Get The Lowest Personal Loan Interest Rates Today: A Simple Comparison Guide

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into the specifics of securing the lowest personal loan interest rates, it's crucial to understand how interest rates work. The Annual Percentage Rate (APR) represents the yearly cost of borrowing money, encompassing the interest rate and any associated fees. A higher APR means you'll pay significantly more over the loan's lifetime. Several factors influence the interest rate you'll qualify for:

- Credit Score: Your credit score is a major determinant of your interest rate. Higher credit scores generally qualify for lower interest rates, reflecting your perceived lower risk to the lender. Aim for a good credit score to access the best personal loan rates.

- Loan Amount: Larger loan amounts often come with slightly higher interest rates due to the increased risk for the lender.

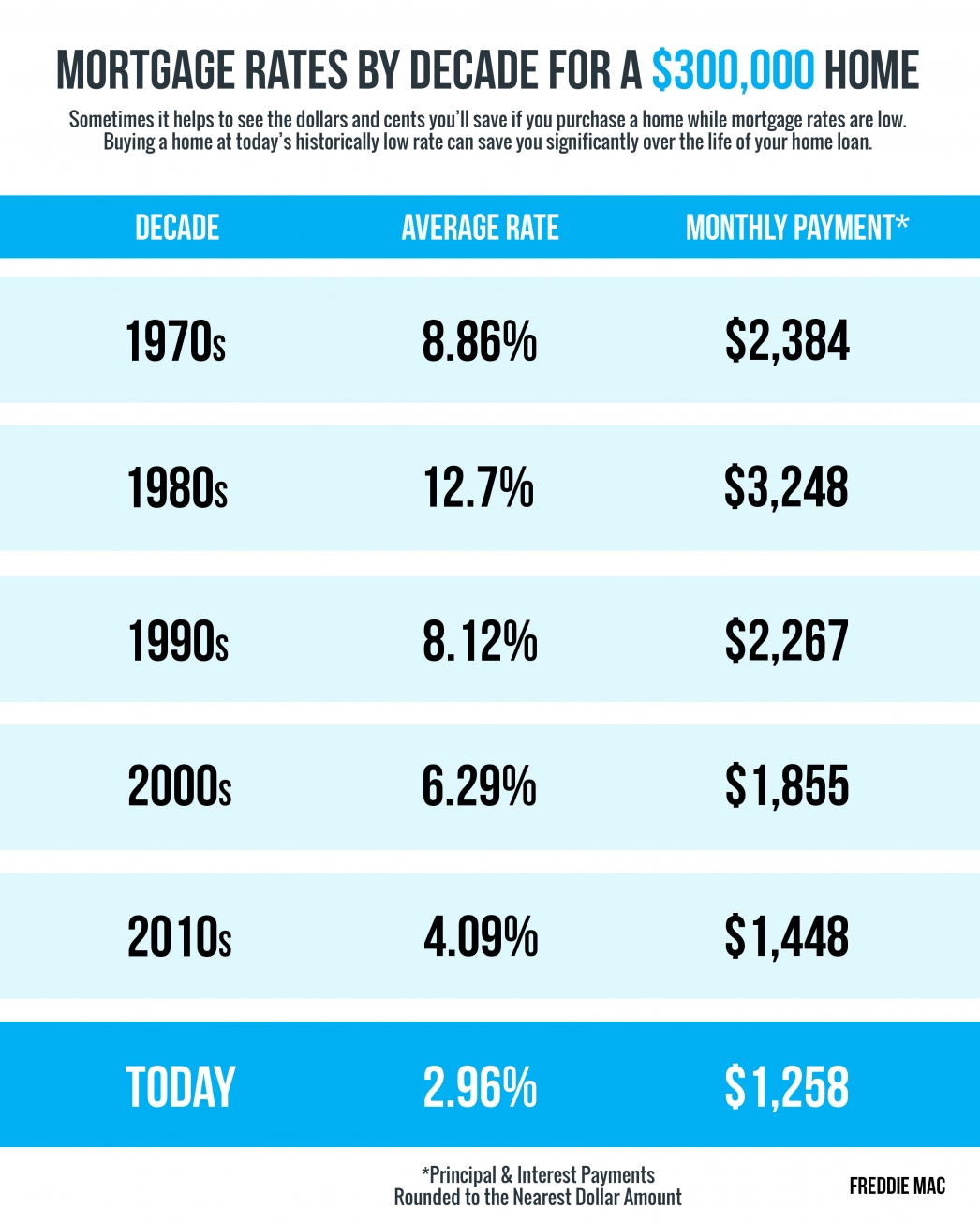

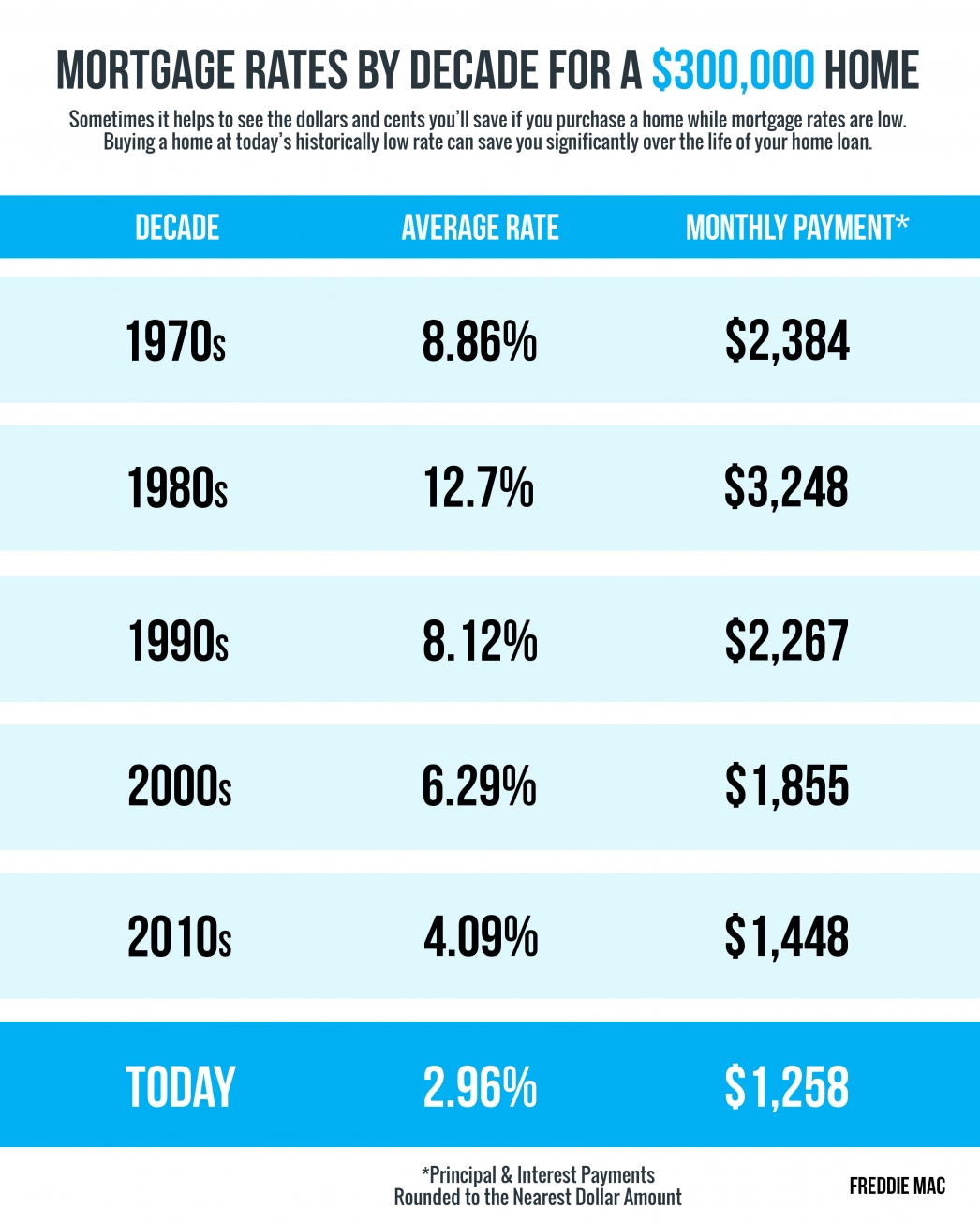

- Loan Term: The length of your loan (loan term) impacts your monthly payment and total interest paid. Longer loan terms result in lower monthly payments but higher overall interest costs. Shorter terms mean higher monthly payments but less interest paid overall.

- Lender Type: Different lenders, including banks, credit unions, and online lenders, offer varying interest rates and loan products. Comparing offers from multiple lenders is crucial to finding the best deal.

- Hidden Fees: Be aware of hidden fees, such as origination fees or prepayment penalties, as these can significantly increase your effective interest rate and impact the total cost of your loan. Always inquire about all fees upfront.

How to Compare Personal Loan Offers Effectively

Comparing personal loan offers effectively is key to securing the lowest personal loan interest rates. Don't just focus on the monthly payment; always compare the APRs. A lower monthly payment might seem appealing, but a higher APR could lead to substantially more interest paid over the loan's life.

- Compare APRs, Not Just Monthly Payments: Prioritize the APR as it represents the true cost of borrowing.

- Consider All Fees: Include all associated fees – origination fees, late payment fees, prepayment penalties – when calculating the total cost of the loan.

- Utilize Online Comparison Tools: Several reputable online resources allow you to compare personal loan offers from multiple lenders simultaneously.

- Create a Spreadsheet: Organize your research by creating a spreadsheet to compare APRs, monthly payments, fees, and loan terms from different lenders side-by-side. This helps visualize which offer is the most cost-effective.

- Check for Prepayment Penalties: Some lenders charge penalties if you pay off your loan early. Avoid these if possible by choosing a loan with no prepayment penalty.

- Read the Fine Print: Always carefully review the loan agreement before signing. Understand all terms and conditions, including interest rate calculations and fee structures.

- Use a Loan Calculator: Online loan calculators help estimate your monthly payments based on different loan amounts, interest rates, and loan terms.

Strategies to Secure the Lowest Personal Loan Interest Rates

Several strategies can help you secure the lowest personal loan interest rates. Improving your creditworthiness is paramount. The better your credit, the lower the interest rate you'll qualify for.

- Improve Your Credit Score: Pay down existing debts, especially high-interest credit card debt, to improve your credit utilization ratio (the amount of credit you're using compared to your total available credit). Check your credit report for errors and dispute any inaccuracies.

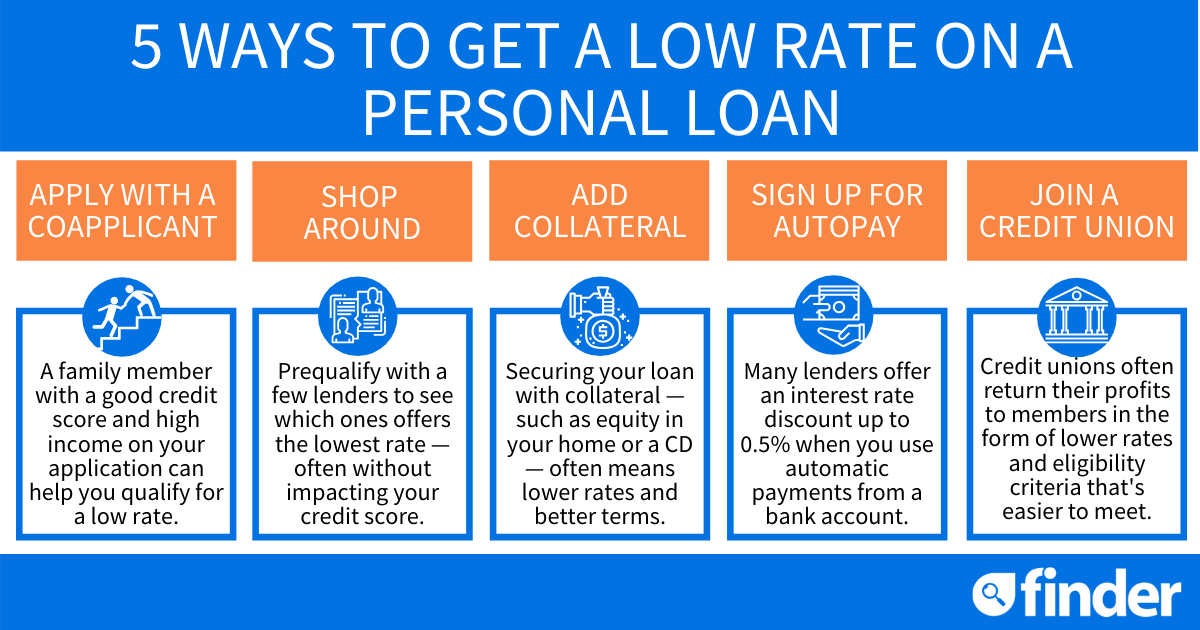

- Shop Around: Compare offers from multiple lenders – banks, credit unions, and online lenders – to find the most competitive rates. Don't settle for the first offer you receive.

- Negotiate: Don't hesitate to negotiate with lenders. Explain your financial situation and inquire about potential rate reductions.

- Consider Secured Loans: If you have difficulty securing a low interest rate on an unsecured loan, explore secured loans (loans backed by collateral, such as a savings account or car). These often come with lower interest rates but involve a risk if you default on the loan.

- Co-Signer: If your credit history isn't strong, consider having a co-signer with good credit to improve your chances of approval and secure a lower interest rate.

- Explore Balance Transfers: If you have high-interest credit card debt, consider a balance transfer to a lower-interest credit card or a personal loan with a lower APR.

Choosing the Right Lender for Your Needs

Selecting the right lender is just as important as securing a low interest rate. Consider the following factors when making your decision:

- Banks: Banks offer a wide range of loan products but often have stricter approval requirements and may not offer the lowest rates.

- Credit Unions: Credit unions frequently offer lower interest rates and more personalized service to their members, but membership may be required.

- Online Lenders: Online lenders provide convenience and speed but may lack the personalized service of traditional lenders. They may also have less stringent requirements.

Conclusion: Finding the Best Personal Loan Interest Rates

Securing the lowest personal loan interest rates requires careful planning and research. By improving your credit score, comparing loan offers meticulously, negotiating rates effectively, and choosing a reputable lender, you can significantly reduce your borrowing costs. Remember, understanding the APR, considering all fees, and reading the fine print are crucial steps in the process. Don't wait any longer! Start your search for the lowest personal loan interest rates today and take control of your finances. Finding the best personal loan rates and securing cheap personal loans is within your reach with the right approach.

Featured Posts

-

Tueketici Kredileri Abd Deki Mart Ayi Artisi Ve Gelecek Tahminleri

May 28, 2025

Tueketici Kredileri Abd Deki Mart Ayi Artisi Ve Gelecek Tahminleri

May 28, 2025 -

A Hideg Es A Talajnedvesseg Kihatasa A Magyar Noevenykulturakra

May 28, 2025

A Hideg Es A Talajnedvesseg Kihatasa A Magyar Noevenykulturakra

May 28, 2025 -

Hasselbaink Ronaldo Ya Emeklilik Oenerdi 2026 Duenya Kupasi Tartismasi

May 28, 2025

Hasselbaink Ronaldo Ya Emeklilik Oenerdi 2026 Duenya Kupasi Tartismasi

May 28, 2025 -

Man United In Race For Rayan Cherki Transfer Speculation Mounts

May 28, 2025

Man United In Race For Rayan Cherki Transfer Speculation Mounts

May 28, 2025 -

Secure Your Lowest Personal Loan Interest Rates Today

May 28, 2025

Secure Your Lowest Personal Loan Interest Rates Today

May 28, 2025

Latest Posts

-

El Regreso De Agassi Un Nuevo Capitulo En Su Carrera

May 30, 2025

El Regreso De Agassi Un Nuevo Capitulo En Su Carrera

May 30, 2025 -

Agassi De Las Pistas A Un Nuevo Desafio Deportivo

May 30, 2025

Agassi De Las Pistas A Un Nuevo Desafio Deportivo

May 30, 2025 -

Marcelo Rios La Admiracion O El Odio De Un Tenista Argentino

May 30, 2025

Marcelo Rios La Admiracion O El Odio De Un Tenista Argentino

May 30, 2025 -

Controversial Revelacion Tenista Argentino Y Su Opinion Sobre Marcelo Rios

May 30, 2025

Controversial Revelacion Tenista Argentino Y Su Opinion Sobre Marcelo Rios

May 30, 2025 -

Un Tenista Argentino Arremete Contra Rios Era Un Dios Del Tenis

May 30, 2025

Un Tenista Argentino Arremete Contra Rios Era Un Dios Del Tenis

May 30, 2025