Dow Jones Gains Momentum: PMI Beat Fuels Steady Ascent

Table of Contents

Strong PMI Data: The Catalyst for Dow Jones Growth

Understanding the PMI and its Significance

The Purchasing Managers' Index (PMI) is a crucial economic indicator that tracks the health of the manufacturing and services sectors. It's a composite index, calculated from data gathered from surveys of purchasing managers at companies across various industries. Key components include new orders, production levels, and employment figures. A PMI reading above 50 generally indicates expansion, while a reading below 50 suggests contraction.

- Higher-than-expected PMI reading boosts investor sentiment: A recent PMI reading significantly above expectations – for instance, a reading of 55 compared to the anticipated 52 – signals robust economic activity and fuels optimism amongst investors. This positive sentiment translates directly into increased buying activity, driving up stock prices.

- Specific PMI numbers and comparison to previous readings: Let's say the latest PMI reading was 56.5, a considerable jump from the previous month's 53 and exceeding analyst predictions of 54. This substantial increase demonstrates a marked improvement in economic conditions and contributes significantly to the Dow Jones's positive trajectory.

- Impact on various sectors: The positive PMI impact ripples across different sectors. A strong manufacturing PMI, for example, positively affects industrial companies listed in the Dow, while a robust services PMI benefits companies in sectors like finance and technology.

Impact of PMI on Investor Confidence

The positive PMI data significantly influences investor behavior, directly impacting the Dow Jones's performance. Investors perceive a strong PMI as a sign of reduced economic risk.

- Economic indicators and stock market performance: Historically, positive economic indicators like the PMI correlate strongly with upward trends in the stock market. Investors see this as confirmation that businesses are performing well, leading to increased profit expectations and higher stock valuations.

- Reduced risk aversion among investors: Positive economic news reduces investor risk aversion. This encourages them to invest more aggressively, leading to increased buying pressure on stocks included in the Dow Jones.

- Institutional investor response to PMI data: Large institutional investors, like pension funds and mutual funds, heavily rely on economic data when making investment decisions. A strong PMI reading often triggers them to increase their holdings in the stock market, further propelling the Dow Jones's ascent.

Other Contributing Factors to the Dow Jones Ascent

Positive Corporate Earnings Reports

Strong corporate earnings reports play a vital role in driving up stock prices and contributing to the overall health of the Dow Jones. Companies exceeding earnings expectations boost investor confidence and lead to higher stock valuations.

- Key companies with positive earnings surprises: Several key companies listed on the Dow, across diverse sectors like technology and consumer goods, have recently reported significantly better-than-expected earnings, adding to the positive market sentiment.

- Sector-specific growth drivers: Specific sectors within the Dow Jones, driven by robust demand or technological advancements, have showcased exceptional growth, contributing substantially to the index's overall rise.

- Significant mergers and acquisitions: Major mergers and acquisitions, often signaling strong market confidence, have positively impacted specific Dow components, providing an additional boost to the overall index performance.

Easing Inflation Concerns

Easing inflation plays a significant role in investor sentiment and market performance. Lower inflation rates generally lead to lower interest rates, making borrowing cheaper for businesses and consumers.

- Inflation, interest rates, and stock market valuations: Lower inflation generally results in lower interest rates, which benefits companies by reducing their borrowing costs. This positive effect translates into higher profits and increased stock valuations.

- Recent inflation reports and their impact: Recent reports indicating a slowdown in inflation have been well-received by investors, fostering optimism about the economic outlook and driving the Dow Jones higher.

- Potential for future interest rate hikes or cuts: The Federal Reserve's decisions regarding interest rates play a crucial role. The anticipation of further rate cuts or a pause in rate hikes can significantly influence investor confidence and impact the Dow Jones's performance.

Geopolitical Stability (or lack thereof)

Geopolitical events and global stability (or instability) can significantly influence investor sentiment and the Dow Jones's trajectory.

- Significant global events impacting investor sentiment: While largely positive, the global economic picture is constantly influenced by geopolitical events. Positive developments, such as improved international relations or de-escalation of conflicts, generally contribute to market stability and investor confidence. Conversely, negative geopolitical events can lead to market volatility.

- Effects of international trade relations on market performance: Trade relations between major economies can strongly influence stock markets. Positive trade agreements and reduced trade tensions often lead to increased investor confidence, while trade disputes or protectionist policies can create uncertainty and negatively impact market performance.

Conclusion

The recent surge in the Dow Jones is primarily driven by a better-than-expected PMI report, which underscores positive economic sentiment. This, coupled with strong corporate earnings, easing inflation concerns, and a relatively stable geopolitical environment, has fostered investor confidence and propelled the market upward. While geopolitical factors always play a role, the current momentum suggests a generally favorable outlook for the near future.

Call to Action: Stay informed about the latest developments influencing the Dow Jones and other key market indicators. Monitor the PMI closely and analyze other critical economic data to make informed investment decisions. Understanding the interplay of factors driving the Dow Jones is crucial for navigating the complexities of the stock market and achieving your financial goals. Keep up to date on the latest Dow Jones news and analysis to capitalize on market opportunities.

Featured Posts

-

Escape To The Country Affordable Dream Homes Available Now

May 24, 2025

Escape To The Country Affordable Dream Homes Available Now

May 24, 2025 -

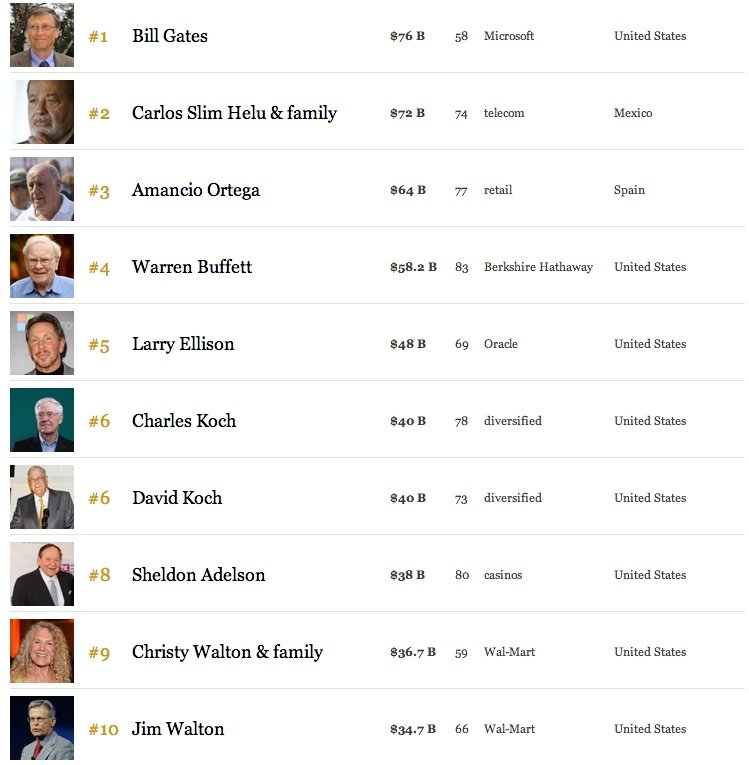

Musk In Vetta La Classifica Forbes Degli Uomini Piu Ricchi Del 2025

May 24, 2025

Musk In Vetta La Classifica Forbes Degli Uomini Piu Ricchi Del 2025

May 24, 2025 -

O Bednom Gusare Zamolvite Slovo Vozrast Glavnykh Geroev I Ikh Rol V Syuzhete

May 24, 2025

O Bednom Gusare Zamolvite Slovo Vozrast Glavnykh Geroev I Ikh Rol V Syuzhete

May 24, 2025 -

Rekordnoe Chislo Svadeb Na Kharkovschine 89 Par Vybrali Krasivuyu Datu

May 24, 2025

Rekordnoe Chislo Svadeb Na Kharkovschine 89 Par Vybrali Krasivuyu Datu

May 24, 2025 -

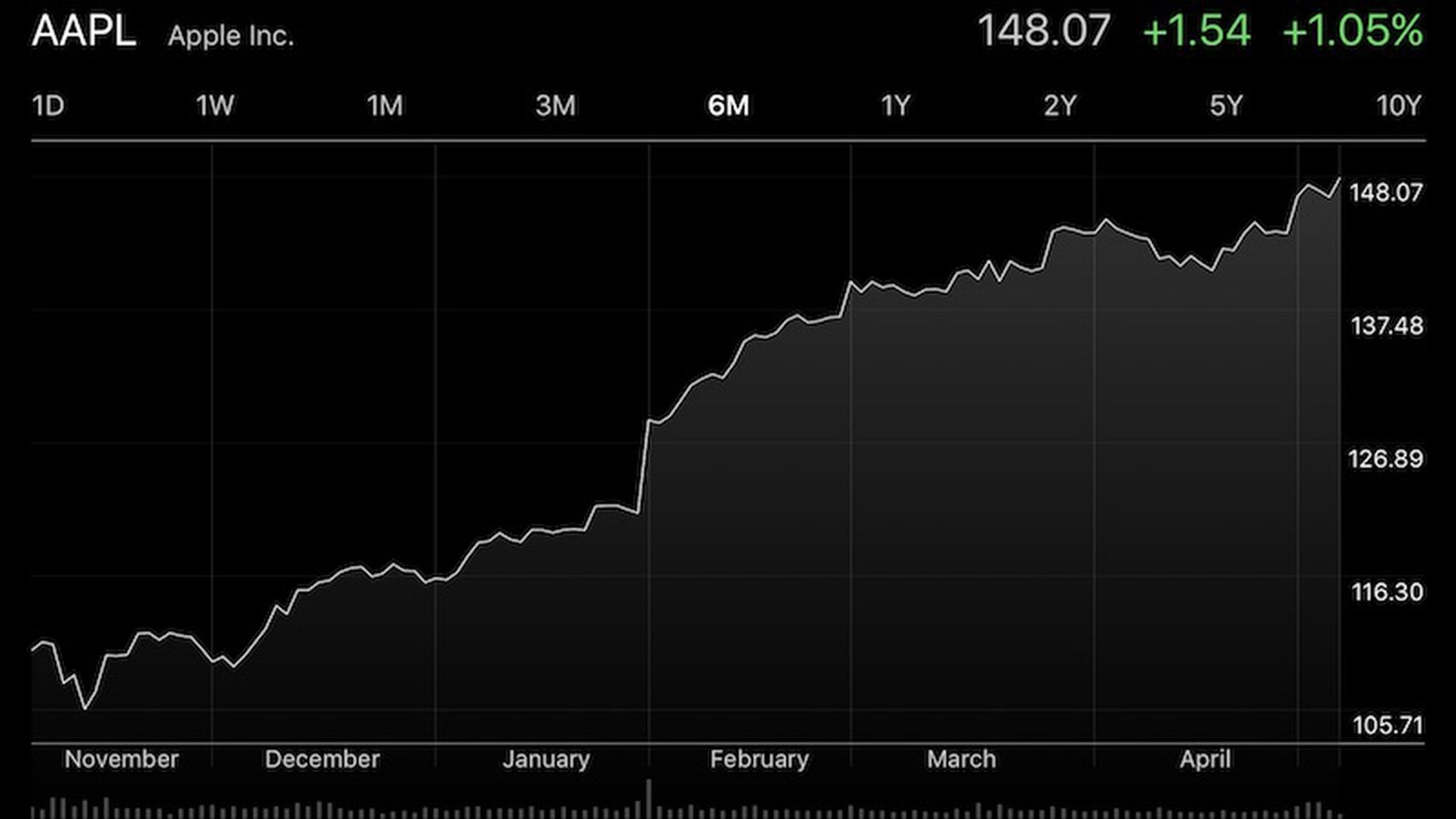

Apple Stock Under Pressure Ahead Of Q2 Results

May 24, 2025

Apple Stock Under Pressure Ahead Of Q2 Results

May 24, 2025

Latest Posts

-

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025 -

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025