Extreme Price Hike: Broadcom's VMware Deal Faces Backlash From AT&T

Table of Contents

The Financial Ramifications of Broadcom's VMware Acquisition

Broadcom's $61 billion acquisition of VMware is a staggering investment, impacting not only Broadcom's financial position but also the bottom line of countless businesses reliant on VMware's virtualization technology. The acquisition's true cost extends far beyond the initial purchase price; the subsequent anticipated price hikes for VMware licensing are the primary source of contention.

For AT&T and other major telecom players, the increase in VMware licensing costs represents a significant budgetary burden. The projected percentage increase remains a point of contention, but industry analysts predict a substantial rise, potentially impacting operational budgets and strategic investments.

- Expected percentage increase in VMware licensing fees: Estimates range from a significant double-digit percentage increase to potentially even higher figures, depending on contract terms and service levels.

- Potential budget impact on AT&T's operations: This price hike could force AT&T to re-evaluate its IT spending, potentially delaying or canceling other projects and impacting its overall competitiveness.

- Broadcom's justification for the price hike: While Broadcom has yet to publicly detail a specific justification for the price increase, it's likely linked to the increased costs associated with the acquisition and the integration of VMware's technology into its broader portfolio. The consolidation of market share is also a major contributing factor.

AT&T's Concerns and Public Opposition

AT&T has openly expressed its strong opposition to the Broadcom's VMware deal, citing concerns about reduced competition and the potential for monopolistic practices. Their official statements emphasize the negative impact this acquisition could have on the overall telecom industry.

AT&T's primary concern centers around the potential for Broadcom to leverage its expanded market power to stifle innovation and increase prices across the board. This concern is particularly acute in the already highly competitive telecom sector.

- Specific concerns about reduced competition: The merging of two major players could lead to a lack of competitive alternatives in the virtualization market, limiting choices for businesses and ultimately hindering technological advancements.

- Potential negative impacts on innovation: Reduced competition can stifle innovation, leading to slower development and fewer choices for customers. This lack of incentive could have far-reaching effects on the overall quality and affordability of telecom services.

- AT&T's lobbying efforts to influence regulatory decisions: AT&T is actively engaging in lobbying efforts, aiming to sway regulatory decisions and ensure the deal undergoes thorough scrutiny before final approval.

Regulatory Scrutiny and Antitrust Investigations

Given the scale of the acquisition and the potential for anti-competitive behavior, the Broadcom's VMware deal is likely to face intense regulatory scrutiny and antitrust investigations. Several antitrust laws, both domestically and internationally, could be applied to assess the deal's potential impact on market competition.

The outcome of these investigations remains uncertain, but potential remedies could range from requiring divestitures of certain VMware assets to even blocking the deal entirely. Similar deals in the past have faced significant regulatory hurdles, providing a precedent for the potential challenges Broadcom could encounter.

- Relevant antitrust laws that could apply: The Sherman Antitrust Act in the US, as well as comparable legislation in other jurisdictions, will be heavily scrutinized in relation to this deal.

- Previous examples of similar deals facing regulatory challenges: Examining past mergers and acquisitions that faced antitrust challenges provides valuable insights into the potential outcomes for Broadcom's VMware deal.

- Possible remedies that could be imposed: Depending on the findings of the investigations, remedies could include forced asset sales, behavioral remedies, or a complete blocking of the merger.

Impact on the Telecom Industry and Consumers

The implications of Broadcom's VMware deal extend far beyond the immediate stakeholders. The telecom industry, as a whole, could face significant changes, with potentially negative consequences for consumers. The increased licensing costs are likely to translate into higher prices for telecom services for both businesses and individuals.

This price increase could stifle innovation within the sector as companies grapple with rising costs. The long-term impact could reshape the competitive landscape of the telecom industry, potentially favoring larger players with greater financial resources.

- Potential effects on service costs for businesses and individuals: Higher VMware licensing costs are likely to be passed on to consumers, resulting in potentially increased prices for internet, phone, and other telecommunication services.

- Impact on innovation and competition within the telecom sector: The consolidation of market power could stifle innovation and lead to a less competitive market, ultimately harming consumers.

- Long-term implications for the industry’s landscape: The deal’s long-term effects on the telecom industry's structure and competitiveness remain uncertain but hold significant implications.

The Future of Broadcom's VMware Deal and Price Hikes

In conclusion, Broadcom's VMware acquisition is facing significant backlash due to the anticipated price hikes and concerns regarding market dominance. AT&T's opposition highlights the potential negative consequences for the telecom industry and consumers. The ongoing regulatory scrutiny and antitrust investigations add further uncertainty to the deal's future. The potential for increased service costs and reduced competition underscores the gravity of this situation.

Stay informed about the ongoing developments surrounding the Broadcom's VMware deal and its price hikes. Further research into related antitrust cases and regulatory actions will be crucial in understanding the long-term implications. We encourage you to share your opinions and concerns about the impact of this acquisition. The future of this deal, and its effect on the telecom market, is far from certain.

Featured Posts

-

Uk Government To Restrict Visas Impact On Certain Nationalities

May 09, 2025

Uk Government To Restrict Visas Impact On Certain Nationalities

May 09, 2025 -

The Buzz Kuzmas Comments On Tatums Viral Instagram Picture

May 09, 2025

The Buzz Kuzmas Comments On Tatums Viral Instagram Picture

May 09, 2025 -

De Inzet Van Brekelmans Om India Als Partner Te Behouden

May 09, 2025

De Inzet Van Brekelmans Om India Als Partner Te Behouden

May 09, 2025 -

Support Grows For American Samoan Family Accused Of Voter Fraud In Whittier

May 09, 2025

Support Grows For American Samoan Family Accused Of Voter Fraud In Whittier

May 09, 2025 -

U S Federal Reserve A Rate Hold Decision In The Face Of Economic Uncertainty

May 09, 2025

U S Federal Reserve A Rate Hold Decision In The Face Of Economic Uncertainty

May 09, 2025

Latest Posts

-

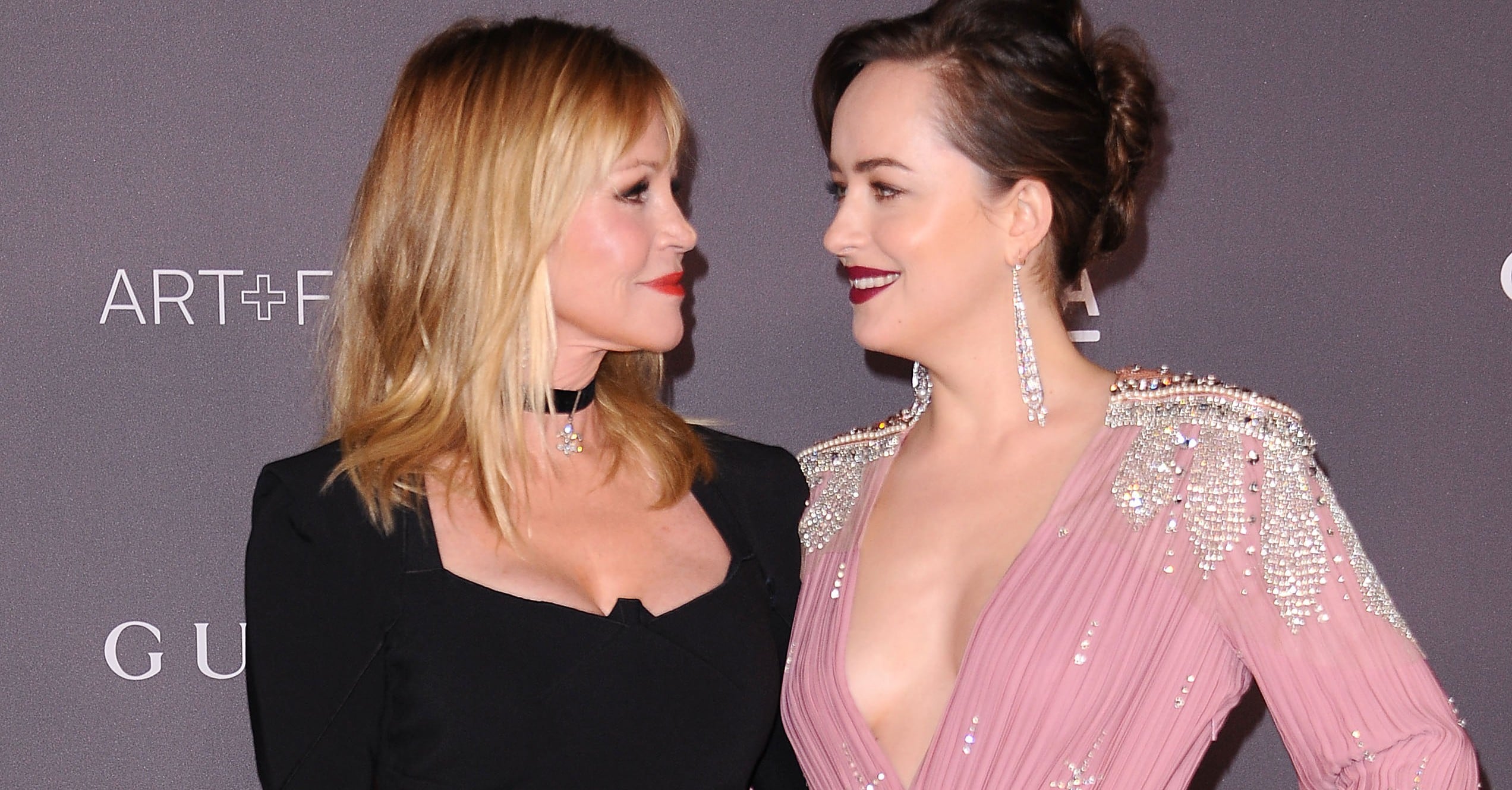

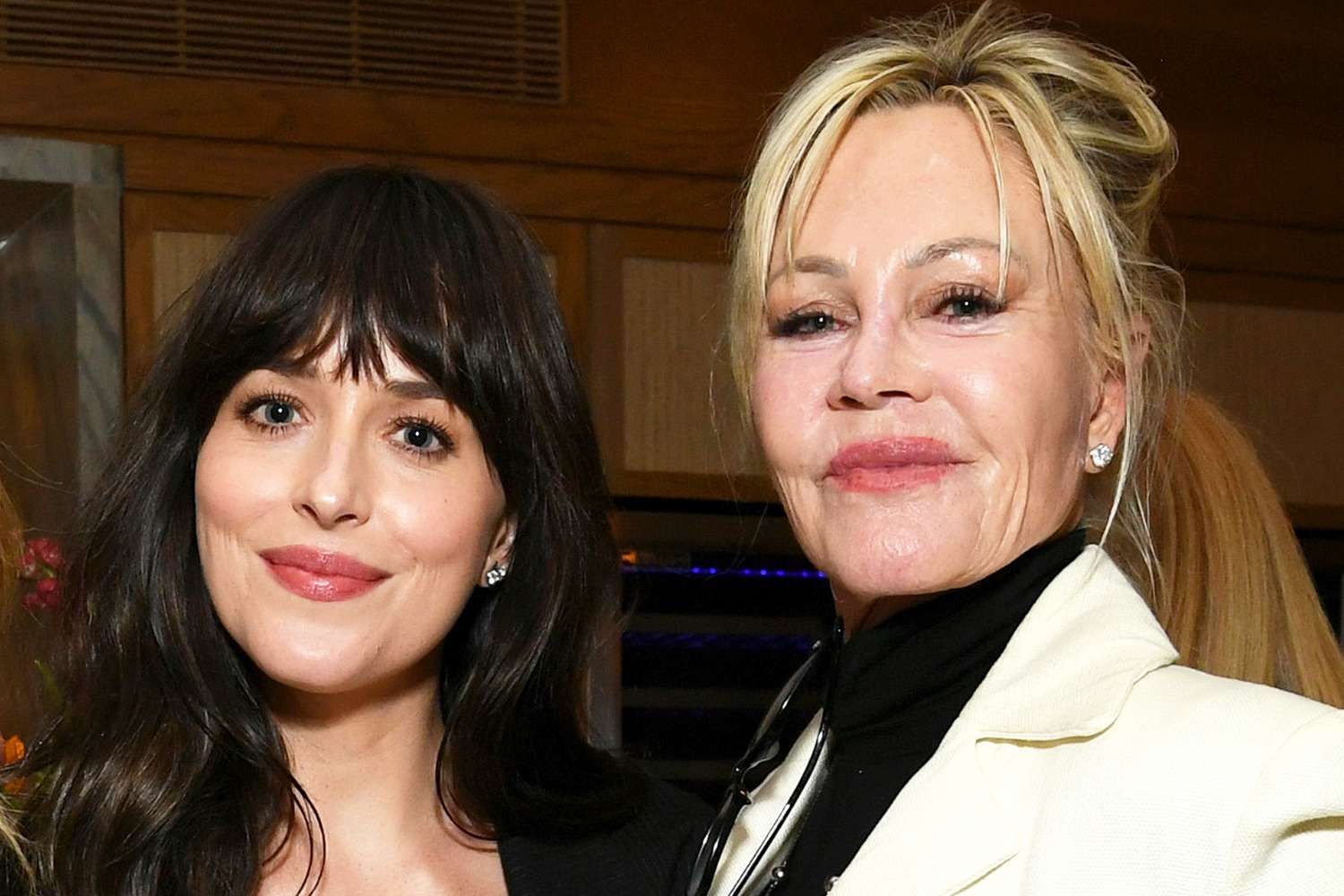

Family Affair Dakota Johnsons Materialist Red Carpet Appearance

May 10, 2025

Family Affair Dakota Johnsons Materialist Red Carpet Appearance

May 10, 2025 -

Dakota Johnsons Materialist Premiere Family Support

May 10, 2025

Dakota Johnsons Materialist Premiere Family Support

May 10, 2025 -

Melanie Griffith And Siblings Support Dakota Johnson At Film Premiere

May 10, 2025

Melanie Griffith And Siblings Support Dakota Johnson At Film Premiere

May 10, 2025 -

Family Support For Dakota Johnson At Materialist Los Angeles Premiere

May 10, 2025

Family Support For Dakota Johnson At Materialist Los Angeles Premiere

May 10, 2025 -

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 10, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 10, 2025