Euronext Amsterdam Stock Market: 8% Rise Following US Tariff Pause

Table of Contents

The US Tariff Pause and its Impact

The temporary pause in the US tariff escalation, announced on [Insert Date], provided a much-needed reprieve from the ongoing trade war uncertainty. This decision immediately impacted global markets, particularly in Europe, which is heavily reliant on trade with the United States.

- Specific Tariffs Paused: The pause specifically addressed tariffs on [List specific goods or sectors affected, e.g., steel, aluminum, specific consumer goods]. This targeted approach aimed to de-escalate tensions and allow for further negotiations.

- Immediate Market Reaction: The Amsterdam stock market, along with other European exchanges, reacted positively. The AEX index, a key indicator of Euronext Amsterdam's performance, saw an immediate and sharp increase, reaching an 8% rise within [ timeframe]. Globally, similar positive reactions were observed in other major indices.

- Lingering Uncertainty: Despite the positive market response, significant uncertainty remains. The temporary nature of the pause leaves investors questioning the long-term implications and the possibility of renewed tariff escalation in the future. This uncertainty continues to influence investor sentiment and trading strategies.

The psychological impact on investor confidence was substantial. The pause alleviated some of the fear and anxiety surrounding the trade war, leading to a surge in risk appetite and increased investment activity.

Euronext Amsterdam's Performance Before and After the News

Leading up to the news of the tariff pause, the Euronext Amsterdam market had experienced [Describe the market conditions before the news – e.g., periods of decline, volatility, or sideways movement]. The AEX index had fluctuated between [Insert numerical data, e.g., X and Y points] in the weeks preceding the announcement.

- Specific Data Points: On [Date], the AEX index closed at [Value]. Following the announcement, it surged to [Value] within [Timeframe], representing an 8% increase.

- Sectoral Performance: The technology and consumer goods sectors experienced particularly strong gains, reflecting their sensitivity to trade relations. Conversely, sectors more reliant on exports to the US showed more modest increases.

- Unusual Trading Activity: [Describe any unusual trading activity observed, e.g., increased trading volume, unusual price spikes, changes in volatility].

[Insert a graph or chart visually depicting the AEX index performance before and after the tariff pause announcement. Clearly label the axes and highlight the 8% increase.]

Analysis of Investor Behavior and Sentiment

The news of the tariff pause triggered a noticeable shift in investor sentiment. Risk aversion decreased considerably, and investors demonstrated a renewed appetite for riskier assets.

- Shift in Investor Sentiment: The prevailing pessimism surrounding the trade war was replaced by a sense of cautious optimism. Investors viewed the pause as a positive signal, indicating a potential de-escalation of tensions.

- Biggest Gains: Stocks in sectors most directly impacted by US tariffs, such as [Specific sectors], experienced the most significant gains. This suggests that the market reacted primarily to the direct impact of the tariff relief.

- Investment Strategy Shifts: Some investors may have shifted their strategies, moving away from defensive investments and towards growth stocks and more cyclical sectors, reflecting the improved outlook.

Market analysts and experts largely concurred with the positive interpretation of the tariff pause, although several cautioned against excessive optimism given the ongoing uncertainty surrounding future trade negotiations. [Cite specific sources if possible].

Long-Term Implications and Future Outlook

While the 8% rise in the Euronext Amsterdam stock market following the US tariff pause is significant, its sustainability depends on several factors.

- Continuation of the Pause: The most important factor will be whether the tariff pause becomes permanent or is merely temporary. A resumption of tariff escalation could quickly reverse the current positive market sentiment.

- Global Economic Conditions: The overall health of the global economy will continue to exert a significant influence on the Euronext Amsterdam market. Factors like global growth rates, interest rates, and inflation will all play a role.

- Risk Assessment: Investors need to carefully assess the risks and opportunities before making significant investment decisions. The current positive sentiment should not be seen as a guarantee of future performance.

Predicting future market trends with certainty is impossible. However, if the tariff pause continues, and global economic conditions remain stable, it is reasonable to expect continued growth in the Euronext Amsterdam market. Nevertheless, the 8% rise may not be sustainable in the long term.

Conclusion

The Euronext Amsterdam stock market experienced a remarkable 8% surge following the temporary pause in the US tariff dispute. This increase reflects a significant shift in investor sentiment, driven by reduced trade war uncertainty and a renewed risk appetite. However, the sustainability of this positive trend hinges on the continuation of the tariff pause, the overall health of the global economy, and the inherent volatility of the stock market. Understanding the interplay of these factors is crucial for informed investment decisions.

Call to Action: Stay informed on the dynamic Euronext Amsterdam stock market and its response to evolving global trade policies. Understanding the impact of events like US tariff pauses on your investment strategy is crucial. Monitor the Euronext Amsterdam index and related news for informed decision-making. Consider consulting a financial advisor before making significant investment decisions in the Euronext Amsterdam market.

Featured Posts

-

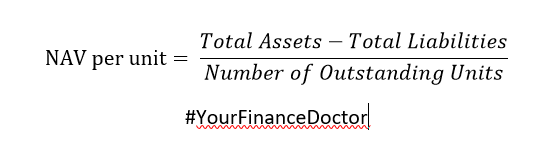

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And What They Mean

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And What They Mean

May 24, 2025 -

Is Kyle Walker Peters Heading To Leeds Transfer Rumours

May 24, 2025

Is Kyle Walker Peters Heading To Leeds Transfer Rumours

May 24, 2025 -

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Na Uitstel Trump Positieve Beursdag Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Positieve Beursdag Voor Alle Aex Aandelen

May 24, 2025 -

Major Disruption On M6 Due To Van Accident

May 24, 2025

Major Disruption On M6 Due To Van Accident

May 24, 2025

Latest Posts

-

1050 Price Hike At And Ts Concerns Over Broadcoms V Mware Deal

May 24, 2025

1050 Price Hike At And Ts Concerns Over Broadcoms V Mware Deal

May 24, 2025 -

U S Senate Recognizes Vital Canada U S Relationship With New Resolution

May 24, 2025

U S Senate Recognizes Vital Canada U S Relationship With New Resolution

May 24, 2025 -

Legal Ruling Impacts E Bays Liability For Banned Chemical Listings

May 24, 2025

Legal Ruling Impacts E Bays Liability For Banned Chemical Listings

May 24, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Faces A 1050 Increase

May 24, 2025

Broadcoms Proposed V Mware Price Hike At And T Faces A 1050 Increase

May 24, 2025 -

Bipartisan Senate Resolution Honors Strong Canada U S Partnership

May 24, 2025

Bipartisan Senate Resolution Honors Strong Canada U S Partnership

May 24, 2025