Executive Chair And Sovereign Wealth Fund Make Offer For InterRent REIT

Table of Contents

Who Made the Offer and Why?

The offer for InterRent REIT comes from a powerful partnership: a prominent Executive Chair and a substantial Sovereign Wealth Fund. While specific details surrounding the exact identities might still be emerging, understanding their motivations is crucial to analyzing the deal's success.

InterRent REIT Bidders: The involvement of a powerful Executive Chair suggests a deep understanding of InterRent REIT’s operational intricacies and potential for growth. This inside knowledge could significantly influence the success of the acquisition strategy. The Sovereign Wealth Fund, likely motivated by diversification within their real estate portfolio and access to a stable, high-yield investment, adds considerable financial clout.

- Background on the Executive Chair: Further investigation is needed to uncover the full history of the Executive Chair's involvement with InterRent REIT or similar entities. This background check will shed light on their strategic vision and potential long-term plans for the REIT.

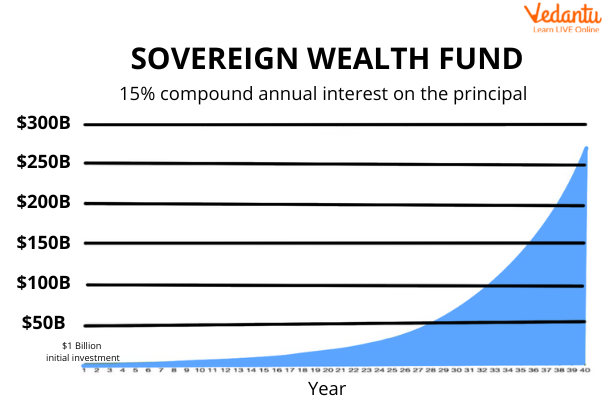

- Sovereign Wealth Fund Investment Strategy: Sovereign Wealth Funds often seek stable, long-term investments with predictable cash flows. InterRent REIT, with its established portfolio of rental properties, fits this profile perfectly. Understanding the fund's overall investment philosophy will offer insights into their rationale for this acquisition.

- Acquisition Rationale: The strategic rationale for this acquisition likely rests on a combination of factors. Diversification of the Sovereign Wealth Fund's portfolio is a key consideration. Furthermore, the existing management team’s experience, coupled with the potential synergies between the two entities, presents a compelling opportunity for enhanced profitability and growth.

- Potential Benefits for the Sovereign Wealth Fund: The acquisition presents the Sovereign Wealth Fund with an opportunity to gain exposure to a relatively stable and growing sector, mitigating risks associated with other volatile investment classes. The predictable cash flow from rental income provides a stable, long-term return on investment.

InterRent REIT's Response and Potential Outcomes

InterRent REIT's official statement regarding the takeover bid is eagerly awaited. The board of directors will need to carefully consider the offer, weighing its potential benefits against other strategic options.

- InterRent REIT's Official Response: The company's response will set the tone for the negotiations. They may accept the offer outright, negotiate a higher price, or reject it altogether, leading to further complexities.

- Potential Benefits and Drawbacks for Shareholders: Accepting the offer might deliver a significant premium to shareholders' current share price. However, a potential counter-offer might yield even higher returns, necessitating a delicate balancing act for the board. The long-term growth potential under current management versus the short-term financial gain from an immediate sale must be considered.

- Legal and Regulatory Hurdles: The acquisition process will involve several legal and regulatory hurdles, including shareholder approvals, regulatory reviews, and antitrust considerations. The timeline for completing these steps will be a significant factor in determining the deal's ultimate success.

- Alternative Outcomes: A bidding war from competing investors interested in acquiring InterRent REIT is certainly a possibility, which could further inflate the final acquisition price.

Market Implications and Future Outlook

This takeover bid has already sent ripples through the REIT market, impacting investor sentiment and share prices across the sector. The long-term impact on InterRent REIT and the broader market warrants careful consideration.

- Immediate Impact on InterRent REIT's Share Price: News of the offer has likely led to an immediate increase in InterRent REIT’s share price, reflecting investor optimism about a lucrative deal.

- Long-Term Effects on Company Performance: The acquisition's success will depend on several factors, including the integration of the two entities, management changes, and market conditions. A successful integration will be crucial for maintaining a positive outlook.

- Implications for the REIT Market and Real Estate Sector: This acquisition could influence other REITs and trigger a wave of mergers and acquisitions within the Canadian real estate sector. Market analysts will be keen to observe similar transactions in the coming months.

- Expert Opinions and Market Forecasts: Market analysts and investment banks are expected to weigh in on the deal, offering their forecasts and perspectives on the deal's long-term consequences.

Conclusion

The offer for InterRent REIT by a powerful Executive Chair and a Sovereign Wealth Fund represents a significant event in the Canadian REIT market and broader real estate sector. The potential outcomes—acceptance, rejection, or a bidding war—will have far-reaching implications for shareholders, the company's future trajectory, and the overall market. This deal highlights the significant investment interest in the Canadian real estate sector and the evolving landscape of REIT acquisitions.

To stay informed about the ongoing developments of this significant InterRent REIT takeover bid and other key REIT acquisitions involving Sovereign Wealth Fund Investments, be sure to follow our publication for further updates and in-depth analysis.

Featured Posts

-

Escape French Traffic Jams Alternative Routes For Smooth Travel This Weekend

May 29, 2025

Escape French Traffic Jams Alternative Routes For Smooth Travel This Weekend

May 29, 2025 -

Opec Meeting Crucial Oil Production Quota Decisions Expected

May 29, 2025

Opec Meeting Crucial Oil Production Quota Decisions Expected

May 29, 2025 -

Bay Area Prep Poll Vote For Your High School Athlete Of The Week

May 29, 2025

Bay Area Prep Poll Vote For Your High School Athlete Of The Week

May 29, 2025 -

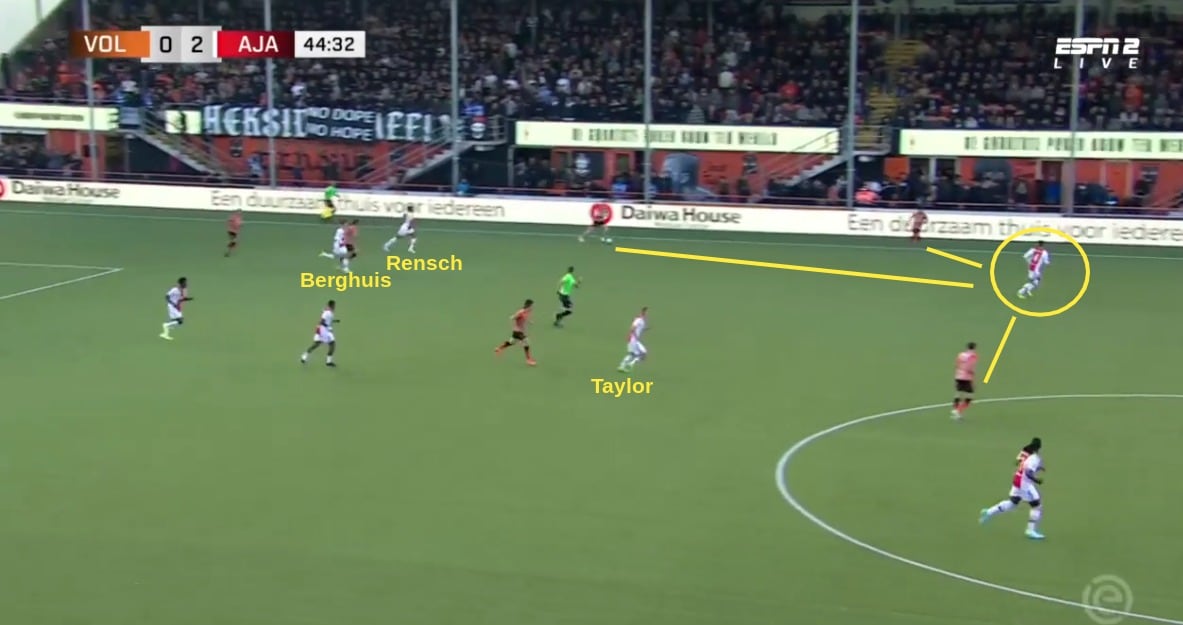

Slot Naar Ajax Voor En Nadelen Van De Potentiele Aanstelling

May 29, 2025

Slot Naar Ajax Voor En Nadelen Van De Potentiele Aanstelling

May 29, 2025 -

Prediksi Cuaca Jawa Timur Hujan Berlanjut 24 Maret

May 29, 2025

Prediksi Cuaca Jawa Timur Hujan Berlanjut 24 Maret

May 29, 2025