Escape To The Country: Nicki Chapman's Profitable Property Investment

Table of Contents

Nicki Chapman's Property Investment Philosophy

Nicki Chapman's success in the property market likely stems from a combination of shrewd strategies and a keen understanding of the rural property landscape. Her approach likely emphasizes several key elements:

Location, Location, Location (and Potential):

The golden rule of property investment holds true, especially in the context of an "Escape to the Country" scenario. Chapman likely focuses on areas with:

- Strong rental yields: Researching locations with high demand for rental properties, such as areas popular with commuters or holidaymakers, ensures a consistent income stream from your investment. This is crucial for securing mortgages and building long-term wealth through your Escape to the Country property investment.

- Significant capital appreciation potential: Identifying up-and-coming areas with potential for future growth is key. This involves analyzing local market trends, considering infrastructure projects (new roads, schools etc.), and researching any planned developments that could increase property values.

- Good transport links and amenities: Properties conveniently located near major roads, train stations, and essential amenities (schools, shops, healthcare) are always more desirable and command higher rental yields or sale prices.

Finding Hidden Gems:

While prime locations are attractive, opportunities often lie in discovering undervalued properties. Chapman's approach likely involves:

- Networking and building relationships with estate agents: Establishing strong connections with local agents provides access to off-market properties and insider knowledge. This is invaluable for securing Escape to the Country property investment opportunities before they hit the open market.

- Utilizing online property portals and auction sites effectively: Thorough online searches, combined with a keen eye for detail, can uncover hidden gems overlooked by other investors. Understanding the nuances of auction processes is particularly important.

- Viewing properties in person to assess their true potential: A physical inspection is crucial. It allows for a thorough assessment of the property's condition, potential for renovation, and its overall suitability for the intended purpose (rental or resale).

Strategic Renovation and Improvement:

Adding value through renovations is a cornerstone of successful property investment. Chapman likely employs:

- Cost-effective upgrades that maximize ROI: Focus on high-impact, relatively inexpensive improvements such as kitchen and bathroom upgrades, energy-efficient installations, and cosmetic enhancements. These can significantly boost rental income or sale price.

- Understanding building regulations and planning permissions: Navigating the complexities of planning permissions and building regulations is essential to avoid costly delays and legal issues.

- Creating desirable features for renters or buyers: Understanding the needs and preferences of potential tenants or buyers is vital. This could involve creating modern, energy-efficient homes with appealing features suited to the local market.

Learning from Nicki Chapman's Success: Key Takeaways for Aspiring Investors

Emulating Nicki Chapman's success requires a structured approach and a long-term vision:

Due Diligence is Crucial:

Thorough research is paramount in any Escape to the Country property investment venture:

- Employing the services of a solicitor and surveyor: Professional advice from a solicitor and a surveyor minimizes risk and protects your investment. They will identify potential problems and ensure all legal and structural aspects are sound.

- Understanding different types of mortgages and financing options: Securing the right mortgage is crucial. Understanding different loan types and interest rates will allow you to make informed decisions.

- Calculating potential rental income and expenses: Accurately forecasting rental income and expenses is crucial for assessing the financial viability of any property investment.

Long-Term Vision and Patience:

Property investment is a marathon, not a sprint.

- Building a diversified property portfolio for risk management: Diversifying your portfolio across different locations and property types helps mitigate risk.

- The importance of adapting to changing market conditions: Market conditions fluctuate. Being adaptable and responsive to change is essential for long-term success.

- Regularly reviewing and adjusting your investment strategy: Regularly reviewing your portfolio and adapting your strategy based on market trends and your financial goals is key to continued growth.

Managing Your Portfolio Effectively:

Effective management is critical to maximizing returns and minimizing risk:

- Employing property management services or self-managing: Deciding whether to self-manage or use a property management company depends on your time commitment and expertise.

- Regular property inspections and maintenance schedules: Preventative maintenance minimizes costly repairs and keeps your properties in good condition.

- Building strong relationships with tenants: Positive tenant relationships lead to longer tenancies and reduced voids.

Conclusion

Nicki Chapman's success in the property market proves that careful planning, thorough research, and a long-term perspective are key to achieving your own "Escape to the Country" dreams. By learning from her strategic approach, focusing on location, understanding the importance of renovation, and mastering effective portfolio management, you can build your own profitable property portfolio. Start your journey towards your own profitable Escape to the Country property investment today! Learn more about successful property investment strategies and begin building your portfolio!

Featured Posts

-

Glastonbury 2025 Announced Lineup Sparks Outrage

May 24, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage

May 24, 2025 -

Test Porsche Cayenne Gts Coupe Suv Dla Wymagajacych

May 24, 2025

Test Porsche Cayenne Gts Coupe Suv Dla Wymagajacych

May 24, 2025 -

Is An Escape To The Country Right For You A Self Assessment

May 24, 2025

Is An Escape To The Country Right For You A Self Assessment

May 24, 2025 -

France New Measures For Underage Criminals On The Table

May 24, 2025

France New Measures For Underage Criminals On The Table

May 24, 2025 -

Kyle Walker Spotted With Models In Milan Following Wifes Uk Return

May 24, 2025

Kyle Walker Spotted With Models In Milan Following Wifes Uk Return

May 24, 2025

Latest Posts

-

Analisi Borsa Focus Su Fed Banche Italiane E Italgas

May 24, 2025

Analisi Borsa Focus Su Fed Banche Italiane E Italgas

May 24, 2025 -

Mercati Europei Impatto Della Fed Performance Banche E Italgas

May 24, 2025

Mercati Europei Impatto Della Fed Performance Banche E Italgas

May 24, 2025 -

Borsa Italiana La Prudenza Prevale In Attesa Della Decisione Della Fed

May 24, 2025

Borsa Italiana La Prudenza Prevale In Attesa Della Decisione Della Fed

May 24, 2025 -

Borsa Europa Attenzione Fed Banche Deboli Italgas In Luce

May 24, 2025

Borsa Europa Attenzione Fed Banche Deboli Italgas In Luce

May 24, 2025 -

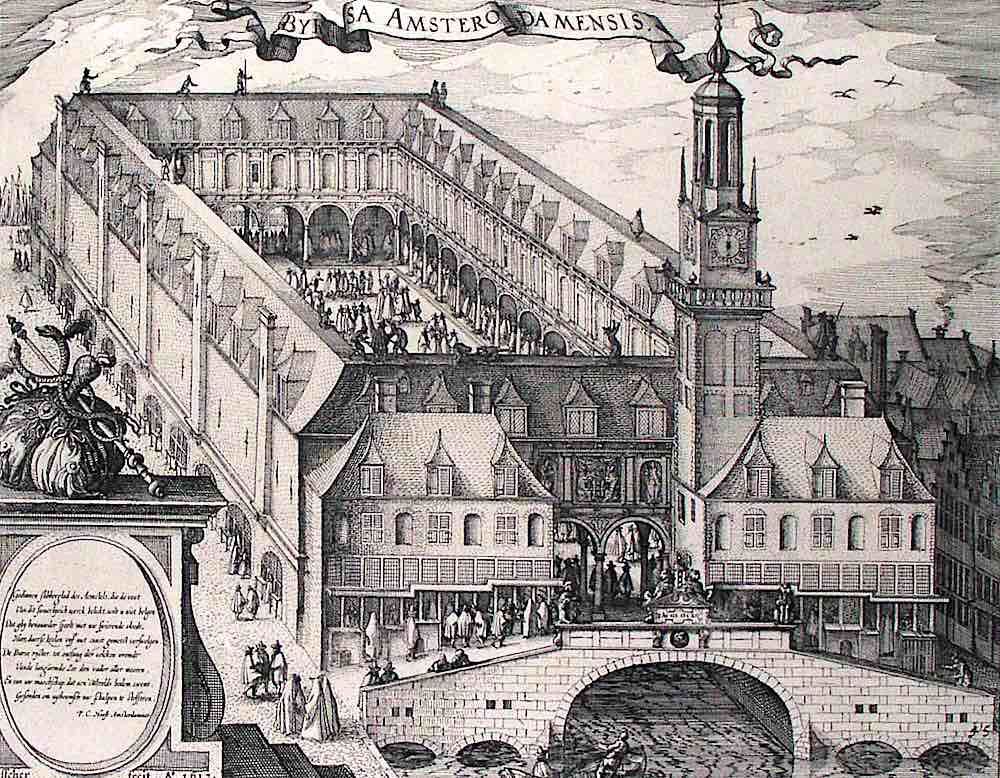

Amsterdam Stock Market 7 Opening Plunge Reflects Global Trade Uncertainty

May 24, 2025

Amsterdam Stock Market 7 Opening Plunge Reflects Global Trade Uncertainty

May 24, 2025