Analyzing The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

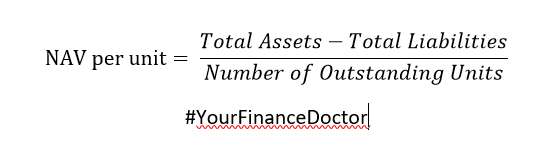

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. It's calculated daily by subtracting the ETF's liabilities from the total market value of its holdings, then dividing by the number of outstanding shares. Understanding the NAV is essential because it reflects the intrinsic value of the ETF. A higher NAV generally suggests a more valuable investment, although the market price may sometimes deviate. The Amundi Dow Jones Industrial Average UCITS ETF, a passively managed fund tracking the Dow Jones Industrial Average, provides a good example of how NAV works in practice. This UCITS ETF aims to replicate the performance of the index, meaning its NAV should closely mirror the index's performance.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors directly influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF. The most significant is the performance of its underlying index, the Dow Jones Industrial Average.

-

Dow Jones Industrial Average Performance: The NAV of the ETF moves in almost direct correlation with the Dow Jones Industrial Average. If the index rises, so will the ETF's NAV, and vice versa. This is because the ETF aims to mirror the index's composition and performance.

-

Currency Fluctuations: For international investors, currency exchange rates play a role. Fluctuations between the investor's home currency and the US dollar (USD) can impact the NAV when converting back to their local currency. A strengthening dollar will reduce the NAV in non-USD currencies, and a weakening dollar will have the opposite effect.

-

Expense Ratios and Management Fees: The ETF's expense ratio and management fees, although typically small, gradually reduce the NAV over time. These fees are deducted from the fund's assets, impacting the overall NAV.

-

Dividend Distributions: Dividend payments from the underlying companies in the Dow Jones Industrial Average are typically distributed to ETF shareholders. This distribution will slightly decrease the NAV on the ex-dividend date as the assets are reduced.

-

Other Influencing Factors: Several other factors can impact the NAV indirectly:

- Individual Stock Performance: The performance of individual stocks within the Dow Jones Industrial Average significantly affects the overall index performance and therefore the ETF's NAV.

- Market Sentiment and Trends: Broader market trends and investor sentiment (bullish or bearish) directly influence the Dow Jones Industrial Average and subsequently the ETF's NAV.

- Macroeconomic Factors: Macroeconomic conditions like interest rate changes, inflation rates, and geopolitical events can significantly impact the overall market and, consequently, the ETF's NAV.

How to Analyze the NAV Trend of the Amundi Dow Jones Industrial Average UCITS ETF

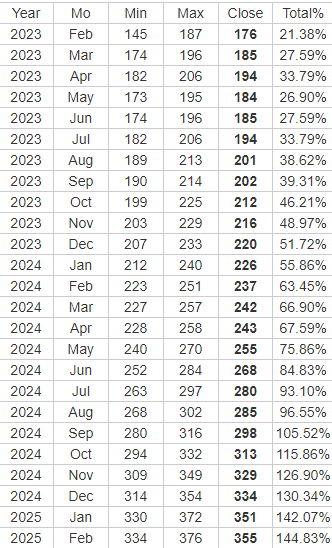

Analyzing the NAV trend helps investors assess the ETF's performance over time and make informed decisions. Historical NAV data can be accessed from various reliable sources:

- Amundi's Website: The official website of Amundi, the ETF provider, is the primary source for accurate and up-to-date NAV information.

- Financial News Websites: Reputable financial news sources often publish ETF data, including NAV information.

- Brokerage Platforms: Most brokerage platforms display real-time and historical NAV data for the ETFs they offer.

Visualizing NAV trends using charts and graphs is crucial. Online charting tools allow you to plot NAV data over different time periods, identifying patterns and trends. Comparing the NAV to the ETF's market price is equally important. Discrepancies between the NAV and market price can create arbitrage opportunities – where the ETF trades at a premium or discount to its NAV. While more advanced, understanding basic technical analysis (moving averages, for example) can provide further insights into NAV trends.

- Using Online Charting Tools: Platforms like TradingView or Google Finance provide tools to visualize NAV data.

- Interpreting NAV Trends: Upward trends generally indicate positive performance, while downward trends suggest underperformance.

- Identifying Significant Fluctuations: Sudden, large fluctuations in the NAV often indicate significant market events or news impacting the Dow Jones Industrial Average.

Comparing the Amundi Dow Jones Industrial Average UCITS ETF NAV to Competitors

Benchmarking the Amundi Dow Jones Industrial Average UCITS ETF's NAV against similar ETFs is crucial to evaluate its relative performance. Several other ETFs track the Dow Jones Industrial Average or broader market indices. Comparing their NAVs over time helps determine whether the Amundi ETF is performing better or worse than its competitors. This comparison should also consider expense ratios, as lower fees can lead to a higher NAV over time.

- Key Competitors: Identify other ETFs tracking the Dow Jones Industrial Average or similar indices.

- Expense Ratio Comparison: Compare expense ratios to see which ETF offers a more cost-effective way to gain exposure to the index.

- Historical NAV Performance: Analyze historical NAV data to compare the performance of the Amundi ETF against its peers.

Practical Applications and Implications of NAV Analysis

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF has several practical applications:

- Investment Decision Making: Monitoring NAV trends helps in making buy, hold, or sell decisions based on the ETF's performance and market conditions.

- Portfolio Diversification: NAV analysis contributes to effective portfolio diversification and risk management by evaluating the contribution of the ETF to the overall portfolio.

- Performance Evaluation: NAV should be considered alongside other performance metrics like total return and Sharpe ratio for a comprehensive assessment.

Conclusion: Mastering Net Asset Value (NAV) Analysis for the Amundi Dow Jones Industrial Average UCITS ETF

Analyzing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is vital for informed investment decisions. Key factors influencing its NAV include the Dow Jones Industrial Average's performance, currency fluctuations, expense ratios, and dividend distributions. By regularly tracking the NAV, comparing it to competitors, and using charting tools to visualize trends, investors can gain a deeper understanding of the ETF's performance and make better investment choices. To make well-informed decisions, actively track the NAV, analyze the NAV, and understand the NAV of the Amundi Dow Jones Industrial Average UCITS ETF and other ETFs. Further research into ETF investing and related financial concepts will enhance your understanding and improve your investment outcomes.

Featured Posts

-

Euro Boven 1 08 Wat Betekenen De Stijgende Kapitaalmarktrentes

May 24, 2025

Euro Boven 1 08 Wat Betekenen De Stijgende Kapitaalmarktrentes

May 24, 2025 -

130 Years After Injustice French Parliament Considers Dreyfus Promotion

May 24, 2025

130 Years After Injustice French Parliament Considers Dreyfus Promotion

May 24, 2025 -

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025 -

80 Millio Forintos Extrak Porsche 911 Atalakitas

May 24, 2025

80 Millio Forintos Extrak Porsche 911 Atalakitas

May 24, 2025 -

Is A Wall Street Revival On The Horizon And What Does It Mean For The Dax

May 24, 2025

Is A Wall Street Revival On The Horizon And What Does It Mean For The Dax

May 24, 2025

Latest Posts

-

Apple Stock And Tariffs Assessing The Risks To Buffetts Portfolio

May 24, 2025

Apple Stock And Tariffs Assessing The Risks To Buffetts Portfolio

May 24, 2025 -

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025

Analysts 254 Apple Stock Prediction Time To Buy

May 24, 2025 -

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025

Apple Stock 200 Entry Point Before 254 Target

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025