Elon Musk's Billions In Decline: Analysis Of Recent Market Volatility And Its Impact

Table of Contents

Elon Musk, once the world's richest person, has seen a dramatic shift in his net worth recently. Headlines have screamed about the billions wiped off his fortune, prompting questions about the factors driving this decline. This article delves into the "Elon Musk's Billions in Decline" phenomenon, analyzing the recent market volatility and its impact on his vast business empire, encompassing Tesla's stock performance, the tumultuous Twitter acquisition, and the mitigating role of SpaceX. We'll explore the interconnectedness of these factors and their effect on his overall financial standing.

H2: Tesla Stock Performance and its Correlation to Musk's Net Worth

H3: Understanding Tesla's Stock Volatility: Tesla's stock price, a key component of Elon Musk's net worth, has experienced significant swings. Numerous factors contribute to this volatility, including production challenges at Tesla's factories, intensifying competition from established and emerging automakers, shifting market sentiment, and the broader macroeconomic environment. Global supply chain disruptions, for example, have repeatedly impacted Tesla's production targets and, subsequently, its stock price.

- Direct Link: Elon Musk's massive ownership stake in Tesla means his net worth is directly tied to the company's performance. A drop in Tesla's stock translates to a significant decrease in his personal wealth.

- Recent Trends: Tesla's stock has seen both spectacular rises and sharp declines in recent years, often mirroring broader market trends but also influenced by specific company news and announcements. Analyzing these trends reveals periods of substantial gains followed by equally dramatic losses.

- News & Events: Negative news about production delays, safety recalls, or controversies surrounding Elon Musk's public statements often trigger immediate sell-offs, impacting both Tesla's stock and Musk's net worth. Conversely, positive news, such as record-breaking sales figures or groundbreaking technological advancements, can rapidly increase the stock price.

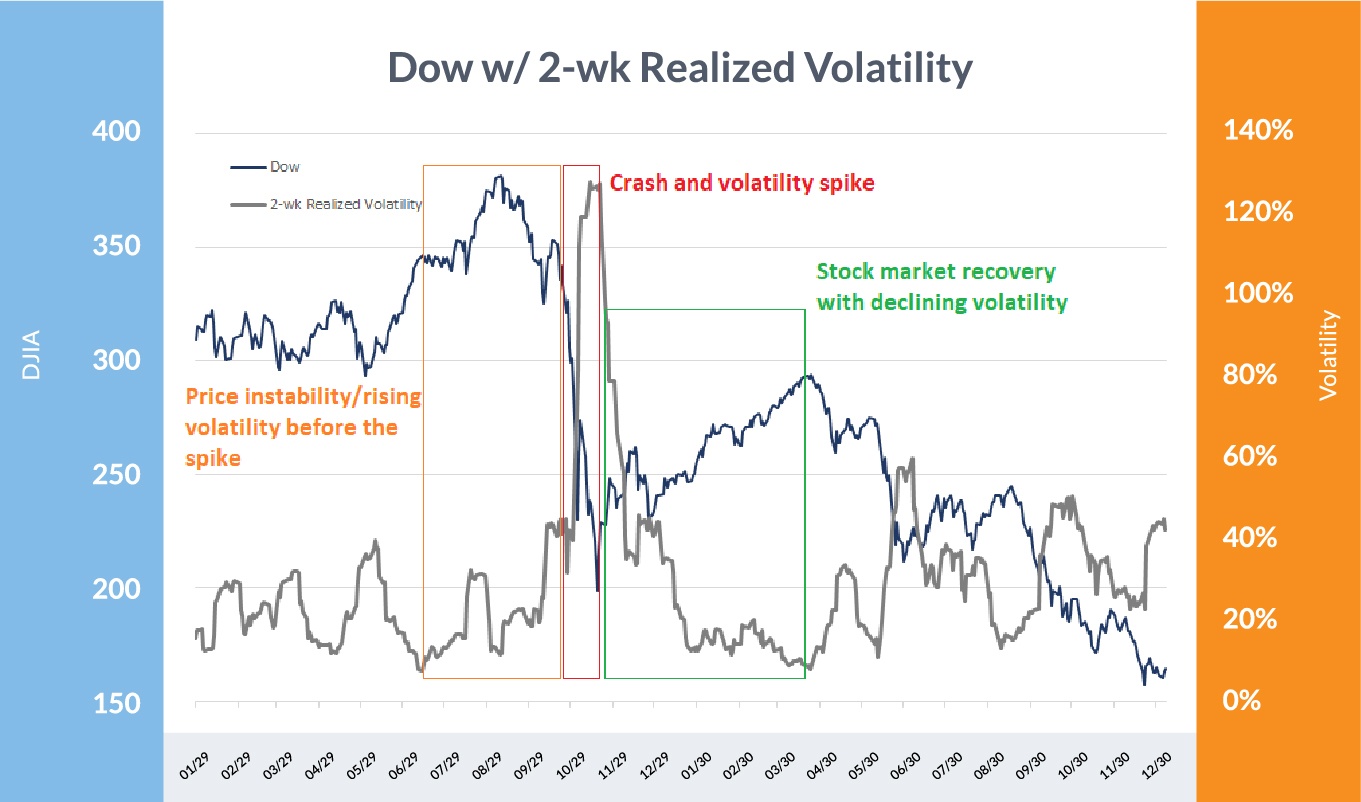

- (Insert chart/graph illustrating Tesla's stock performance over the last 1-2 years)

H2: The Impact of the Twitter Acquisition on Musk's Finances

H3: Financial Strain and Debt: The controversial acquisition of Twitter, now X, has placed a significant strain on Elon Musk's finances. The massive debt incurred to finance the deal has undoubtedly impacted his overall net worth.

- Acquisition Cost & Financing: The high purchase price and the methods used to finance the acquisition, including significant personal loans and debt financing, have added considerable financial burden.

- Debt Impact: Servicing this debt requires substantial ongoing payments, potentially reducing the available resources for Musk’s other ventures.

- Implications for Tesla & SpaceX: The Twitter acquisition has raised concerns about potential resource allocation conflicts, with some analysts questioning whether the demands of running Twitter might distract from the leadership and investment required for Tesla and SpaceX.

- Twitter's Financial State: Twitter's own financial situation, characterized by losses and substantial debt, further contributes to the negative impact on Musk's overall financial position.

H2: SpaceX Valuation and its Role in Mitigating Losses

H3: SpaceX as a Counterbalance?: SpaceX, Musk's space exploration company, offers a potential counterbalance to the financial challenges facing Tesla and Twitter. Its high valuation and future growth prospects could help offset losses in other areas.

- SpaceX Valuation & Growth: SpaceX is a privately held company, making its precise valuation subject to estimations. However, various reports suggest a high valuation reflecting its significant technological advancements and lucrative contracts. Future projects like Starship could substantially boost its valuation further.

- Cushioning the Impact: SpaceX's success and potential future revenue streams could mitigate some of the financial losses experienced by Tesla and Twitter, offering a degree of stability to Musk's overall financial portfolio.

- Future Plans: SpaceX's ambitious plans for space tourism, satellite internet deployment (Starlink), and interplanetary travel contribute to its considerable long-term growth potential, which could positively impact Musk's net worth.

H2: Broader Market Volatility and its Influence on High-Net-Worth Individuals

H3: The Impact of Economic Factors: The recent market volatility isn’t solely attributable to Musk’s individual ventures; broader economic factors have significantly influenced the valuations of his holdings.

- Macroeconomic Trends: Inflation, recessionary fears, rising interest rates, and geopolitical instability all contribute to market uncertainty, directly impacting the valuations of companies like Tesla and SpaceX.

- Portfolio Impact: These macroeconomic headwinds affect not just Tesla and SpaceX but Musk's entire investment portfolio, leading to an overall decrease in his net worth.

- Similar Experiences: Many high-net-worth individuals have experienced similar challenges due to the current economic climate, highlighting the vulnerability of substantial wealth during periods of market instability.

Conclusion:

The decline in "Elon Musk's Billions" is a complex issue driven by several interconnected factors. Tesla's stock performance, the financial strain of the Twitter acquisition, and the impact of broader market volatility all contributed to the decrease in his net worth. While SpaceX's valuation provides a potential mitigating factor, the overall picture highlights the vulnerability even of the most significant fortunes during turbulent economic times. The key takeaway is the interconnectedness of Musk's business ventures and their susceptibility to both company-specific events and macroeconomic trends. To stay informed about the fluctuating fortunes of one of the world's most prominent entrepreneurs, follow Elon Musk's net worth and track market volatility closely. Stay updated on Elon Musk's Billions—it's a story that continues to unfold.

Featured Posts

-

The Reach Of Divine Mercy Religious Groups In 1889

May 09, 2025

The Reach Of Divine Mercy Religious Groups In 1889

May 09, 2025 -

Nyt Crossword April 6 2025 Complete Guide To Clues And The Spangram

May 09, 2025

Nyt Crossword April 6 2025 Complete Guide To Clues And The Spangram

May 09, 2025 -

Bondis Unprecedented Fentanyl Seizure A Significant Victory

May 09, 2025

Bondis Unprecedented Fentanyl Seizure A Significant Victory

May 09, 2025 -

Planned Trump Appearance At Kennedy Center Prompts Les Miserables Cast To Consider Boycott

May 09, 2025

Planned Trump Appearance At Kennedy Center Prompts Les Miserables Cast To Consider Boycott

May 09, 2025 -

Vislovlyuvannya Stivena Kinga Pro Trampa Ta Maska Pislya Povernennya Do Kh

May 09, 2025

Vislovlyuvannya Stivena Kinga Pro Trampa Ta Maska Pislya Povernennya Do Kh

May 09, 2025

Latest Posts

-

Tracking The Billions Musk Bezos And Zuckerbergs Post Inauguration Losses

May 10, 2025

Tracking The Billions Musk Bezos And Zuckerbergs Post Inauguration Losses

May 10, 2025 -

Elon Musk Jeff Bezos Mark Zuckerberg Billions Lost Since January 20 2017

May 10, 2025

Elon Musk Jeff Bezos Mark Zuckerberg Billions Lost Since January 20 2017

May 10, 2025 -

How Much Wealth Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025

How Much Wealth Did Musk Bezos And Zuckerberg Lose Since Trumps Inauguration

May 10, 2025 -

Despite 100 Billion Loss Elon Musk Tops Hurun Global Rich List 2025

May 10, 2025

Despite 100 Billion Loss Elon Musk Tops Hurun Global Rich List 2025

May 10, 2025 -

2025 Hurun Global Rich List Elon Musks Billions Shrink But He Stays Number One

May 10, 2025

2025 Hurun Global Rich List Elon Musks Billions Shrink But He Stays Number One

May 10, 2025