FTC Appeals Activision Blizzard Acquisition By Microsoft

Table of Contents

The FTC's Arguments Against the Acquisition

The FTC's core argument centers on the belief that the merger between Microsoft and Activision Blizzard would create an anti-competitive environment, granting Microsoft undue market power and stifling competition. Their concerns are primarily focused on several key areas:

-

Call of Duty and Market Dominance: The FTC argues that Microsoft's acquisition of Activision Blizzard, and specifically the ownership of the immensely popular Call of Duty franchise, would give them an unfair advantage. They believe this could lead to Microsoft making Call of Duty exclusive to its Xbox ecosystem, harming competitors like Sony PlayStation and Nintendo. This exclusive strategy, the FTC contends, would significantly reduce consumer choice and potentially lead to higher prices.

-

Stifling Competition and Higher Prices: Beyond Call of Duty, the FTC claims that the merger's potential to stifle competition extends across the wider gaming market. They argue that Microsoft's increased market share would allow them to dictate pricing, reduce innovation, and limit consumer options. This anti-competitive behavior, the FTC believes, would ultimately harm gamers.

-

Microsoft's Acquisition History and Exclusive Content: The FTC points to Microsoft's past acquisitions of game studios and its practice of making some titles exclusive to its Xbox platform as evidence of its anti-competitive tendencies. This pattern, they claim, strongly suggests that Microsoft would leverage its power post-merger to further limit competition.

-

Concerns Regarding Cloud Gaming: The FTC also expresses concern about Microsoft's potential to leverage the acquisition to dominate the burgeoning cloud gaming market. They believe that Microsoft could use its newly acquired power to exclude competitors from this space, further consolidating its dominance within the industry.

-

Insufficient Proposed Remedies: The FTC rejected Microsoft's proposed remedies to address antitrust concerns, arguing that they were insufficient to mitigate the potential for anti-competitive behavior following the merger.

Microsoft's Defense and Counterarguments

Microsoft, naturally, vehemently defends the acquisition, arguing that it will ultimately benefit consumers through increased innovation and broader access to games. Their counterarguments include:

-

Maintaining Competition and Consumer Benefits: Microsoft maintains that the gaming market remains fiercely competitive, with multiple significant players, and that the acquisition won't create a monopoly. They insist the merger will lead to increased innovation, lower prices through Xbox Game Pass expansion, and broader access to games across different platforms.

-

Continued Availability of Call of Duty: A key part of Microsoft's defense rests on its pledge to continue making Call of Duty available on PlayStation. They argue this commitment directly addresses the FTC's concerns about exclusive content and ensures continued competition.

-

Expansion of Xbox Game Pass: Microsoft highlights the expansion of its Xbox Game Pass subscription service as a major benefit to consumers, arguing it provides access to a wider library of games at a lower cost than purchasing individual titles.

-

Investment in Game Development and Innovation: Microsoft emphasizes its substantial investments in game development and its commitment to fostering innovation within the gaming industry. They argue the merger will accelerate this process and benefit gamers in the long run.

The Implications of the Appeal for the Gaming Industry

The FTC's appeal carries significant implications for the entire gaming industry, regardless of the outcome. Several key areas will be directly affected:

-

Impact on Game Prices: If the merger is blocked, it could potentially prevent further price increases. Conversely, allowing the merger might lead to increased pricing power for Microsoft, potentially affecting prices for both existing and future titles.

-

Future of Exclusive Content: The outcome of this appeal will have a profound effect on the future of exclusive content in gaming. A blocked merger might curb the trend toward platform-specific titles, while an approved merger could accelerate it.

-

Cloud Gaming Competition: The appeal's resolution will shape the competitive landscape of cloud gaming. A blocked merger could foster more competition in this emerging sector, while an approved merger could lead to Microsoft's dominance.

-

Industry Consolidation and Future Mergers: This case sets a significant precedent for future mergers and acquisitions in the gaming industry. Increased regulatory scrutiny is likely, potentially slowing down industry consolidation.

-

Precedent for Tech Antitrust Cases: This case could significantly influence future antitrust cases involving large technology companies, regardless of their industry.

The Role of Regulatory Bodies in the Gaming Market

The FTC's actions highlight the critical role regulatory bodies play in maintaining fair competition within the gaming market. The case also offers a comparison to similar antitrust cases involving major tech companies, such as the recent scrutiny of other large-scale mergers and acquisitions. This case demonstrates the ongoing challenge of balancing innovation with competition and the need for effective regulatory oversight. The comparison with other regulatory bodies, like the CMA (Competition and Markets Authority) in the UK, which also expressed concerns about the merger, illustrates the international nature of antitrust enforcement in the tech industry.

Conclusion

The FTC's appeal of the Activision Blizzard acquisition by Microsoft represents a pivotal moment in the gaming industry. The arguments made by both sides reveal a complex interplay between innovation, market dominance, and consumer welfare. The potential outcomes – either a blocked merger leading to increased competition or an approved merger increasing Microsoft's market power – will dramatically alter the gaming landscape. The ramifications extend far beyond Call of Duty, affecting game prices, exclusive content, and the growth of cloud gaming.

Call to Action: Stay informed about this ongoing legal battle and its ultimate impact on the Activision Blizzard acquisition by Microsoft. The outcome will shape the future of the gaming industry and serve as a crucial precedent for future mergers and acquisitions in the tech sector. Continue following this story for further updates and analysis on Microsoft's evolving gaming strategy and the future of antitrust regulations in the tech world.

Featured Posts

-

Giant Sea Wall Upaya Dpr Lindungi Warga Pesisir Dari Abrasi Dan Banjir

May 15, 2025

Giant Sea Wall Upaya Dpr Lindungi Warga Pesisir Dari Abrasi Dan Banjir

May 15, 2025 -

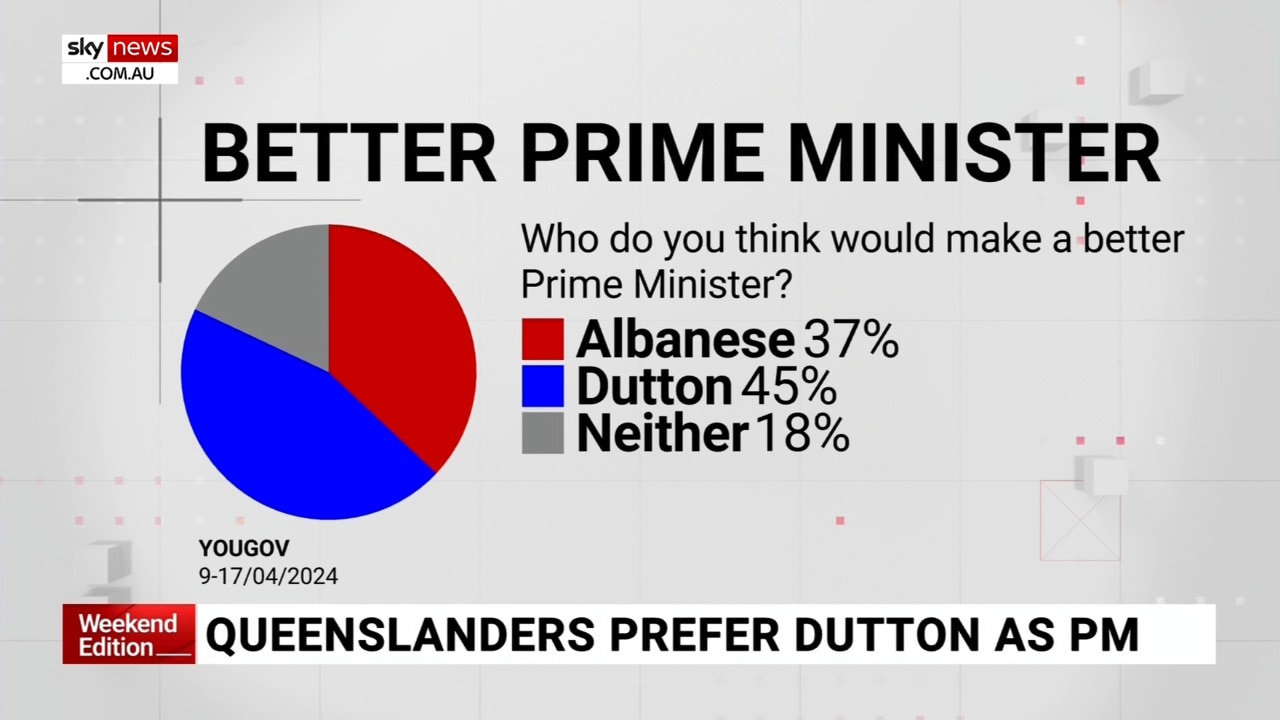

Election 2024 Albanese And Duttons Campaign Strategies

May 15, 2025

Election 2024 Albanese And Duttons Campaign Strategies

May 15, 2025 -

Padres 2025 Regular Season Broadcast Schedule Announced

May 15, 2025

Padres 2025 Regular Season Broadcast Schedule Announced

May 15, 2025 -

Land Your Dream Private Credit Job 5 Dos And Don Ts

May 15, 2025

Land Your Dream Private Credit Job 5 Dos And Don Ts

May 15, 2025 -

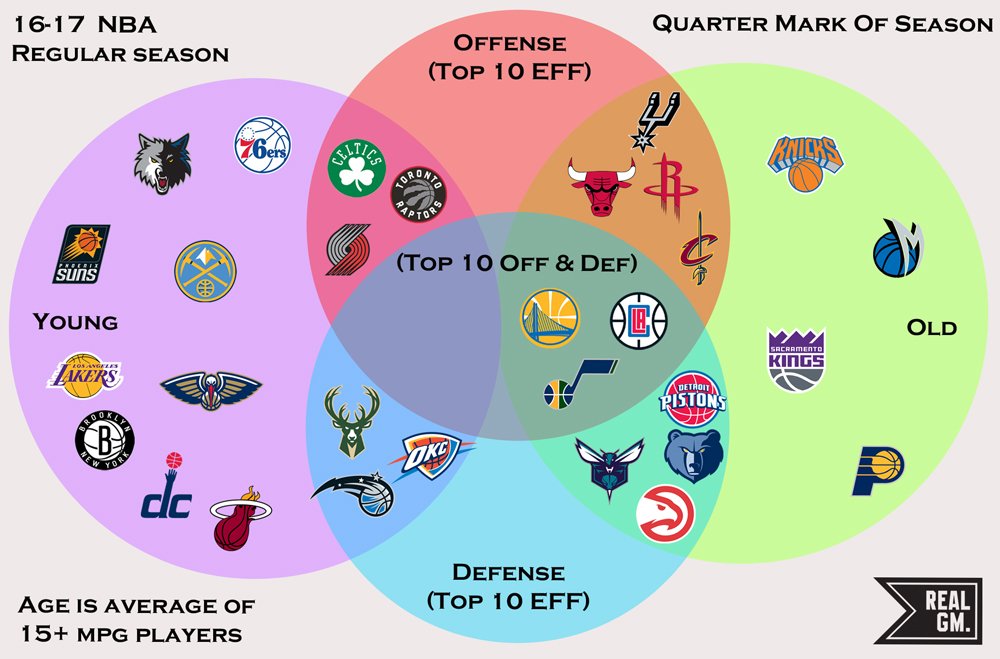

Whats Preventing The Top 10 Nba Teams From Winning

May 15, 2025

Whats Preventing The Top 10 Nba Teams From Winning

May 15, 2025