Falling Behind On Student Loans: Protecting Your Credit Score

Table of Contents

Understanding the Impact of Delinquent Student Loans on Your Credit

Falling behind on your student loan payments can severely damage your credit score and have long-lasting financial repercussions. Understanding the mechanics of this damage is the first step towards protecting your credit health.

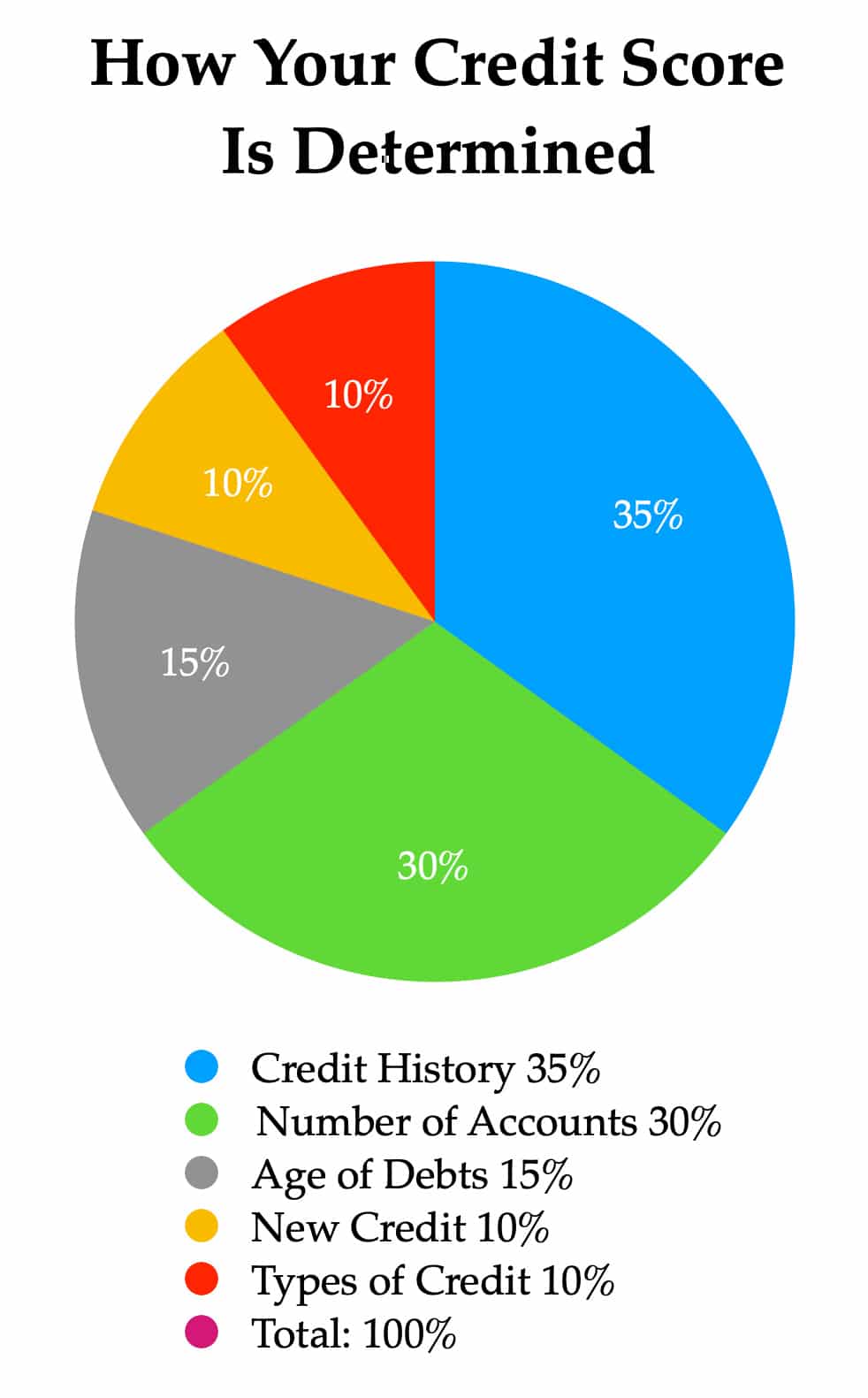

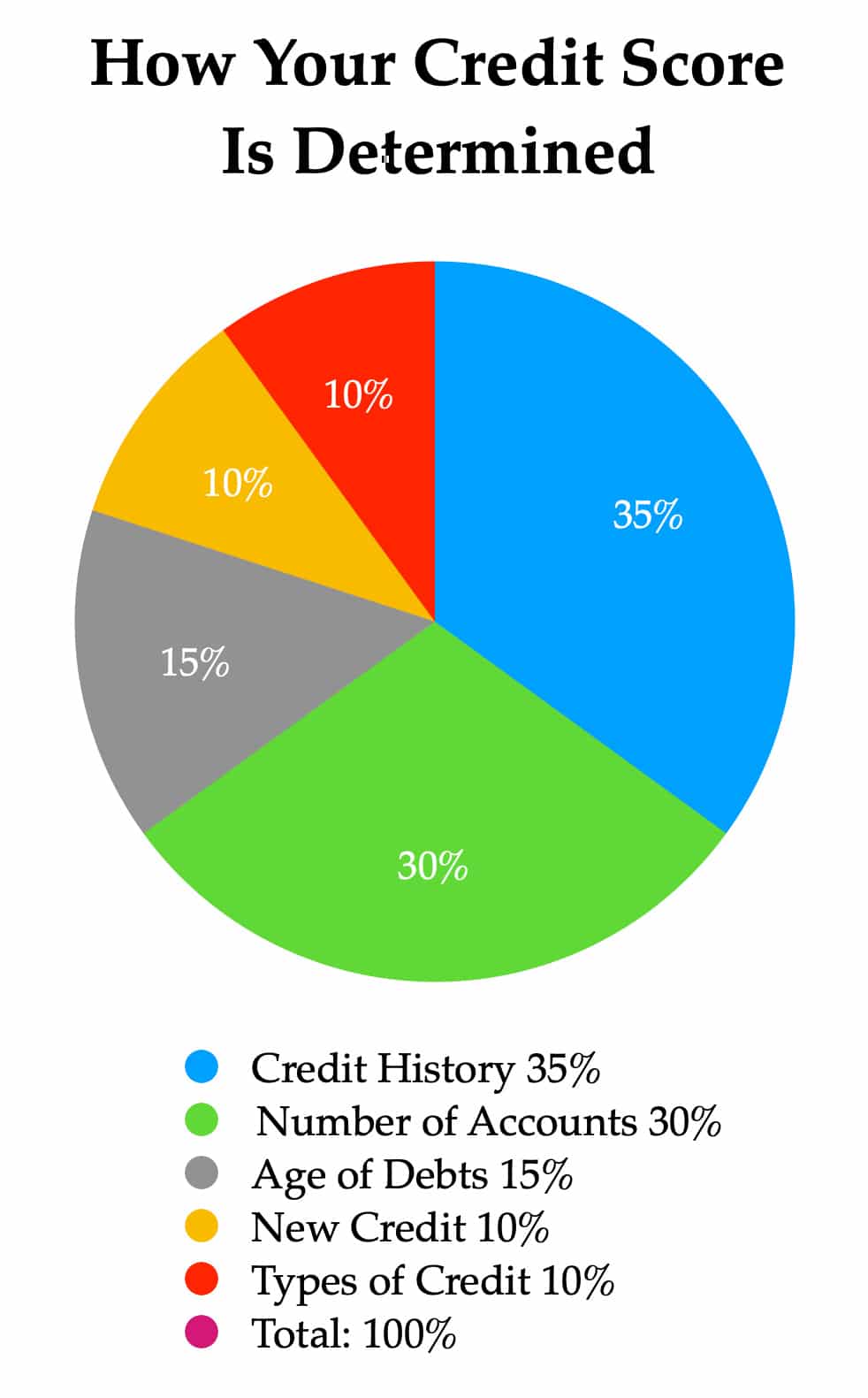

How Late Payments Affect Your Credit Score

Your FICO score, a crucial element in determining your creditworthiness, is significantly impacted by late payments. The FICO scoring system considers payment history as a major factor.

- 30 days late: A noticeable drop in your score.

- 60 days late: A more substantial decrease, impacting your ability to secure loans and credit cards.

- 90+ days late: A significant and potentially devastating drop, making it much harder to obtain favorable interest rates or even qualify for loans. This can also negatively impact your credit utilization ratio (the percentage of available credit you're using), further harming your score.

This negative impact extends beyond just your score. A low credit score can affect your ability to:

- Secure loans with favorable interest rates.

- Rent an apartment.

- Get approved for a new credit card.

- Even secure certain jobs.

The Difference Between Delinquency and Default

While both are serious, delinquency and default represent different stages of loan mismanagement. Delinquency refers to being late on your payments, while default occurs when you've significantly fallen behind and failed to make payments for an extended period.

- Delinquency: Results in negative marks on your credit report and a declining credit score.

- Default: Triggers much more severe consequences, including:

- Wage garnishment.

- Tax refund offset (the government seizing your tax refund).

- Difficulty obtaining future loans or credit.

Defaulting on your student loans has long-term, potentially crippling effects on your financial well-being.

Strategies to Avoid Falling Behind on Student Loan Payments

Proactive management is key to preventing delinquency and protecting your credit score. Here are some crucial strategies:

Creating a Realistic Budget

A well-structured budget is fundamental to responsible loan repayment.

- Track your expenses: Use budgeting apps (Mint, YNAB), spreadsheets, or even a simple notebook to meticulously record all your income and spending.

- Identify areas for savings: Analyze your spending habits to pinpoint unnecessary expenditures.

- Prioritize loan payments: Allocate sufficient funds for your student loan payments each month. Consider debt snowball or avalanche methods to systematically pay off your debts.

Effective budgeting provides a clear picture of your financial situation, allowing you to make informed decisions and prioritize your student loan payments.

Exploring Loan Repayment Options

Several repayment plans can help you manage your student loans.

- Income-Driven Repayment (IDR) Plans: Your monthly payments are based on your income and family size. These include plans like ICR, PAYE, REPAYE, and IBR.

- Deferment: Temporarily postpones your payments, but interest may still accrue.

- Forbearance: Temporarily reduces or suspends your payments, but interest usually accrues.

Each plan has its pros and cons and eligibility requirements. Research thoroughly and choose the plan that best suits your circumstances. Contact your loan servicer to learn more about your options.

Communicating with Your Loan Servicer

Open communication with your loan servicer is crucial.

- Proactive communication: Contact your servicer before you fall behind. Explain your financial hardship and explore options like forbearance or a repayment plan adjustment.

- Documentation: Keep records of all communication, including dates, times, and the details discussed.

Proactive communication can often prevent default and mitigate the negative impact on your credit score.

Repairing Your Credit After Falling Behind on Student Loans

If you've already fallen behind on your student loans, repairing your credit requires time and effort.

Understanding Your Credit Report

Your credit report is a detailed record of your credit history.

- Obtain your credit report: Get your free annual credit reports from AnnualCreditReport.com.

- Identify errors: Carefully review your report for any inaccuracies. Dispute any errors with the relevant credit bureaus.

Regularly monitoring your credit report is essential for identifying and rectifying any issues promptly.

Strategies for Credit Repair

Rebuilding your credit takes consistent effort.

- On-time payments: Make all future payments on time. This is the most significant factor in improving your credit score.

- Reduce credit utilization: Keep your credit card balances low, ideally below 30% of your available credit.

- Credit repair services (optional): Consider professional help if you're struggling to navigate the process. However, research thoroughly and avoid scams.

Rebuilding your credit takes time; it's not an overnight fix. Be patient and persistent.

The Role of Credit Counseling

Credit counseling agencies can offer guidance and support.

- Reputable agencies: Choose a reputable agency accredited by the National Foundation for Credit Counseling (NFCC).

- Services offered: Agencies can provide budgeting advice, debt management plans, and financial literacy education.

- Costs involved: Be aware of any fees associated with their services.

Credit counseling can be a valuable tool, but it's essential to choose a reputable agency.

Conclusion

Falling behind on student loan payments significantly impacts your credit score and overall financial health. By understanding the consequences of delinquency, creating a realistic budget, exploring repayment options, communicating proactively with your loan servicer, and diligently working on credit repair, you can protect your credit score and build a secure financial future. Don't let falling behind on your student loans damage your financial future. Take control of your student loan debt today by implementing the strategies outlined in this article. Protect your credit score and secure your financial well-being.

Featured Posts

-

Where To Watch The Indiana Fevers Preseason Games Featuring Caitlin Clark

May 17, 2025

Where To Watch The Indiana Fevers Preseason Games Featuring Caitlin Clark

May 17, 2025 -

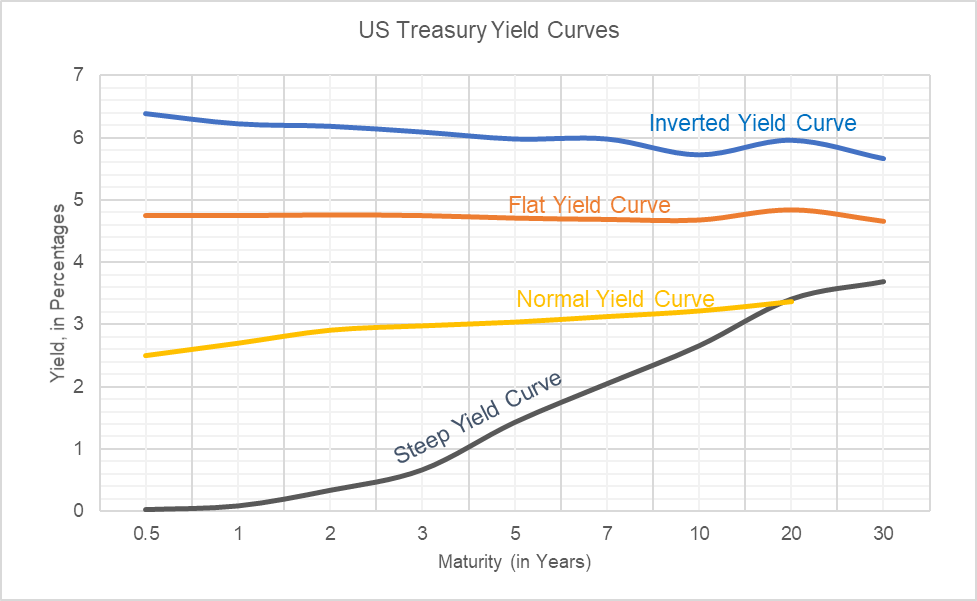

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025

Japans Bond Market Steep Yield Curve Poses Economic Challenges

May 17, 2025 -

Analysis Of Trumps Proposed F 55 And F 22 Enhancements

May 17, 2025

Analysis Of Trumps Proposed F 55 And F 22 Enhancements

May 17, 2025 -

Kosarkaska Reprezentacija Srbije Izvestaj Sa Generalne Probe Pred Evrobasket

May 17, 2025

Kosarkaska Reprezentacija Srbije Izvestaj Sa Generalne Probe Pred Evrobasket

May 17, 2025 -

Los 76ers Sufren Su Novena Derrota Anunoby Anota 27 Para Los Knicks

May 17, 2025

Los 76ers Sufren Su Novena Derrota Anunoby Anota 27 Para Los Knicks

May 17, 2025