Financial Literacy For Women: Avoiding Costly Errors

Table of Contents

Understanding Your Finances: The Foundation of Financial Literacy for Women

Before you can achieve your financial goals, you need a solid understanding of your current financial situation. This involves creating a realistic budget, diligently tracking your expenses, and clearly understanding your income streams. Mastering these foundational aspects is crucial for building strong financial literacy for women.

Creating a Realistic Budget

- Use budgeting apps: Mint, YNAB (You Need A Budget), and Personal Capital are popular choices that can automate tracking and provide insightful visualizations.

- Categorize expenses (needs vs. wants): Differentiate between essential expenses (housing, food, transportation) and discretionary spending (entertainment, dining out). This helps identify areas where you can potentially cut back.

- Set financial goals (short-term and long-term): Define specific, measurable, achievable, relevant, and time-bound (SMART) goals, such as paying off credit card debt within a year or saving for a down payment on a house in five years.

The 50/30/20 rule is a simple yet effective budgeting method: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Many free resources and budgeting tools are available online to help you get started.

Tracking Your Spending

- Use spreadsheets: A simple spreadsheet can provide a clear overview of your income and expenses.

- Use budgeting apps: Many budgeting apps automatically categorize transactions, simplifying the tracking process.

- Manual tracking methods: If you prefer a more hands-on approach, keep receipts and manually record your expenses in a notebook or journal.

Analyzing your spending patterns helps identify areas for improvement. Understanding where your money is going empowers you to make informed financial decisions and achieve your financial goals more effectively.

Debt Management Strategies for Women

High-interest debt can significantly hinder your financial progress. Developing effective debt management strategies is vital for building a strong financial foundation. This is a crucial aspect of improving financial literacy for women.

Identifying and Prioritizing Debt

- List all debts: Make a comprehensive list of all your debts, including credit cards, student loans, personal loans, and other outstanding balances.

- Calculate interest rates: Identify which debts carry the highest interest rates. These are typically the most urgent to address.

- Prioritize high-interest debts: Focus on paying down high-interest debt first to minimize the overall cost of borrowing.

Two common debt repayment strategies are the snowball method (paying off the smallest debt first for motivation) and the avalanche method (paying off the highest-interest debt first to save money on interest).

Negotiating Lower Interest Rates and Fees

- Contact creditors: Don't hesitate to contact your creditors and negotiate lower interest rates or fees. Many are willing to work with you, especially if you have a good payment history.

- Explore debt consolidation options: Consolidating multiple debts into a single loan with a lower interest rate can simplify payments and potentially save you money.

Seek help from credit counseling agencies or debt management programs if you're struggling to manage your debt. These resources can provide guidance and support to help you get back on track.

Investing for Your Future: Smart Financial Decisions for Women

Investing is crucial for long-term financial security and achieving financial independence. Understanding investment options and building a diversified portfolio is a critical component of financial literacy for women.

Understanding Different Investment Options

- Stocks: Represent ownership in a company and offer potential for high returns, but also carry higher risk.

- Bonds: Loans to governments or corporations, generally considered less risky than stocks.

- Mutual funds: Pools of money invested in a diversified portfolio of stocks, bonds, or other assets.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but trade on stock exchanges like individual stocks.

- Retirement accounts (401k, IRA): Tax-advantaged accounts designed for retirement savings.

Each investment option has a different risk tolerance associated with it. Understand your risk tolerance before making investment decisions.

Building an Investment Portfolio

- Diversification: Spread your investments across different asset classes to reduce risk.

- Asset allocation: Determine the appropriate mix of stocks, bonds, and other assets based on your risk tolerance and financial goals.

- Regularly contributing to investments: Consistency is key to long-term investment success. Set up automatic contributions to maximize your returns.

If you're unsure where to start, consider seeking advice from a qualified financial advisor. They can help you create a personalized investment strategy tailored to your individual needs and goals.

Protecting Yourself: Insurance and Financial Planning for Women

Insurance and estate planning are essential for protecting your financial well-being and securing your future. This aspect of financial literacy for women is often overlooked but incredibly important.

Essential Insurance Coverage

- Health insurance: Essential for protecting against high medical expenses.

- Life insurance: Provides financial security for your dependents in the event of your death.

- Disability insurance: Replaces a portion of your income if you become disabled and unable to work.

- Auto insurance: Protects you against financial losses resulting from car accidents.

- Home insurance: Covers damage to your home and personal belongings.

Ensure you have adequate coverage for your specific needs and circumstances. Compare policies and choose the best option for your budget.

Estate Planning and Wills

- Creating a will: A will dictates how your assets will be distributed after your death.

- Designating beneficiaries: Specify who will receive your assets.

- Power of attorney: Designate someone to manage your financial affairs if you become incapacitated.

Having a well-defined estate plan ensures your wishes are carried out and protects your loved ones' financial security.

Conclusion

Mastering financial literacy for women is not just about managing money; it's about empowering yourself to achieve financial independence and security. By understanding your finances, managing debt effectively, investing wisely, and protecting yourself through insurance and estate planning, you can build a brighter financial future. Neglecting these aspects can lead to significant financial hardship and missed opportunities.

Start improving your financial literacy today by taking advantage of the many resources available, including online courses, workshops, and financial advisors. Don't let costly financial errors impact your future – take control of your financial destiny! Boost your financial knowledge and master your finances to build a secure and prosperous life.

Featured Posts

-

New Playwrights Watercolor Script A Critical Review

May 22, 2025

New Playwrights Watercolor Script A Critical Review

May 22, 2025 -

Addressing Concerns About Rio Tintos Pilbara Operations

May 22, 2025

Addressing Concerns About Rio Tintos Pilbara Operations

May 22, 2025 -

Analyzing The Countrys Newest Business Hotspots Growth Potential And Investment Strategies

May 22, 2025

Analyzing The Countrys Newest Business Hotspots Growth Potential And Investment Strategies

May 22, 2025 -

Parcourir La Loire A Velo Nantes Vignoble Et Estuaire

May 22, 2025

Parcourir La Loire A Velo Nantes Vignoble Et Estuaire

May 22, 2025 -

Chat Gpt And Open Ai The Ftc Investigation And Its Ramifications

May 22, 2025

Chat Gpt And Open Ai The Ftc Investigation And Its Ramifications

May 22, 2025

Latest Posts

-

Large Fire Engulfs Used Car Dealership

May 22, 2025

Large Fire Engulfs Used Car Dealership

May 22, 2025 -

Used Car Lot Fire Extensive Damage Reported

May 22, 2025

Used Car Lot Fire Extensive Damage Reported

May 22, 2025 -

Crews Battle Blaze At Used Car Dealership

May 22, 2025

Crews Battle Blaze At Used Car Dealership

May 22, 2025 -

Recent Susquehanna Valley Storm Damage Cleanup Repairs And Community Support

May 22, 2025

Recent Susquehanna Valley Storm Damage Cleanup Repairs And Community Support

May 22, 2025 -

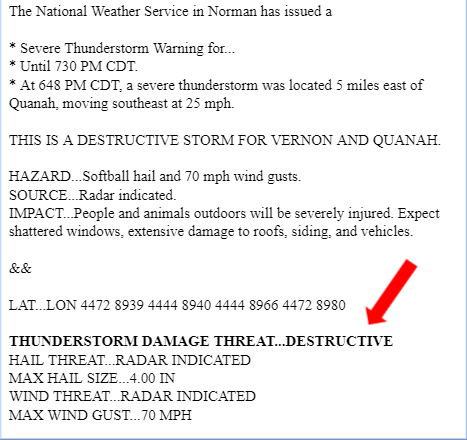

Urgent Severe Thunderstorm Watch In Effect South Central Pennsylvania

May 22, 2025

Urgent Severe Thunderstorm Watch In Effect South Central Pennsylvania

May 22, 2025