Deutsche Bank's Strategic Investment In Defense Finance: A New Deals Team

Table of Contents

The Rationale Behind Deutsche Bank's Defense Finance Strategy

Deutsche Bank's foray into defense finance is a calculated strategy driven by several key factors. The decision reflects a keen understanding of the market's potential and a desire to secure a leading position within this rapidly expanding sector.

Capitalizing on a Booming Market

Global defense spending is on a steep upward trajectory. According to the Stockholm International Peace Research Institute (SIPRI), global military expenditure reached a record high of $2.27 trillion in 2022, a 3.7% increase from the previous year. This growth is driven by several factors:

- Geopolitical instability: Rising tensions between major world powers, regional conflicts, and the ever-present threat of terrorism are prompting nations to increase their defense budgets significantly.

- Technological advancements: The development and adoption of advanced military technologies, such as artificial intelligence, hypersonic weapons, and cyber warfare capabilities, require substantial investments.

- Modernization efforts: Many countries are modernizing their existing military equipment and infrastructure, creating a significant demand for new procurements and upgrades.

This booming market presents Deutsche Bank with the potential for substantial returns on investment, making it an attractive area for expansion.

Diversification and Risk Mitigation

Deutsche Bank's move into defense finance is also a strategic diversification play. By expanding into a sector with relatively low correlation to traditional economic cycles, the bank aims to mitigate risk and enhance the stability of its portfolio. Defense spending often remains relatively consistent even during economic downturns, offering a degree of resilience against market volatility. This diversification is crucial for long-term stability and reduced exposure to systemic risks.

Securing a Competitive Advantage

Deutsche Bank's entry into the defense finance market is not merely opportunistic; it’s a calculated move to secure a competitive edge. The bank is leveraging its existing expertise in complex financial transactions, coupled with its global network and established relationships with key players in various sectors. This strategic positioning allows Deutsche Bank to offer unique advantages to its clients in the defense industry, including:

- Access to a wide range of financing solutions

- Specialized expertise in regulatory compliance within the defense sector

- Deep understanding of the complexities of defense procurement

The New Deals Team: Structure, Expertise, and Focus

Central to Deutsche Bank's success in defense finance is its newly established deals team. This specialized unit is composed of individuals with extensive expertise relevant to this niche market.

Team Composition and Expertise

The team comprises experienced professionals with backgrounds in:

- Military procurement and logistics

- Regulatory compliance and international sanctions

- Financial modeling and risk assessment

- Project finance and infrastructure development

Their combined expertise allows for a comprehensive approach to assessing and managing investments in the defense sector. The team also benefits from strong partnerships with leading defense industry analysts and consultants.

Investment Focus and Target Clients

Deutsche Bank's defense finance team will focus on a diversified range of investments, including:

- Financing for large-scale defense infrastructure projects

- Investments in defense technology companies, particularly those specializing in cutting-edge technologies

- Providing financing solutions for government agencies and defense contractors

- Facilitating mergers and acquisitions within the defense industry

The team's target client base includes government agencies, defense contractors, private equity firms, and sovereign wealth funds with an interest in the defense sector. Their investment strategies will incorporate a robust risk assessment process and a deep understanding of geopolitical factors.

Implications and Future Outlook for Deutsche Bank and the Defense Industry

Deutsche Bank's strategic investment in defense finance holds significant implications for both the bank and the broader defense industry.

Impact on Deutsche Bank's Financial Performance

The bank anticipates a positive impact on its revenue and profitability. The high-growth nature of the defense finance market, coupled with Deutsche Bank's strategic approach, suggests significant potential for increased deal flow and higher returns. However, the bank acknowledges potential risks, including regulatory challenges and geopolitical uncertainty, which will require careful risk management. Market analysis suggests that successful navigation of these challenges will yield strong returns.

The Broader Impact on the Defense Industry

Deutsche Bank's entry into the defense finance market is expected to increase competition and potentially foster innovation within the sector. Increased access to capital could accelerate the development and deployment of advanced defense technologies, and potentially improve transparency and accountability in defense spending. This influx of financial expertise could streamline procurement processes and promote greater efficiency in resource allocation.

Conclusion: Deutsche Bank's Strategic Investment – A Bold Move with Significant Potential

Deutsche Bank's strategic investment in defense finance represents a bold move with considerable potential for both the bank and the defense industry. By capitalizing on a booming market, diversifying its portfolio, and establishing a highly specialized team, Deutsche Bank is well-positioned to become a key player in this growing sector. The implications for investors and the broader financial market are significant. The long-term success of this initiative depends on skillful navigation of inherent risks and proactive adaptation to evolving geopolitical dynamics. To learn more about Deutsche Bank's new initiatives in defense finance and explore potential investment opportunities in defense finance investments and strategic investment in defense, visit [link to relevant Deutsche Bank page].

Featured Posts

-

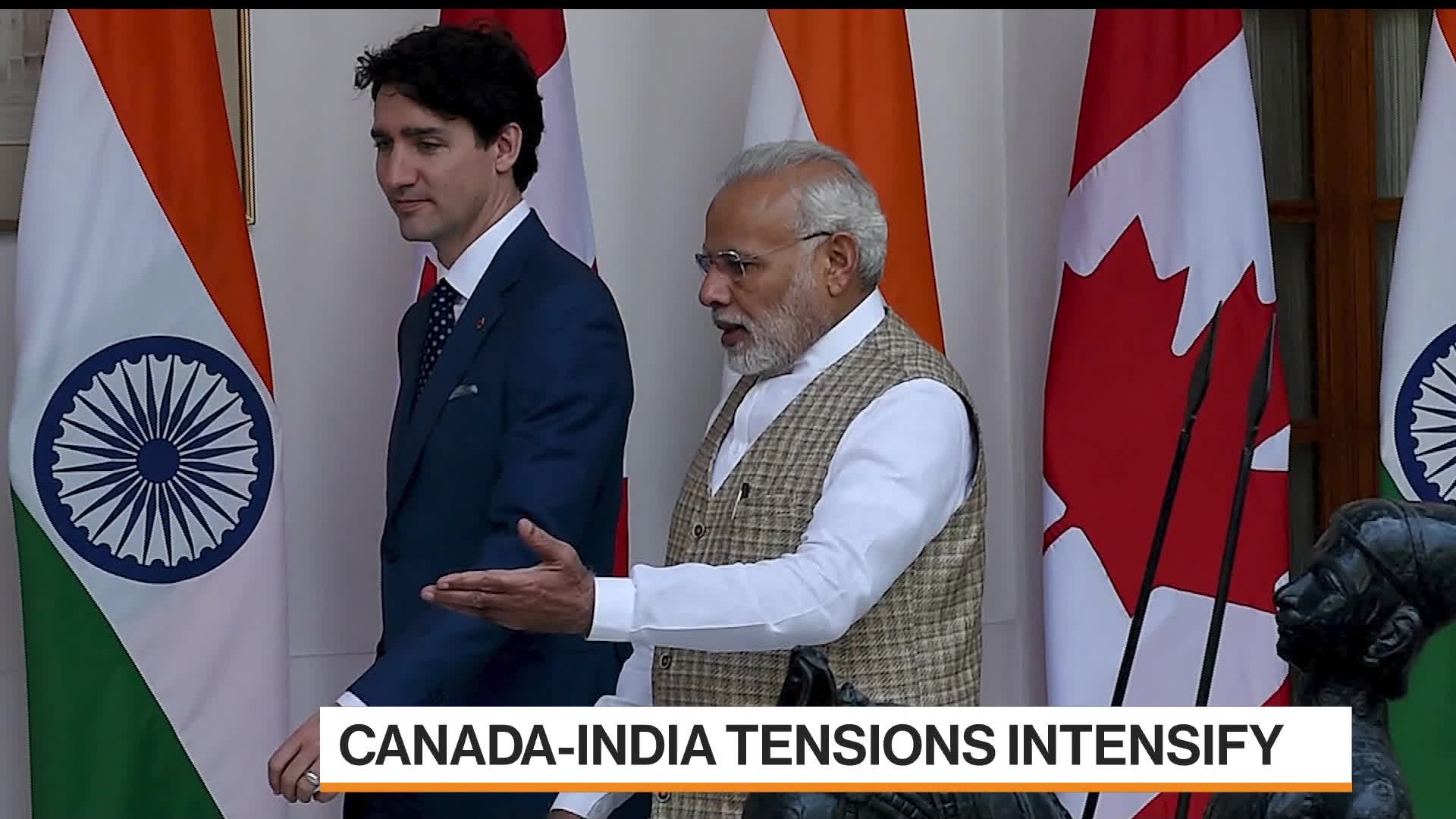

Canola Trade Diversification Chinas Response To Canada Tensions

May 09, 2025

Canola Trade Diversification Chinas Response To Canada Tensions

May 09, 2025 -

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh I Barselona Protiv Intera

May 09, 2025

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh I Barselona Protiv Intera

May 09, 2025 -

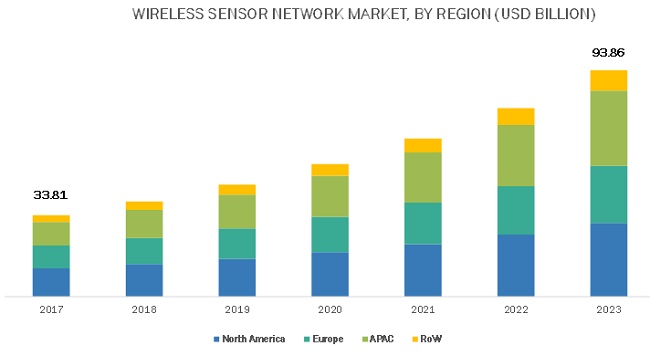

Growth Of The Wireless Mesh Networks Market A 9 8 Cagr Outlook

May 09, 2025

Growth Of The Wireless Mesh Networks Market A 9 8 Cagr Outlook

May 09, 2025 -

Olly Murs Music Festival A Stunning Castle Setting Near Manchester

May 09, 2025

Olly Murs Music Festival A Stunning Castle Setting Near Manchester

May 09, 2025 -

Palantir Stock Prediction 2 Potential Winners In The Next 3 Years

May 09, 2025

Palantir Stock Prediction 2 Potential Winners In The Next 3 Years

May 09, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025 -

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025 -

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025 -

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025