Facing A Student Loan Default? Navigating The Government's Aggressive Actions

Table of Contents

Recognizing the Signs of Impending Student Loan Default

Student loan default occurs when you fail to make payments on your federal student loans for 270 days or more. The consequences are severe, impacting your credit score, future borrowing capabilities, and even your wages. Ignoring warning signs can lead to a devastating financial situation.

- Missed Payments: Consistent missed payments are the clearest indicator. Even one missed payment can trigger warnings from your loan servicer.

- Forbearance Expiration: If you've been granted forbearance (a temporary pause on payments), failure to resume payments after the forbearance period ends puts you on the path to default.

- Collection Notices: Official notices from the government or collection agencies are serious warnings. These may include a "Notice of Default" or demands for immediate payment.

- Credit Report Impact: A significant drop in your credit score is a late sign, indicating that your loan servicer has reported your delinquency to the credit bureaus.

The impact of default extends beyond your credit score. Wage garnishment, tax refund offset, and even bank levies are all possible outcomes of student loan default. Your ability to secure loans, rent an apartment, or even get a job might be significantly affected.

Understanding the Government's Collection Tactics

The government employs various aggressive collection methods to recover defaulted student loans. These tactics can be overwhelming and financially devastating if you're unprepared.

- Wage Garnishment: A portion of your wages can be directly seized by the government to repay your debt.

- Tax Refund Offset: Your federal and state tax refunds can be used to pay down your student loan debt.

- Bank Levy: The government can seize funds directly from your bank account.

Despite the aggressive nature of these tactics, borrowers do possess legal rights. You have the right to dispute inaccuracies in your loan information and, in some cases, the right to a hearing. Understanding these rights is crucial in protecting yourself. Agencies involved in collections include the Department of Education, the Federal Student Aid (FSA), and private collection agencies working on behalf of the government.

Exploring Available Options to Avoid Student Loan Default

Before facing the consequences of default, explore available options to manage your student loan debt and avoid default.

- Income-Driven Repayment (IDR) Plans: IDR plans adjust your monthly payments based on your income and family size. Several plans exist, including Income-Contingent Repayment (ICR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

- Deferment: This option temporarily postpones your payments, but interest may still accrue on unsubsidized loans.

- Forbearance: Similar to deferment, forbearance temporarily suspends payments, but interest may accrue, potentially increasing your overall debt.

Finding the right repayment plan can be challenging. Fortunately, resources are available to help you navigate this process. The Federal Student Aid website (studentaid.gov) provides comprehensive information, and many non-profit organizations offer free or low-cost guidance.

Seeking Professional Help and Legal Advice

Navigating the complexities of student loan default can be daunting. Seeking professional help is often the best course of action.

- Credit Counselors: These professionals can help you create a budget, manage your debt, and negotiate with your loan servicer.

- Student Loan Attorneys: If you're facing legal action from the government, an attorney can represent your interests and protect your rights.

Numerous government resources and non-profit organizations offer free or low-cost assistance. Consulting a professional can be invaluable in negotiating more manageable repayment plans or defending against aggressive collection tactics. This can help prevent wage garnishment and other severe repercussions.

Conclusion: Taking Control of Your Student Loan Situation

Facing student loan default can have serious and long-lasting consequences. Understanding the signs of impending default, the government's collection tactics, and the available options for repayment are crucial steps in taking control of your financial future. By proactively seeking professional help and exploring solutions like income-driven repayment plans, you can avoid the devastating effects of student loan default and protect your credit and financial stability. Don't let student loan debt control your future. Take action today by exploring your options and seeking help from qualified professionals to manage your student loan debt effectively and avoid default.

Featured Posts

-

Cade Cunningham The Key To The Pistons Potential Knicks Playoff Spoiler

May 17, 2025

Cade Cunningham The Key To The Pistons Potential Knicks Playoff Spoiler

May 17, 2025 -

Peringatan Houthi Serangan Rudal Potensial Ke Dubai Dan Abu Dhabi

May 17, 2025

Peringatan Houthi Serangan Rudal Potensial Ke Dubai Dan Abu Dhabi

May 17, 2025 -

Fortnite Cowboy Bebop How To Get The Free Cosmetics

May 17, 2025

Fortnite Cowboy Bebop How To Get The Free Cosmetics

May 17, 2025 -

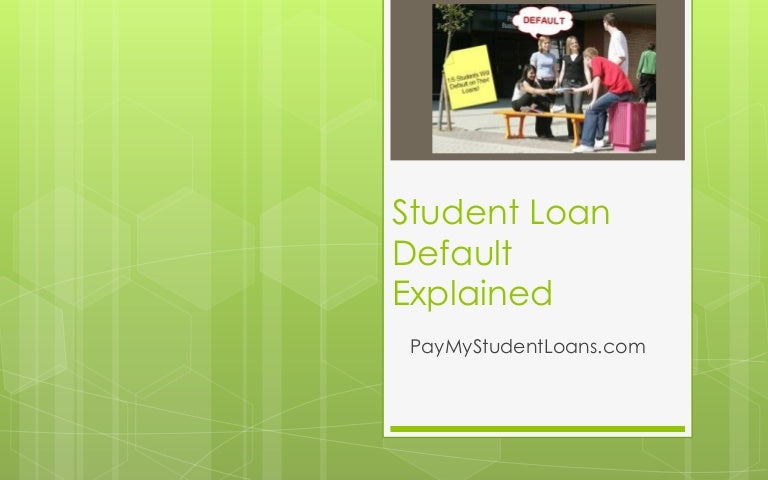

Investing In Ubers Autonomous Driving Technology Through Etfs

May 17, 2025

Investing In Ubers Autonomous Driving Technology Through Etfs

May 17, 2025 -

Columbia Universitys Legal Battle Responding To Allegations Of Harboring Undocumented Immigrants

May 17, 2025

Columbia Universitys Legal Battle Responding To Allegations Of Harboring Undocumented Immigrants

May 17, 2025