Gold (XAUUSD) Rally: Is A Rate Cut The Catalyst?

Table of Contents

Interest Rate Cuts and Their Impact on Gold Prices

The relationship between interest rates and gold prices is often described as inverse. This means that when interest rates go up, gold prices tend to go down, and vice versa.

Inverse Relationship between Interest Rates and Gold Prices

Higher interest rates generally increase the opportunity cost of holding non-yielding assets like gold. Investors often shift their investments towards higher-yielding options like bonds and savings accounts when interest rates are attractive. This reduced demand for gold typically leads to lower prices. Conversely, lower interest rates make gold a relatively more attractive investment, as the opportunity cost of holding it diminishes.

- Increased returns on bonds/savings accounts: Higher interest rates offer better returns on traditional investments, making gold less appealing.

- Decreased demand for gold as an investment: Reduced demand directly impacts the price of gold in the market.

- Impact on gold trading volumes: Lower interest rates can stimulate increased trading activity in the gold market.

The Role of Inflation in the Equation

Inflation plays a crucial role in the gold-interest rate dynamic. Central banks often cut interest rates to combat inflation, aiming to stimulate economic growth. However, this can create a paradoxical situation for gold.

- Inflation hedging properties of gold: Gold is often viewed as a hedge against inflation because its value tends to rise when the purchasing power of fiat currencies declines.

- Purchasing power erosion: High inflation erodes the purchasing power of money, making gold a more attractive store of value.

- Central bank intervention to control inflation: Central bank actions to curb inflation, including rate cuts, can have unpredictable effects on gold prices.

Market Sentiment and Speculation

Anticipation of future rate cuts can significantly influence market sentiment and drive gold price movements. Speculative trading based on expectations plays a considerable role.

- Speculative buying: Traders may buy gold in anticipation of a price increase following a rate cut announcement.

- Anticipation of policy changes: News and rumors about potential policy changes can trigger significant price fluctuations.

- Impact of news and announcements: Official announcements regarding interest rates often cause immediate and dramatic shifts in the gold market.

Economic Factors Influencing the Gold Rally

Beyond interest rates, broader economic conditions strongly influence the gold market. The current gold rally is being fueled by several significant factors.

Recessionary Fears and Safe Haven Demand

Gold's reputation as a safe haven asset is a critical driver of its price. During times of economic uncertainty and recessionary fears, investors often flock to gold as a safe store of value.

- Investor flight to safety: During economic downturns, investors often sell riskier assets and move capital into perceived safer havens like gold.

- Diversification strategies: Gold is often included in diversified investment portfolios as a way to mitigate risk.

- Gold's historical performance during recessions: Gold has historically performed well during recessions, further enhancing its safe-haven appeal.

Geopolitical Instability and Gold's Value

Geopolitical events and global instability frequently impact gold prices. Uncertainty and conflict often lead to increased demand for gold as a safe haven.

- Safe haven demand during times of conflict: Periods of conflict or political instability usually see a rise in gold prices.

- Impact of sanctions and trade wars: Geopolitical tensions, including sanctions and trade wars, can increase gold's appeal.

- Currency fluctuations: Uncertainty in the global currency market often contributes to the appeal of gold as a stable store of value.

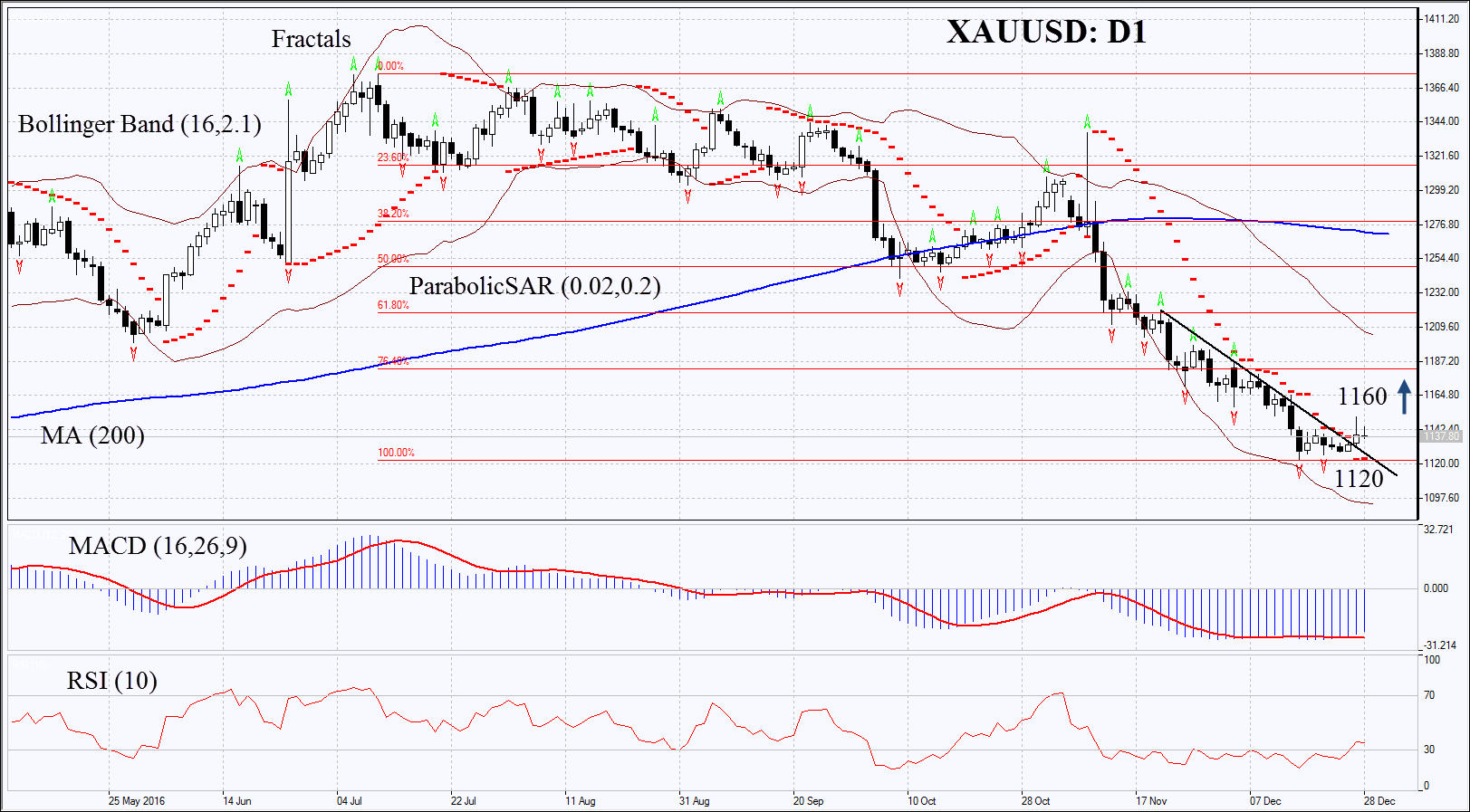

Technical Analysis and Gold Price Predictions

Technical analysis offers valuable insights into potential future price movements of XAUUSD. Chart patterns and indicators can provide signals for traders.

Chart Patterns and Indicators

Various technical indicators can help predict future trends in the gold market. Analyzing charts for patterns and interpreting indicators is a crucial element in gold trading strategies.

- Support and resistance levels: Identifying support and resistance levels can help predict price reversals.

- Moving averages: Moving averages can help smooth out price fluctuations and identify trends.

- RSI (Relative Strength Index): The RSI helps gauge the strength of price movements and identify overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): The MACD helps identify momentum changes and potential trend reversals.

Analyst Forecasts and Market Outlook

Many analysts offer forecasts for gold prices, but these are always subject to significant uncertainty. Various economic and geopolitical factors will influence the final outcome.

- Price targets: Analyst price targets vary widely depending on the factors they consider most significant.

- Potential volatility: Gold prices are inherently volatile and subject to rapid changes based on news and events.

- Factors influencing predictions: Predictions vary widely because of the multitude of factors influencing gold prices.

Conclusion

The recent gold (XAUUSD) rally is likely a result of several intertwined factors. While a potential interest rate cut could act as a catalyst, it's crucial to consider the broader economic landscape, including inflation, recessionary fears, and geopolitical instability. Gold's role as a safe haven asset and its historical performance during times of uncertainty contribute to its current appeal. While the future is uncertain, staying informed and analyzing market indicators will be essential for making sound investment decisions.

Call to Action: Understanding the complex interplay between interest rates, inflation, and geopolitical factors is crucial for navigating the gold (XAUUSD) market effectively. Consider adding gold to your diversified investment portfolio as a hedge against inflation and economic uncertainty. Learn more about effective gold trading strategies and explore various investment options to manage your financial future. Consult a financial advisor to create a personalized investment strategy tailored to your risk tolerance and financial goals.

Featured Posts

-

Analyzing Red Carpet Protocol Violations A Cnn Perspective

May 17, 2025

Analyzing Red Carpet Protocol Violations A Cnn Perspective

May 17, 2025 -

2024 112

May 17, 2025

2024 112

May 17, 2025 -

Severance Season 3 Will It Happen Lehighvalleylive Com

May 17, 2025

Severance Season 3 Will It Happen Lehighvalleylive Com

May 17, 2025 -

Preimuschestva I Nedostatki Razmescheniya Biznesa V Perepolnennykh Industrialnykh Parkakh

May 17, 2025

Preimuschestva I Nedostatki Razmescheniya Biznesa V Perepolnennykh Industrialnykh Parkakh

May 17, 2025 -

Tony Bennett His Collaborations And Influences

May 17, 2025

Tony Bennett His Collaborations And Influences

May 17, 2025

Latest Posts

-

7 Bit Casino A Leading Online Casino Choice In Canada

May 17, 2025

7 Bit Casino A Leading Online Casino Choice In Canada

May 17, 2025 -

Top Paying Online Casino Ontario 2025 Mirax Casino Review

May 17, 2025

Top Paying Online Casino Ontario 2025 Mirax Casino Review

May 17, 2025 -

Top Rated Online Casino Canada Why 7 Bit Casino Is 1

May 17, 2025

Top Rated Online Casino Canada Why 7 Bit Casino Is 1

May 17, 2025 -

Secure And Reliable Bitcoin And Crypto Casinos 2025 Edition

May 17, 2025

Secure And Reliable Bitcoin And Crypto Casinos 2025 Edition

May 17, 2025 -

Mirax Casino A Top Rated Online Casino In Ontario For 2025

May 17, 2025

Mirax Casino A Top Rated Online Casino In Ontario For 2025

May 17, 2025