Fiscal Responsibility: A Necessary Component Of Canada's Vision

Table of Contents

Strategic Government Spending and Budget Allocation

Effective government spending is the bedrock of fiscal responsibility. Prioritizing essential services while carefully managing non-essential expenses is paramount. This requires a meticulous approach to budget allocation, focusing on maximizing the impact of every dollar spent. Evidence-based budgeting, utilizing data and analysis to inform decisions, is crucial for ensuring efficient allocation of public funds. Performance measurement helps track the effectiveness of government programs and allows for adjustments to optimize outcomes.

- Examples of effective government spending programs in Canada: Investments in infrastructure projects like the Trans-Canada Highway have yielded significant long-term economic benefits. Similarly, targeted funding for research and development in key sectors has fostered innovation and job creation.

- Examples of areas where spending could be reduced or improved: A critical review of administrative costs and potential redundancies within government departments could unlock significant savings. Furthermore, streamlining procurement processes can lead to greater efficiency and cost reductions.

- The benefits of transparent budget processes: Open and accessible budget information promotes accountability and allows citizens to scrutinize government spending, fostering public trust and ensuring responsible use of taxpayer money.

Responsible Taxation and Revenue Generation

A fair and efficient tax system is vital for fiscal responsibility. Different tax systems have varying impacts on economic growth and income inequality. Progressive taxation, where higher earners pay a larger percentage of their income in taxes, is often favored for its ability to redistribute wealth and fund social programs. However, excessively high taxes can stifle economic activity. A well-designed tax system balances revenue generation with the need to encourage investment and job creation.

- Discussion on progressive vs. regressive taxation: While progressive taxation aims to address income inequality, regressive taxes, such as sales taxes, disproportionately affect lower-income households. Finding the right balance between these approaches is crucial.

- Analysis of the impact of tax policies on different income groups: A thorough understanding of how tax policies affect different segments of the population is essential for designing equitable and efficient tax systems.

- Exploration of potential tax reforms to increase revenue: Exploring options like closing tax loopholes, improving tax collection efficiency, and potentially broadening the tax base can help generate additional revenue without unduly burdening taxpayers.

Managing Canada's National Debt

Canada's national debt represents a significant long-term economic challenge. High debt levels increase the burden of debt servicing costs, diverting funds that could be used for essential public services like healthcare and education. Managing the national debt requires a multi-pronged approach. This includes controlling spending, increasing revenue through responsible tax policies, and fostering strong economic growth to increase the tax base.

- Current levels of Canada's national debt and its trajectory: [Insert data on Canada's current debt levels and projected trajectory, with source]. Understanding the current situation and its projected path is crucial for developing effective debt management strategies.

- Comparison of Canada's debt levels to other developed nations: Comparing Canada's debt-to-GDP ratio with that of other comparable countries provides valuable context and helps identify areas for improvement.

- Potential risks associated with high national debt: High national debt can lead to increased interest rates, reduced investor confidence, and potentially a sovereign debt crisis, highlighting the importance of proactive debt management.

Promoting Economic Growth and Job Creation

Responsible fiscal policies play a crucial role in driving economic growth and job creation. Investment in infrastructure, education, and innovation is vital for boosting productivity and competitiveness. Fiscal policies can be strategically targeted to support various economic sectors and regions across Canada, promoting balanced and sustainable growth.

- Examples of successful economic growth strategies in Canada: Targeted tax incentives for specific industries, coupled with investments in infrastructure projects, have proven effective in stimulating economic growth in certain regions.

- Discussion of the relationship between fiscal policy and employment: Fiscal policies like tax cuts or infrastructure spending can have a direct impact on employment levels, either through increased private sector investment or through government job creation.

- Analysis of the impact of economic growth on poverty reduction: Sustainable economic growth leads to increased job opportunities and higher incomes, ultimately helping reduce poverty rates across the country.

Securing Canada's Future through Fiscal Responsibility

Fiscal responsibility is not merely a matter of balancing budgets; it is a fundamental requirement for securing Canada's long-term economic well-being. Strategic government spending, responsible taxation, effective debt management, and policies that promote sustainable economic growth are all interconnected and essential components of a robust and resilient economy. We must engage in informed discussions about fiscal policy and advocate for responsible government spending and taxation. Further research into the multifaceted impacts of fiscal responsibility on Canada’s future is vital. Contact your elected officials to express your support for policies that prioritize fiscal responsibility in Canada, ensuring a prosperous future for all Canadians.

Featured Posts

-

Middle Management A Critical Component Of A Thriving Organization

Apr 24, 2025

Middle Management A Critical Component Of A Thriving Organization

Apr 24, 2025 -

Trump On Powell No Intention To Remove Fed Chair

Apr 24, 2025

Trump On Powell No Intention To Remove Fed Chair

Apr 24, 2025 -

Sharks Missing Swimmer And A Body Found A Troubled Israeli Beach

Apr 24, 2025

Sharks Missing Swimmer And A Body Found A Troubled Israeli Beach

Apr 24, 2025 -

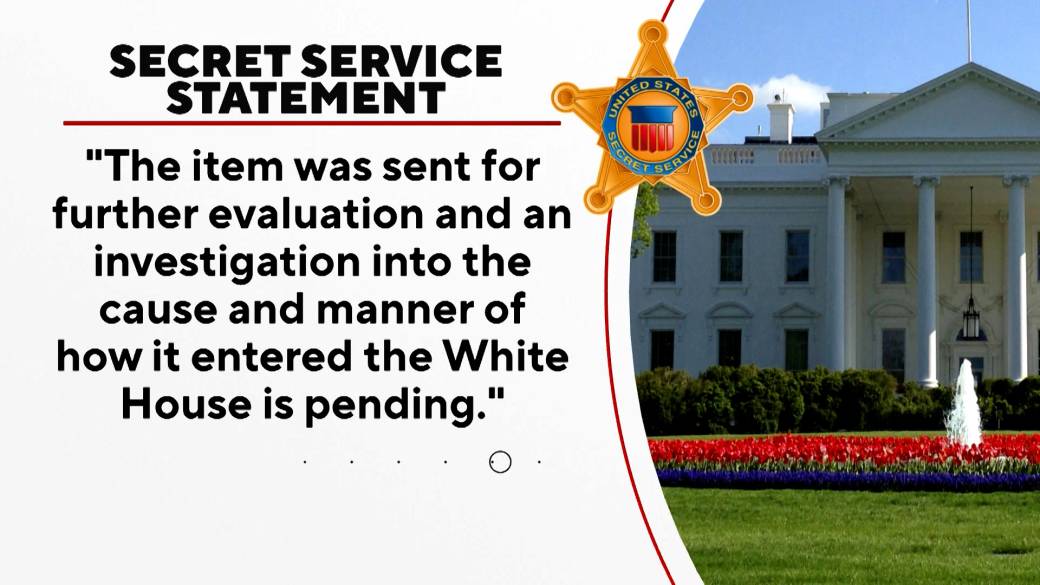

Cocaine Found At White House Secret Service Investigation Complete

Apr 24, 2025

Cocaine Found At White House Secret Service Investigation Complete

Apr 24, 2025 -

Gambling On Catastrophe Analyzing The Los Angeles Wildfire Betting Market

Apr 24, 2025

Gambling On Catastrophe Analyzing The Los Angeles Wildfire Betting Market

Apr 24, 2025