Gold (XAUUSD) Price Rebound: Weak US Data Fuels Rate Cut Expectations

Table of Contents

Weak US Economic Data – The Catalyst for Gold's Rise

Recent economic indicators paint a concerning picture for the US economy, providing a significant catalyst for the rise in gold prices. Several key metrics point towards a potential slowdown, directly impacting investor sentiment and driving demand for safe-haven assets like gold.

-

Lower-than-expected inflation figures: While inflation has cooled from its peak, recent data suggests a slower-than-anticipated decline, leaving room for concern about persistent inflationary pressures. This uncertainty boosts gold's appeal as a hedge against inflation.

-

Slowing GDP growth rate: The US GDP growth rate has shown signs of deceleration, indicating a potential economic slowdown. This weakness contributes to investors seeking the safety and stability associated with gold investment.

-

Rising unemployment claims: An increase in unemployment claims suggests a weakening labor market, further fueling concerns about the overall health of the US economy. Such indicators often push investors towards gold as a safer investment option.

-

Weakening consumer confidence: Declining consumer confidence reflects uncertainty about the future economic outlook. This uncertainty often translates into increased demand for precious metals, including gold, as investors seek stability.

These weakening economic indicators collectively signal a possible reduction in the Federal Reserve's aggressive interest rate hiking cycle, further bolstering gold's appeal.

Federal Reserve Rate Cut Expectations – A Gold Bull Market Driver?

Gold and interest rates share an inverse relationship. Higher interest rates typically increase the opportunity cost of holding non-yielding assets like gold, pushing prices down. Conversely, lower interest rates make gold more attractive. The market is now anticipating a potential Fed rate cut, a move that would significantly impact the XAUUSD price.

-

Lower interest rates decrease the opportunity cost of holding non-yielding assets like gold. Reduced interest rates make it less expensive to hold gold, increasing its relative attractiveness compared to interest-bearing investments.

-

A weaker US dollar makes gold more affordable for investors using other currencies. A rate cut often weakens the US dollar, making gold cheaper for international investors and boosting demand. This strengthens the XAU/USD exchange rate.

-

Rate cut expectations often lead to increased safe-haven demand for gold. Concerns about economic slowdown and potential market instability increase the demand for gold as a safe haven, pushing its price upward.

The anticipation of a Fed rate cut is therefore a significant driver for the current gold bull market, reinforcing its position as a safe-haven asset.

Other Factors Influencing Gold (XAUUSD) Price

While weak US economic data and rate cut expectations are major contributors to the recent gold price rebound, other factors also play a significant role in influencing the XAUUSD price.

-

Geopolitical risks increase demand for safe-haven assets like gold. Global conflicts and political instability create uncertainty, prompting investors to flock towards the perceived safety of gold.

-

Persistent inflation can erode the purchasing power of fiat currencies, increasing gold's appeal. Inflation acts as a hedge against currency devaluation, further bolstering gold's value as a store of value.

-

Speculative trading can amplify gold price fluctuations. Market speculation and trading activity can significantly influence short-term price movements, creating volatility in the XAUUSD market.

Gold (XAUUSD) Price Prediction and Future Outlook

Predicting future gold prices with certainty is impossible due to inherent market volatility. However, considering the current factors, a cautious outlook is warranted.

-

Consider potential changes in US monetary policy. Future Fed decisions regarding interest rates will significantly influence the gold price.

-

Assess the impact of global economic growth. Global economic conditions influence investor risk appetite and demand for gold.

-

Analyze shifts in investor sentiment and market conditions. Changing market sentiment and unexpected events can impact the XAUUSD price significantly.

Effective risk management is crucial for any gold investment strategy. Diversification and a thorough understanding of market dynamics are key to navigating the complexities of the gold market.

Conclusion: Navigating the Gold (XAUUSD) Market

In summary, the recent surge in gold prices (XAUUSD) is largely attributable to weak US economic data, fueling expectations of Federal Reserve rate cuts. This, combined with geopolitical uncertainties and persistent inflation, has boosted gold's appeal as a safe-haven asset. The inverse relationship between the US dollar and gold prices is a key factor to consider, as rate cut expectations often weaken the dollar, making gold more attractive. While the future outlook remains uncertain, the potential for further gold price increases exists, contingent on evolving economic conditions and investor sentiment. Stay tuned for updates on XAUUSD, learn more about investing in gold, and monitor the XAU/USD price for optimal trading opportunities. Develop a robust investment strategy for gold and other precious metals to effectively navigate this dynamic market.

Featured Posts

-

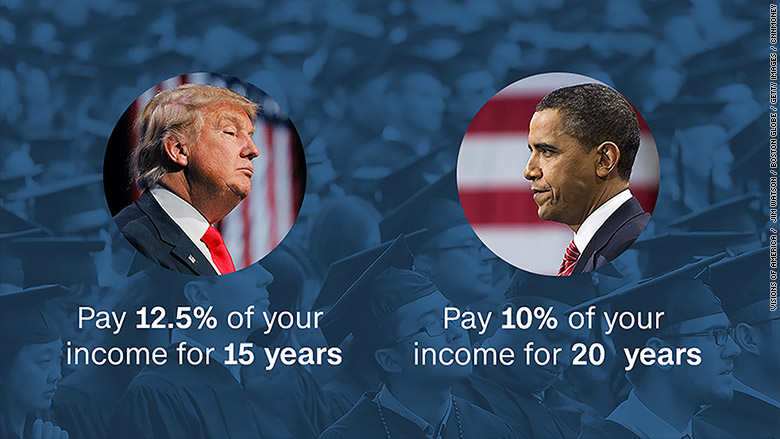

Trumps Student Loan Privatization Plan What It Could Mean For Borrowers

May 17, 2025

Trumps Student Loan Privatization Plan What It Could Mean For Borrowers

May 17, 2025 -

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025 -

False Angel Reese Quotes Identifying And Preventing Their Spread

May 17, 2025

False Angel Reese Quotes Identifying And Preventing Their Spread

May 17, 2025 -

Top Rated No Kyc Casinos With Instant Withdrawals 7 Bit Casino

May 17, 2025

Top Rated No Kyc Casinos With Instant Withdrawals 7 Bit Casino

May 17, 2025 -

Nba Rekordas Boston Celtics Parduotas Lietuviai Neinvestavo

May 17, 2025

Nba Rekordas Boston Celtics Parduotas Lietuviai Neinvestavo

May 17, 2025