Nisan 2025

May 25, 2025

Stoxx Europe 600 Ve Dax 40 Endeksleri Duestue Avrupa Borsalari Analizi 16 Nisan 2025

May 25, 2025 -

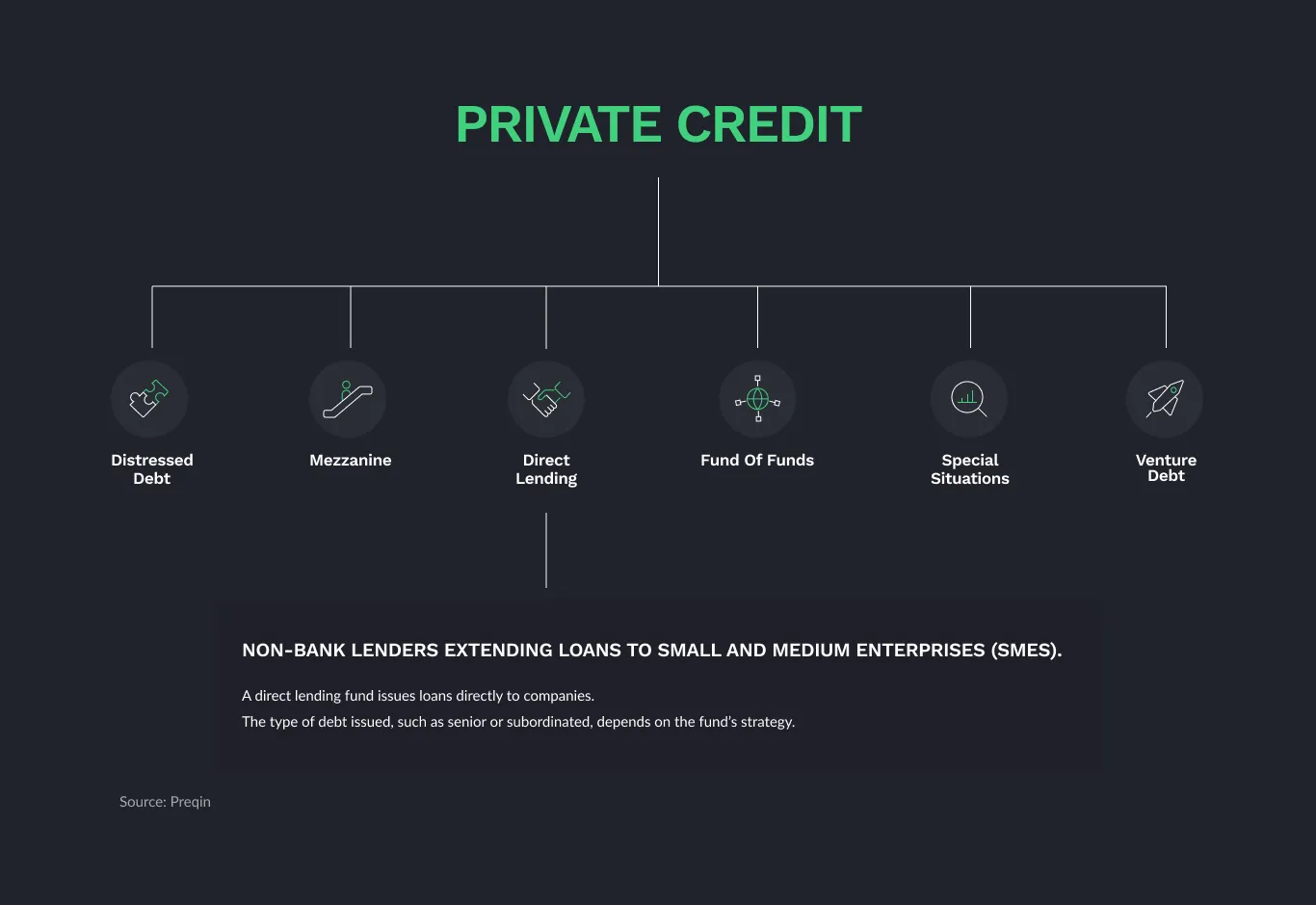

5 Key Actions To Secure A Role In The Booming Private Credit Sector

May 25, 2025

5 Key Actions To Secure A Role In The Booming Private Credit Sector

May 25, 2025 -

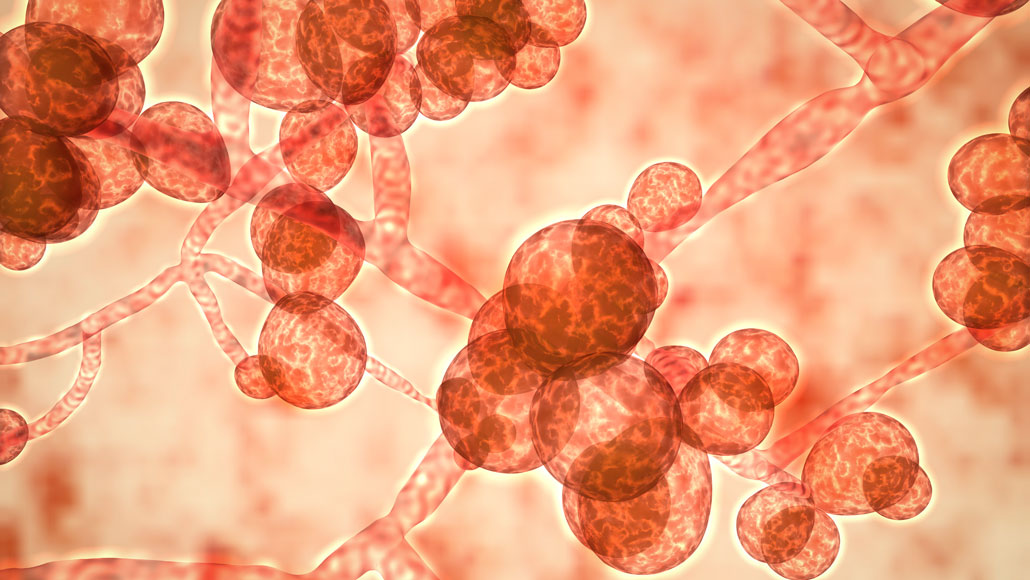

The Growing Threat Of Fungal Infections In A Warming World

May 25, 2025

The Growing Threat Of Fungal Infections In A Warming World

May 25, 2025 -

Frankfurt Stock Market Report Dax Closes Under 24 000

May 25, 2025

Frankfurt Stock Market Report Dax Closes Under 24 000

May 25, 2025