Dutch Stock Market Suffers Another Blow From US Trade Tensions

Table of Contents

Impact on Key Sectors of the Dutch Economy

The escalating US trade tensions are not impacting all sectors equally. Some key areas of the Dutch economy are feeling the pressure more acutely than others.

The Technology Sector's Vulnerability

The technology sector, a significant component of the Amsterdam Stock Exchange (AEX), is particularly vulnerable to US trade policies. Companies involved in the semiconductor industry and related technologies are facing increased trade tariffs and restrictions, leading to decreased profitability and reduced competitiveness.

- Examples of Affected Companies: Several Dutch semiconductor companies and technology firms listed on the AEX have seen significant drops in their stock prices. Specific examples (and their performance data) would need to be included here based on current market conditions.

- Specific Trade Restrictions: The introduction of tariffs on specific components or finished products has directly impacted the profitability of these companies, hindering their ability to export to the US market.

- Quantitative Data: Data on the percentage drop in stock prices for specific technology companies since the most recent trade actions should be inserted here, referencing reliable sources. This could show a comparison to the overall AEX index performance for better context.

Agricultural Exports Facing Headwinds

Dutch agricultural exports, a cornerstone of the Dutch economy, are also facing headwinds due to US trade tensions. The imposition of tariffs or other trade barriers on Dutch agricultural products can significantly reduce export volumes and negatively impact farmers and exporters.

- Types of Agricultural Products Affected: Dairy products, flowers, and other agricultural goods are all susceptible to US trade restrictions, depending on the specific policies enacted.

- Impact on Farmers and Exporters: Reduced export volumes can lead to lower incomes for farmers and difficulties for exporters in maintaining market share.

- Potential Retaliatory Measures from the EU: The EU might implement retaliatory measures against the US, further complicating the situation for Dutch agricultural exports and potentially leading to trade wars with wider implications.

The Energy Sector and its Uncertain Future

The Dutch energy sector is not immune to the influence of US trade policies. Potential sanctions or limitations on energy trade could create significant market volatility and investment uncertainty.

- Specific Energy Companies: Identify specific energy companies listed on the Dutch stock market that could be significantly affected by US trade policies (both traditional fossil fuel and renewable energy).

- Types of Energy Affected: The impact could vary depending on the type of energy: oil, gas, or renewable energy sources.

- Market Volatility and Investment Uncertainty: The uncertainty surrounding US trade policies creates volatility in energy markets, making it difficult for investors to predict future energy prices and impacting investment decisions in the sector.

Investor Sentiment and Market Reactions

The latest US trade actions have significantly impacted investor sentiment and triggered a notable reaction in the Dutch stock market.

Decreased Investor Confidence

The uncertainty surrounding the future of US trade relations has led to a decline in investor confidence in the Dutch stock market.

- Data on AEX Index Performance: Clearly illustrate the performance of the AEX index since the start of the recent trade tensions, showing the percentage changes and comparing it to previous periods.

- Investor Flight to Safer Assets: Discuss how investors are moving their investments into safer assets like government bonds or gold, reducing their exposure to riskier assets like Dutch stocks.

- Analysts' Predictions and Comments: Include quotes and summaries of analyses from financial experts regarding the current situation and their predictions for the future.

The Flight to Safety

As investor confidence wanes, a clear "flight to safety" is evident, with capital moving away from riskier assets like Dutch stocks.

- Capital Outflow Data: Include data on capital outflow from the Dutch stock market and any changes in foreign investment.

- Shifts in Investment Strategies: Discuss how investors are adjusting their portfolios to reduce their exposure to risk and seek safer investments.

- The Impact on Smaller Dutch Companies: Smaller companies with less financial resilience are particularly vulnerable during periods of risk aversion, experiencing more significant challenges in securing capital.

Potential Long-Term Consequences for the Dutch Economy

The ongoing US trade tensions could have significant long-term consequences for the Dutch economy.

Economic Growth Projections

The uncertainty surrounding US trade policies creates significant challenges in predicting future economic growth for the Netherlands.

- Predictions from Financial Institutions: Present predictions from reputable financial institutions regarding the impact on Dutch GDP growth.

- Government Responses: Describe any government responses or initiatives to mitigate the negative economic impacts.

- Potential Mitigation Strategies: Explore potential strategies that the Dutch government or businesses can employ to lessen the negative effects.

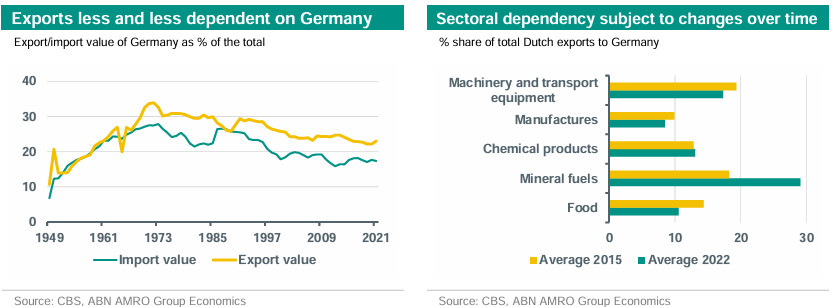

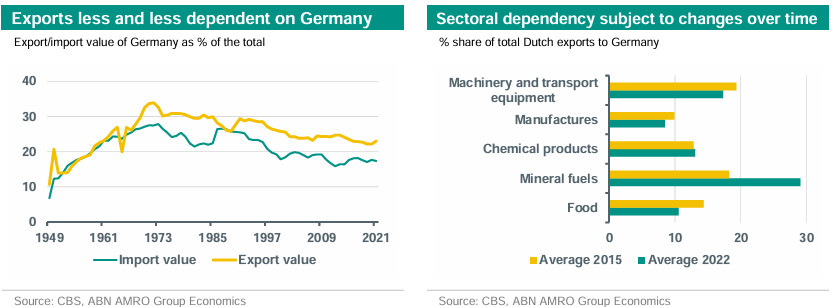

Opportunities for Diversification

While the situation presents challenges, it also presents opportunities for the Dutch economy to diversify and reduce its dependence on trade with the US.

- Focus on Other Export Markets: Emphasize the importance of exploring and developing new export markets beyond the US to reduce dependence on a single trading partner.

- Strategies for Increased Domestic Consumption: Stimulating domestic consumption can help reduce the reliance on exports.

- Investments in New Technologies: Investment in new technologies and innovation can improve competitiveness and create new opportunities for growth.

Conclusion:

The ongoing US trade tensions have dealt a significant blow to the Dutch stock market, impacting key sectors like technology, agriculture, and energy. The resulting decline in investor confidence and the flight to safety highlight the vulnerability of the Dutch economy to external shocks. While the short-term outlook remains uncertain, the long-term consequences necessitate a proactive approach toward economic diversification and resilience. To stay informed about further developments in the Dutch Stock Market and the ongoing US Trade Tensions, regularly consult reputable financial news sources such as the Financial Times, Bloomberg, and the website of the Amsterdam Stock Exchange (AEX). Understanding these dynamics is crucial for navigating the complexities of the current market and making informed investment decisions. Keep a close eye on the Dutch Stock Market and the ongoing effects of US Trade Tensions for a better understanding of the evolving economic landscape.

Featured Posts

-

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Kueloenleges Porsche 911 80 Millio Forintos Extrak

May 24, 2025

Kueloenleges Porsche 911 80 Millio Forintos Extrak

May 24, 2025 -

A Seattle Green Space Providing Refuge During The Covid 19 Pandemic

May 24, 2025

A Seattle Green Space Providing Refuge During The Covid 19 Pandemic

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Significance

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Significance

May 24, 2025 -

Quotas De Contenu Francophone Le Gouvernement Du Quebec S Attaque Aux Plateformes De Streaming

May 24, 2025

Quotas De Contenu Francophone Le Gouvernement Du Quebec S Attaque Aux Plateformes De Streaming

May 24, 2025

Latest Posts

-

Quotas De Contenu Francophone Le Gouvernement Du Quebec S Attaque Aux Plateformes De Streaming

May 24, 2025

Quotas De Contenu Francophone Le Gouvernement Du Quebec S Attaque Aux Plateformes De Streaming

May 24, 2025 -

Quebec Nouvelles Reglementations Pour Le Contenu Francophone En Ligne

May 24, 2025

Quebec Nouvelles Reglementations Pour Le Contenu Francophone En Ligne

May 24, 2025 -

Canada Post Strike Averted Details Of The New Offer

May 24, 2025

Canada Post Strike Averted Details Of The New Offer

May 24, 2025 -

Trumps Trade Threats Prompt Call To Action From Canadian Auto Industry

May 24, 2025

Trumps Trade Threats Prompt Call To Action From Canadian Auto Industry

May 24, 2025 -

Canada Posts New Offers Averted Strike

May 24, 2025

Canada Posts New Offers Averted Strike

May 24, 2025