Emerging Market Stock Surge: A Winning Strategy Amidst US Uncertainty?

Table of Contents

Why Emerging Markets Are Attracting Investors Now

The current interest in emerging market stocks is driven by a confluence of factors, making them an attractive alternative to more established markets.

-

Diversification Benefits: Emerging markets often exhibit lower correlation with developed market indices like the S&P 500. This means that when US stocks decline, emerging market stocks may not necessarily follow suit, providing valuable portfolio diversification and reducing overall risk. This is crucial for investors seeking to weather market storms.

-

Higher Growth Potential: Many emerging economies boast significantly higher GDP growth rates than their developed counterparts. Countries like India, several nations in Southeast Asia (Vietnam, Indonesia, the Philippines being prime examples), and parts of Africa are experiencing rapid economic expansion, fueling demand and driving stock market growth. This presents opportunities for substantial capital appreciation.

-

Undervalued Assets: Some argue that emerging market stocks remain undervalued compared to their developed market equivalents, offering potential for significant gains as these markets mature and their intrinsic value becomes more widely recognized. This undervaluation presents a compelling entry point for long-term investors.

-

Currency Appreciation: The currencies of some emerging markets can appreciate against the US dollar and other major currencies, further boosting returns for international investors. This currency effect adds another layer of potential profit beyond simple stock price appreciation.

-

Government Initiatives: Many emerging market governments are actively implementing policies to stimulate economic growth and improve infrastructure. These initiatives, ranging from tax incentives to large-scale infrastructure projects, create a positive environment for investment and business expansion.

Navigating the Risks of Emerging Market Investments

While the potential rewards are substantial, investing in emerging markets is not without risk. It's crucial to understand and manage these potential challenges:

-

Volatility: Emerging markets are inherently more volatile than developed markets. This increased volatility stems from factors such as political instability and economic fluctuations. Investors should be prepared for significant price swings.

-

Political and Economic Instability: Political instability, corruption, and economic downturns are more prevalent in some emerging markets than in developed economies. These events can significantly impact investment returns, sometimes leading to substantial losses. Careful due diligence is paramount.

-

Regulatory Hurdles: Navigating the regulatory environments in different emerging markets can be complex and challenging. Understanding local laws and regulations is crucial to avoid legal pitfalls.

-

Currency Risk: Fluctuations in exchange rates can significantly impact returns. A weakening of the emerging market currency against the investor's home currency can erode profits or even lead to losses. Hedging strategies might be considered.

-

Liquidity Issues: Trading volume and liquidity can be lower in some emerging markets compared to developed markets. This can make it difficult to buy or sell assets quickly, potentially impacting investment decisions.

Strategies for Successful Emerging Market Investing

Successful emerging market investing requires a well-defined strategy and a cautious approach:

-

Diversification across markets and sectors: Don't put all your eggs in one basket. Diversify your investments across multiple emerging markets and sectors to mitigate risk.

-

Thorough due diligence: Conduct thorough research and analysis of individual companies and markets before making any investment decisions. Understand the specific risks and opportunities associated with each investment.

-

Long-term investment horizon: Emerging market investments are often best suited for long-term investors who are comfortable with volatility and can ride out short-term market fluctuations.

-

Professional investment advice: Consider seeking advice from a financial advisor specializing in emerging markets. They can provide valuable insights and help you develop a suitable investment strategy.

-

Consider ETFs and mutual funds: These diversified investment vehicles provide exposure to a broader range of emerging market stocks, offering a convenient and cost-effective way to access this asset class.

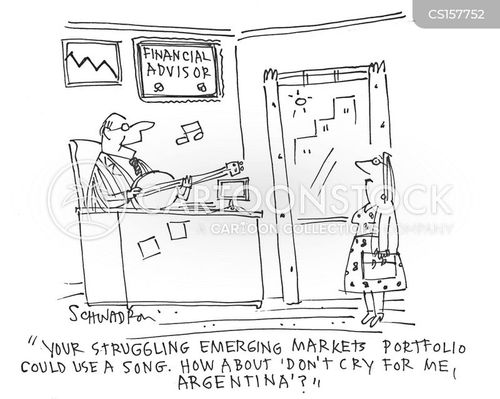

Comparing Emerging Market Performance to Developed Markets

Historical data reveals periods where emerging market indices have outperformed major developed market indices like the S&P 500, and vice versa. While past performance is not indicative of future results, analyzing these trends helps to contextualize the potential for both significant gains and potential losses. (This section would ideally include charts and graphs comparing relevant indices over various time periods). Factors such as global economic growth, commodity prices, and geopolitical events significantly impact this relative performance.

Conclusion: Is an Emerging Market Stock Surge Your Winning Strategy?

Investing in emerging markets offers the potential for substantial returns, fueled by high growth rates and potentially undervalued assets. However, this potential is accompanied by increased volatility and unique risks associated with political and economic instability. A successful strategy requires careful planning, thorough research, diversification, and a long-term perspective. While the current emerging market stock surge presents an attractive opportunity, it's vital to approach it with caution and a thorough understanding of the inherent risks. Begin your journey into the world of emerging market investing today, and discover the potential for significant gains amidst global uncertainty. Remember to always seek professional advice tailored to your individual financial situation and risk tolerance before making any investment decisions.

Featured Posts

-

Secret Service Ends Probe Into Cocaine Found At White House

Apr 24, 2025

Secret Service Ends Probe Into Cocaine Found At White House

Apr 24, 2025 -

65 Hudsons Bay Leases Generate Strong Buyer Interest

Apr 24, 2025

65 Hudsons Bay Leases Generate Strong Buyer Interest

Apr 24, 2025 -

Heats Herro Claims 3 Point Crown Cavaliers Skills Challenge Victory

Apr 24, 2025

Heats Herro Claims 3 Point Crown Cavaliers Skills Challenge Victory

Apr 24, 2025 -

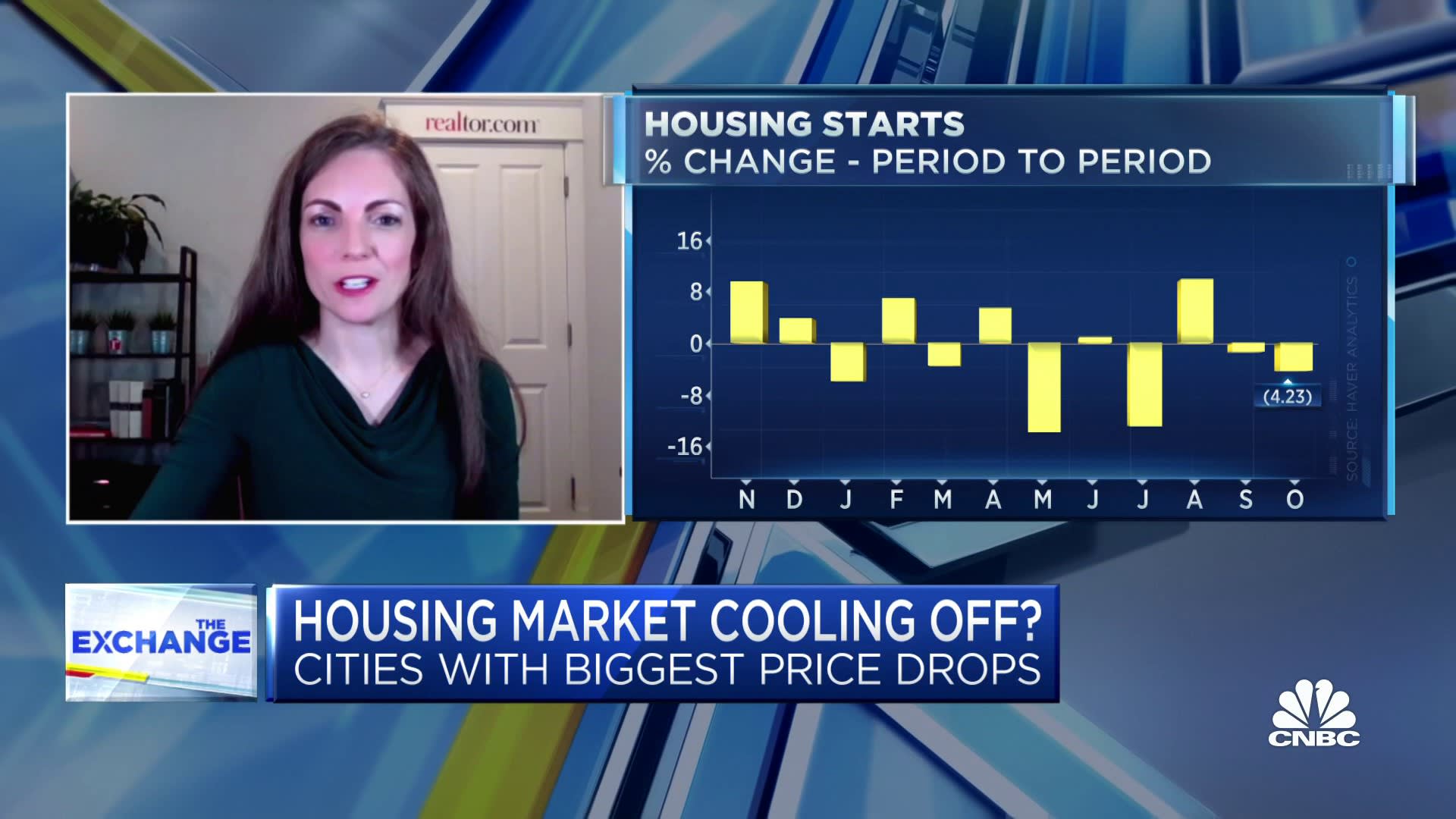

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increases

Apr 24, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increases

Apr 24, 2025 -

Zuckerbergs Meta In The Age Of Trump Opportunities And Risks

Apr 24, 2025

Zuckerbergs Meta In The Age Of Trump Opportunities And Risks

Apr 24, 2025