Direct Tribal Lender Loans: Options For Bad Credit With Guaranteed Approval

Table of Contents

Understanding Direct Tribal Lender Loans

Direct tribal lender loans are offered by lending institutions owned and operated by Native American tribes. These lenders operate under the principle of tribal sovereignty, meaning their lending practices are often governed by tribal laws and regulations rather than solely by state or federal laws. This unique legal framework allows them to operate differently than traditional banks or credit unions. It's crucial to differentiate between direct tribal lenders and those merely claiming tribal affiliation; many illegitimate lenders exploit this distinction to mislead borrowers.

Direct tribal lenders often present both advantages and disadvantages compared to traditional lenders.

Potential Advantages:

- Less stringent credit requirements: Direct tribal lenders may be more willing to consider applicants with lower credit scores than traditional financial institutions.

- Faster approval processes: Their streamlined processes can result in quicker loan approvals compared to traditional banks.

Potential Disadvantages:

- Higher interest rates: The risk associated with lending to borrowers with bad credit often translates into higher interest rates.

- Potential for predatory lending practices: Some lenders may employ unethical practices, so due diligence is crucial. Always research thoroughly before committing to a loan.

Finding Reputable Direct Tribal Lenders

Navigating the world of direct tribal lenders requires careful research to avoid scams and predatory lenders. Verifying a lender's tribal affiliation and legitimacy is paramount. Legitimate lenders will openly provide information about their tribal ownership and licensing.

How to Identify Reputable Lenders:

- Check online reviews and ratings: Explore independent review sites and forums to see what past borrowers have experienced.

- Look for transparency in fees and terms: Avoid lenders who are unclear about their fees, interest rates, and repayment terms.

- Verify licensing and registration information: Ensure the lender is properly licensed and registered to operate in your state.

- Avoid lenders who guarantee approval without any credit check: While some lenders advertise “guaranteed approval”, a completely credit-check-free loan is a major red flag. Legitimate lenders will assess your creditworthiness to some degree.

The Application Process for Direct Tribal Lender Loans

The application process for direct tribal lender loans typically involves these steps:

- Online application forms: Most lenders offer convenient online applications.

- Required documentation: Be prepared to provide proof of income, employment, and identification.

- Loan approval timeline: Approval times vary, but are often faster than traditional loans.

- Funding methods: Funding may be deposited directly into your bank account.

Even with the concept of "guaranteed approval," expect some level of credit assessment. While the criteria may be less stringent than traditional lenders, a complete absence of credit evaluation should raise concerns.

Understanding the Terms and Conditions of Direct Tribal Lender Loans

Before signing any loan agreement, meticulously review all the terms and conditions. Key aspects to understand include:

- APR (Annual Percentage Rate): This reflects the total cost of borrowing, including interest and fees.

- Loan fees: Understand all associated fees, including origination fees, late payment penalties, and prepayment penalties.

- Repayment schedule: Clarify the repayment schedule, including the number of payments and the due dates.

- Consequences of default: Understand the potential repercussions of missing payments.

- Rollover options: Be aware of the potential for rollovers and the significant additional costs they can incur.

Alternatives to Direct Tribal Lender Loans for Bad Credit

While direct tribal lenders can be an option, exploring alternatives is wise. Consider:

- Credit unions: Often more lenient than banks, credit unions may offer better rates and terms.

- Peer-to-peer lending: Platforms connect borrowers directly with individual lenders.

- Credit counseling: A credit counselor can help you improve your credit score and explore other financial options.

Making Informed Decisions with Direct Tribal Lender Loans

Remember, obtaining a loan, even a direct tribal lender loan, involves responsibility. Thoroughly research potential lenders, compare offers, and completely understand the terms before committing. Avoid lenders who pressure you into making quick decisions or who are vague about their fees and terms. Use the information provided in this article to find the best direct tribal lender loan for your specific financial situation, always prioritizing responsible decision-making. Find the right direct tribal lender loan today!

Featured Posts

-

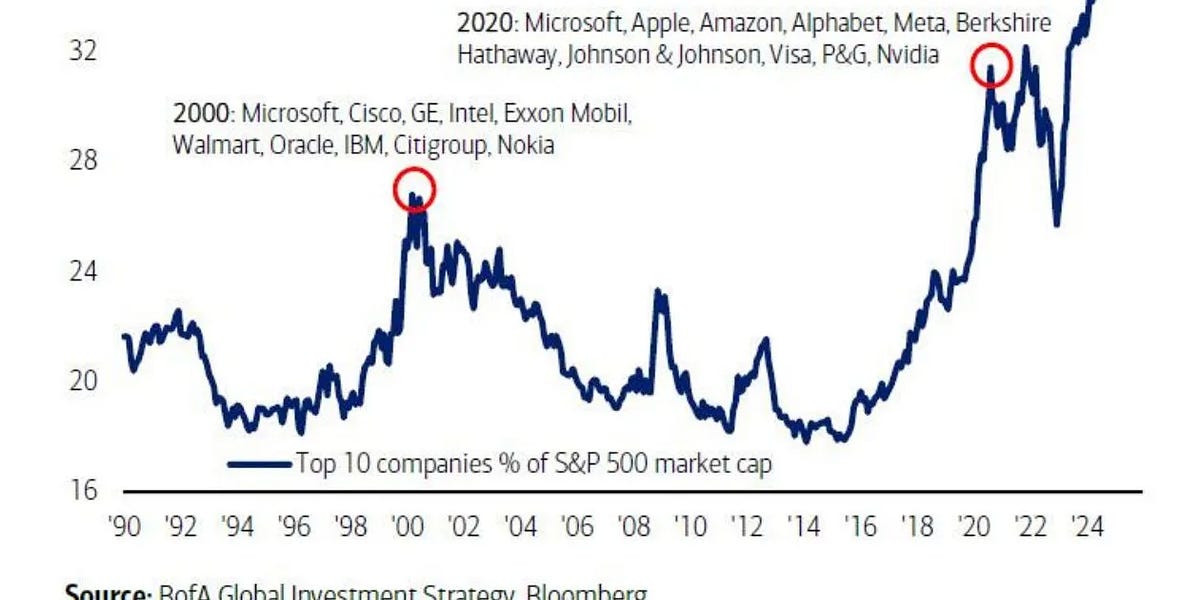

High Stock Market Valuations Bof As Argument For Investor Calm

May 28, 2025

High Stock Market Valuations Bof As Argument For Investor Calm

May 28, 2025 -

Is Hailee Steinfeld Expecting Her First Child With Josh Allen

May 28, 2025

Is Hailee Steinfeld Expecting Her First Child With Josh Allen

May 28, 2025 -

Court Rules Against Section 230 In Case Involving Banned Chemicals On E Bay

May 28, 2025

Court Rules Against Section 230 In Case Involving Banned Chemicals On E Bay

May 28, 2025 -

Lavender Milk Nails Der Sanfte Nageltrend Des Jahres

May 28, 2025

Lavender Milk Nails Der Sanfte Nageltrend Des Jahres

May 28, 2025 -

Athletics Fall To Marlins On Stowers Walk Off Grand Slam

May 28, 2025

Athletics Fall To Marlins On Stowers Walk Off Grand Slam

May 28, 2025

Latest Posts

-

Aeroport De Bordeaux Avenir De La Piste Secondaire En Debat Manifestation Prevue

May 30, 2025

Aeroport De Bordeaux Avenir De La Piste Secondaire En Debat Manifestation Prevue

May 30, 2025 -

Bordeaux Lutte Contre Le Maintien De La Piste Secondaire De L Aeroport

May 30, 2025

Bordeaux Lutte Contre Le Maintien De La Piste Secondaire De L Aeroport

May 30, 2025 -

Le Projet A69 Decisions Politiques Et Implications Judiciaires

May 30, 2025

Le Projet A69 Decisions Politiques Et Implications Judiciaires

May 30, 2025 -

Manifestation A Bordeaux Les Opposants A La Piste Secondaire Mobilises

May 30, 2025

Manifestation A Bordeaux Les Opposants A La Piste Secondaire Mobilises

May 30, 2025 -

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025