Gas Price Fluctuation In Columbus: A 48¢ Difference

Table of Contents

Factors Contributing to Gas Price Fluctuation in Columbus

Several interconnected factors contribute to the rollercoaster ride of gas prices we experience in Columbus.

Crude Oil Prices: A Global Impact on Local Pumps

The price of crude oil, the raw material for gasoline, is a primary driver of gas price fluctuation. Global events significantly influence crude oil prices. The Organization of the Petroleum Exporting Countries (OPEC) plays a critical role, influencing production levels and impacting global supply. Geopolitical instability, such as conflicts or sanctions, can also disrupt oil markets, leading to price spikes. Seasonal demand also contributes, with higher prices typically seen during peak driving seasons (summer).

- Examples of global events impacting oil prices: The war in Ukraine, sanctions against specific oil-producing nations, and unexpected disruptions to major pipelines significantly influence crude oil prices and, consequently, gas prices in Columbus.

- Translation to Columbus gas prices: A rise in global crude oil prices directly translates into higher gas prices at the pump in Columbus, often within a few days or weeks.

[Insert chart or graph illustrating crude oil price changes over the past few months here.]

Refinery Capacity and Distribution Costs: The Path to Your Tank

The journey from crude oil to your gas tank involves refining and transportation, both contributing to price variations. Regional refinery issues, such as unplanned maintenance or disruptions, can lead to limited supply and increased prices in a specific area, like Columbus. Transportation costs, including pipeline fees and trucking expenses, also influence the final price at the pump. These costs vary depending on the distance from the refinery to the station and overall fuel distribution efficiency within Ohio.

- Impact of pipeline issues or refinery maintenance: A temporary shutdown of a major pipeline or refinery maintenance can cause localized shortages, leading to a surge in gas prices in Columbus and surrounding areas.

- Transportation costs within Ohio: The distance a gas station is from the refinery and the efficiency of distribution networks across Ohio influence the transportation component of the gas price.

Local Market Competition: A Battle for Your Business

The competitive landscape among gas stations in Columbus is another key player. The number of stations, their proximity to each other, and their individual pricing strategies influence the final price you see. Larger chains may have more negotiating power with suppliers, leading to lower costs. However, independent stations may offer more competitive pricing to attract customers.

- Examples of gas station chains and their pricing strategies: Major chains often adjust their prices based on regional competition and national trends.

- Independent stations and their competitive advantage (or disadvantage): Independent stations might have to offer lower prices to compete with larger chains, sometimes leading to even wider price fluctuations.

Finding the Cheapest Gas in Columbus

The 48¢ difference highlights the importance of actively seeking the best deals.

Utilizing Gas Price Tracking Apps

Several apps can help you locate the cheapest gas in Columbus.

- App features (price comparison, station location, user reviews): Apps like GasBuddy provide real-time gas price updates, station locations, and user reviews, enabling informed decisions.

- Highlight the benefits of real-time updates: Real-time updates are crucial, as prices can fluctuate daily, even hourly.

Monitoring Local Gas Station Websites & Social Media

Checking individual gas station websites and social media pages can sometimes reveal promotions and current prices.

- Explain the limitations of this method compared to apps: This method can be time-consuming and might not capture all stations in Columbus.

Exploring Different Neighborhoods

Gas prices can vary significantly across different neighborhoods in Columbus.

- Examples of areas with potentially higher or lower gas prices: Areas with higher competition might offer better prices than those with fewer stations.

The Long-Term Outlook for Gas Prices in Columbus

Predicting future gas price fluctuations is challenging.

Predicting Future Fluctuations

Several factors will impact future gas prices.

- Mention upcoming economic forecasts, potential geopolitical events, and the transition to renewable energy sources: Economic growth, international relations, and the shift towards renewable energy all have long-term impacts on fuel costs.

Strategies for Managing Gas Expenses

There are several strategies to help manage your fuel costs.

- Practical tips for reducing fuel consumption: Maintain your car regularly, drive at a steady speed, avoid unnecessary idling, and consider carpooling or using public transport when feasible.

Conclusion

The significant gas price fluctuation in Columbus, with price differences reaching 48¢, is a result of a complex interplay between global crude oil prices, local market competition, and distribution costs. By utilizing gas price tracking apps, monitoring station websites, exploring different neighborhoods, and adopting fuel-efficient driving habits, you can effectively navigate these fluctuations and minimize their impact on your budget. Stay informed about gas price fluctuation in Columbus; take control of your gas budget; find the cheapest gas in Columbus using our tips; and minimize the impact of Columbus gas price fluctuation.

Featured Posts

-

Toledo Gas Prices Recent Trends And Predictions

May 22, 2025

Toledo Gas Prices Recent Trends And Predictions

May 22, 2025 -

6 1 Georgia Obtine O Victorie Clara Asupra Armeniei In Liga Natiunilor

May 22, 2025

6 1 Georgia Obtine O Victorie Clara Asupra Armeniei In Liga Natiunilor

May 22, 2025 -

Israeli Embassy Identifies Couple Killed In Washington D C Shooting

May 22, 2025

Israeli Embassy Identifies Couple Killed In Washington D C Shooting

May 22, 2025 -

Tory Councillors Spouse Imprisoned After Hotel Fire Tweet Appeal Process Begins

May 22, 2025

Tory Councillors Spouse Imprisoned After Hotel Fire Tweet Appeal Process Begins

May 22, 2025 -

Understanding Cassis Blackcurrant Taste Profile And Culinary Applications

May 22, 2025

Understanding Cassis Blackcurrant Taste Profile And Culinary Applications

May 22, 2025

Latest Posts

-

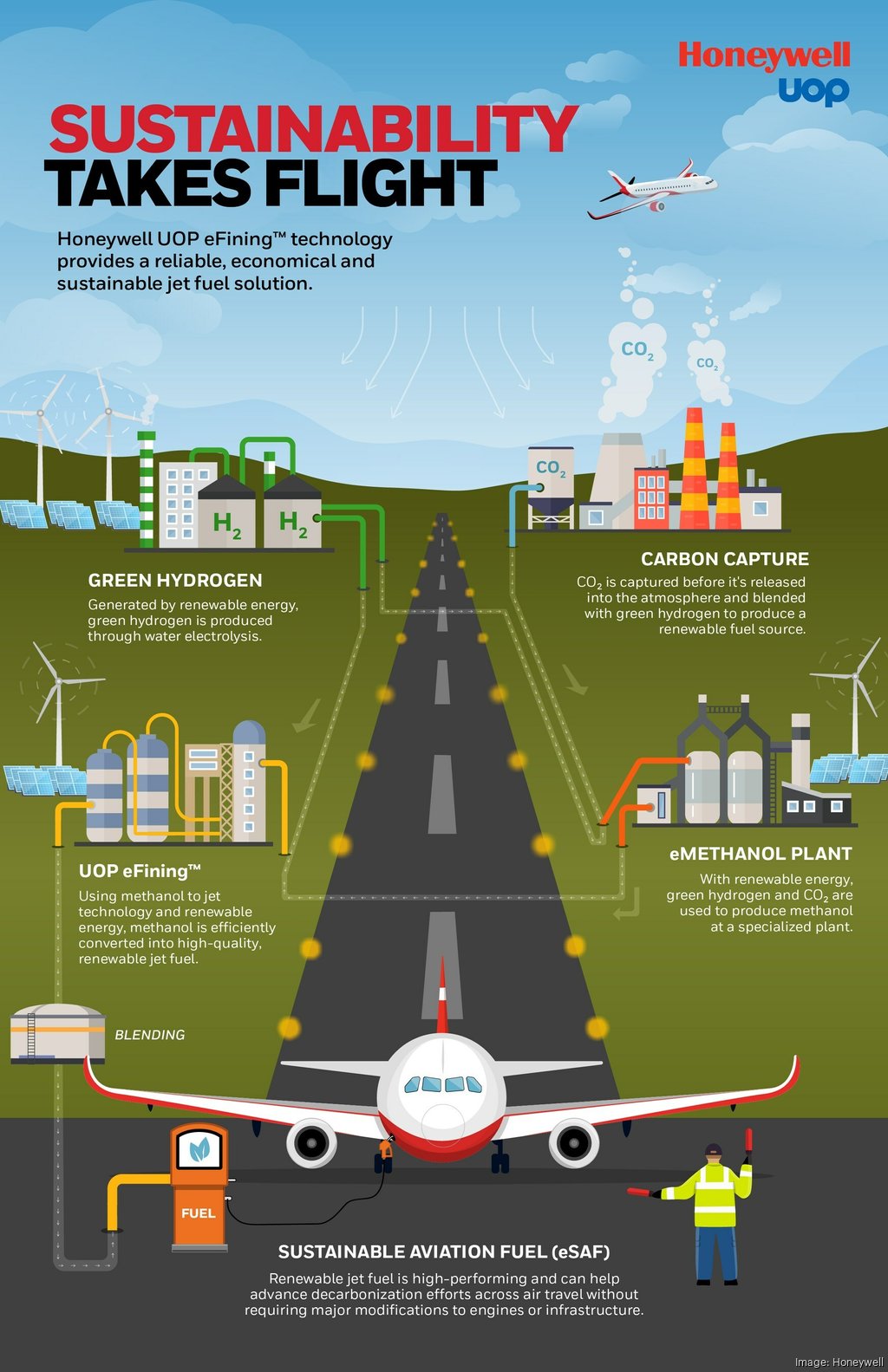

Honeywell And Johnson Matthey Near 1 8 B Deal

May 23, 2025

Honeywell And Johnson Matthey Near 1 8 B Deal

May 23, 2025 -

Johnson Matthey Sells Catalyst Unit To Honeywell For 2 4 Billion Impact And Analysis

May 23, 2025

Johnson Matthey Sells Catalyst Unit To Honeywell For 2 4 Billion Impact And Analysis

May 23, 2025 -

Honeywells 2 4 Billion Acquisition Of Johnson Mattheys Catalyst Unit A Deep Dive

May 23, 2025

Honeywells 2 4 Billion Acquisition Of Johnson Mattheys Catalyst Unit A Deep Dive

May 23, 2025 -

Honeywells Acquisition Of Johnson Mattheys Catalyst Technologies Boosting Its Process Technology Capabilities

May 23, 2025

Honeywells Acquisition Of Johnson Mattheys Catalyst Technologies Boosting Its Process Technology Capabilities

May 23, 2025 -

Reaching 100 Test Wickets The Challenges Facing Zimbabwes Muzarabani

May 23, 2025

Reaching 100 Test Wickets The Challenges Facing Zimbabwes Muzarabani

May 23, 2025