Investing In Uber's Autonomous Driving Technology Through ETFs

Table of Contents

Understanding Uber's Autonomous Vehicle Ambitions

Uber's foray into autonomous driving technology represents a significant bet on the future of transportation. Their Advanced Technologies Group (ATG) has been investing heavily in research and development, aiming to disrupt the ride-hailing and logistics industries. Uber's ATG isn't just about self-driving cars; it's about creating a comprehensive ecosystem of autonomous vehicles, potentially impacting everything from ride-sharing to delivery services.

Uber has formed key partnerships and collaborations within the self-driving car space, leveraging external expertise and technology. These partnerships help accelerate development and reduce the financial burden of this capital-intensive endeavor. However, the potential market disruption Uber's ATG could create is immense. Successfully deploying a large-scale autonomous fleet would revolutionize urban mobility and logistics.

- Uber's ATG's technological advancements and milestones: Uber has achieved significant milestones in autonomous driving technology, including millions of autonomous miles driven in testing programs.

- Uber's strategic goals for its autonomous vehicle program: Uber aims to integrate its autonomous vehicles seamlessly into its existing platform, improving efficiency and potentially reducing operating costs.

- Potential challenges and risks facing Uber's ATG: Competition from other tech giants and established automakers, regulatory hurdles, and the inherent technical challenges of autonomous driving pose significant risks.

Identifying Relevant ETFs for Exposure to Autonomous Driving

Directly investing in Uber's ATG is difficult, but Exchange Traded Funds (ETFs) offer a diversified and convenient solution. ETFs pool investments across multiple companies involved in self-driving technology, robotics, and artificial intelligence (AI), providing broad exposure to the sector's growth potential. This diversification mitigates risk associated with investing in a single company. Furthermore, ETFs offer lower costs and easier trading compared to individual stock purchases.

-

List of relevant ETFs (Examples - replace with current, relevant ETFs and their tickers):

- Technology Select Sector SPDR Fund (XLK): A broad technology ETF with exposure to companies involved in AI and autonomous vehicle technology.

- Invesco QQQ Trust (QQQ): Another technology-focused ETF with holdings in companies developing autonomous driving technologies. (Note: Check holdings carefully for specific relevance).

- Global X Robotics & Artificial Intelligence ETF (BOTZ): This ETF focuses specifically on companies involved in robotics and AI, which are crucial components of autonomous driving systems.

-

Expense Ratios and Holdings: Carefully compare the expense ratios (fees) of different ETFs and examine their holdings to ensure alignment with your investment goals. Look for ETFs with a high weighting in companies related to automotive technology, sensors, mapping software, or AI.

-

ETFs with a specific focus on robotics or AI: These ETFs offer indirect exposure to companies that supply critical components and technologies to the autonomous driving sector, including those potentially supplying to Uber's ATG.

Analyzing ETF Holdings for Uber-Related Exposure

Determining an ETF's indirect exposure to Uber's autonomous driving technology requires careful analysis of its holdings. While you won't find Uber directly listed, look for companies supplying crucial technologies: sensor manufacturers, software developers for autonomous systems, mapping companies providing high-definition maps for self-driving vehicles, and AI companies contributing to the underlying algorithms.

- Step-by-step guide on checking an ETF's portfolio composition: Most ETF providers provide detailed portfolio breakdowns on their websites. Alternatively, financial news websites offer ETF screening tools to analyze holdings.

- Examples of companies that could benefit from the success of autonomous driving technology: Companies like Nvidia (GPU technology), Mobileye (autonomous driving systems), and various sensor manufacturers are examples of indirect beneficiaries.

- Cautionary note about indirect exposure: Remember, indirect exposure doesn't guarantee profits from Uber's ATG success. The correlation might be weak, and market forces will influence ETF performance independently of Uber’s progress.

Risk Management and Diversification Strategies

Investing in autonomous vehicle technology carries significant risks. Technological challenges, regulatory uncertainty, and intense competition create a volatile investment environment. Diversification is crucial to mitigate these risks.

- Potential risks associated with investing in autonomous driving technology: Regulatory changes, technological setbacks, and the potential for slower-than-expected market adoption pose substantial risks.

- Strategies for diversification: Don't put all your eggs in one basket. Diversify across different ETFs, asset classes (stocks, bonds), and sectors to reduce your overall portfolio risk.

- Importance of conducting thorough research before investing: Always conduct thorough due diligence before making any investment decisions. Consult with a financial advisor for personalized guidance.

Conclusion: Navigating the Future of Transportation: Your Guide to Investing in Uber's Autonomous Driving Technology Through ETFs

This article explored a strategic approach to investing in Uber's autonomous driving technology through ETFs. We highlighted Uber's ambitious goals in the autonomous driving space and explained how ETFs offer diversified exposure to the broader autonomous vehicle ecosystem. Remember, while ETFs provide a convenient and diversified way to participate in this exciting sector, thorough research and risk management remain paramount. By carefully analyzing ETF holdings and implementing robust diversification strategies, you can navigate the complexities of this evolving market. Start your research today by exploring the ETFs mentioned above and consider them as part of a well-diversified investment portfolio focused on investing in Uber's autonomous driving technology through ETFs. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Reddit Down For Thousands Worldwide Service Issues

May 17, 2025

Reddit Down For Thousands Worldwide Service Issues

May 17, 2025 -

Angel Reeses Post Chicago Sky Game Statement A Full Breakdown

May 17, 2025

Angel Reeses Post Chicago Sky Game Statement A Full Breakdown

May 17, 2025 -

Mission Impossible China Release Date Confirmed By Paramount

May 17, 2025

Mission Impossible China Release Date Confirmed By Paramount

May 17, 2025 -

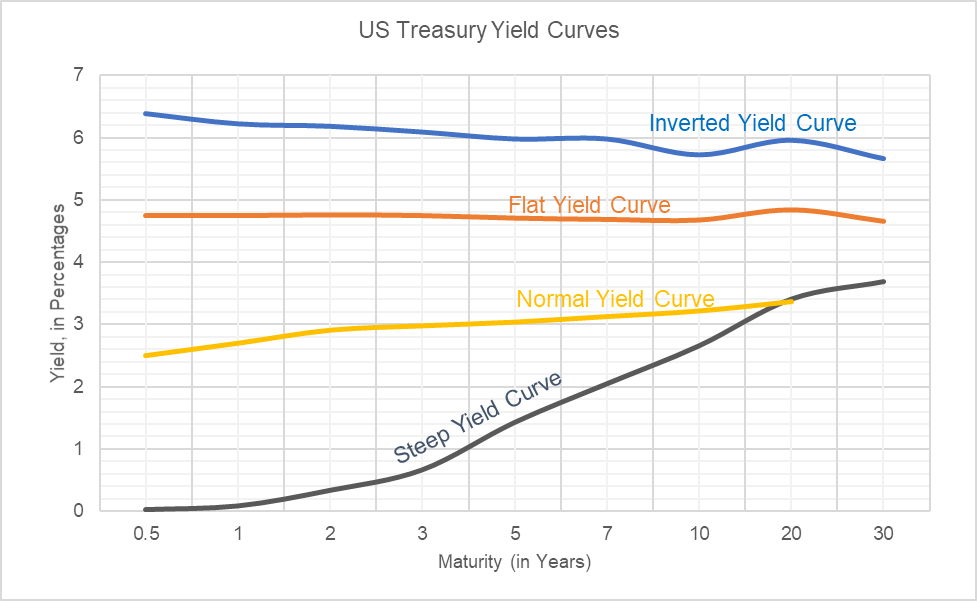

Japans Steep Bond Curve A Deep Dive Into Investor Sentiment And Economic Outlook

May 17, 2025

Japans Steep Bond Curve A Deep Dive Into Investor Sentiment And Economic Outlook

May 17, 2025 -

New Orleans Jazz Fest Dates Tickets And Must See Performances

May 17, 2025

New Orleans Jazz Fest Dates Tickets And Must See Performances

May 17, 2025