Japan's Bond Market: Steep Yield Curve Poses Economic Challenges

Table of Contents

Understanding the Steepening Yield Curve in Japan's Bond Market

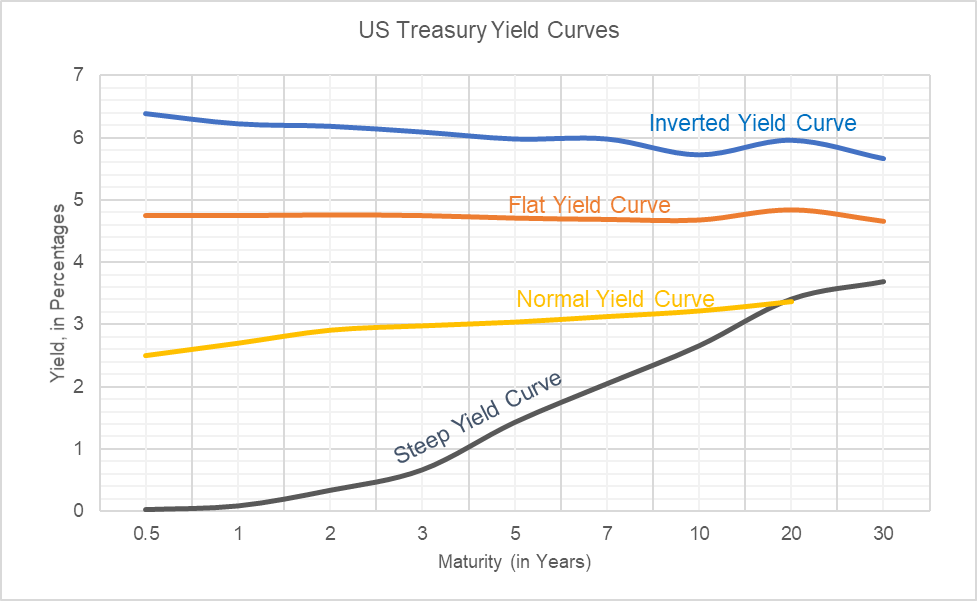

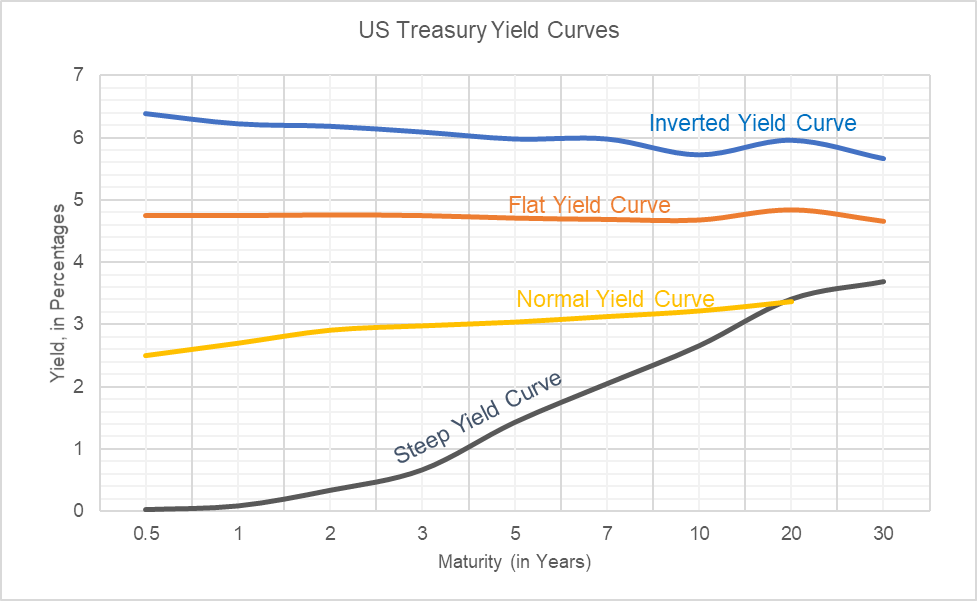

A yield curve is a graphical representation of the relationship between the interest rates (yields) and the time to maturity of debt securities with the same credit quality. A normal yield curve is upward-sloping, indicating that long-term bonds offer higher yields than short-term bonds to compensate investors for the increased risk associated with longer maturities.

A steep yield curve, however, is characterized by a significantly larger difference between short-term and long-term yields. This steepening indicates a growing divergence in market expectations for future interest rates. Currently, Japan's yield curve is exhibiting this steepening trend.

- Rising long-term yields: Driven by increasing inflation expectations, both domestically and globally influenced by interest rate hikes in major economies like the US. This signals investor anticipation of future monetary policy tightening.

- Relatively low short-term yields: Maintained by the Bank of Japan's (BOJ) continued monetary easing policies, including yield curve control (YCC). The BOJ has been attempting to keep borrowing costs low to stimulate economic activity.

- Increased government bond issuance: The aging population and rising social security costs in Japan necessitate significant government borrowing, increasing the supply of Japanese government bonds (JGBs) in the market and potentially influencing long-term yields.

Economic Implications of a Steep Yield Curve for Japan

The steepening yield curve in Japan's bond market has several significant economic implications.

Increased Government Borrowing Costs

Rising long-term yields directly translate to higher borrowing costs for the Japanese government. This means increased interest payments on its massive national debt.

- Higher interest payments strain the national budget: A larger portion of government revenue must be allocated to debt servicing, leaving less for crucial social programs and infrastructure investments.

- Reduced fiscal flexibility: The government has less room to maneuver its fiscal policy, potentially limiting its ability to respond effectively to economic downturns or other unforeseen circumstances.

- Potential for increased taxation: To offset higher debt servicing costs, the government might be forced to consider unpopular measures like increased taxes, potentially impacting economic growth.

Impact on Private Investment

Rising long-term interest rates also increase borrowing costs for Japanese corporations. This can significantly impact investment decisions and overall economic activity.

- Reduced corporate investment: Higher borrowing costs discourage companies from investing in expansion projects, new equipment, and research and development.

- Slowdown in business expansion and job creation: Reduced investment leads to slower economic growth, potentially affecting job creation and overall employment levels.

- Negative impact on overall economic growth: The dampening effect on private investment can significantly hinder Japan's potential economic growth rate.

Effects on the Japanese Yen

Interest rates play a significant role in influencing currency exchange rates. A steep yield curve can impact the value of the Japanese yen in several ways.

- Potential for increased capital inflows: Higher yields on Japanese government bonds can attract foreign investment, potentially leading to increased demand for the yen.

- Potential for appreciation of the Japanese yen: An appreciating yen can make Japanese exports more expensive in international markets, potentially negatively impacting Japan's trade balance.

- Uncertainty and volatility in the foreign exchange market: The interplay of domestic and global factors creates uncertainty and potential volatility in the foreign exchange market.

Potential Policy Responses to the Steepening Yield Curve

The Bank of Japan faces significant challenges in managing the steepening yield curve. The BOJ's current YCC policy is under scrutiny, and various policy adjustments are being considered.

- Gradual adjustments to yield curve control (YCC) policy: The BOJ may gradually adjust its YCC target, allowing long-term yields to rise more freely. However, this needs to be carefully managed to avoid sudden market disruptions.

- Fiscal reforms to address unsustainable debt levels: The government needs to implement fiscal reforms to address the country's high debt levels and improve long-term fiscal sustainability. This could include measures to increase tax revenue or reduce government spending.

- Coordination between monetary and fiscal authorities: Effective coordination between the BOJ and the Ministry of Finance is crucial to address the challenges posed by the steepening yield curve and ensure a stable economic outlook.

Conclusion

The steepening yield curve in Japan's bond market presents significant economic challenges. Rising long-term yields increase government borrowing costs, impacting fiscal sustainability, and dampen private investment, hindering economic growth. The Bank of Japan faces a delicate balancing act in managing this situation, requiring careful consideration of monetary and fiscal policy adjustments. Understanding the complexities of Japan's bond market and its evolving yield curve is crucial for investors and policymakers alike. Stay informed on the latest developments in Japan's bond market to make informed decisions and navigate the evolving economic landscape. Further analysis of Japan's bond market is essential for understanding future economic stability.

Featured Posts

-

Uae Newborn Emirates Id Cost And Application Process March 2025

May 17, 2025

Uae Newborn Emirates Id Cost And Application Process March 2025

May 17, 2025 -

How To Interpret A Proxy Statement Form Def 14 A Effectively

May 17, 2025

How To Interpret A Proxy Statement Form Def 14 A Effectively

May 17, 2025 -

Iowa Hawkeyes Hire Former D2 National Champion Ben Mc Collum

May 17, 2025

Iowa Hawkeyes Hire Former D2 National Champion Ben Mc Collum

May 17, 2025 -

Star Wars Andor Creators Reflections On A Defining Project

May 17, 2025

Star Wars Andor Creators Reflections On A Defining Project

May 17, 2025 -

Best Australian Crypto Casinos Your 2025 Gambling Guide

May 17, 2025

Best Australian Crypto Casinos Your 2025 Gambling Guide

May 17, 2025