Elon Musk's Billions: Tesla's Rally And The Dogecoin Effect On His Net Worth

Table of Contents

Tesla's Stock Market Performance and its Impact on Elon Musk's Net Worth

Tesla's Meteoric Rise:

Tesla's phenomenal growth story is a key driver of Elon Musk's immense wealth. Several factors have fueled this remarkable ascent:

- Innovation in Electric Vehicles (EVs): Tesla's pioneering work in electric vehicle technology has disrupted the automotive industry, establishing it as a leading innovator and setting the standard for others to follow.

- Strong Demand: Consistent high demand for Tesla's vehicles, notably the Model 3 and Model Y, has translated into strong sales figures and revenue growth.

- Successful Product Launches: The strategic timing and success of new model releases have consistently bolstered Tesla's market position and investor confidence.

- Government Incentives: Government subsidies and tax credits for electric vehicles in various countries have stimulated sales and further propelled Tesla's growth.

- Visionary Leadership: Elon Musk's leadership style, though often controversial, has cultivated a dedicated following and a fervent belief in Tesla's mission, attracting both customers and investors.

Tesla's stock price and Elon Musk's net worth are intrinsically linked. Significant increases in Tesla's share price directly translate into billions added to Musk's fortune. For instance, a 10% jump in Tesla's stock price can easily add several billion dollars to his net worth, showcasing the immense leverage his ownership stake provides. Musk's ownership stake, therefore, acts as a powerful amplifier of Tesla's market capitalization, directly impacting his overall wealth.

Analyzing the Risks Associated with Tesla's Stock:

While Tesla's success is undeniable, several factors pose considerable risks and contribute to the volatility of its stock price, and consequently, Musk's net worth:

- Competition from other EV Manufacturers: The emergence of numerous competitors in the burgeoning electric vehicle market presents a significant challenge to Tesla's dominance.

- Economic Downturns: Global economic recessions can severely impact consumer spending on luxury goods like Tesla vehicles, affecting sales and stock prices.

- Regulatory Challenges: Government regulations concerning emissions, safety, and autonomous driving technology can significantly impact Tesla's operations and profitability.

- Supply Chain Disruptions: Global supply chain issues can hinder production, leading to delays and impacting revenue and stock prices.

- Reliance on Musk’s Leadership: The company’s heavy reliance on Elon Musk's leadership and vision introduces a unique risk. Any significant change in his role could impact investor confidence and stock valuation.

These risks highlight the inherent volatility in Tesla's stock and underscore the precarious nature of Elon Musk's considerable wealth tied to it.

The Dogecoin Phenomenon and its Influence on Elon Musk's Net Worth

Musk's Influence on Dogecoin's Price:

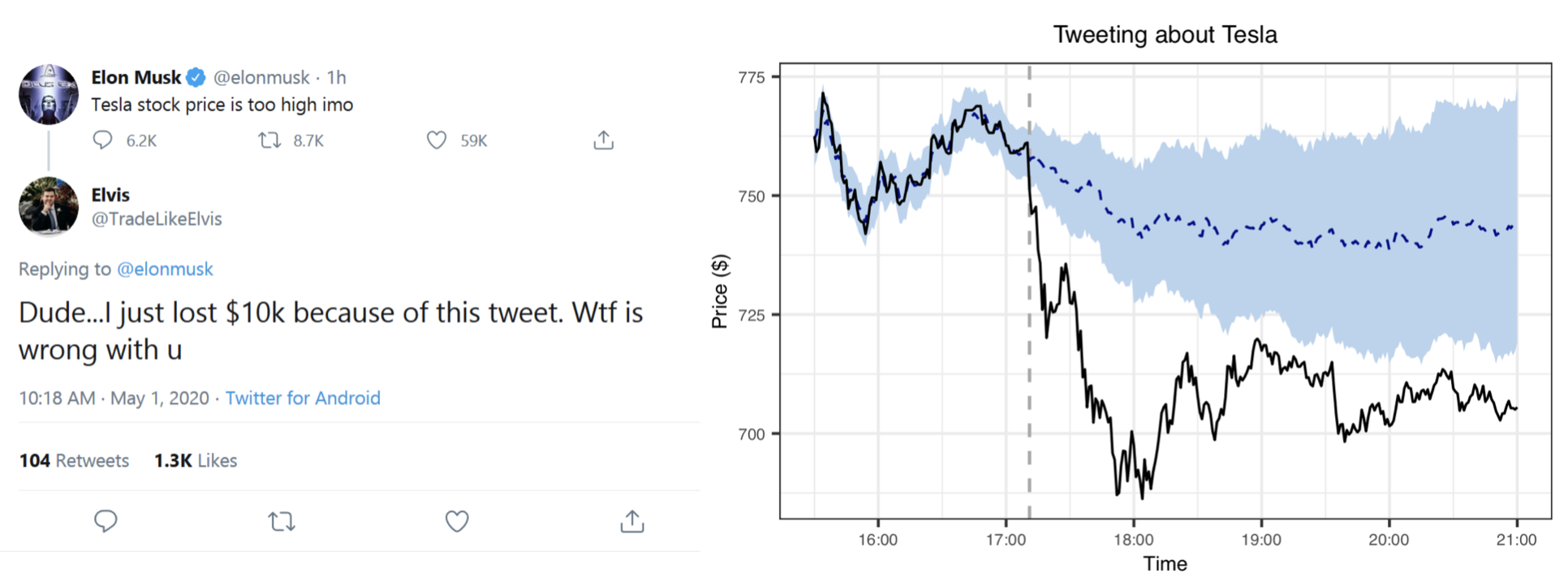

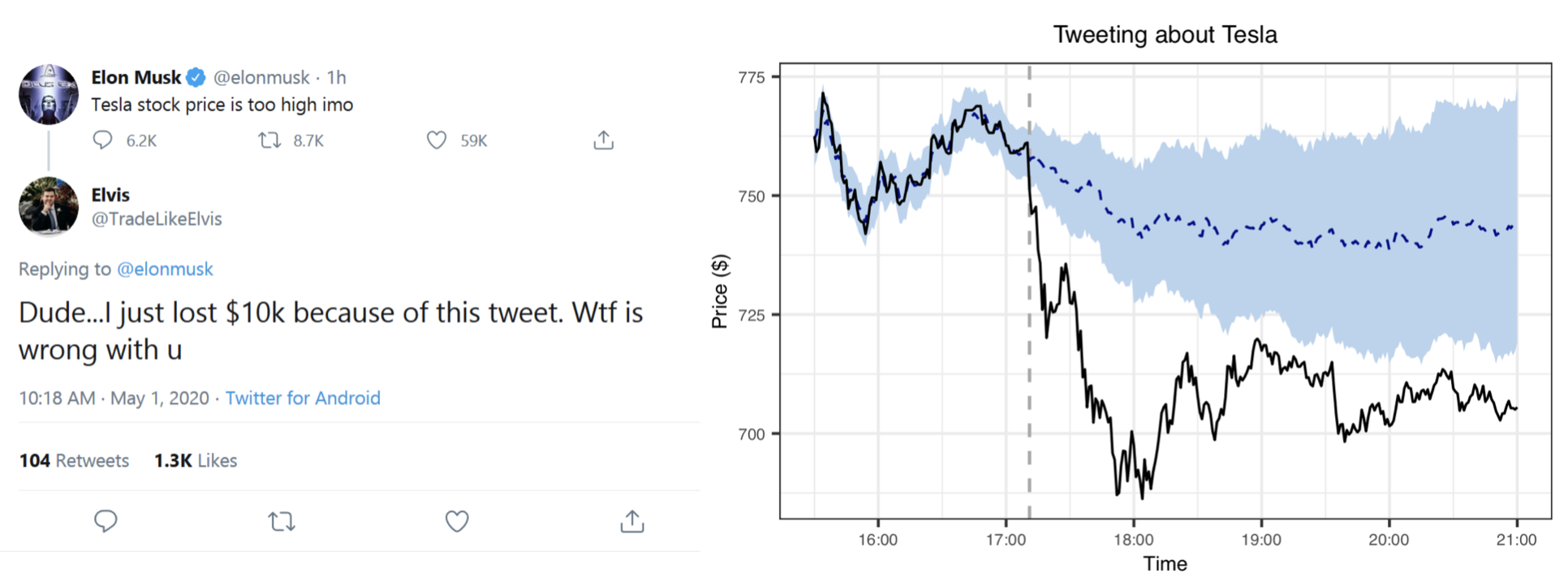

Elon Musk's pronouncements on Dogecoin, often via tweets and social media posts, have significantly impacted the cryptocurrency's price.

- Example 1: A single tweet from Musk mentioning Dogecoin can send its price soaring, sometimes by tens of percent in a matter of hours.

- Example 2: Musk's appearances on shows discussing Dogecoin have also been linked to dramatic price swings.

- Example 3: Even seemingly casual comments about Dogecoin have triggered significant market activity.

Musk's influence demonstrates the power of social media and celebrity endorsements in manipulating cryptocurrency markets. His actions, intentional or otherwise, have created substantial market fluctuations, directly affecting the value of his own Dogecoin holdings and, therefore, his overall net worth.

The Speculative Nature of Dogecoin and its Impact on Musk's Overall Wealth:

Dogecoin, unlike established currencies or assets, is highly speculative. Its value is subject to extreme volatility, creating both immense opportunities and significant risks:

- Volatility of Cryptocurrency Markets: The cryptocurrency market is notorious for its wild price swings, making it a high-risk investment.

- Regulatory Uncertainty: The lack of clear regulatory frameworks for cryptocurrencies adds to the uncertainty and potential for dramatic shifts in value.

- Potential for Significant Gains and Losses: The potential for massive gains is balanced by the equally significant risk of substantial losses.

Musk's association with Dogecoin adds a layer of both potential reward and considerable risk to his overall net worth. The ethical implications of his influence on such a volatile market are a subject of ongoing debate.

Other Factors Contributing to Elon Musk's Billions

SpaceX's Success and its Role:

SpaceX's achievements are a substantial contributor to Elon Musk's wealth. Its groundbreaking success stems from:

- Successful Launches: SpaceX has achieved numerous successful rocket launches, establishing itself as a major player in the space industry.

- Contracts with NASA and Other Entities: Securing contracts with NASA and other organizations for space transportation services has significantly bolstered SpaceX's revenue.

- Development of Reusable Rockets: SpaceX's innovation in reusable rocket technology has significantly lowered the cost of space travel, expanding the possibilities for commercial space exploration.

- Potential Future Ventures (e.g., Starlink): The development of Starlink, a satellite internet constellation, represents a potential new revenue stream of significant scale.

Other Ventures and Investments:

Beyond Tesla and SpaceX, Elon Musk's entrepreneurial ventures contribute to his overall wealth. These include:

- The Boring Company: Focusing on infrastructure and tunnel construction.

- Neuralink: Developing brain-computer interfaces.

Conclusion

Elon Musk's billions are a fascinating case study in the intertwined forces of innovation, market volatility, and social media influence. The performance of Tesla's stock and the speculative nature of Dogecoin have demonstrably shaped his immense wealth, highlighting both the incredible potential for growth and the inherent risks involved. While Tesla's success is largely attributable to its technological innovation and market demand, the volatility of both Tesla's stock and cryptocurrencies like Dogecoin underscores the unpredictable nature of his fortune. The unique nature of Musk’s influence on global markets, whether through business decisions or social media posts, remains a defining feature of "Elon Musk's Billions," and a subject worthy of continued investigation. To delve deeper into the intricacies of Elon Musk's financial empire and the factors driving its fluctuating value, further research into Tesla's financial reports, Dogecoin market trends, and SpaceX's progress is encouraged.

Featured Posts

-

Trumps Greenland Gambit A Closer Look At Denmarks Role

May 10, 2025

Trumps Greenland Gambit A Closer Look At Denmarks Role

May 10, 2025 -

Abrz Almdkhnyn Fy Tarykh Krt Alqdm

May 10, 2025

Abrz Almdkhnyn Fy Tarykh Krt Alqdm

May 10, 2025 -

Macron Announces Planned Signing Of France Poland Friendship Treaty

May 10, 2025

Macron Announces Planned Signing Of France Poland Friendship Treaty

May 10, 2025 -

The Feds Decision Holding Rates Steady In Face Of Inflation And Unemployment

May 10, 2025

The Feds Decision Holding Rates Steady In Face Of Inflation And Unemployment

May 10, 2025 -

Nyt Strands April 10th 2024 Game 403 Hints And Answers

May 10, 2025

Nyt Strands April 10th 2024 Game 403 Hints And Answers

May 10, 2025