FTC's Monopoly Case Against Meta: A Shift In Strategy

Table of Contents

The FTC's Revised Complaint: A Deeper Dive into Anti-Competitive Practices

The FTC's revised complaint against Meta isn't just a rehash of previous arguments; it represents a more sophisticated and comprehensive legal challenge. This updated lawsuit aims to demonstrate a pattern of anti-competitive behavior, specifically targeting Meta's acquisition practices.

Focus on Acquisitions: Stifling Innovation Through Strategic Buyouts

The heart of the FTC's revised complaint centers on Meta's acquisition strategy. The FTC alleges that Meta systematically acquired promising competitors, not to foster innovation, but to eliminate potential threats to its dominance in social networking, virtual reality (VR), and other related markets.

- Specific examples of acquisitions under scrutiny: The FTC's case heavily scrutinizes Meta's acquisitions of Instagram and WhatsApp. These acquisitions, the FTC argues, eliminated significant potential competitors and solidified Meta's already substantial market share. Other smaller acquisitions are also likely to be examined as part of this broader pattern of anti-competitive behavior.

- Details on how these acquisitions allegedly stifled competition: The FTC will likely present evidence showing how the acquired companies could have posed significant competitive challenges to Meta had they remained independent. This might include demonstrating that the acquired companies had innovative features or business models that could have disrupted Meta's dominance.

- Analysis of the FTC's argument regarding the anti-competitive effects: The FTC's central argument rests on demonstrating that these acquisitions weren't simply about expanding Meta's reach; they were specifically designed to neutralize competitive threats and prevent the emergence of new rivals, resulting in reduced innovation and higher prices for consumers.

Strengthened Evidence and Legal Arguments: Addressing Past Shortcomings

One key difference between the revised complaint and the previous iterations is the inclusion of stronger evidence and more refined legal arguments. The FTC aims to address the shortcomings that led to previous dismissals.

- Mention specific types of new evidence presented: The FTC likely bolstered its case with newly discovered internal documents, emails, and communications revealing Meta's strategic intent behind these acquisitions. Expert testimony from economists and market analysts will also play a significant role.

- Explain how the legal arguments have been strengthened: The FTC has refined its legal strategy, focusing on a more comprehensive narrative that links the acquisitions to a broader pattern of anti-competitive behavior, rather than focusing on individual cases in isolation.

- Discuss the potential impact of these improvements on the case's outcome: The strengthened evidence and refined legal arguments significantly increase the chances of a successful prosecution, potentially leading to a favorable outcome for the FTC.

Broader Implications for Future Acquisitions: Setting a Precedent for Tech Mergers

The FTC's renewed case against Meta has far-reaching implications that extend beyond the specific acquisitions under scrutiny. It establishes a crucial precedent for future tech acquisitions, significantly increasing regulatory scrutiny and setting a higher bar for mergers and acquisitions in the industry.

- Discussion of the impact on the merger review process: The case could lead to more rigorous antitrust reviews of future tech mergers, with a greater focus on the potential anti-competitive effects of acquisitions, even those involving companies that don't appear to be direct competitors at first glance.

- Analysis of the potential chilling effect on future acquisitions in the tech sector: The increased regulatory scrutiny may create a chilling effect, deterring large tech companies from undertaking potentially beneficial acquisitions for fear of lengthy and costly legal battles.

- Exploration of potential changes in merger guidelines: This case could result in changes to merger guidelines, making it harder for large companies to consolidate market power.

Meta's Defense Strategy and Potential Outcomes

Meta is expected to vigorously defend itself against the FTC's allegations. The company will likely employ a multi-pronged defense strategy.

Meta's Counterarguments: A Focus on Consumer Benefits and Innovation

Meta's defense will likely center on the argument that its acquisitions were pro-competitive, benefiting consumers through integration of services and fostering innovation.

- Summarize Meta's likely defense strategy: Meta will likely emphasize the benefits consumers have gained through the integration of Instagram and WhatsApp into its ecosystem, arguing that these acquisitions led to improved user experience and innovation.

- Mention any previous statements or actions taken by Meta in response to the lawsuit: Meta has previously issued statements defending its acquisition strategy and maintaining that it operates within the bounds of the law. These statements and any legal actions taken will be integral parts of its defense.

- Include analysis of the strength of Meta's counterarguments: The strength of Meta's defense will depend on its ability to convincingly demonstrate that the acquisitions did not substantially lessen competition and led to tangible benefits for consumers.

Potential Legal Outcomes: Divestiture, Fines, or Structural Changes

The outcome of the FTC's case against Meta could have significant repercussions, ranging from substantial fines to forced divestiture of acquired companies.

- Discussion of potential scenarios and their implications for Meta: Depending on the court's ruling, Meta might face significant financial penalties, be forced to divest itself of Instagram or WhatsApp, or be subject to structural changes designed to curb its market power.

- Analysis of the legal precedents and their relevance to the case: The judge's decision will be influenced by existing antitrust laws and precedents, making an understanding of relevant case law critical to predicting the outcome.

- Exploration of the potential impact on Meta's stock price and market valuation: The uncertainty surrounding the legal proceedings is likely to create volatility in Meta's stock price. An unfavorable outcome could result in a significant decline in its market valuation.

The Broader Context: Shifting Regulatory Landscape for Big Tech

The FTC's renewed case against Meta is not an isolated event. It reflects a broader trend of increased regulatory scrutiny of Big Tech companies worldwide.

Increased Regulatory Scrutiny: A Global Trend

The intensified scrutiny is not confined to the United States. Many other countries are increasingly focusing on antitrust issues related to tech monopolies.

- Discussion of similar antitrust cases against other tech giants: Similar antitrust cases are being pursued against other tech giants globally, reflecting a growing concern about the dominance of a few powerful companies.

- Analysis of the impact of recent regulatory changes and proposed legislation: Recent regulatory changes and proposed legislation in various countries aim to curtail the power of Big Tech and create a more competitive landscape.

- Mention of international regulatory efforts targeting tech monopolies: International cooperation is also emerging, with various regulatory bodies collaborating to address the global challenges posed by tech monopolies.

The Future of Tech Regulation: Shaping the Industry's Trajectory

The outcome of the FTC's case against Meta will be pivotal in shaping the future direction of tech regulation.

- Discussion of potential future regulatory changes: This case may lead to further regulatory changes, including stricter guidelines for mergers and acquisitions, increased enforcement of existing antitrust laws, and new regulations designed to address specific concerns related to market dominance.

- Analysis of the long-term implications for the tech industry: The long-term implications for the tech industry are significant, potentially impacting innovation, competition, and the overall structure of the digital economy.

- Exploration of the challenges and opportunities presented by the changing regulatory environment: The evolving regulatory landscape presents both challenges and opportunities for tech companies, requiring them to adapt their business strategies to comply with new regulations while seeking to maintain their competitive edge.

Conclusion

The FTC's revised monopoly case against Meta marks a pivotal moment in the ongoing debate over Big Tech's market dominance. The shift in strategy, focusing on acquisitions and presenting stronger evidence, underscores a growing determination to curb anti-competitive practices. The outcome will not only significantly impact Meta but also shape the future of tech regulation globally. Staying informed about the developments in this landmark case is crucial for understanding the evolving landscape of the tech industry and the ongoing fight against tech monopolies. Keep following the developments in the FTC's Monopoly Case Against Meta for further updates.

Featured Posts

-

Trans Australia Run Challenging The Existing World Record

May 21, 2025

Trans Australia Run Challenging The Existing World Record

May 21, 2025 -

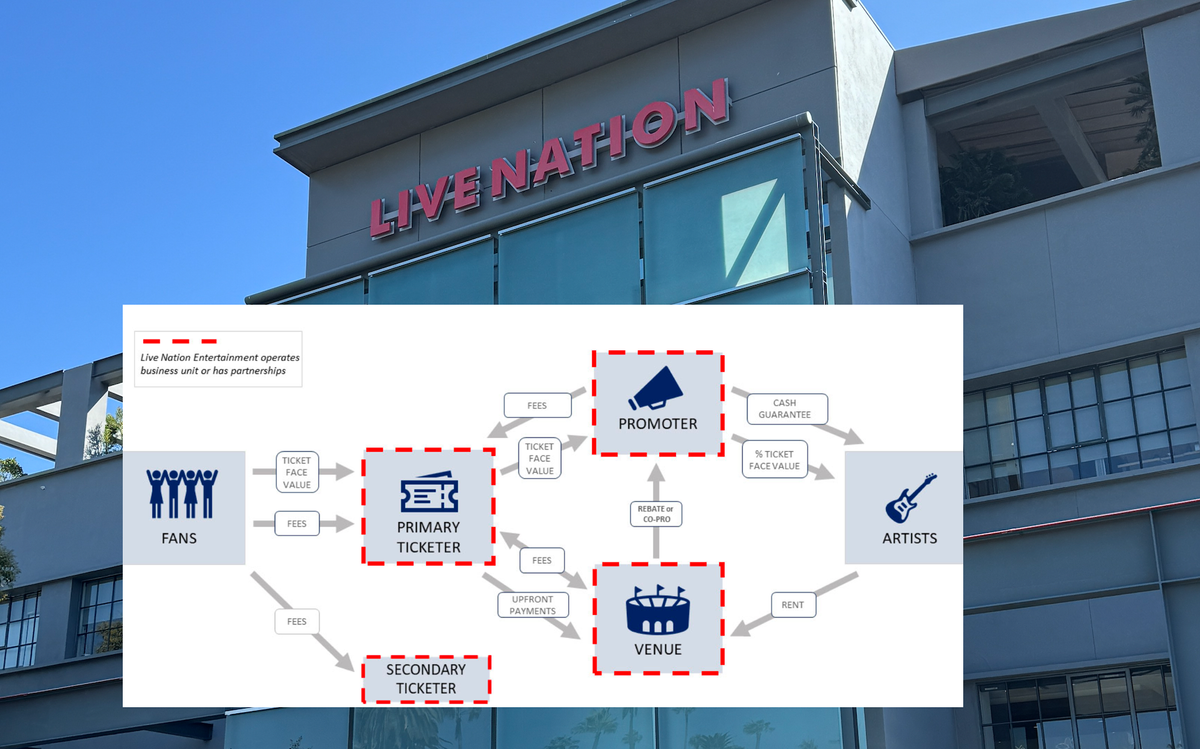

Wtt Press Conference Unveils Innovative Competitive Concept

May 21, 2025

Wtt Press Conference Unveils Innovative Competitive Concept

May 21, 2025 -

Unexpected Interruption Bbc Breakfast Guests Live Broadcast Intrusion

May 21, 2025

Unexpected Interruption Bbc Breakfast Guests Live Broadcast Intrusion

May 21, 2025 -

D Wave Quantum Qbts Stock Decline Monday A Deep Dive Into The Causes

May 21, 2025

D Wave Quantum Qbts Stock Decline Monday A Deep Dive Into The Causes

May 21, 2025 -

Liverpools Win Slots Admission And Enriques Alisson Verdict

May 21, 2025

Liverpools Win Slots Admission And Enriques Alisson Verdict

May 21, 2025

Latest Posts

-

Where To Watch Live Bundesliga Football Online

May 21, 2025

Where To Watch Live Bundesliga Football Online

May 21, 2025 -

Live Bundesliga Your Guide To Watching Every Match

May 21, 2025

Live Bundesliga Your Guide To Watching Every Match

May 21, 2025 -

Fsv Mainz 05 Vs Bayer Leverkusen Matchday 34 Report And Highlights

May 21, 2025

Fsv Mainz 05 Vs Bayer Leverkusen Matchday 34 Report And Highlights

May 21, 2025 -

Preparing For Damaging Winds Associated With Fast Moving Storms

May 21, 2025

Preparing For Damaging Winds Associated With Fast Moving Storms

May 21, 2025 -

Exploring Nadiem Amiris Career From Leverkusen To Mainz

May 21, 2025

Exploring Nadiem Amiris Career From Leverkusen To Mainz

May 21, 2025