U.S. Federal Reserve: A Rate Hold Decision In The Face Of Economic Uncertainty

Table of Contents

The U.S. economy navigates choppy waters. Persistent inflation battles against a surprisingly resilient job market, creating a complex economic landscape that demands careful navigation. The Federal Reserve's recent decision to hold interest rates, amidst this uncertainty, has sparked considerable debate and analysis. This article delves into the key factors influencing the Fed's decision, examining inflation, employment data, global economic headwinds, and the potential implications for future rate adjustments.

<h2>Inflationary Pressures and the Fed's Dilemma</h2>

<h3>Persistent Inflation: A Stubborn Challenge</h3>

The current inflation rate remains a significant concern for the Federal Reserve. High inflation erodes purchasing power, impacting consumer spending and business investment.

- CPI Data: Recent Consumer Price Index (CPI) reports show inflation stubbornly above the Fed's 2% target, indicating that price increases are not cooling as quickly as hoped.

- Core Inflation: Even excluding volatile food and energy prices, core inflation remains elevated, suggesting underlying inflationary pressures.

- Contributing Factors: Supply chain disruptions, lingering effects of the pandemic, and the ongoing war in Ukraine have all contributed to persistent inflationary pressures. Energy prices also continue to fluctuate, adding to the volatility.

The persistence of inflation presents a formidable challenge for the Fed. Lowering inflation too aggressively risks triggering a recession, while allowing inflation to continue unchecked can lead to further economic instability. This delicate balancing act necessitates careful consideration of all economic indicators.

<h3>The Fed's Mandate: Balancing Competing Goals</h3>

The Federal Reserve operates under a dual mandate: achieving price stability and maximum employment. These two goals often conflict, forcing the Fed to make difficult choices.

- History of the Dual Mandate: The dual mandate has guided monetary policy for decades, but its implementation has been tested throughout various economic cycles.

- Challenges in Balancing Price Stability and Employment: Lowering inflation often requires slowing economic growth, which can lead to job losses. Conversely, maintaining strong employment growth can fuel further inflation.

The Fed's decision to hold rates reflects this inherent tension. A rate hike could curb inflation but potentially stifle employment growth. Maintaining the current rate allows the Fed to assess the impact of previous rate hikes while monitoring economic data for signs of either cooling inflation or weakening employment.

<h2>Employment Data and Economic Growth</h2>

<h3>Job Market Strength: A Mixed Blessing</h3>

The U.S. labor market remains surprisingly robust despite economic headwinds.

- Unemployment Rate: The unemployment rate remains historically low, indicating a strong job market.

- Participation Rate: While the participation rate has shown some improvement, it remains below pre-pandemic levels, suggesting potential untapped labor resources.

- Wage Growth Statistics: Wage growth, though moderating slightly, continues to outpace inflation in some sectors, potentially contributing to inflationary pressures.

A strong job market is generally positive for the economy, but it also adds complexity to the Fed’s inflation fight. Strong wage growth can fuel further inflation, creating a dilemma for policymakers.

<h3>GDP Growth and Economic Forecasts: Uncertain Outlook</h3>

Recent GDP growth figures have been mixed, painting an uncertain picture for the future.

- Recent GDP Growth Numbers: Recent quarters have shown varying rates of GDP growth, reflecting the volatility of the current economic environment.

- Predictions from Economists and Financial Institutions: Forecasts for future economic growth vary widely among economists and financial institutions, underscoring the uncertainty surrounding the economic outlook.

The Fed's decision to hold rates allows time to assess the trajectory of GDP growth. A rate hold might support continued, albeit slower, economic expansion, while avoiding a potential recessionary spiral.

<h2>Geopolitical Factors and Global Economic Uncertainty</h2>

<h3>Global Economic Slowdown: Ripple Effects on the U.S.</h3>

Global economic factors significantly influence the U.S. economy and the Fed's policy decisions.

- Impact of Global Events on Inflation: The war in Ukraine, energy crises in Europe, and ongoing supply chain disruptions contribute to global inflation, impacting U.S. prices.

- Impact of Global Events on Supply Chains: Global instability continues to disrupt supply chains, adding to inflationary pressures and economic uncertainty.

- Impact of Global Events on Investor Sentiment: Geopolitical uncertainty can negatively impact investor sentiment, affecting investment decisions and economic activity.

The interconnectedness of the global economy makes it challenging for the Fed to isolate the U.S. from external shocks. Global uncertainty adds another layer of complexity to the already challenging task of managing the domestic economy.

<h3>Potential Future Rate Adjustments: A Cautious Approach</h3>

Based on the current economic landscape and the Fed’s communication, future rate adjustments remain uncertain.

- Market Expectations: Financial markets are closely watching economic data and Fed statements to gauge the likelihood of future rate changes.

- Statements from Fed Officials: Statements from Fed officials often provide clues about the central bank's future policy intentions, but these can be subject to interpretation.

The Fed is likely to adopt a data-dependent approach, carefully monitoring economic indicators before making any further rate adjustments. The path of future monetary policy will depend on the evolution of inflation, employment, and global economic conditions.

<h2>Conclusion: Navigating Uncertainty with the U.S. Federal Reserve</h2>

The Federal Reserve's decision to hold interest rates reflects the complex interplay of persistent inflation, a robust job market, and significant global economic uncertainty. The decision allows the Fed to assess the impact of prior rate hikes and gather more data before potentially enacting further adjustments. The implications of this rate hold remain to be seen, but it underscores the challenges faced by central bankers in navigating a turbulent economic environment. The potential short-term consequences include continued inflationary pressures, while long-term implications depend heavily on the future trajectory of economic growth and global stability. Stay updated on the latest developments from the U.S. Federal Reserve and the implications of their interest rate decisions for your financial planning. Continue following our coverage of the U.S. Federal Reserve’s monetary policy to navigate economic uncertainty.

Featured Posts

-

Fast Paced Fun St Albert Dinner Theatres Latest Farcical Comedy

May 09, 2025

Fast Paced Fun St Albert Dinner Theatres Latest Farcical Comedy

May 09, 2025 -

Ra Soat Chat Che Co So Giu Tre Tu Nhan Xu Ly Nghiem Bao Hanh Tre Em

May 09, 2025

Ra Soat Chat Che Co So Giu Tre Tu Nhan Xu Ly Nghiem Bao Hanh Tre Em

May 09, 2025 -

Driver Charged After Fatal Collision Killing Two In Elizabeth City

May 09, 2025

Driver Charged After Fatal Collision Killing Two In Elizabeth City

May 09, 2025 -

Bodycam Video Police Rescue Toddler Choking On Food

May 09, 2025

Bodycam Video Police Rescue Toddler Choking On Food

May 09, 2025 -

Trumps 100 Day Economic Plan And Its Potential Impact On Bitcoins Price

May 09, 2025

Trumps 100 Day Economic Plan And Its Potential Impact On Bitcoins Price

May 09, 2025

Latest Posts

-

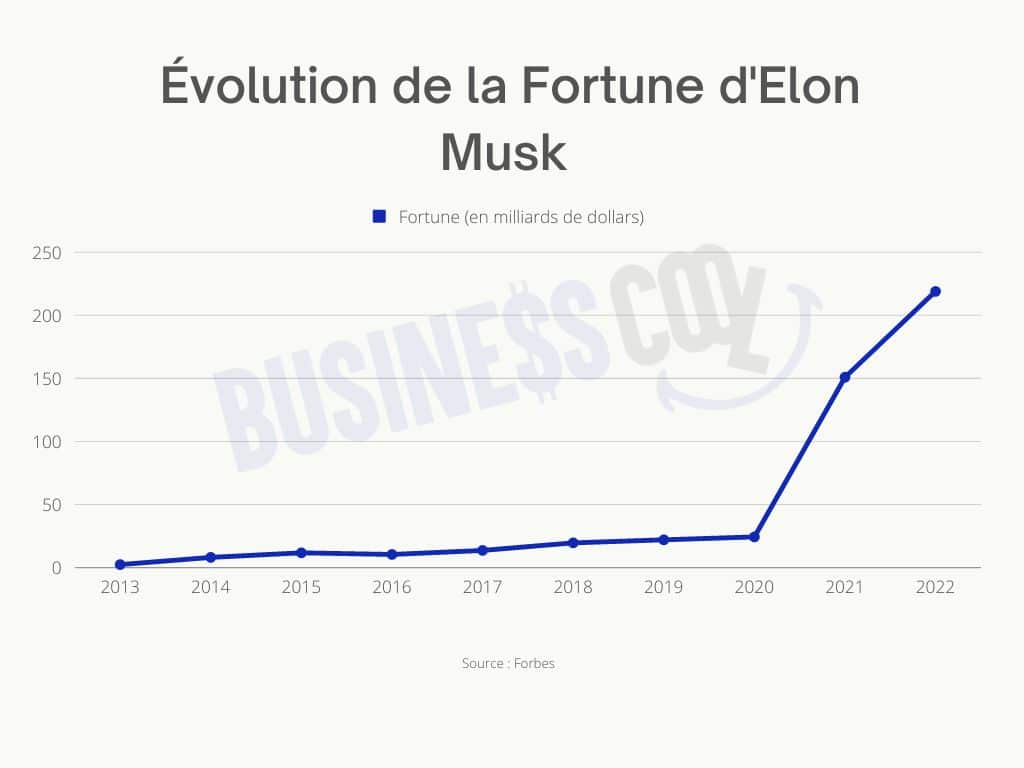

Elon Musks Path To Riches Key Investments And Entrepreneurial Strategies

May 10, 2025

Elon Musks Path To Riches Key Investments And Entrepreneurial Strategies

May 10, 2025 -

The Economic Impact Of Post Liberation Day Tariffs On Trumps Billionaire Circle

May 10, 2025

The Economic Impact Of Post Liberation Day Tariffs On Trumps Billionaire Circle

May 10, 2025 -

The Elon Musk Fortune Examining The Business Strategies Of The Worlds Richest Man

May 10, 2025

The Elon Musk Fortune Examining The Business Strategies Of The Worlds Richest Man

May 10, 2025 -

Liberation Day Tariffs The Financial Fallout For Trumps Wealthy Associates

May 10, 2025

Liberation Day Tariffs The Financial Fallout For Trumps Wealthy Associates

May 10, 2025 -

Elon Musks Financial Empire From Pay Pal To Space X And Beyond

May 10, 2025

Elon Musks Financial Empire From Pay Pal To Space X And Beyond

May 10, 2025