European Futures Up, US Futures Down: Swissquote Bank's Market Analysis

Table of Contents

European Futures Surge: Factors Contributing to the Rise

Positive Economic Indicators Fuel European Market Growth

Recent economic data releases paint a positive picture for the Eurozone. Strong GDP growth figures from major economies like Germany and France signal a robust recovery. Positive investor sentiment towards the Eurozone is further fueled by:

- Stronger-than-expected GDP growth: Preliminary estimates suggest GDP growth exceeding initial projections, indicating a healthy economic expansion.

- Controlled inflation: While inflation remains a concern globally, the Eurozone has seen relatively controlled inflation rates compared to the US, boosting investor confidence.

- Resilient consumer spending: Consumer spending remains relatively strong, indicating continued economic activity and fueling market optimism.

These positive economic indicators contribute significantly to the rise in European futures, reflecting a belief in sustained European economic growth.

Geopolitical Stability Boosts European Market Confidence

The relative geopolitical stability within the European Union is also contributing to the positive market sentiment. The absence of major geopolitical shocks, coupled with the EU's efforts to maintain stability, creates a favorable investment climate. This stability translates into:

- Increased investor confidence: A stable geopolitical environment reduces uncertainty and encourages investment, leading to higher demand for European assets.

- Reduced risk aversion: Investors are less likely to pull out of European markets, contributing to the upward trend in futures.

- Foreign direct investment: The stability attracts foreign direct investment, further bolstering economic growth and market confidence.

US Futures Dip: Understanding the Downturn

Inflation Concerns Weigh on US Market Performance

Rising inflation rates continue to be a major concern impacting US investor sentiment. The Federal Reserve's efforts to combat inflation through monetary policy adjustments are creating uncertainty in the market.

- Aggressive interest rate hikes: The potential for further interest rate hikes by the Federal Reserve to curb inflation is dampening investor enthusiasm.

- Increased borrowing costs: Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate earnings.

- Reduced consumer spending: Inflation erodes purchasing power, leading to reduced consumer spending and impacting overall economic activity.

These factors contribute significantly to the downturn observed in US futures markets.

Supply Chain Disruptions Impact US Economic Outlook

Persistent supply chain disruptions continue to weigh on the US economic outlook. The lingering effects of the pandemic, geopolitical events, and other logistical challenges are impacting various sectors.

- Increased production costs: Supply chain bottlenecks lead to increased production costs, reducing profitability for businesses and impacting investor confidence.

- Shortages of goods: Supply chain disruptions result in shortages of goods, leading to higher prices and reduced consumer spending.

- Uncertainty in the manufacturing sector: The volatility in the supply chain creates uncertainty for businesses, leading to reduced investment and impacting economic growth.

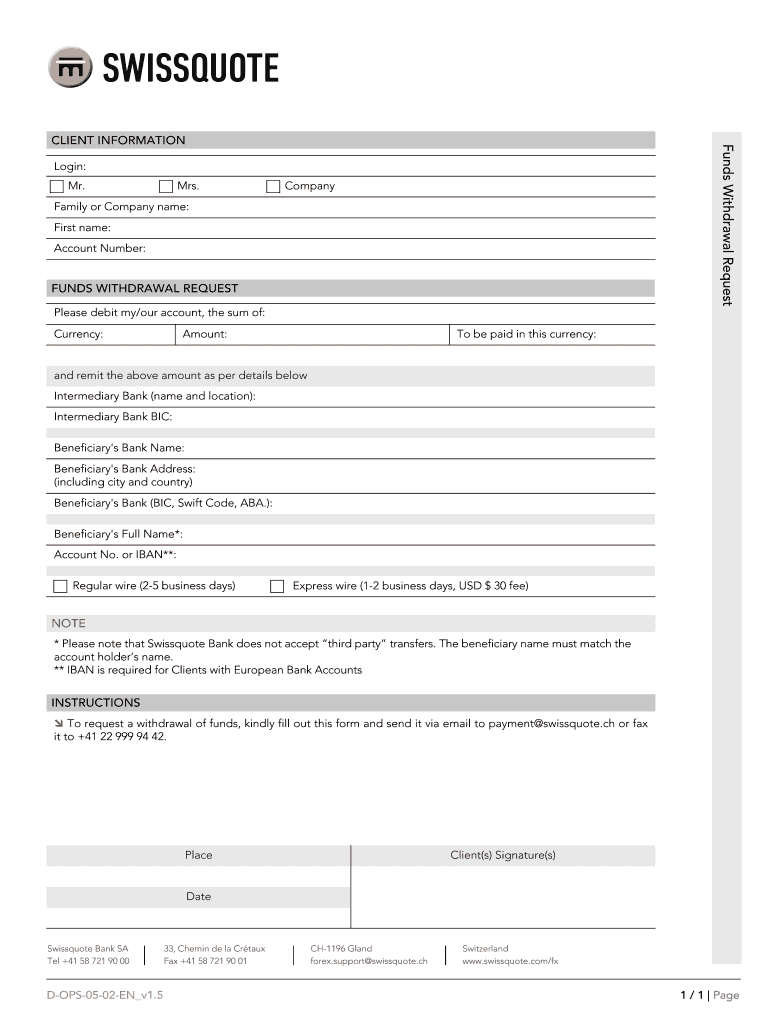

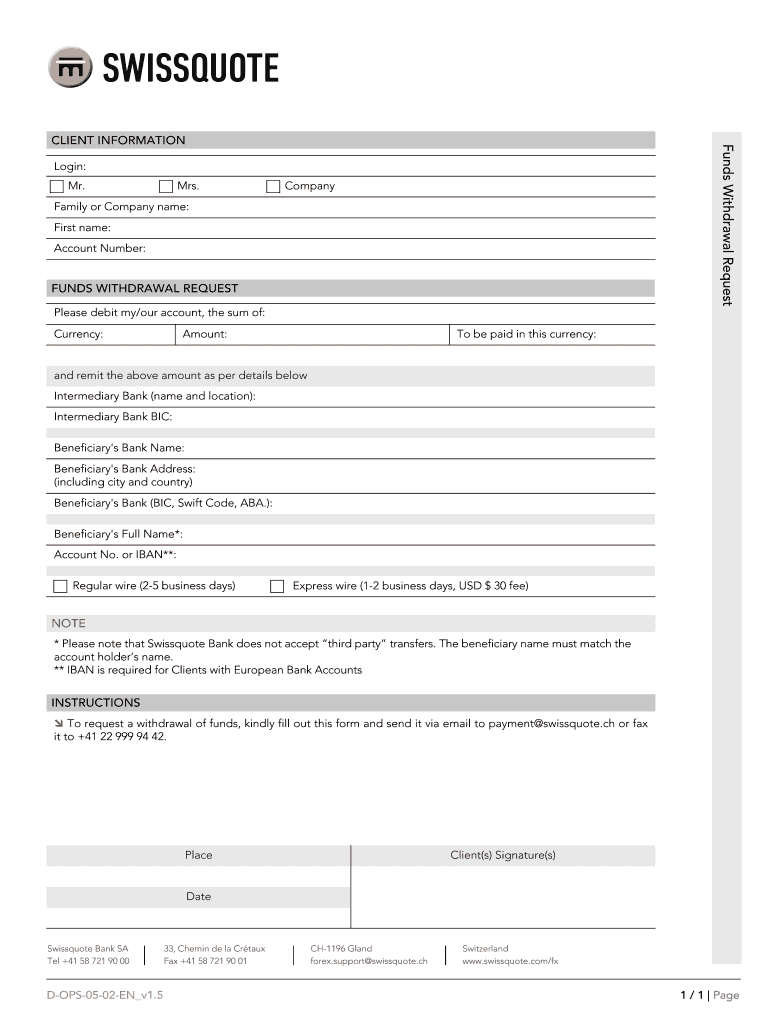

Swissquote Bank's Perspective and Trading Strategies

Expert Insights from Swissquote Bank's Market Analysts

Swissquote Bank's market analysts offer a nuanced perspective on the current market dynamics. Their analysis highlights the significant divergence between the European and US markets, emphasizing the contrasting impacts of economic factors and geopolitical events. (Note: This section would ideally include specific quotes or excerpts from Swissquote Bank's reports, with proper attribution.) Their forecasts suggest that the current trends might persist in the short to medium term, but a careful watch on economic indicators is necessary.

Potential Trading Opportunities and Risk Management

The current market conditions present both opportunities and risks. Investors can potentially profit from the divergence between European and US futures, but careful risk management is crucial.

- Diversification: Diversifying investments across different asset classes and geographies is essential to mitigate risk.

- Hedging strategies: Employing hedging strategies can help protect against potential losses in volatile markets.

- Careful analysis: Thorough analysis of market trends and economic indicators is essential for informed investment decisions.

Conclusion

The contrasting performances of European and US futures markets highlight the complexities of global finance. While positive economic indicators and geopolitical stability fuel the rise in European futures, inflation concerns and supply chain disruptions contribute to the downturn in US futures. Swissquote Bank's analysis provides valuable insights into these trends, highlighting potential trading opportunities and emphasizing the importance of risk management. To make informed decisions regarding your European futures and US futures investments, stay updated on the latest market analysis from Swissquote Bank. Visit their website for more detailed information on market analysis and trading strategies and gain a competitive edge in today's dynamic markets.

Featured Posts

-

Cliffs Pavilion Cinderella Pantomime Rylan Clark To Star

May 19, 2025

Cliffs Pavilion Cinderella Pantomime Rylan Clark To Star

May 19, 2025 -

Iran Three Death Sentences For Mosque Attacks

May 19, 2025

Iran Three Death Sentences For Mosque Attacks

May 19, 2025 -

Final Destination Bloodline Director Reveals A Game Changing Twist

May 19, 2025

Final Destination Bloodline Director Reveals A Game Changing Twist

May 19, 2025 -

S Fur Nin Eurovision 2025 Soezcuesue Olmasi Az Rbaycan Uecuen N L R D Yis C K

May 19, 2025

S Fur Nin Eurovision 2025 Soezcuesue Olmasi Az Rbaycan Uecuen N L R D Yis C K

May 19, 2025 -

New Jersey To Host Legendary Crooners Last Performance

May 19, 2025

New Jersey To Host Legendary Crooners Last Performance

May 19, 2025