FTC To Challenge Activision Blizzard Acquisition Approval

Table of Contents

The FTC's Antitrust Concerns

The FTC's primary concern centers on the potential anti-competitive effects of the merger. The acquisition would grant Microsoft control over a vast portfolio of popular game franchises, including the immensely popular Call of Duty, Candy Crush, and World of Warcraft. This level of consolidation raises significant antitrust concerns.

- Domination of the console gaming market: Microsoft's acquisition of Activision Blizzard would significantly bolster its Xbox gaming ecosystem, potentially giving it an unfair advantage over competitors like Sony's PlayStation and Nintendo's Switch.

- Control over key gaming franchises: The FTC worries about Microsoft leveraging its ownership of iconic franchises like Call of Duty to exclude competitors, potentially making them less attractive to consumers. Exclusive content or timed exclusivity deals are key concerns here.

- Potential for anti-competitive practices: The FTC fears that Microsoft could use its expanded market power to increase prices, reduce innovation, or stifle competition in the wider gaming market. This could negatively impact both developers and consumers.

The FTC's strategy likely draws on past antitrust cases, including those involving other tech giants, to build its case against the merger. Precedents set in previous cases involving anti-competitive practices will heavily influence the court's decision.

Microsoft's Defense Strategy

Microsoft is expected to mount a robust defense against the FTC's challenge. Their arguments are likely to focus on:

- Claims of increased competition and innovation: Microsoft may argue that the merger will actually foster innovation and competition by bringing together talented developers and resources, ultimately benefiting consumers.

- Arguments against the FTC's market definition: Microsoft may challenge the FTC's definition of the relevant market, arguing that the gaming market is far more diverse than the FTC suggests, including PC gaming, mobile gaming, and subscription services.

- Promises of continued availability of Activision Blizzard games across platforms: A key part of Microsoft's defense will be assuring regulators and consumers that Call of Duty and other Activision Blizzard titles will remain available on competing platforms like PlayStation. This might involve legally binding commitments.

- Concessions to appease regulators: To increase the likelihood of approval, Microsoft may offer concessions, such as licensing Call of Duty to competitors for a set period.

The effectiveness of Microsoft's defense strategy will be crucial in determining the outcome of the FTC's challenge.

Potential Outcomes and Implications

The FTC's challenge could lead to several possible outcomes:

- The FTC successfully blocks the acquisition: This would be a major blow to Microsoft and would send a strong signal to other companies considering large mergers in the gaming industry.

- The acquisition proceeds after concessions or modifications: Microsoft might be required to make significant concessions to secure regulatory approval, potentially involving licensing agreements or divestitures.

- A lengthy legal battle ensues: The case could drag on for months or even years, creating uncertainty for both companies and the gaming industry as a whole.

The implications for the gaming industry are far-reaching:

Impact on Game Pricing and Availability

The outcome of the FTC's challenge could significantly impact game pricing and availability for gamers. If the merger is blocked, Call of Duty and other Activision Blizzard titles will likely remain on multiple platforms, potentially maintaining price competition. However, if the merger goes through with concessions, the long-term impact on prices and platform availability remains uncertain.

The Future of Game Mergers and Acquisitions

This case will set a significant precedent for future mergers and acquisitions in the gaming industry. A successful FTC challenge could lead to increased scrutiny of future deals and make it more difficult for large companies to consolidate their market power.

Conclusion: The FTC's Challenge and the Future of Activision Blizzard

The FTC's challenge to the Activision Blizzard acquisition approval presents a complex legal battle with significant implications for the future of the gaming industry. The arguments presented by both the FTC and Microsoft highlight the tension between fostering innovation and preventing anti-competitive practices. The outcome will have a lasting impact on game pricing, availability, and the overall competitive landscape. Stay informed about this ongoing legal battle by following relevant news sources and regulatory updates regarding the "FTC to Challenge Activision Blizzard Acquisition Approval" – its resolution will shape the future of gaming for years to come. The future of gaming, in many ways, hangs in the balance.

Featured Posts

-

The Next Papal Election Key Cardinals To Watch

May 11, 2025

The Next Papal Election Key Cardinals To Watch

May 11, 2025 -

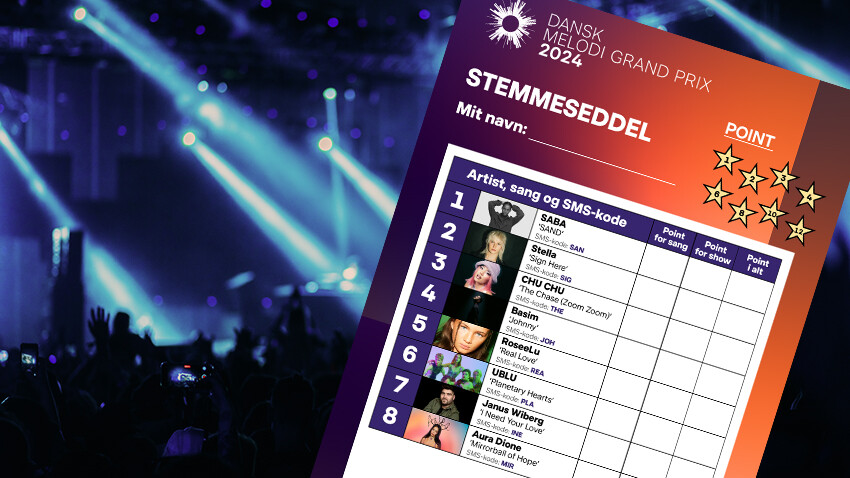

Dansk Melodi Grand Prix 2025 Stem Pa Din Favorit Nu

May 11, 2025

Dansk Melodi Grand Prix 2025 Stem Pa Din Favorit Nu

May 11, 2025 -

Budget Serre 12 Astuces Pour Faire Des Economies

May 11, 2025

Budget Serre 12 Astuces Pour Faire Des Economies

May 11, 2025 -

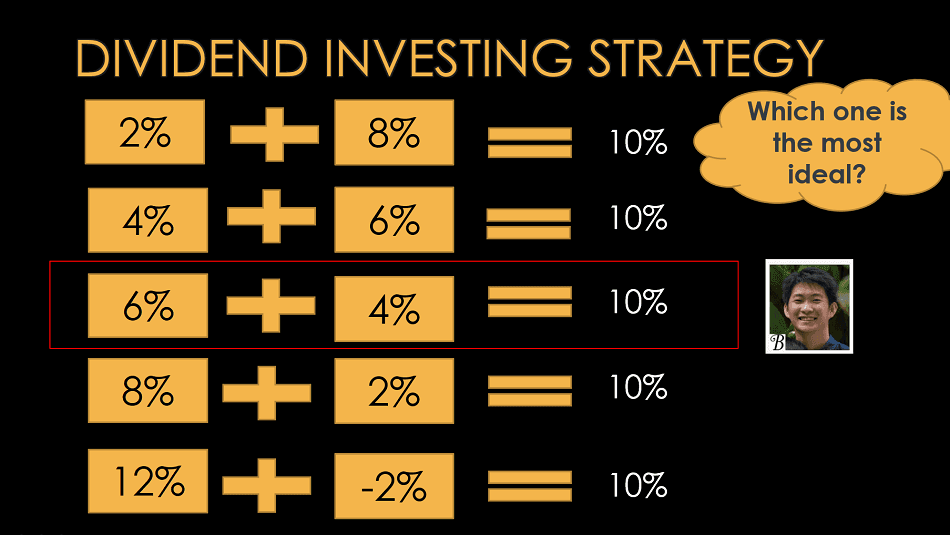

The Most Profitable Dividend Strategy Simplicity And Success

May 11, 2025

The Most Profitable Dividend Strategy Simplicity And Success

May 11, 2025 -

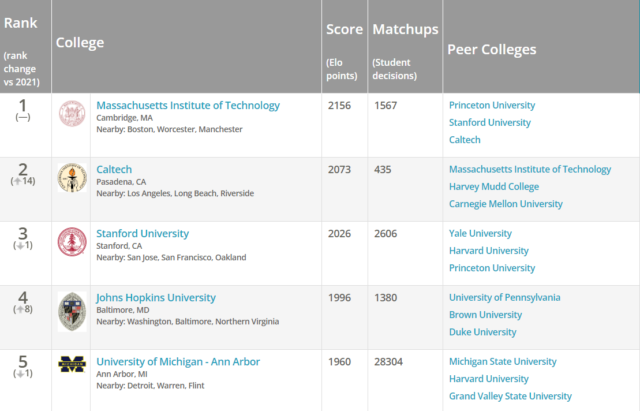

City Name Mi A Top Choice For College Students

May 11, 2025

City Name Mi A Top Choice For College Students

May 11, 2025